Learn how to expertly execute global payments for streamlined accounts payable and business efficiency.

Fill out the form to get your free eBook.

There are numerous options for paying international suppliers, from prepaid debit cards to international ACH to wire transfers and more. Each has benefits and drawbacks that impact the satisfaction of your suppliers and the workload of your finance team Download the eBook to discover: 1. The current state of supplier payments 2. Today’s top global payment methods 3. Comparing Wire Transfers, Domestic ACH, Global ACH, Paper Checks, Prepaid Debit Cards, and PayPal 4. How automation enables multiple payment methods

Modern business is changing the way B2B payments are made. Today, automation is the driving force behind how we get paid. Paper checks have been almost completely replaced by electronic payments in the consumer arena, but business-to-business payment options have been slower to evolve.

Disruptive payment technology has made it easier for people to network and connect from all over the world, and the market is flooded with options. It can be difficult to figure out the right B2B payment solution for your business.

To help you, we’ve compiled this detailed guide to walk you through everything about the B2B payment process, trends we’re seeing, popular options, and what to look for in a B2B payment solution.

What are B2B Payments?

Business-to-business (B2B) payments are the exchange of goods or services supplied for a determined value that is denominated in currency. B2B payments can be recurring or single transactions, depending on the terms set between the buyer and seller.

Paper checks still make up a large part of the payments space, but digital B2B payment solutions are a more effective form of financial services. This B2B method speeds up issuing, receiving, and processing payments and helps to greatly improve positive cash flow.

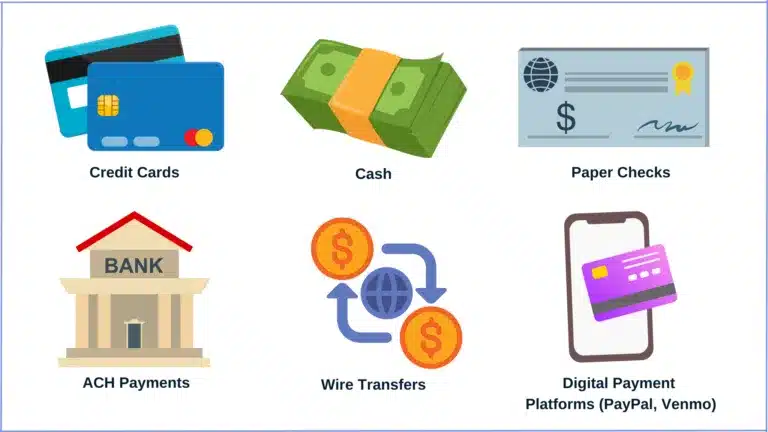

The Most Popular Types of B2B Payments

- Credit cards

- ACH payments

- Wire transfers

- Digital payment platforms

- Paper checks

- Cash

What are the Most Popular Types of B2B Payments?

1. Credit Cards

A credit card is one of the primary vehicles for B2B payments. They provide a convenient and inexpensive way to facilitate transactions and float cash. In addition, card payments can be easily tracked at month-end with an electronic or paper statement.

Although credit cards incur interest rates (like an annual percentage rate (APR), when the revolving balance is paid fast, it gives a business access to extra funds. If the credit card is treated more like a debit card and paid off each month, it’s a highly beneficial form of payment.

To avoid cybercrime, credit card issuers offer numbers for a one-time use. This helps to avoid fraud as, after the first transaction, the number becomes null and void. These virtual credit cards are typically attached to a regular credit card number in your account, which means all transactions appear on a single statement at the end of the billing cycle.

2. ACH Payments (Automated Clearing House)

ACH, which stands for Automated Clearing House, is another form of B2B digital payment that’s faster and more efficient than hard-copy methods. This type of transaction moves electronically from one entity to another using a routing number and bank accounts. Because they’re so simple, ACH payments work great for B2B recurring payments.

Many organizations use ACH because it’s cost-effective. In fact, some financial institutions charge nothing at all and push this form of transaction over paper checks.

ACH payments are a good way to manage cash flow and settle accounts. That’s because these payments are easier to track and appear on the month-end statement. ACH payments can also integrate into a company’s enterprise resource planning (ERP) system and other applications as they are a form of EFT (electronic file transfer).

It should be noted, however, that Automated Clearing House is a U.S. institution that can only be used within America. Additionally, there’s a daily cut-off time for ACH payments. This is because transactions are conducted in multiple batches throughout the day. If you miss this time frame, a business must wait until the next day to send it out.

3. Wire Transfers

Much like an ACH, wire transfers are a digital form of payment that facilitates B2B transactions. For real-time payments, companies often use wire transfers for e-commerce and other digital transactions.

International wire transfers are an option for businesses that make global payments. Once the funds land in the receiving account, they become available immediately. Unlike ACH, the batch system is not used for wire transfers and has a faster turnaround time.

Companies that are looking for a quick transfer find wire payments to have the best terms and timing. However, some wire transfers still have a daily cut-off time.

There are two types of wire transfers: cash and digital. In a cash-based wire transfer, funds are sent to a cash office for a recipient to collect. In a digital wire transfer, funds are sent electronically from one bank account to another.

4. PayPal and Other Digital Payment Platforms

Another form of a B2B digital payment option is using an online platform from a fintech brand. You may have heard of companies like:

- PayPal

- Venmo

- Google Pay

- Dwolla

- Skrill

These platforms can be used to electronically transfer money from one account to another. This is typically done between two entities and usually avoids dipping into any bank accounts (although they are connected).

Some payment platforms, like Venmo and Google Pay, are only available through mobile apps, while others, like Paypal, are used through a PC and/or mobile device.

One drawback to this method is the fees that are incurred with these transactions. In many cases, these can be a lot higher than other types of digital payments.

5. Paper Checks

Even though there’s been a significant decline in the past decade, companies are still using paper checks to pay other businesses. Although convenience-hungry consumers may be more interested in speed over security, such is not the case when paying another organization. Typically, speed is of lesser concern when serving other vendors.

Paper checks are still used because B2B transactions require more security and data exchange than normal B2C payments. A check also helps a brand better track cash flow and inventory because there is always a definitive audit trail. This can’t always be done with digital payments. Paper checks work well because:

- They are always traceable

- A bank account is not required to cash a check

- It makes budgeting a tad easier

- Checks don’t need to be deposited immediately

6. Cash

Cash is always king, and in some cases, it facilitates B2B transactions better than other payment types. The biggest advantage of a business paying cash is that they never have to pay annual fees like a line of credit. Also, if the money is not there, it doesn’t get spent, and interest is never incurred.

Paying with cash is the quickest way to process and keep your transaction expenses to a minimum. In some cases, vendors only accept cash. Any other payment type can lead to late fees and inconvenience.

One downfall, however, is that paying with cash all the time can produce a negative cash flow balance. Direct cash payment deducts the amount from your cash flow balance immediately. What you see is what you get.

Are you paying international suppliers efficiently?

Today’s top global payment methods give you tons of options!

Market Growth and Landscape of the B2B Payments Market

Twenty years ago, there were only a few ways to make a B2B payment, and digital transactions were still a pipe dream. But now, new B2B payment methods have exploded, and the market has been on a path of exponential growth, only interrupted by the pandemic.

The Global B2B Payments Market is valued at $903.5 billion dollars in 2021 and is projected to reach a value of $1,618.15 billion by 2028.

When it comes to revenue and market growth, the application segment held the largest revenue share in 2021, and is estimated to maintain its dominance for the forecasted future. The product segment held the second-largest market share in 2021, and is estimated to grow rapidly during the next few years.

The growth of the B2B payments market can be attributed to technological advancement, rapid urbanization, and an increase in investment by developing countries.

Drivers of market growth include the rising partnership of fintech and B2B payment brands. Bank-fintech collaborations have emerged as a lucrative and viable growth path for both sides of the partnership. For traditional financial institutions, working with a would-be competitor means integrating tools and technologies for customers without having to build anything from scratch.

Trends in the B2B Payments Space

While the market continues to grow at extreme rates, specific trends are appearing that any business, big or small, should pay close attention to. This may help them gain a competitive edge in future transactions. Some of the more common movements in the B2B payments industry include:

A Decline in Paper Checks

Newer, faster forms of payments like credit cards and digital payment platforms have overtaken the use of paper checks.

So much so that back in 2012, the Federal Reserve Bank of Philadelphia made the bold claim that paper checks would be phased out completely by 2026. It looked like an accurate prediction because, according to the Federal Reserve Payment Study (FRPS), 22.5 billion checks were written in 2012, compared to the 16 billion checks written in 2018.

However, at that rate, checks won’t disappear in 2026, even though the decline is evident. The 2021 FRPS found that the number of checks used for payments slowed from 2018 to 2020 at a rate of 1.02 percent, compared to the 1.54 percentage decline between 2015 and 2018. Businesses will eventually move on from checks, slowly but surely.

The Growth of Split (or Deferred) Payments Solutions

Buy Now Pay Later (BNPL) solutions are growing in the B2B world, where finances and cash flow difficulties are recurring issues. A report by Allied Market Research estimates that the global B2B Buy Now Pay Later (BNPL) market will grow from $90.6 billion in 2020 to a whopping $3.98 trillion industry by 2030. As a byproduct of this growth, B2B BNPL solutions are getting funding at an accelerated rate to meet future demand.

London-based B2B BNPL platform Playter got $55 million in funding in June to expand its services to more businesses for software payments, agency fees, and other business expenses. Its counterpart Hokodo also snapped up $40 million in series B funding in the same month to help businesses access better payment terms.

Berlin-based Mondu, another B2B BNPL solution, acquired $43 million in Series A funding to expand in Europe and globally. Mondu has raised $57 million to date on its way to simplifying “the financial lives of small and medium-sized businesses.”

More Automation in AR and AP Departments

More businesses adopted AR and AP automation during the pandemic to reduce invoicing and payment delays. Manual processes and any collaboration that involved paperwork were difficult with strict lockdown rules in place.

Businesses could no longer send invoices and pay bills promptly. In Germany, for example, the average number of days for settling B2B transactions grew from 22 days in 2019 to three months in 2020.

Research by the Institute of Financial Operations and Leadership (IFOL) in association with Tipalti shows that 9% of AP teams are now fully automated, a marginal increase from the 8% reported in 2019. However, there’s a glimmer of hope because 41 percent of AP teams also expect complete automation in their department within one to three years.

Investors are increasingly betting on AR/AP B2B payments companies. According to a survey by Credit Suisse and CrunchBase, ten AP/AR B2B payment companies worldwide had raised over three billion dollars in funding by July 2021 to automate accounts payable and accounts receivable processes. When businesses fully switch to automated AR/AP processes, these payment solutions will be there for them.

The Rise of Mobile Devices

Using mobile devices has long been a trend in the B2C world, and its convenience is starting to catch on for B2B transactions.

Some examples of a business that can benefit from mobile payments include transportation and food supply. This is where a driver might be in a position to accept an order and payment outside of a consumer’s usual standing order. In this case, they would benefit from the autonomy that a mobile platform can provide and accept the order and payment immediately.

Companies will start rolling out more mobile capabilities and payment portals as the demand continues to rise. This, in turn, gives a business more flexibility and automation in the process.

Real-Time Processing

Another trend gathering momentum is real-time payments. Unlike same-day ACH, immediate (or real-time) payment systems and infrastructures are being developed and planned in more countries.

Companies increasingly require speed, ease, convenience, security, and always-on processing for their payments. This is driving more innovation and disruption in the payments industry.

Peer-to-Peer Payments

As far as digitization goes, the biggest trend in B2B payments is following the path of peer-to-peer payments. All of this starts with speed and reliability. After all, companies need to be paid on time to keep running, and whatever solution you use has to deliver as quickly as possible.

Why Companies Use B2B Payment Gateway Software

There are many upsides to billing and invoicing software—especially for B2B payment processing. In addition to streamlining operations, other key advantages of adopting B2B payment gateway software include:

Improve Cash Flow

Starting a small business can be risky, especially considering the failure rate consistently sits at about 50% after five years. One of the top reasons a company doesn’t make it is because they have cash flow issues.

Automating B2B processes (rather than relying on paper checks to make/receive payments) allows you to easily identify patterns in the cash flow. This helps you make smarter decisions about where and when you spend/save.

Using a payment software platform enables a business to generate reports that give you an overview of the AP and AR processes. This top-down transparency means you identify merchants that pay regularly and those that pay late, and then you can handle those relationships accordingly.

B2B accounting software also makes it easier for customers to pay you. For example, invoicing apps allow merchants to pay with the simple click of a button rather than writing a check and mailing it. This gets the money in your account sooner and vastly improves cash flow.

Simplify Accounting

A robust B2B payment solution is also a good way to simplify accounts payable and receivable. Rather than managing a bunch of checks coming and going, the software automatically scans, records, and stores them.

There’s no human labor required and thus much less room for error.

The system may even integrate with ERP, accounting, or bookkeeping software for shared data management and functionality. This also makes filing taxes a lot easier.

Increase Security

Sticking a check in the mail opens a business up to payment fraud. An internal USPS memo reported a 400% increase in postal robberies nationwide since 2019. Although digital solutions aren’t immune to security breaches, most payment providers have a team of engineers and experts watching over your data at all times. There is also a clearer “paper trail” when every transaction is done electronically.

Save Time and Labor

Adopting B2B payment solutions means saving resources like time and money for the business, employees, and customers. The merchant doesn’t need to write a check, and you don’t need to deposit and reconcile one.

Processing a hard copy check costs an average of $2 — which can add up if there’s a large volume. Your team could be spending time more efficiently on core products and services while AI does the menial tasks.

How to Accept B2B Payments

Solutions for B2B payments tend to lag. According to a recent report by PYMNTS and CheckAlt, an estimated “40% of all B2B payments in the US are still made via check.” However, this is not always the most secure way. Many organizations are planning to universally switch to digital payment options.

Today, a business can accept B2B payments in five different ways.

Checks

This includes traditional paper checks and electronic checks. When deposited, one bank will request payment from the other (seller to buyer).

Wire Transfers

Wire transfers are secure payments that are routed through a financial network (just like SWIFT payments). Delivered within hours, these are funds transferred between two banks.

Electronic Bank Transfers

Payments between two banks that are routed through the Automated Clearing House (ACH) are considered electronic bank transfers. This is one of the safest and most reliable systems but usually took longer than wire transfers (a few days). However, Nacha introduced same-day ACH for credit payments in 2016 and for debit payments in 2017.

Credit Cards

Credit cards (including one-time virtual cards) allow a seller to receive payment quickly. A business that is buying can defer payment for one or more billing cycles. Credit card payments are the standard way to collect money online. It’s a popular method for SaaS and e-commerce companies.

Payment Gateway

This is an online payment platform that allows a buyer to pay for goods/services during the checkout process. It represents different options at the end of the shopping experience (like Paypal or Venmo).

Each option will differ in use for the sender and recipient as well as in security and cost. That being said, most businesses are shifting away from paper checks and moving toward digital payments.

How to Process International and Cross-Border B2B Payments

The internet has opened the world to cross-border business opportunities. Many companies require a way to process transactions from another country. This typically means sending and/or receiving international money transfers.

When making global ACH payments, the Automated Clearing House or Federal Reserve will act as the mediator. It requires a global payments platform that can serve as a second mediator and automate payments for a business. This eliminates the hassle of processing transactions in-house. You can also use the platform for tasks like:

- Keeping track of invoices

- Collecting payee tax information

- Storing pertinent data

- Meeting regulatory compliance

Whether you’re making an international wire transfer or a global ACH payment, there are several factors to consider.

Ready to simplify global transactions?

Automation means you can use multiple payment methods to pay suppliers

How to Send a Cross-Border Payment

There are several steps to take when a business wants to start making cross-border payments. These include:

1. Supply Data in Line With Local Regulations

Not all cross-border payment options are available in every country. That means even if you pay all entities within your supply chain using global ACH payments, new ones may not accept your payment option.

The first step is to supply unique data according to the country you’re dealing with. For example, in China, to make a global ACH transaction, you must have the payee’s telephone number.

In the UK, you’ll need their SORT code, and Ukraine requires a tax ID number. In most European countries, you’ll need a payee’s IBAN to send global SEPA ACH payments.

A global payments platform provides onboarding for payees, which takes care of the data collection you need from vendors. Payees can upload bank account information and payment preferences in minutes. This saves a business both time and money. It simplifies accounts payable and provides a centralized location for all payee data.

2. Decide Whether it’s a One-Time or Recurring Transaction

The next step is to decide whether it’s a one-time or a recurring transaction. If you’re going to make payments to a business on a regular basis, setting up a recurring payment is an easy way to get future discounts. It also means vendors are paid on time, and the relationship remains solid.

When setting up cross-border payments, you should immediately ask about early payment discounts. They typically range from 1%-10%, depending on how much and how early you pay. If you acquire this type of discount, the global payment platform you choose should allow for payee prioritization rules. That ensures those entities always get paid first.

3. Verify Applicable Payment Rules

Verify if the funds being sent abide by all applicable payment rules. There are over 26,000 rules around the world, so using a payments program makes the most sense. The staff doesn’t have time to check thousands of rules for each international transfer. That’s what computers are for.

4. Use Invoice Automation Tools

Sending global funds means you need complete oversight of each payment. This can be a time-consuming process. A single platform to view the status of every payment simplifies operations and reduces human error.

Instead of checking and reconciling each payment individually, the system can filter according to which are past due or need to be reconciled. A business can then use invoice automation tools to see who’s responsible for approving the payment and why they’ve failed to do so.

Choosing a Global Payments Platform

To get the most out of international payments, you need to employ a tool with business intelligence. Choosing a global payments platform will improve efficiency, reduce labor costs, and speed up the AP process. Here are some main features to look for when choosing a system:

Mass Payment Processing

To get the most out of cross-border payments, you need a program that supports mass payment processing. Schedule thousands of payments according to multiple methods in a single dashboard.

Tipalti is a payment service that supports transfers to 200+ countries in 120 unique currencies. They enable a business to easily partner with suppliers overseas and quickly pay them in their own currency. This type of model is at the heart of enterprise scalability.

No more data entry across multiple bank ports or extra processing fees. Tipalti allows you to schedule payments in different methods, currencies, and countries from a single application. The system automatically remits to all suppliers with no human interaction required. There is no need to hire more payables staff as you grow.

Payments are triggered from invoices, a file upload, or the API. All payment statuses and data from each method are reconciled, normalized, and can be sent to your ERP.

Banking Rules

The platform you choose must integrate with the 26,000+ banking rules required when sending international payments. This ensures they are processed quickly and without error.

Compliance

A successful global payments platform will guarantee OFAC (Office of Foreign Assets Control) compliance. Regulatory screening is a headache, but it must be done when suppliers provide you with banking details. The right software allows a business to skip a manual query on SDN and OFAC databases.

Instead, the platform can automatically screen all payees against a blacklist. Not only does this reduce the risk of fraud, but it also prevents losses caused by payment errors. It also keeps you from criminal liability. You never want to do business with a supplier on the OFAC blacklist.

Supplier Portal

Whether paying vendors, freelancers, suppliers, or contractors, your global payments platform should provide a self-service portal. It will guide these entities through entering banking details and choosing a preferred payment method. Tipalti is a program that provides six international payment methods. These are:

- U.S. ACH

- Global ACH (e-check)

- Wire transfer

- PayPal

- Paper check

The system should automatically validate supplier data in real-time using the 26,000 global banking rules to eliminate staff errors.

Advanced Payment Configuration

The right global payments platform should feature a variety of advanced payment configuration options. This enables a business to split transaction fees with the payee or set payment thresholds. Hold payments until a predetermined amount is reached to improve cash flow and optimize margins.

Tipalti incentivizes suppliers to choose the most cost-effective payment methods while shifting to safe, digital payments. Fees can be passed on or discounted according to the payment method that payees choose.

Total Transparency

If you want to reduce the number of calls and emails to your accounts payable department, proactive payment status communications are necessary. Total transparency to suppliers on where and when payments are processed is part of maintaining good vendor relationships.

Tipalti is a platform that also allows suppliers to view their complete payment history through the online portal. This frees your team up from spending hours on issue resolution or explaining why a payment was held up.

If additional information is required, payees are immediately alerted through the system to take quick action. In addition, all supplier portals are white-labeled, so your brand stays front and center at all times.

Financial Control

Look for enterprise-grade financial control in your global payments platform. Tipalti gives a business the flexibility to protect funds that are leaving the organization. Institute robust internal controls for healthy growth. This includes delegating authority, system permissions, and segregation of duties. Tipalti allows you to set:

- Unlimited payment approvers

- Role-based access

- Configurable workflows

- Audit trail logs

This system will always send mass payments backed by money transmitter licenses.

How Various B2B Industries Handle Payments

Business-to-business payments are handled differently depending on the type of industry, product, and service involved. Here is how some of the top markets are working with the technology today.

B2B Payments in SaaS

SaaS companies often set up recurring payments and subscriptions. Customers get to choose between a monthly subscription at regular prices or an annual subscription at discounted prices.

It goes like this: pay a higher normal price monthly or pay for 10-11 months upfront and get access to the software for a year. However, some companies offer no discounts, and customers pay the same amount whether they’re paying monthly or paying the yearly cost upfront.

While B2B SaaS customers expect speedy payment processing as obtained with other digital businesses, payments are still flexible. SaaS companies like Ahrefs, Mailchimp, and many others accept payments using credit cards or digital payment platforms like PayPal. SEMRush and Moz accept checks and wire transfers from customers in select locations or certain subscription plans.

Those options are all viable, but digital payment solutions allow SaaS companies to charge customers automatically when payments are due.

Benefits of B2B Payments in SaaS

- Speedy payments: Customers can make instant payments and get auto-generated receipts immediately without any extra input from the software company.

- Easy tracking: A database stores payment information where the SaaS company can get revenue reports, and sometimes customers can also track their payments.

- Convenient international payments: International customers get at least one option that’s suitable for their payment needs, and SaaS companies don’t lose out on revenue from international customers.

- Lower costs: Digital payments are typically more cost-efficient for the company and the customer — no need to spend money on transport for in-person payments or pay to process checks.

B2B Payments in e-Commerce

Modern commerce expects a brand to understand the problems buyers have and solve them before they ask you to. B2B suppliers are increasingly embracing digital payment methods (from e-catalogs to online checkout) to meet these needs. That’s because B2B buyers want a B2C experience.

Unlike an individual shopper online, corporate buyers expect to purchase against an account for larger transactions. This requires additional work, like purchase orders, negotiated payment terms, and invoicing. Paper checks are still the preferred method to pay these high-volume invoices.

A virtual credit card is often used in B2B payment processing. Unlike regular credit cards, these are good for one-time use and assigned a specific amount. They’re a hedge for B2B credit card fraud.

Benefits of B2B Payments in e-Commerce

- International payments: Customers can buy goods from anywhere in the world and pay conveniently without ever leaving their house.

- Invoice factoring: This allows companies to access cash immediately when they need to pay bills and improve cash flow.

- Real-time credit risk processing: E-commerce business owners can assess customers’ credit risks based on past records to determine how much to lend and a suitable interest rate in order to avoid losses.

- Early payment discounts: Customers get a discount and build business credit, while businesses improve cash flow and the “availability of working capital.”

B2B Payments in AdTech

Despite large overhauls in advertising technology, the way advertisers pay publishers is still rather traditional. One issue is that publishers get paid in longer payment cycles. Payment terms can go for as long as 180 days. You may still get a check in the mail or a wire transfer — the industry really has struggled to keep up with the times.

For some publishers, more than half of their working cash flow is tied up in accounts receivable. The bottleneck happens from late payments. A global payments platform creates a level of payment transparency that helps mitigate the risk of collaborating with new partners in this industry. It moves funds in a timely manner and leverages early payment discounts.

Benefits of B2B Payments in AdTech

- Schedule timely payments: Publishers get paid on time every time based on pre-approved payment schedules — no need for any calculations or sending invoices.

- Nourish business relationships: Regular, timely payments foster a good relationship between publishers and advertisers.

- Create transparency: Customers see their earnings in a dashboard and can tell how the AdTech company calculates them, which shows transparency.

- Reduce human error: Manually tracking ad metrics and tying them to publisher payments is tedious work that automated payments in the AdTech industry handle flawlessly.

B2B Payments in Online Marketplaces (Gig Economy)

The rise of the gig economy is forcing the payments industry to rethink B2B payment systems. It’s a complex technological leap that must satisfy gig workers and the clients they serve.

Freelancers want faster and easier access to payouts. They also seek more ways to use their money. This includes offers from the four major party card networks (mostly Visa and Mastercard) with an active debit card that can be used at any ATM.

If a business needs to use a contractor more than once, the right platform allows you to set up recurring payments to ensure all parties are meeting the contract terms. It also stores freelancer data (like bank account and payment method) for easier management.

Benefits of B2B Payments in Online Marketplaces

- A clear audit trail: Digital invoices used in online marketplaces give accounting and human resource teams a clear audit trail in line with government regulations.

- Easy international payments: International contractors work with international clients and receive payments on time while marketplaces make more money,

- Cross-border business support: Companies can have and keep a global workforce without worrying about international payments and regulations.

- Lower costs: Companies bear the cost of any non-compliance errors with in-house payroll, but the marketplace bears the risk of fines and penalties when they handle payments.

B2B Payments in Retail

Online shopping is growing more rapidly than ever. Offering online payment options is critical for business success. There is currently a shift in the B2B retail payments landscape. Many providers feel underserved in their payment needs. More can be done to address the segment’s key pain points, which include:

- Fraud risk

- Payment delays

- Limited transaction visibility

- High processing costs

- Supplier payment methods

- Manual AP processing

- Remittance data management

Another new trend in the retail industry is that mobile wallets are now being used for B2B transactions. PayPal Business and Bank of America have integrated with Google Pay and Apple Pay to bring the convenience of mobile wallets to business transactions. Soon, million-dollar invoices will be paid with the tap of a smartphone.

Benefits of B2B Payments in Retail

- Smooth processing of discounts and refunds: B2B payment solutions enable retailers to process discounts and refunds automatically without wading through a pile of customer data.

- Convenience of digital wallets: These allow customers to store digital coupons or loyalty card details in addition to credit card information to facilitate payments online and even offline.

- Speed and efficiency: Payments are processed instantly with an accompanying notification or receipt, reducing the time that would be spent on handling traditional payments.

- Third-party financing opportunities: Some B2B payment solutions like Klarna and Clearpay work with retailers to give customers third-party financing, which expands the retailer’s customer base and boosts revenue.

- Cryptocurrency adoption: Some retailers like Home Depot and Whole Foods accept cryptocurrency payments, which opens up business possibilities and advances the inclusion of non-traditional payment methods.

B2B Payments in Affiliate and Influencer Networks

Affiliate and influencer marketing are effective promotional channels for raising brand awareness and generating leads. However, paying these workers isn’t so straightforward for some companies. The average affiliate commission rate is somewhere between 5% and 30%. Payments to these people can fluctuate.

Influencers and affiliates are an extension of the gig economy, so payments work essentially the same. They want to be paid quickly but realize a lot of payment amounts are tied to analytics. However, like a freelancer, if you work with an influencer or affiliate often, setting up a recurring payment amount is a good idea.

Benefits of B2B Payments in Affiliate and Influencer Networks

- Scheduled payments: Payment schedules differ between affiliate networks, but affiliates are paid promptly whenever payments are due.

- Cross-border and international payments support: B2B payment solutions that support international payments enable businesses to sign more affiliates and boost revenue for all parties.

- Lower in-house labor costs: Affiliate networks handle payroll for affiliates, which reduces the amount of labor and any cost involved in handling payroll internally for companies.

How to Improve Operational Efficiency by Automating Payment

The vast majority of small businesses still use paper checks to settle transactions. This can indicate that many companies are unaware of their B2B payment options or deem automation an expensive solution.

Although person-to-person (P2P) payments have been on the rise in the past decade, B2B presents an even larger opportunity for saving time and money. For these reasons, a modern business of any type should consider automation and digital payment options.

Going digital with your B2B payments makes it easier to send, receive, and process money. It improves cash flow, guides merchant relationships, facilitates payments, and drives growth. Simple automation streamlines operations and encourages employees to focus more on creative tasks.

Evaluate where your organization excels and where there’s an opportunity to improve processes. This will help to better position your company for efficient treasury operations and prepare you to take advantage of key B2B payment innovations.

Risk Management for Digital B2B Payment Solutions

The rise in processing payments digitally has unfortunately been accompanied by an upsurge in cybercrime.

Business Email Compromise (BEC)

A report by Abnormal Security reveals that companies affected by Vendor Email Compromise (VEC) attacks rose by 119 percent between July 2020 and April 2021. Cybercriminals target communication between vendors and customers as the easiest way to carry out supply chain attacks.

VEC is convincing because both parties often have trusted relationships, and the criminal is impersonating the vendor after hijacking the vendor’s real email account. This means that even the best security experts may not recognize VEC attacks.

Tighten your email security by recognizing phishing emails and phishing links designed to steal your data in the following ways:

- Hover the cursor over a link: When the words describing the link and the URL you see on the bottom left of your screen (on a computer) don’t match, it’s a dangerous link.

- Check the sender’s email address: Legitimate emails often come from company addresses. An email like [email protected] or [email protected] are both fake emails. Always check for abnormalities in a sender’s email address.

- Watch out for the contents: Some phishing emails will contain typos and grammatical errors. Those are red flags from a supposedly credible entity. Also, they tend to create an abnormal sense of urgency to drive immediate irrational decisions. Always pause to consider the legitimacy of requests.

If you’re still unsure of requests via email, call the company allegedly sending the email for more clarity to avoid any mistakes.

Remember that phishing attempts are often the first stage of a VEC attack, so successfully stopping them can prevent a full-blown attack. However, since VEC attacks take time, they might already be subtly occuring in the background without your knowledge.

Use an email fraud solution to enable you to detect fake account numbers, edited invoices, and suspicious IP addresses to determine if you’re already at risk. Early detection will save money and eliminate other risks associated with VEC attacks.

Other steps are also essential in securing your digital payment process. Use only secure networks to send and receive funds to avoid any unauthorized access to payment information. Also, don’t rely on the payment provider to monitor and verify incoming and outgoing transactions — track everything yourself, too.

Despite the risks, B2B digital payments are here to stay, providing a greater level of safety than cash and checks and helping businesses become more agile. What methods are you going to offer customers? Check out our recent e-book, Comparing the Top Global Payment Methods, to help you decide.