Home / AP Automation / Multi-Entities

One Accounts Payable Platform to Manage All Your Entities

Tipalti Accounts Payable unifies global subsidiaries under one roof, giving you centralized control with local flexibility. This centralization provides the real-time financial data and cash flow visibility needed for better decision-making, so you can standardize workflows, reduce errors, and close your books faster.

Multi-Entity Features

Customized Workflows Tailored to Local Needs

Give each subsidiary its own brand identity with custom email templates and supplier communications. Streamline onboarding and approvals, and configure entity-specific workflows for payment methods, approval processes, reconciliation, and reporting. Set rules to meet each entity’s local tax and compliance needs.

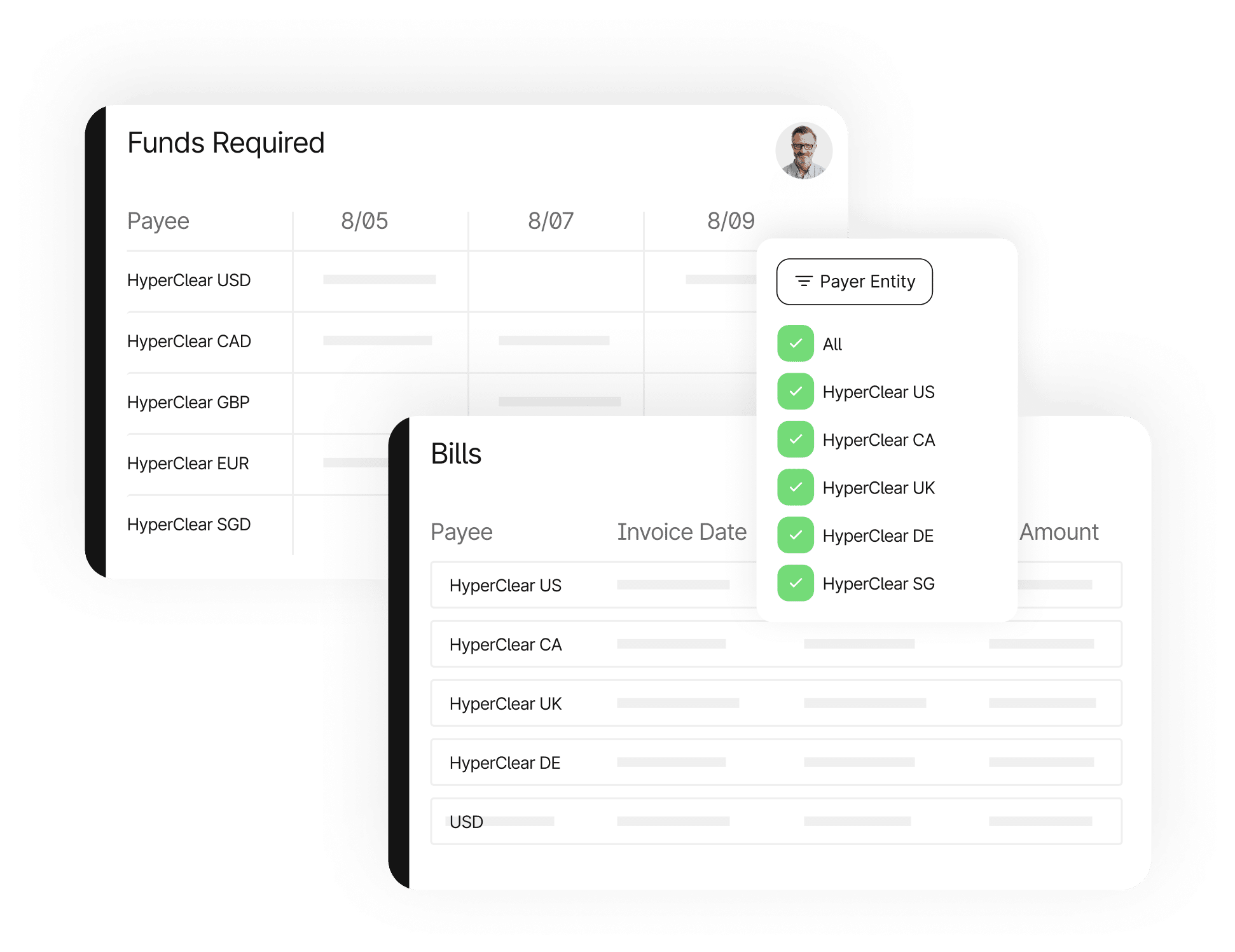

Consolidated Reporting and Real-Time Insights

Automatically capture spend data across all entities, in multiple currencies, and across payment methods. Combine subsidiary data into one view for better monitoring, analysis, and real-time reporting. Payment data syncs directly to your ERP’s sub-ledgers, streamlining reconciliation across entities.

Granular Control at the Entity Level

Secure financial data by separating payables by entity and assigning users to specific entities. Grant users access to different entities based on their roles and responsibilities.

Integrations

Pre-built connections to extend automated workflows

Easily extend and simplify your workflows with pre-built integrations and powerful APIs for your ERPs, accounting systems, performance marketing platforms, HRIS, SSO, Slack, credit cards, and more.

Testimonials

Don’t just take our word for it,

see what our customers are saying

Customer Stories

Explore our customer success stories

Platform Features

Work smarter, not harder

With AI and machine learning capabilities, an intuitive UX, and quick and easy global payments, you can drive unprecedented efficiency.

Awards

#1 Award-Winning Finance Automation Solution

The Fintech Awards

Best SaaS for FinTech 2025

2025 Deloitte Technology

Fast 500

Awarded to Tipalti for the 8th consecutive year

2025 CNBC World’s Top Fintech Company

Awarded to Tipalti for the 3rd consecutive year

Leader in the IDC 2024 MarketScape

Worldwide Accounts Payable Automation Software for Midmarket

Ready to Save Time and Money?

Book a demo to get started today and take control of your finance operations with Tipalti.

Recommendations

Access All Insights on Multi-Entity

Multi-Entity Accounting Software FAQs

What is multi-entity AP management?

Multi-entity AP management enables a company with multiple subsidiaries, business units, or legal entities to manage accounts payable across all entities from a single system, while preserving entity-specific rules, workflows, currencies, tax IDs, and banking details.

It centralizes visibility and control but allows each entity to operate independently where needed, supporting more effective financial management at scale.

What are the challenges of decentralized AP processing?

A decentralized AP process presents significant hurdles, primarily impacting efficiency, financial control, and scalability.

Because each local entity may develop its own procedures, decentralization leads to inconsistent processes and duplication of effort, making it difficult to consolidate financial information, generate accurate financial statements, manage intercompany transactions, and maintain centralized dashboards for visibility.

This lack of standardization and heavy reliance on manual effort result in limited visibility and control over spending patterns, making scaling with business growth difficult and expensive.

What features should you look for in AP automation software for a multi-entity business?

For multi-entity businesses, AP automation software should function as a scalable accounting solution that makes it easier to manage multiple legal entities without adding operational complexity. Look for solutions that allow finance teams to work from a single, unified system while supporting growth as new entities are added. This helps organizations scale without relying on separate tools or manual workarounds.

It’s also important that the software can accommodate entity-level differences. Each entity may have its own payment requirements, supplier onboarding needs, approval processes, reconciliation practices, and reporting structures. The right platform should allow teams to standardize core processes while still supporting local or entity-specific requirements.

Finally, visibility and data controls become increasingly important as organizations grow. AP software should provide clear insight across entities, multi-currency environments, and payment methods, with the ability to view consolidated data while maintaining appropriate access controls at the entity level. This balance helps finance teams maintain oversight, simplify reconciliation, and support governance without slowing down day-to-day operations or relying on manual bookkeeping as entities scale.

The best multi-entity accounting software should also offer transparent pricing and flexible functionality that can adapt to the needs of growing businesses as new entities, currencies, and workflows are added.

What are the benefits of multi-entity accounts payable automation?

Automating multi-entity AP drastically reduces manual work by offering a unified system to manage AP operations across multiple entities, eliminating the need to hire more staff to keep up with the increased workload.

For invoice management, a single automated solution accelerates the financial close and enhances audit readiness by centralizing data, ensuring real-time visibility, and supporting accurate consolidated financial reports across all subsidiaries.

Also, it reinforces internal controls and compliance by segregating payable data and maintaining comprehensive audit trails across all subsidiaries.

How does multi-entity AP automation integrate with ERP systems?

Multi-entity AP automation integrates with your ERP system and broader accounting solution by automatically capturing spend data across all entities, currencies, and payment methods, and then syncing this real-time payment data to your ERP’s sub-ledgers and chart of accounts to accelerate reconciliation.

This unified process enables the system to aggregate spend data into a consolidated headquarters view for easy monitoring and analysis, while supporting downstream financial consolidation processes such as eliminations.

How does Tipalti’s AP automation solution support complex multi-entity organizations?

Managing payables across multiple entities can be complex and time-consuming—especially for growing organizations with global operations or decentralized business units. Tipalti’s AP automation solution is designed to simplify and streamline multi-entity finance operations from a single, unified platform.

- Centralizes AP operations across holding companies, subsidiaries, and business units

- Supports entity-specific workflows, tax setups, branding, approval flows, and payment methods

- Enables consolidated and entity-level reporting for full visibility and control

- Scales easily with the ability to add unlimited entities without extra headcount

- Integrates with leading ERPs such as Oracle NetSuite, QuickBooks, and Sage Intacct, for real-time data sync and streamlined reconciliation

- Built-in global compliance and financial controls ensure audit readiness across entities

How can Tipalti help support regulatory compliance for multi-entity businesses?

Tipalti automates crucial financial controls and global tax management across all subsidiaries. It helps reduce risk through proactive fraud monitoring, “Do Not Pay” national blacklist screening (e.g., OFAC, EU, HMC), and built-in internal controls, such as two- and three-way PO matching.

For global tax compliance, Tipalti utilizes a KPMG-approved tax engine to automatically collect and validate supplier tax IDs across 62 countries, supporting specific forms such as W-9s/W-8s (US) and DAC7 reporting (EU). This approach includes maintaining granular audit trails and segregating payable data by entity.

Can Tipalti support different currencies and tax rules across entities?

Yes. Tipalti supports multi-entity organizations that operate across multiple currencies and tax environments, including US-based companies with subsidiaries in the EU and other regions. Each entity can be configured with its own currency, tax onboarding requirements, payment methods, and approval workflows to align with local regulations.

At the same time, payment and spend data across entities and countries is captured in a unified system and can be consolidated for centralized visibility and reporting. This allows headquarters teams to maintain oversight while ensuring each entity complies with local currency and tax rules as the business expands globally.

Does Tipalti allow corporate HQ to maintain centralized control while enabling local autonomy?

Tipalti is specifically designed to allow corporate headquarters to maintain centralized control while enabling local autonomy for multi-entity businesses.

Central control is achieved through a unified solution that provides instant, consolidated visibility and the ability to manage approvals and security across all entities from a single place.

Local autonomy is supported by configuring entity-specific AP workflows, including customized branding, payment methods, tax onboarding, and approval flows for each subsidiary.

This architecture ensures global compliance and control standards are met while local teams retain the necessary operational flexibility.

How does Tipalti simplify multi-entity management for accounts payable operations?

Tipalti simplifies multi-entity management for AP by providing a single, unified platform to govern all subsidiaries. It supports the essential multi-entity capability of allowing headquarters to maintain consolidated spend visibility while also configuring entity-specific AP workflows.

This flexibility extends to setting up customized branding, payment methods, tax onboarding, and approval flows for each subsidiary. By unifying these processes, Tipalti helps segregate payable data by entity and syncs real-time data with your ERP’s sub-ledgers.