See how forward-thinking finance teams are future-proofing their organizations through AP automation.

Fill out the form to get your free eBook.

Today, the finance function has more responsibilities than ever. In high-growth businesses, every operation—both front and back-office—is inexplicably tied to investment versus reward. To survive the uncharted road ahead, the modern, forward-thinking finance team has to future-proof their organization for success. Download the guide to discover: – The untamed wilderness of finance – How to forge an accounts payable path – How to strategize your next move – The ultimate accounts payable survival tool – How real-life survivalists scaled their businesses

What is Invoice-to-Pay?

Invoice-to-pay is the request for payment on goods or services. To request payment, suppliers will create an invoice with a list of goods sent, or services provided, along with a statement of money owed, and send the payment request to the buyer.

What is the invoice-to-pay processing cycle?

The invoice-to-pay processing cycle (sometimes known as the purchase-to-pay or procure-to-pay cycle) is a primary step in supplier payments operations for accounts payable. Once the supplier completes invoicing, the accounts payable department receives the invoice from a supplier. The invoice must be read, entered into a system of record (accounting system or ERP), assigned a billing code, and sent for internal buyer approval or through a purchase order matching process. Once the invoice is approved, payment is scheduled and executed to the supplier, often based on the due date.

Invoice processing is how accounts payables teams manage, process, and pay their supplier invoices. Invoice processing encompasses the whole process from when a company receives an invoice, reviews and approves it, pays it, and records it in the general ledger. Companies can track invoice processing through paper documents or digital documents.

How Invoices Are Read and Recorded

Invoices are inbound into an organization in several ways:

- physical mail

- facsimile (Fax)

- supplier portal

Many organizations, particularly small businesses, rely on a staff member (such as an accounts payable clerk) to read the invoice and enter it into an accounting or ERP system through manual data entry. For organizations facing a high volume of inbound supplier invoices, there has been an increased use of OCR (optical character recognition) services to digitally execute the invoice-to-pay cycle by reading the contents of the invoice and matching them to input fields in the accounting system.

Invoice Approval Process

Once the invoice is recorded, several possible methods are used to approve the invoice, including manual or automated invoice approval processes. Manual invoice approval processes are time-consuming, including substantial follow-up with approvers.

Manual invoice approval processes include:

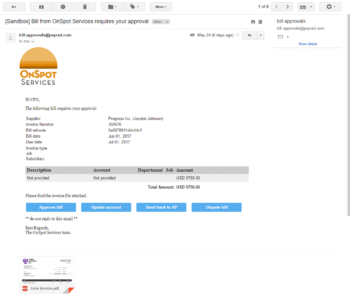

- accounts payable notifies internal buyer via email

- accounts payable notifies internal buyer via phone

- accounts payable notifies internal buyer via physical contact

Automated invoice approval processes include:

- The invoice or AP automation system routes an automatically generated request for approval like an invoice approval email template providing notification and document viewing

- A supplier portal facilitating invoice approval and document viewing

- A match attempt from a previously generated purchase order (two-way match)

- A match attempt from a previously generated purchase order and shipping receipt of order (three-way match)

Upon approval from one of these methods, accounts payable then determines when to pay and how much (i.e., if this is a partial or full payment). The payment instruction is then set for approval. AP automation systems offer a choice of global payment methods.

Payment Approval Process

The payment approval process varies for every organization and any established policies. For example, there may be thresholds for amounts that require additional approvals including by the department heads or executives. In some cases, approvals are walked (physical signature), emailed, or verbalized, but some proof of approval is required.

An electronic approval process is highly recommended due to the efficiency and traceability of the approval action. Some systems require approval via portal, while others accept approvals through email.

Supplier Payment Execution

Customarily, the invoice-to-pay process has been known to end at payment approval, however it is possible to extend the cycle to include payment execution if the payment system is controlled by the accounting system tasked with tracking the invoice. Payment execution depends on the payment method used for remittance. For example:

- paper checks

- ACH transfers

- wire transfers

- global ACH transfers (local bank transfers)

- e-wallet / debit card transfers

In order to remit in a particular method, accounts payable must know how the supplier can be paid (i.e. are they payable). This may involve contacting the supplier for bank account information, gathering required tax identification information, and ensuring the supplier is not named on do-not-pay blacklists. It may also require secured access to the banking portal. If paying a supplier in another country, other factors may be involved limiting certain types of payment methods and foreign exchange of currency.

Use of Automation in Invoice-to-Pay Cycles

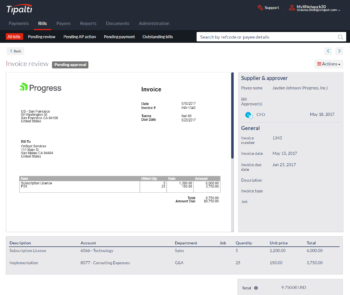

AP automation systems have begun to incorporate and expand on the invoice-to-pay process. For instance, Tipalti recently introduced a sophisticated, highly integrated approach to handling supplier invoices that combines OCR invoice processing, machine learning, and managed services to achieve 100% touchless, straight-through processing. Invoices are accepted via email or through a branded supplier portal and its data is directly entered into the system with no interaction from anyone in accounts payable.

This offering is fully connected to Tipalti’s payment system so that invoices can be approved, paid, and reconciled with minimal interaction by accounts payable and internal buyers. The entire invoice-to-pay process, including for batch invoices, is reduced to a handful of clicks. And because Tipalti controls the remittance process, payments are fully reconciled as they clear regardless of check, wire, ACH, global ACH, PayPal, or debit card.