See how forward-thinking finance teams are future-proofing their organizations through AP automation.

Fill out the form to get your free eBook.

Today, the finance function has more responsibilities than ever. In high-growth businesses, every operation—both front and back-office—is inexplicably tied to investment versus reward. To survive the uncharted road ahead, the modern, forward-thinking finance team has to future-proof their organization for success. Download the guide to discover: – The untamed wilderness of finance – How to forge an accounts payable path – How to strategize your next move – The ultimate accounts payable survival tool – How real-life survivalists scaled their businesses

TL;DR:

Modern AP departments are evolving from tactical processors to strategic financial hubs. Learn how automation, compliance, and cross-functional alignment reshape AP for growth-ready companies.

A company’s accounts payable refer to all its purchases made on credit for which it still owes money. From vendor invoices to partner payments, running an efficient, accurate, and secure accounts payable process is critical to a company’s stability. That’s where the Accounts Payable department comes in and ensures all outstanding invoices are paid on time.

The accounts payable department manages a company’s financial obligations to vendors and suppliers. Our guide teaches you how to structure it effectively.

Key Takeaways

- The AP Department plays a crucial role in financial health.

- These teams manage all outgoing payments, ensuring timely, accurate, and secure invoice processing. This helps to maintain good supplier relationships, strengthens cash flow, and adds to overall financial stability.

- Segregation of duties and proper structuring enhance internal controls.

- A well-structured AP department helps prevent fraud by segregating duties and assigning specific roles to reduce risk. Smaller businesses should scale their team structures as they grow to achieve greater internal controls.

- The right automation transforms efficiency and control.

- The best AP automation software will significantly reduce manual workload, eliminate errors, and speed up the end-to-end process. These tools offer features for robust internal controls (like automated matching, duplicate detection, audit trails, and real-time analytics). This makes the whole AP department more strategic.

- Automation helps to leverage AP job functions and organizational value.

- As the right automation tools manage routine manual tasks, AP roles evolve from clerical to analytical. New responsibilities can include monitoring robotic process automation (RPA), supplier data oversight, and spend analysis. Automation adds strategic value to the finance team.

- You can overcome common AP challenges through automation.

- Ongoing vendor inquiries, lost documents, and delayed approvals are common AP issues. Automation resolves these by offering tools like vendor self-service portals, digitized document storage, and workflow-driven approvals. This leads to a higher level of productivity and improved vendor satisfaction.

A Quick Overview of Accounts Payable

Did you know, 66% of payment errors are due to manual processes? Accounts payable is a current liability on the balance sheet for invoiced purchases of goods and services from suppliers made by a business on credit terms. The invoices, matched with purchase orders and receivers, will be paid when approved and due or earlier to take discounts. Managing invoice processing and overseeing payments are key duties of the accounts payable department.

The difference between accounts payable vs accounts receivable is that accounts payable relates to supplier or vendor invoices for purchases with payment terms for later payment, whereas accounts receivable relates to customer invoices for sales or services with credit terms, to be collected from customers when due.

What is the Accounts Payable Department?

The accounts payable department ensures that invoices and payments are properly approved and processed and keeps track of what’s owed to vendors, ultimately controlling expenses for an accurate balance sheet. It includes collecting tax information from their suppliers, reimbursing employees for any small business-related expenses, and preparing financial reports related to accounts payable.

Why is the AP Department Important?

The AP department is important because it ensures that suppliers are paid on time. When suppliers are paid on a timely basis, the company will have good supplier/vendor relationships and not experience shipment cutoffs due to nonpayment of invoices due. If the accounts payable department is able to process invoices on time to take early payment discounts, AP can improve business profitability.

See how Tipalti automates AP across your entities

Can you be sure the software program you choose will fit all your needs? Learn more in our free whitepaper.

Accounts Payable Department Structure

There are two main objectives when structuring or restructuring your accounts payable department:

- Preventing fraud through the separation of duties both inside and outside the accounts payable department structure. Proper segregation of duties is a requirement for good internal controls.

Although achieving strong internal controls is the goal for businesses of all sizes, it’s more difficult for smaller businesses. Startups and businesses with limited employees can’t separate duties to the extent that larger, more established companies can. As they grow, startups will hire to adequately staff departments, achieving better internal controls.

- Matching responsibilities and roles with a redefined automated accounts payable process workflow. This will yield impressive time savings by:

- Reducing or eliminating manual invoice processing for each account payable

- Stopping repetitive vendor inquiries about the invoice payment date requiring follow-up

- Removing inefficient workflow process bottlenecks

Modern AP Processes

Modern AP processes leverage digital transformation tools like invoice automation, integrated workflows, and cloud-based platforms. These systems are essential for addressing the inefficiencies of traditional, manual systems.

According to Ardent Partners’ State of ePayables report, best-in-class companies that use automation process invoices 74% faster and at 81% lower cost than their peers.

These improvements streamline day-to-day operations and significantly enhance larger financial functions. Faster invoice approvals accelerate financial close, giving AP teams and CFOs more timely data for reporting. Enhanced transparency into liabilities and payment timelines also improves cash flow forecasting.

Modern automation will reduce the need for additional labor to manage high-volume jobs, allowing for a leaner and more strategic workforce. Modern AP isn’t just about digitizing documents—it’s about building a connected ecosystem that supports accuracy, agility, and scalability across the finance function.

In 2025, CFOs and AP managers are navigating an increasingly complex landscape shaped by increasing performance expectations and evolving regulatory demands. New challenges and pain points are emerging.

Compliance is growing with expanding requirements like leveraged 1099/1042-S reporting, the EU’s DAC7 directive for digital platform transparency, and ESG obligations, all of which demand traceable, auditable financial reports.

Manual vs. Automated AP

| Process Step | Manual AP Workflow | Automated AP Workflow |

|---|---|---|

| Invoice Receipt | Paper, mail, and email-based where invoices are manually collected and routed | Digitally capture using OCR, email parsing, or portal upload |

| Invoice Matching | Manually matched POs to receipts; prone to errors | 2- or 3-way PO matching is automatically performed |

| Data Entry | Manual input data into accounting/ERP systems | Automated data extraction and validation |

| Approval Workflow | Routed via email or printed forms; delays are common | Digital workflows you can customize with automatic routing and notifications |

| Payment Processing | Manual checks or bank transfers | Scheduled, secure electronic payments (like ACH, wires, virtual cards) |

| Exception Handling | Taken care of through emails and manual notes | Automatically flagged and routed with rules-based logic and resolution tracking |

| Audit Trail and Compliance | Scattered records are harder to trace | Centralized and searchable audit logs and automated compliance tracking |

| Tax Reporting | Manually collected from spreadsheets or vendor files | Automated data collection, validation, and e-filing |

| Visibility and Reporting | Limited real-time data and manual report creation | Dashboards and real-time analytics across all entities and vendors |

| Scalability | This requires more staff to handle volume growth | Scales with minimal need for added headcount through automation |

Challenges AP Managers Face

CFOs and Accounts Payable (AP) managers typically face challenges that can hinder their workflow efficiency and accuracy. One of the most common problems is slow invoice approvals, which can cause month-end close delays, strain supplier relationships, and create cash flow bottlenecks.

A lack of visibility into payment cycles and invoice status compounds these issues, making it challenging to track outstanding liabilities or accurately forecast expenses.

In addition, manual tax compliance increases the risk of issues and missed deadlines, exposing the organization to costly penalties and audit risks. These pain points highlight the need for AP automation and improved process controls.

A Compounding Impact

These challenges in accounts payable, like delayed approvals, limited visibility, and manual tax compliance, have a compounding impact on critical financial systems.

A slower and more transparent AP process can stall the monthly financial close. This leads to inaccurate or late reporting that can affect CFOs’ decision-making. Inadequate transparency also undermines streamlined cash flow management, making it difficult to optimize working capital or plan for upcoming liabilities.

When AP teams are bogged down with manual labor, it complicates headcount planning by increasing the need for extra employees to manage workloads that may otherwise be automated. This drives up costs and reduces scalability.

Outside vs. Inside Accounts Payable Tasks

Separation of duties should include the following to prevent paying fraudulent invoices and expenses:

| Task | Outside Accounts Payable | Inside Accounts Payable |

|---|---|---|

| Issuing purchase orders | ||

| Establishing vendor master file and adding vendors with vendor name and contact information | ||

| Preparing receiving reports as goods are received | ||

| Processing and collecting accounts receivable | ||

| Processing vendor invoices in the payable system | ||

| Matching invoices, purchase orders, and receiving reports | ||

| Approving vendor invoices for payment | ||

| Evaluating which early payment discounts make sense | ||

| Communicating with vendors (suppliers) | ||

| Paying vendor invoices in batches or via “bill pay” after vendor payment approvals (with good early payment discounts or timely payment terms, considering due dates) | ||

| Generating financial reports for cash requirements and cash disbursements | ||

| Reconciling accounts payable to the general accounting ledger | ||

| Receiving, processing, and monitoring W-9 supplier tax forms for compliance | ||

| Handling the petty cash fund, including small cash disbursements as business expense reimbursement | ||

| Monitoring, approving, and bookkeeping for the petty cash fund | ||

| Preparing checks to replenish the approved petty cash fund requests (with expense reimbursement vouchers attached) | ||

| Approving travel reimbursement reports | ||

| Paying travel and business expense report payments. | ||

| Approving and reconciling purchasing cards (P-cards) for office supplies and other business expenses | ||

| Paying with a purchasing card (P-card), credit cards, or debit cards |

The above table also answers the question: What are the duties of the accounts payable department? Checked items in the Inside Accounts Payable column cover the accounts payable cycle. These internal control considerations include businesses that perform manual data entry of vendor invoices and companies that run efficient and secure AP automation software using electronic documents.

Accounts payable automation software offers not only time-saving and cost-saving but also improved internal control features.

Ten Internal control enhancements from AP automation software are:

- Improved system security

- Supplier verification through a KPMG system

- Self-service supplier onboarding, submission of contact information and W-9 forms, and uploading of vendor invoices

- The reduction of data inaccuracy caused by human error

- Better (automated) recognition of duplicate invoices

- Improved identification of inactive vendors in the vendor master file for recommended deletion to lessen fraud risk

- A stronger approval process for payments

- Better visualization of spend management

- Automatic reconciliation of accounts payable to the general ledger for more timely and accurate financial statements

- Built-in audit trails

This list of internal control improvements from accounts payable automation software is not all-inclusive. You’ll discover more ways to improve internal controls.

Different Types of Accounts Payable Job Roles

As companies recognize the savings that businesses can gain through the application of AP automation software and efficiency from streamlined payables processes, the job of accounts payable can increase in status beyond the traditional role of Accounts Payable Clerk. As the AP department gains efficiency, the accounts payable staff has more time for elevated analytical roles.

Accounts payable job titles include:

- Accounts Payable Officer (for large companies)

- Accounts Payable Manager

- Invoice to Pay Manager

- Accounts Payable Coordinator

- Accounting Assistant

- Accounts Payable Specialist

- Accounts Payable Clerk

These job titles reflect the level of accounts payable department responsibilities, AP processes handled, and company size.

Tips to Run an Accounts Payable Department with AP Automation

The accounts payable department streamlines its operations using accounts payable automation software integrated with your ERP or accounting software. The way that accounts payable handles core business processes is changing rapidly.

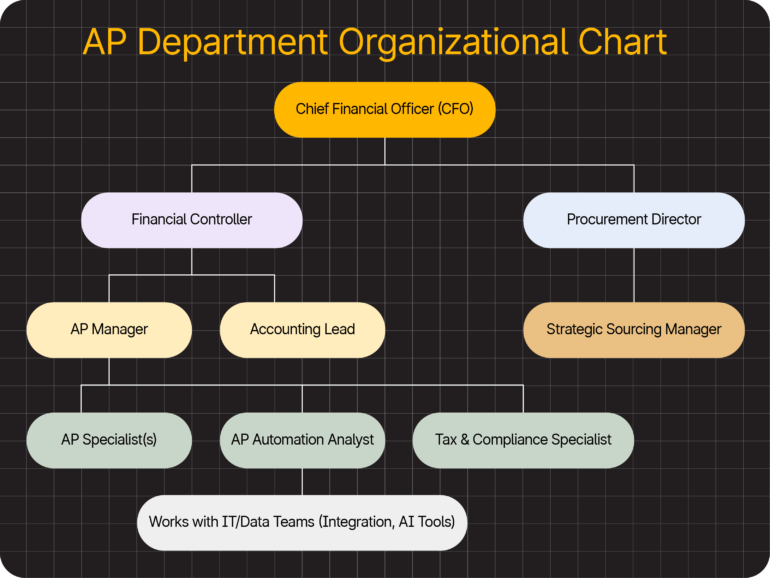

Consider a new organizational chart structure for the AP department to get ahead of the curve and adapt to these changes. Shifting roles for AP better aligns with financial management’s analytic and strategic goals.

AP automation software uses robotic process automation (RPA) by applying standard rules to routine accounts payable processes. Automation and robots may scare some accounts payable staff, who fear the loss of their jobs when work is automated with new systems.

The communication should focus on how accounts payable automation software will eliminate many frustrating tasks that prevent the AP team from getting their job done.

Impact of Automation on Month-End Close Time

| Level of Automation | Average Month-End Close Time |

|---|---|

| Manual | 8–10 business days |

| Partial (OCR and ERP) | 5–7 business days |

| Full Automation (AI and Workflow) | 2–4 business days |

| Best-in-Class (Real-Time Close) | Less than 2 business days |

Accounts Payable Challenges

The AP department typically operates under intense pressure, juggling multiple manual tasks and payment methods while facing tight deadlines. Without the right tools, this can lead to inefficiencies, issues, and mounting frustration from both vendors and internal stakeholders.

Here are some of the most common challenges and pain points AP teams face, and how AP automation can help them shift from being reactive to becoming strategic partners in finance:

Continual Vendor Inquiries About Payment

Vendors will frequently call or email the AP team to ask when they’ll receive payment. This is especially true if payments are delayed or there’s no visibility into the process. This reactive communication will destroy valuable time and create friction with suppliers.

How automation helps:

AP automation will offer vendor portals that provide real-time payment status updates, significantly reducing inbound inquiries. Vendors can self-serve and track their invoices without relying on your team for answers, leading to better vendor relationships and improved productivity.

Lost Paperwork

Paper invoices, receipts, and printed contracts can be lost or misfiled, causing delays and issues with three-way matching, payments, and compliance.

How automation helps:

Digitizing invoices through scanning, OCR, and electronic storage will centralize documents in a secure, unified platform. AP teams can easily retrieve documentation and maintain a clear audit trail for every transaction.

Chasing Approvals

Waiting on invoice approvals is the biggest bottleneck in the AP process. When invoices are stuck in someone’s inbox or lost in emails, payments are delayed, and late fees or strained vendor relationships can follow.

How automation helps:

Automated workflows route invoices to the correct approvers based on custom rules. They can send reminders to ensure timely responses. Some systems offer mobile approvals, allowing managers to approve invoices from anywhere, at any time, keeping the process moving.

These challenges in the accounts payable department can be easily overcome through AP automation, which can help the department achieve its goals and objectives.

When communicating, share stories about how the accounts payable team can elevate its job. New functions of the accounts payable department include monitoring the RPA and payables processes and analyzing data to suggest potential cost savings.

The time and cost savings will convince finance and accounting.

AP Automation Benefits

Automating AP has many benefits, from efficiency gains to complete financial control. Companies implementing AP automation solutions can expect significant cost and time savings while reducing human error, eliminating late payments, and improving regulatory compliance.

Here are a few ways these types of accounting systems can benefit your business.

Return on Investment (ROI) and Financial Benefits

Investing in AP automation software drastically cuts operational costs, influencing ROI (return on investment). Tipalti, for example, can reduce invoice processing costs by up to 80% while allowing finance teams to close the books up to 25% faster. These efficiencies free up resources and enable finance teams to focus on more value-added tasks like financial planning and analysis.

Early Payment Discounts

By streamlining payments, organizations can take advantage of early-payment discounts, such as 2/10 net 30 terms, which enable businesses to save 2% on every invoice paid within 10 days. On the other hand, companies using manual AP processes to input invoice data risk missing these discounts due to slower approvals and processing times. Additionally, automation prevents companies from paying fraudulent or duplicate invoices, removing short-term liabilities.

Compliance and Risk Management

AP automation also helps mitigate fraud risks and reduce human errors. This ensures that invoices are processed accurately and that vendor payments are legitimate. This type of software integrates fraud detection mechanisms, such as duplicate invoice detection, vendor validation, and approval workflows that flag discrepancies before payments are made.

In addition, it can help companies stay compliant with global tax and regulatory requirements, including VAT, sales tax, and country-specific e-invoicing mandates.

Enhanced Cash Flow Management and Real-Time Analytics

Using AP automation, CFOs and budget managers benefit from improved cash flow management. This ensures better visibility into pending invoices, outstanding liabilities, and payment schedules. An integrated analytics dashboard also enables finance teams to monitor real-time AP metrics, including stats like the AP turnover ratio, which reflects how efficiently a company is managing payables.

Audit Preparedness and Compliance

AP automation solutions provide a complete audit trail, routing, and documentation of every invoice approval and payment process step. This is invaluable when an independent CPA firm conducts an external AP audit. It ensures accurate, accessible financial records that align with regulatory requirements and can withstand any form of verification.

7 Steps for Organizing Your AP Department

- Assign each designated accounts payable task or role in the above table to a job.

- Update each accounts payable job description to remove manual task processing from necessary automated accounts payable department duties.

- Add new RPA, payables monitoring and analytic responsibilities to the accounts payable department functions.

- Decide how many hours will be saved in performing the accounts payable department responsibilities by each job.

- Assign the number of AP staffers required to fill each job role.

- Reassign current staff to new positions in accounting or other business departments if their job is downsized.

- Revise your budget to reflect future hiring reductions, offset by increased staffing you’ll need to process and pay for more supplier purchases as your company grows.

Case Studies of Successful AP Department Structures

Wondering how successful AP automation proves in real life? It’s not just a theory. Tipalti proves it every day with processing $60B+ and serving 4m+. Not only that, they are the Fintech Awards winner for 2025, Forbes Fintech 50 for 2025, and TrustRadius Top Rated Accounts Payable Software.

Here are a few case studies that prove how successful the right tools can be for your business:

NEXT Insurance

NEXT Insurance struggled with manual vendor management and invoice processing challenges. They were spending too much time inputting documents into the ERP, leading to inefficiencies.

Implementing Tipalti Accounts Payable helped NEXT Insurance save over 2 hours per week by streamlining approval workflows. Automated vendor management and invoice processing enabled the finance team to process 1,000+ invoices monthly and support rapid growth.

Centerfield

Centerfield Media’s rapid growth across 28 countries made managing accounts payable increasingly complex and inefficient. With limited invoice processing and no payment capabilities, their existing AP system could no longer keep up, prompting the need for a more comprehensive solution.

By implementing Tipalti, Centerfield Media cut 20 weeks of AP work annually and shortened their monthly close by 12 days. A single AP specialist now manages operations across 28 countries, supporting growth without additional hires.

Sugar CRM

SugarCRM, a global CRM platform with users in 120 countries, struggled with manual, paper-based AP processes that were time-consuming, error-prone, and inefficient. The heavy reliance on manual workflows strained finance (especially when managing international payments), increased workloads and created delays.

By automating their AP with Tipalti Accounts Payable, SugarCRM eliminated the need for manual paperwork, leading to significant time savings and increased efficiency. The streamlined workflow also reduced workload, enabling more focus on strategic tasks.

Automation also enabled SugarCRM to manage increased demands without hiring additional staff, resulting in cost savings. The transition to a digital system improved record-keeping and reduced the risk of errors associated with manual data entry.

How Tipalti Benefits Your Business

The positive ROI from using the Tipalti AP automation app easily justifies the investment. AP automation software can save 80% on supplier invoice processing and help accounting close the books 25% faster.

That frees up more time for value-adding strategic initiatives, decision support, researching expenditures, and financial analysis and planning (FP&A). Your company will save money by taking worthwhile accounts payable discounts (like 2/10 net 30) and not paying duplicate or fraudulent invoices.

Tipalti AP automation software provides an audit trail that will help your business achieve better results for its external accounts payable audit by an independent CPA firm. The system offers a real-time analytics dashboard, including AP turnover ratio.

Besides offering AP automation software for handling supplier invoices in accounts payable, Tipalti also has products for Procurement, Global Partner Payments, and Expenses (for employee expense reimbursements). The Tipalti Card is a virtual P-card for controlling employee spend.

The next challenge is how to structure the accounts payable department optimally when using an AP automation software app. Try using the seven steps below for how to organize the accounts payable department in a new small business or restructure your existing accounts payable organization.

Beyond AP: Comprehensive Financial Automation

While AP automation is essential for handling supplier invoices, Tipalti offers additional financial automation solutions that extend beyond accounts payable:

- Procurement – Streamlines purchase order processes and ensures compliance with internal approval workflows.

- Global Partner Payments – Facilitates seamless cross-border payments in multiple currencies with tax and regulatory compliance built in.

- Expense Management – Automates employee expense reimbursements for better tracking and control.

- Tipalti Card (Virtual P-Card) – Provides a prepaid virtual purchasing card (P-card) to control employee spending and reduce the risks of unauthorized or excessive purchases.

Customer Testimonials

1. Lucidworks (Software/Tech)

PO matching with Tipalti allows us to be more strategic with how we handle cash burn.

– Andrew Jenks, Sr. Accounting Manager

2. Stack Overflow (Tech)

We’ve removed 90% of the manual elements and saved 5 days on the monthly close.

– Bradley Clifford, Assistant Controller

3. Zola (eCommerce)

We’re 400% more productive and kept AP staff at 2 instead of scaling to 10.

– Shayon Donaldson, AP Manager

4. Therabody (Healthcare)

Tipalti eliminates 60 hours a month of AP work. Now we can focus on strategy.

– Kevin Crowley, Accounting Manager

Frequently Asked Questions

What are the core functions of an AP department?

Modern AP teams manage invoice processing, payment execution, PO matching, vendor compliance, and tax reporting. These teams also support effective cash flow management and provide financial information for reporting and real-time decision-making.

How is a modern AP department structured to support collaboration with finance and procurement teams?

AP works closely with finance teams on reporting, month-end close, and procurement on vendor management and purchase orders. Cross-functional roles and job titles ensure more alignment, efficiency, and data transparency.

How has automation changed the roles and responsibilities of the AP department?

Automation reduces manual labor and shifts AP roles toward handling strategic exceptions, compliance, and optimizing processes. New roles focus on the management of automation tools and the use of data to drive performance.

Summing it Up

Managing the accounts payable department functions by implementing AP automation software is a small challenge. You’re on the way to achieving substantial cost savings and internal control improvements for your business. Download our eBook, “Leading Companies Power Accounts Payable with Automation.”