Real-Time Cash Control for Better Decision-Making

Automate, optimize, and streamline cash management with instant control across every account, real-time cash visibility, and automated forecasting.

Statement® Treasury Features

Cash Management Made Easy

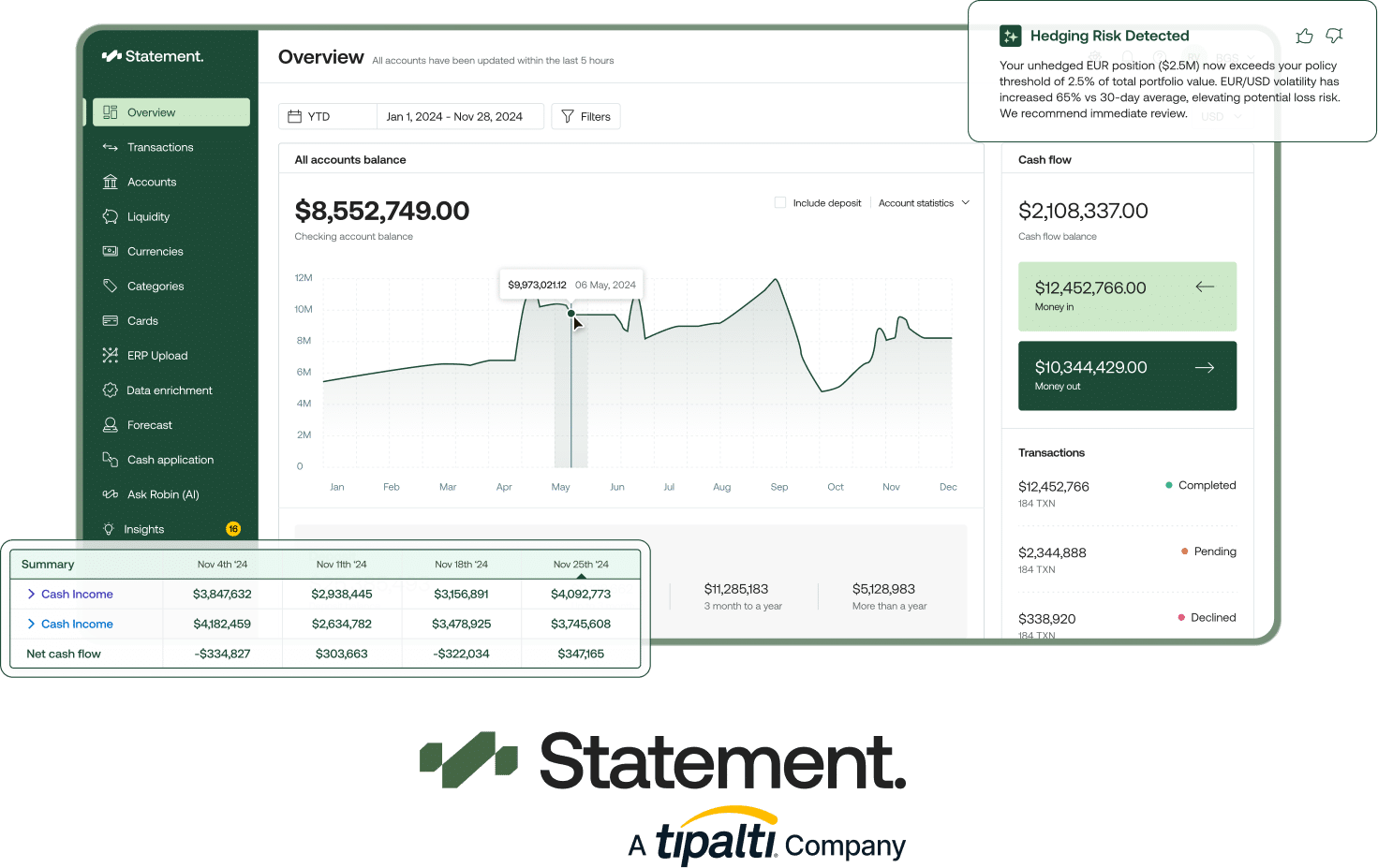

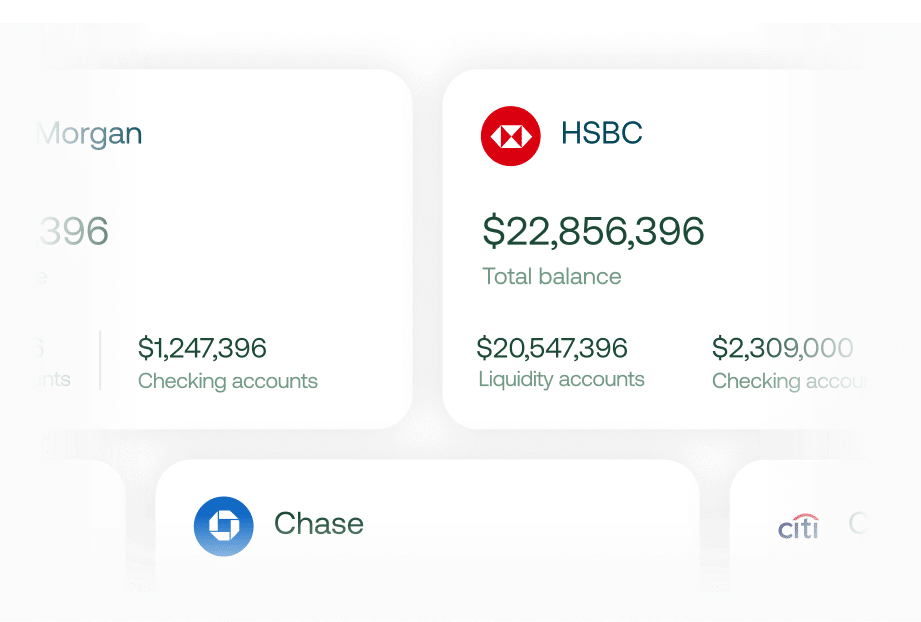

Real-Time Cash Visibility

Real-time data enables teams to act on today’s cash, not yesterday’s metrics. Intra-day and prior-day balances are rolled up by bank account, entity, currency, or bank in a single dashboard. Filter to any level—transaction, vendor, or category—for instant drill-down analysis.

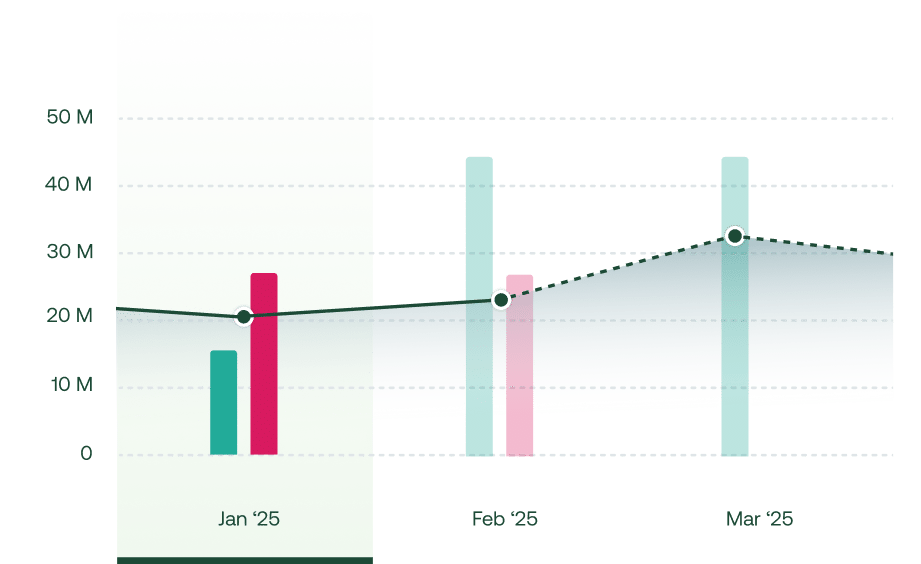

Automated Cash Flow Forecasting

Cash flow forecasting means fewer manual spreadsheets and more accurate liquidity planning. Unlimited 13-week cash-flow projections pull in live transaction and ERP data, then let you tweak assumptions on the fly so everything stays aligned with changing plans.

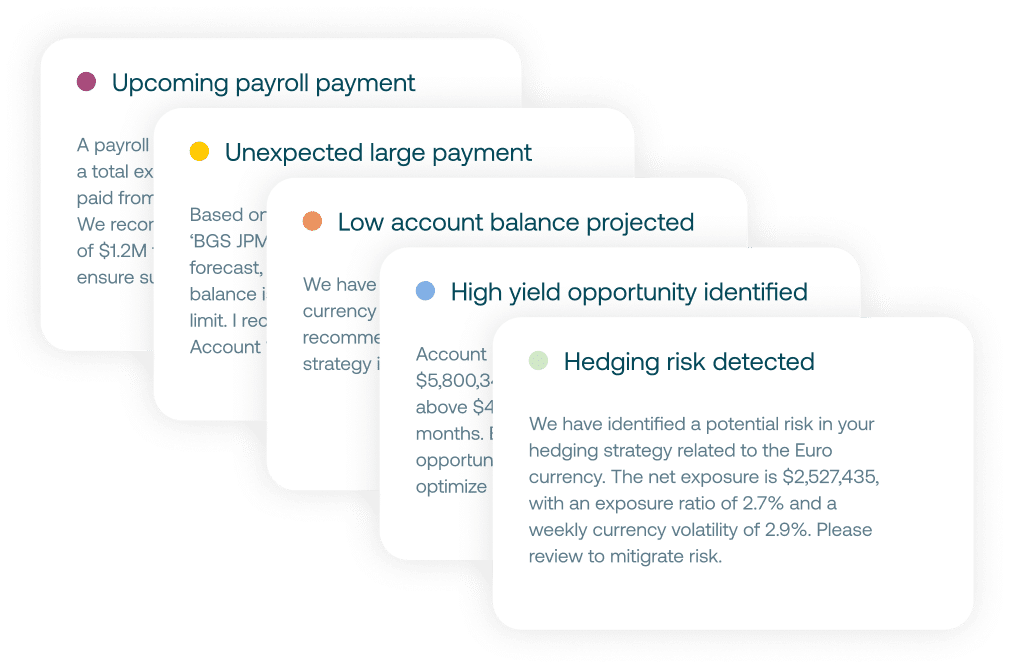

AI-Driven Insights

AI insights replace manual processes to drive smarter cash flow forecasting and prevent idle funds. Machine-learning models flag anomalies, surface investment opportunities, and send proactive alerts so capital always works harder.

Testimonials

See What Statement Treasury

Customers Are Saying

Customer Stories

Explore Statement Treasury Customer Success Stories

Learn how global marketing leaders used natural intelligence to improve cash and liquidity management with Statement Treasury.

48

hours saved monthly

70+

accounts consolidated

How It Works

Turn Raw Data Into Real-Time Cash Flow Insights

Unlike legacy cash management solutions that rely on overnight files and manual uploads, modern treasury solutions connect live data streams and automate every step of the liquidity workflow.

Step 1

Connect Every Data Source

Secure APIs pull live transactions from 3,000+ banks and financial institutions, ERPs, billing tools, and databases, eliminating manual file uploads.

Step 2

Enrich Transactions with AI

Our AI engine normalizes, structures, and categorizes your raw bank data to create a clear and accurate view of your cash position.

Step 3

Consolidate Balances in Real Time

Consolidate intra-day activity into a single dashboard, so you always know your cash balances and the amount in transit, and can more easily identify potential financial risks.

Step 4

Generate Predictive Intelligence

Analyze historical AP, AR, and payroll flows to build rolling 13-week forecasts. Intelligence helps you spot trends, anomalies, risks, and opportunities before they impact liquidity.

Step 5

Mitigate risk and put more cash to work

Stay ahead with smart alerts on hedging risk, projected liquidity, unusual transactions, and high fees. Understand where you can invest to optimize yield.

Ready to Learn More about Statement Treasury?

Explore the platform further and request a demo.

Recommendations

You may also like

Treasury and Cash Management FAQs

What is cash management software?

Cash management software is a tool that provides real-time visibility and automation for tracking and forecasting an organization’s cash flows across all accounts and currencies. It is used by finance teams to manage and maintain sufficient liquidity to meet all immediate and short-term obligations.

What is treasury management software used for?

Treasury management software (TMS) is a broader system that includes cash management functions while also managing financial risks (like Foreign exchange exposure), optimizing investments, and debt.

By automating data capture from all bank accounts and ERPs, the TMS eliminates manual processes, ensuring accurate and real-time data for effective liquidity planning and financial oversight.

Additionally, continuous sanctions screenings, role-based approvals, and audit trails provide robust risk control, while SOC 2 Type 2 certification ensures the security of sensitive financial data.

How does treasury management software help CFOs?

Treasury management software (TMS) enables CFOs to make strategic decisions and plan scenarios by centralizing real-time financial data on cash, debt, investments, and risk exposure into a single platform.

This complete visibility and control over global operations enable CFOs to better manage liquidity, mitigate financial risks such as FX volatility, and track portfolios to ensure capital efficiency and optimized returns.

What are the benefits of real-time cash visibility?

Centralized, real-time cash visibility improves cash control, working capital management, and forecasting precision.

How does AI improve cash flow forecasting?

AI streamlines cash flow forecasting by automating the capture of spend data across entities, currencies, and payment methods, leading to higher accuracy compared to manual methods.

Machine learning surfaces anomalies, suggests adjustments, and increases cash flow forecasting accuracy by detecting unusual patterns in financial transactions that might skew predictions. This helps finance teams build more reliable models and make proactive decisions about future liquidity.

How does Statement® Treasury help prevent cash shortfalls?

Statement Treasury is specifically designed to help prevent cash shortfalls by providing real-time data and advanced analytical tools. The system continuously monitors global cash positions and uses accurate cash flow modeling based on live data from banks and ERPs to anticipate future liquidity needs.

Can treasury software integrate with ERP and billing platforms?

Yes, modern treasury management software is specifically designed to integrate with ERP and accounting systems as a core function to ensure real-time financial oversight and data accuracy. This integration eliminates manual processes by automatically capturing data from all systems.

For instance, Statement Treasury supports seamless integration with products like NetSuite to more accurately create cash flow forecasts.