Ready to modernize your purchasing process and reduce your AP workload through automation? Let’s dive in.

Buyers exert downward pressure on a seller’s revenue and profitability when they have strong bargaining power. Companies need ways to mitigate buyer bargaining power. Bargaining power of buyers is an essential concept that businesses should understand when setting prices and dealing with buyers of their products or services. It also applies when buying from their suppliers.

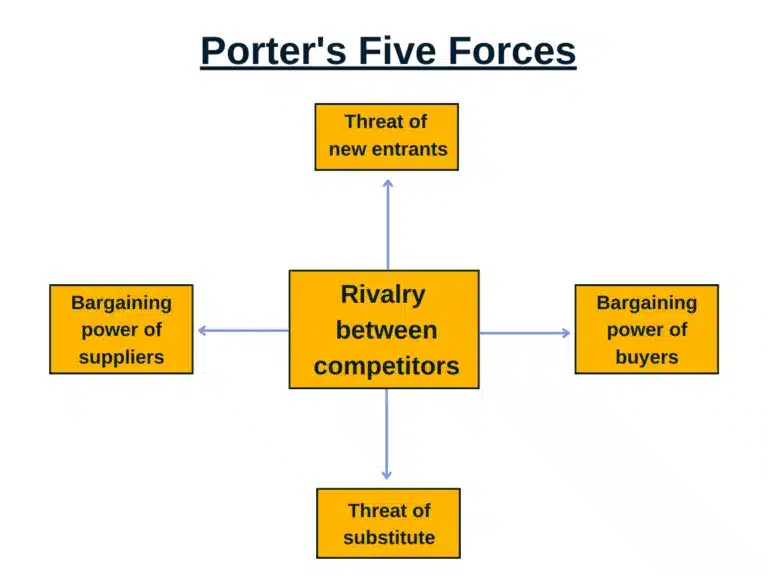

This guide defines the bargaining power of buyers, which is one of Michael Porter’s Five Forces in an industry. It explains driving factors, gives an example and strategies, and provides insight on tools to decrease your company’s workload for dealing with the bargaining power of buyers.

What is the Bargaining Power of Buyers?

The bargaining power of buyers is the concept that customers can apply pressure to vendors in order to lower product prices, increase product quality, or provide better customer care.

The bargaining power of buyers is one of Michael Porter’s Five Forces in his framework for assessing and managing competition in an industry. When their bargaining power is high, buyers gain negotiating power for lower prices, better quality, and better terms for their purchases when dealing with suppliers. When the bargaining power of buyers is low, sellers have more negotiating power.

Understanding Porter’s Five Forces

Porter’s Five Forces analysis in his industry competitiveness model framework includes the first four forces affecting the fifth force, Rivalry Among Existing Competitors. When rivalry among existing competitors is high, this force can give buyers more bargaining power over suppliers. It may reduce the threat of new entrants to the industry when entry barriers are high and increase the threat of substitute products or services.

Michael Porter’s Five Forces in an industry are:

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Threat of Substitute Products or Services

- Threat of New Entrants

- Rivalry Among Existing Competitors

Bargaining power of buyers and suppliers determines their relative position in an industry, including revenues, prices, market share, and profitability.

The following quote from Harvard Business School’s Institute for Strategy & Competitiveness’ description of The Five Forces indicates it may be a zero-sum game:

“The Five Forces is a framework for understanding the competitive forces at work in an industry, and which drive the way economic value is divided among industry actors.”

Top Strategies for Online Marketplaces

Although the marketplace industry continues to shift with evolving demands, one critical aspect remains—the need to compensate for an increasingly global stream of service providers and suppliers. Payments are paramount for establishing a loyal, motivated, high-performing, and valuable network.

The Relative Bargaining Power of Buyers is Most Likely Low When…

The relative bargaining power of buyers from Porter’s 5 forces industry analysis is most likely low where very few suppliers exist for a product or service. The products are differentiated, high switching costs exist, and product demand is high compared to supply, in industries with price sensitivity. In times of supply chain disruptions, the bargaining power of buyers decreases when the available supply is lower. Prices are higher, and buyer profitability is lower, increasing a supplier’s profit potential.

The Relative Bargaining Power of Buyers is Most Likely High When…

The relative bargaining power of buyers from Porter’s five forces model is high in an industry when the number of suppliers is plentiful for a product or service, the buyer company size and potential order are large, buyer concentration exists, undifferentiated products are being sold, switching costs are low, and the industry is oversupplied compared to buyer demand.

Buyer concentration means that the supplier is dependent on a few customers for its sales revenue. Buyer concentration results in financial risk for the supplier company when there’s a competitive rivalry.

Buyers could switch suppliers where industry competition exists. Suppliers selling products that aren’t differentiated open the door to potential buyer purchases of similar products offered by different vendors, increasing their buyer bargaining power.

Strong buyers exist when industry product prices for buyers are reduced by sellers. These buyers can demand higher quality and more service from product providers.

Example of Bargaining Power of Buyers

This example explains the bargaining power of individual and business buyers vs. sellers in the residential real estate market.

The Industry

Single-family residential real estate is an industry noted for cyclical changes in the bargaining power of buyers versus sellers when houses are bought and sold. The seller in the new homes market is the residential construction company (builder). The seller in the resale home market is usually an individual seller that resides in the residence or rents it to tenants.

The Bargaining Power of Real Estate Buyers vs. Sellers

The bargaining power of buyers in these new home and resale home industries is similar.

Factors determining the relative bargaining power of buyers vs. sellers include:

- The high or low supply of houses available for sale

- The number of offers received on a house for sale

- Mortgage interest rate levels

- The number of competing buyers qualified for mortgage loan approval

- Buyer cash availability for down payments and subsequent house payments affordability

During real estate downturns, known as a buyer’s market, the number of houses available for sale is above average, interest rates are generally higher, fewer buyers are competing for houses to buy (viewing houses and making offers), and fewer buyers are approved for mortgage loans or have enough cash for down payments and subsequent house payments. The economy may be in a recession, resulting in job losses.

In a buyer’s market, the bargaining power of buyers is strong. Sellers may reduce the price of the house to gain offers while listing it on the market. Buyers may ask for seller incentive concessions like paying for points on the buyer’s loan and offering an allowance for repairs. The buyers won’t waive contingencies or inspections, as they might in a seller’s market. The owners (sellers) may offer seller financing to buyers to improve the chances of selling their house.

In a seller’s market, the bargaining power of typical buyers is weak. They compete for a limited supply of houses with other sellers, including those willing to make all-cash offers to win the deal.

Real Estate Investment Businesses as Buyers

Sometimes businesses like real estate investment firms or private equity firms compete with other buyers to pool and purchase multiple houses from a builder or residential house owners. They may offer cash to the sellers or have adequate bank financing lined up. Their strength as a buyer may be considered high. This strength increases their bargaining power as an investor buyer.

Strategies to Reduce the Buyer Bargaining Power of Customers

Strategies to reduce the bargaining power of buyers that are customers include:

- Increase product differentiation

- Use backward integration M&A to buy or merge with suppliers or their product lines

- Acquire companies through horizontal integration to gain size and reduce the relative bargaining power of large customers

- Increase your company’s internal growth rate and financial strength

- Consider using contribution margin pricing analysis as an incentive to increase sales when necessary or negotiate better

Companies with differentiated products or services that aren’t commodities encounter buyers with less bargaining power. These supplier businesses may charge premium prices for their products or services. Buyers may be unable to substitute comparable products. Therefore, most buyers have less negotiating power to get price reductions.

Horizontal vs. vertical integration means the difference between buying companies selling in the same industry vs. buying suppliers providing inputs to the final product or service, or acquiring distribution channels, retailers, or logistics companies in the supply chain. A company using a conglomerate merger strategy owns multi-entity operations in unrelated businesses.

Backward integration is a type of vertical integration in which manufacturers buy or merge with suppliers earlier in their supply chain to own the inputs like raw materials and labor needed to manufacture their own products being sold to end users.

When companies increase their size and financial strength, they may increase their bargaining power with buyers.

If buyers attempt to assert their bargaining power, analyze your company’s contribution margin by product to see if offering an incentive of below-standard pricing to buyers will still cover the variable costs, increase economies of scale, and contribute to revenues and profits. If not, use this contribution margin pricing analysis as bargaining power to get a higher price from the potential customer during negotiations.

Automation + Customer Relationship Management

Businesses use automation software tools, including customer relationship management, to manage contacts and business processes, improve customers’ experience, and increase efficiency, saving time and reducing costs. Automation software is used to counteract the bargaining power of buyers and increase profitability.

Customer Relationship Management Software

CRM software is used for traditional sales and eCommerce businesses, gaining new customers, relationship marketing, and customer service.

With customer relationship management (CRM) software, companies:

- Manage their contacts with prospective buyers and customers

- Conduct and track marketing campaigns to generate revenue

- Manage sales and sales force processes and productivity

- Initiate and track customer service revenue

CRM software integrates with your company’s ERP system, as does purchase order management automation, AP automation, and global payments software, which are useful when your company acts as a buyer or supplier to buyers.

Purchase Order, Procurement, AP Automation and Payments

Purchase order management software provides automation for the purchasing process.

Other procurement automation and spend management software can be used to manage supplier relationships and track spending by category. These procurement software products automate the procurement process for buyers and coordinate with suppliers. The entire online procurement process from requirements, strategic sourcing, competitive bids, vetting, negotiating, contracting, and supplier review can be automated.

AP Automation and Global Payments Software

AP automation and global payments software:

- Provides a self-service supplier portal that handles supplier onboarding and tax compliance, communications, and automated payments status

- Streamlines and automates the accounts payable workload, including 2 or 3-way invoice matching and approvals

- Eliminates manual document processing

- Screens for global regulatory compliance

- Validates payees and reduces payment errors and fraud risk

- Makes and automatically reconciles mass payments with multiple payment method options in many countries and currencies

Using Accounts Payable automation software improves supplier relationships for all types of businesses, whether they operate online as eCommerce businesses or use their physical presence to interface with buyers.

Key things CEOs, CFOs, and controllers should know about AP automation include its features and benefits and the business case for using this type of advanced software. AP automation software saves time and money and reduces financial risk.

Conclusion

The bargaining power of buyers is one of Porter’s Five Forces for competitive analysis of an industry. Businesses that consider buyer bargaining power in negotiations can consider implementing strategies. These business strategies include:

- Increasing product differentiation

- Completing backward vertical integration of suppliers in M&A deals

- Achieving internal and external growth for more financial strength

- Using automation software tools to gain a competitive advantage

As a Key to Growth, access the financial automation tools your business needs to control the bargaining power of buyers in your industry. Discover how CFOs are transforming into business strategists.