Unlike accounting automation, manual data entry is a costly and outdated approach that lacks scalability and accuracy, resulting in bottlenecks, increased workloads, and the need for overtime and additional hiring. The application of accounting automation tools can be a powerful way for businesses to eliminate manual accounting tasks.

This guide explains what accounting automation is, how it works, which tasks can be automated, and how modern finance teams put it into practice.

What is Accounting Automation?

Accounting automation is the application of efficient, AI-driven software that replaces manual tasks with rules and digital tools. Accounting automation strengthens controls and compliance, reduces errors, and enables real-time transaction recording, providing better visibility into decision-making.

Common use cases for accounting automation include:

- Accounts payable automation

- Global payouts automation

- Procurement automation (for PRs and POs)

- Expense management

- Cash management/treasury automation

- Accounts receivable automation

- Auditing automation

In short, accounting automation replaces repetitive manual work with rules-based, AI-assisted workflows.

Watch: Accounting Automation Explained (Video Guide)

With the core concepts covered in the video, let’s take a deeper look at how accounting automation works, which processes benefit most, and what it takes to implement it effectively.

How Accounting Automation Works

At its core, accounting automation uses digital tools, AI, and rule-based workflows to take over repetitive tasks and keep processes moving smoothly. Instead of relying on manual data entry or hand-offs, systems handle much of the work behind the scenes so teams can stay focused on higher-value tasks.

Accounting automation works in this way:

- Software uses workflows, rules, and AI to automate tasks

- Data flows automatically between invoices, approvals, ledgers, and reporting

- It removes manual data entry by capturing information, validating it, and routing it

- Approvals move automatically

- Reconciliation is updated in real time

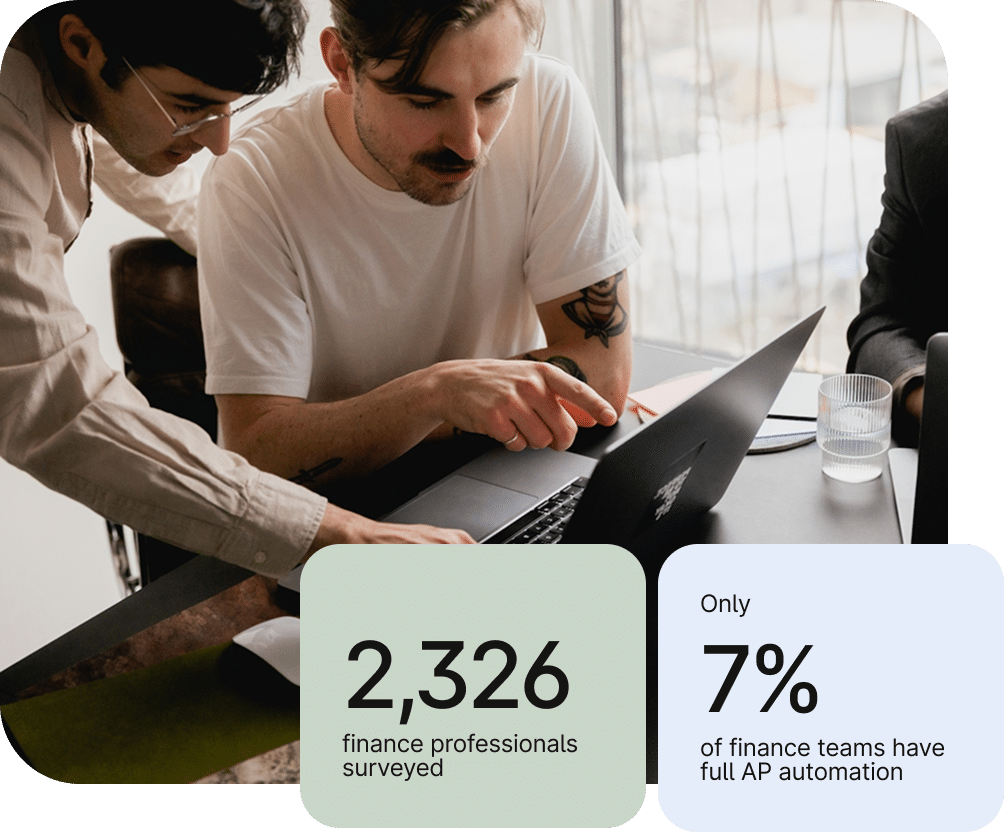

Accounts payable (AP) automation is one of the most common and valuable applications of accounting automation. It begins with self-service supplier onboarding and intelligent invoice data capture powered by OCR, AI, and machine learning.

From there, it automates invoice processing, approval routing, global payments, and payment reconciliation. Modern AP automation platforms also provide real-time visibility, compliance controls, and AI-driven insights that help finance teams make faster, more informed decisions.

Key Benefits of Accounting Automation

Accounting automation offers several key benefits, including time and cost savings, reduced error and fraud risk, a faster closing process, and enhanced financial controls.

Key benefits of accounting automation include:

1. Saving Time and Accelerating Close

Accounting automation software, when integrated with your ERP or accounting software, quickly processes related incoming information and syncs it to existing records in your system. Real-time batch payment reconciliation helps your company accelerate its accounting close.

Automated accounting programs generate relevant structure reports and post the correct timestamps of all associated data to create an audit trail.

2. Reducing Manual Data Entry

Accounting automation replaces time-consuming and error-prone manual data entry for routine tasks.

3. Improving Accuracy and Reducing Errors and Fraud Risks

An AI-driven accounting automation software add-on enhances accuracy and reduces errors, compared to a manual accounting system.

With accounting automation, accounting specialists are automatically notified of flagged issues, enabling them to resolve discrepancies discovered during invoice processing promptly. Automated taxpayer ID number (TIN) verification for suppliers or other payees and AI-powered fraud detection monitoring reduces fraud risks.

4. Offering Real-time Visibility into Finances

AP automation gives your business real-time access to spending and accounts payable balances by entity and combined. An AI agent can add functionality to generate real-time custom reports based on your queries.

Automating activities also allows businesses to quickly see how much they are generating, which areas they are spending the most on, and when they can expect their money. This kind of visibility helps them make wiser decisions.

5. Avoiding a Cash Flow Crisis

Mismanaging funds and insufficient cash flow forecasting are the main reasons why any business can go bankrupt. When specific accounting tasks are automated, business managers can immediately get a complete picture of their cash flow. They no longer need to sort through all their transactions manually to understand their financial status.

Businesses that process their accounts payable quickly can take advantage of early payment discounts, consistently saving 2% on the cost of purchased items. This prompt payment discount from timely vendor invoice processing through payment improves your company’s gross margin, profitability, and cash flow.

6. Strengthening Compliance

Without accounting automation, companies are more at risk of fines and, in some cases, criminal penalties for non-compliance with global payments regulations and for failing to achieve tax compliance. It’s challenging for accounting managers and specialists to keep up with international requirements across all countries where your business operates or makes payments.

7. Improving Data Security

Accounting automation uses encryption and other advanced security features. These systems ensure maximum protection of company records and data, helping protect from cyberattacks.

Businesses have more control over which individuals in their business or back office can access unauthorized financial information. This capability helps minimize the risk that unauthorized employees will access specific ledgers.

8. Shifting to More Strategic Work

In accounting, employees can shift their roles to more strategic initiatives that add value to company results rather than being bogged down in routine, day-to-day tasks.

9. Reducing Stress and Burnout

The automation of accounting processes reduces workload frustrations, bottlenecks, and overtime, resulting in less employee burnout and churn.

10. Providing Cloud Access

Cloud-based accounting systems make it easy to access and share documents from anywhere. CPAs and accounting teams can process transactions or review required documents without being tied to a specific workstation. These platforms also offer around-the-clock availability and enterprise-grade security to ensure continuity and protect sensitive financial data.

11. Improving System Flexibility

High-quality accounting automation software is often adaptable enough to meet business requirements. Apart from the standard formatting for easy reference, these programs also offer various templates for different business ledgers. These qualities make accounting automation systems particularly flexible for a wide range of industries.

12. Providing Digital Storage and Organization

Automated accounting software improves data entry, processing, and storage, making it far easier to locate specific information when needed. Once details are entered into the system, they’re stored reliably and indefinitely. Many platforms also offer automatic backups to protect against data loss and ensure critical financial information is always preserved.

13. Enabling Fast Retrieval of Data

Automated accounting programs are designed to make ledgers and documents easier to name, categorize, and store safely. These traits make it easy to find vital business records.

14. Providing Comprehensive Analytics

Beyond improving organization and security, accounting automation enables fast access to accurate financial data. Reports can be quickly generated, shared, and reviewed across the company, simplifying audits and reconciliations.

The software also delivers more precise analysis of trends, variances, and forecasts. With real-time financial insights at their fingertips, accountants can work more efficiently and make better-informed decisions, faster.

15. Preparing Records for Tax Deductions

Without automation, businesses struggling to keep up with income tax deductions may scramble during tax season to track expenses and receipts. This can lead to mistakes with serious consequences.

An automated bookkeeping system can help determine deductions, letting financial management know how much to expect during tax preparation as soon as transactions come in.

16. Providing Professional Development Opportunities

For many finance teams, automation marks a turning point. It allows accountants to expand their expertise, contribute more strategically, and increase their value within the organization. Even an automated system still relies on accountants to guide the process and keep everything running smoothly.

When used effectively, automation removes much of the tedious, repetitive work from accounting roles. This gives professionals more time to focus on higher-level responsibilities, like managing treasury activities, shaping financial strategy, and collaborating more closely with colleagues.

AP Automation Belongs in Your Accounting Automation Strategy

Scalable Tipalti AP automation eliminates manual processes, improving operational efficiency, on-time payments to suppliers, and visibility.

Which Accounting Processes Should Be Automated?

Automating the Accounts Payable Process

With an AP automation system like Tipalti’s, invoices can move quickly and efficiently through the accounts payable department during invoice management and payment processing. After integrating accounts payable automation software, your business can process invoices on time to earn early payment discounts and automatically reconcile payments to sub-ledgers in real-time.

General Ledger Reconciliation

Account and payment reconciliation with the general ledger should be automated to the extent possible. Automated accounting software with reconciliation functionality lets your business speed up its financial close.

Expense Management

Providing your employees with access to automated expense management through a mobile app simplifies the process of submitting and approving expense claims generated from receipt photos. Your business can pay these claims by integrating expense management software with your AP automation solution.

Reporting

Different types of accounting automation software have financial reporting functionality. Consolidation automation, automatic AI-generated analysis reports, and AI for anomaly detection improve the financial reporting process.

Financial Close

Accounting automation software helps companies streamline their financial close process and complete it more efficiently.

Payroll Integrations

Businesses can integrate automated payroll applications with their ERP systems or outsource payroll to a service that leverages accounting automation for greater efficiency.

Audit Documentation

Using intuitive automation in accounting, finance, and auditing for audit documentation, including audit trails, should be a priority for organizations. If any records (such as invoices) are accessed, any business must know who opened them and when it happened.

Procurement

Procurement is the process of identifying business needs and sourcing the supplies and services required for operations. It also involves managing relationships with suppliers to ensure quality, cost-effectiveness, and continuity.

Because procurement relies heavily on documentation, digitizing and organizing records significantly improves efficiency. Accounting automation further streamlines this work by simplifying tasks such as:

- Requesting quotation files, inspection sheets, and approval documents

- Preparing shipment receipts, freight bills, manufacturing records, invoices, supplier data, and other essential business records

- Forecasting with regulatory sheets, product research documents, and supplier details

- Documenting inspection reports, defect-resolution workflows, and testing results

- Managing purchase orders, contracts, and estimates

These processes traditionally involve extensive paperwork and multiple systems to maintain accuracy. By automating them, companies reduce manual documentation, minimize errors, and free managers and specialists to focus on higher-value activities.

How to Automate Accounting Processes

Automating accounting processes enables your business to reduce manual data entry in bookkeeping. To automate accounting processes, consider these steps.

To switch to automated accounting processes:

- Start small by identifying repetitive workflows

- Digitize documents first

- Standardize approvals

- Connect accounting automation tools to your ERP

- Pick automation for AP, reconciliations, or reporting

- Use AI/intelligent document processing (IDP) to eliminate manual data entry

- Measure time savings and error reduction

By taking these steps, businesses can shift smoothly from manual work to more efficient, automated processes—reducing errors, saving time, and giving finance teams more room to focus on higher-value work.

What to Look for in an Accounting Software

Choosing the right accounting software can be challenging, but focusing on the features that truly support your workflows makes the process easier. Start by identifying the essentials your team needs, along with capabilities that can improve efficiency and streamline operations.

Here are key factors to consider when evaluating accounting software:

Automation

As mentioned earlier, automation enables accountants to do more for a company compared to the manual processes of traditional accounting. At this time, accounting automation could mean many things, such as generating weekly transaction reports or processing numerous invoices automatically.

Regardless of the situation, businesses should strive to make their CPAs and accounting specialists more efficient and effective by automating routine, repetitive tasks through an automated accounting system.

Core Accounting Modules

Accounting software should cover the essentials of running a business. Many accounting programs today offer similar features, but some provide unique financial services that may not be available elsewhere.

Below are some of the most practical features that business owners should look for in an accounting system:

- Invoicing capabilities

- Time tracking

- Expense tracking

- Automated financial reports

- Daily dashboard

- Customer support service

- Mobile application

Platforms like Tipalti enable users to schedule a demo that showcases how their system can help automate payables processes.

Cloud Access and Capabilities

Businesses want software solutions that can be accessed remotely whenever they are needed. An accountant or approver who has to access the application away from their desk or while at home will find a cloud-based solution essential.

Another benefit of cloud technology is that companies do not need to hire experts, as most service providers take responsibility for upgrading and protecting their platform.

Tipalti offers a cloud accounting solution that they update multiple times a year to stay ahead. They also manage any necessary upgrades, so companies do not need to maintain hardware or track various codebases. Tipalti systems use enterprise-grade security to ensure that the highest standards in business continuity and safety are met.

Multi-User Access

Companies looking to expand in the near future should begin preparations for growth and involve more people. They should also have a system that can accommodate multiple users and assign various role-based permission levels.

Not everyone in the company should have access to specific financial records, particularly those containing sensitive client data. The ability to authorize specific users is crucial in preventing data security breaches.

Business Intelligence

A company’s financial data provides valuable insight into its overall business operations when analyzed correctly. Mid-market or small business accounting software that offers predefined reports can be helpful. The ability to customize beyond the standard profit-and-loss financial statements can also be beneficial.

These capabilities allow financial teams to identify which payments arrive on time and which are late, which departments contribute the most in revenue, or which teams are spending more than expected.

The ideal accounting system should provide valuable information, such as an overview of the bottom-line profit, along with more detailed records for specific accounts.

A Proven Track Record

As with any service provider, assessing reputable accounting software is essential to selecting the right solution. Business owners can conduct their own research to find an accounting services provider who is knowledgeable and experienced in the industry.

Reading reviews and user testimonials is one way to determine whether accounting software can be trusted. Awards and achievements within the industry indicate an accounting platform’s capabilities.

A financial management system with a good track record means it has been in operation for some time and is likely to deliver on its promises.

Ability to Scale

Ultimately, businesses should seek accounting software that supports their operations, even as they expand and evolve. Software scalability increases the capacity to accommodate customers or clients, send and pay more invoices, or handle projects as a business grows. It can reduce the need for hires that would increase headcount as volume increases.

Challenges of Manual Accounting

With increasing global complexity and tax and regulatory burdens, businesses face many challenges when using a manual accounting system.

Manual accounting challenges include:

- Time-consuming: Manual data entry and matching paper documents during invoice processing take too much time and aren’t scalable when volume increases.

- Lost invoices and bottlenecks: Paper invoices could sit on desks for weeks, awaiting approval, or get misplaced.

- Error-prone: Errors include failing to properly match invoices to POs and GRNs, accidentally entering the wrong information into specific accounts, transposing figures, or recording data backward.

- Lacks security: Manual systems may not be sufficient to defend against cyberattacks or ensure adequate data privacy.

Each time an invoice is received by the accounts payable department, it needs to be approved and recorded immediately. Manual invoice processing could lead to late payments, understated accounts payable balances, and inaccurate cash flow forecasts.

In manual accounting processes, accounting mistakes can happen frequently. Although these issues can also occur in modern accounting systems, they are more common in manual accounting and spreadsheets, where there are no automated systems to perform internal checks and balances.

Accountants tasked with identifying errors can spend several hours locating and fixing these computer data entries and adjusting journal entries throughout the accounting cycle.

Filing paper documents manually is less secure because documents can easily be misfiled or misplaced. A filing cabinet filled with crucial customer details is easier to access than a computer that requires a password and credentials to open.

Accounting Automation: AI, Implementation Challenges, and Future Trends

To fully comprehend accounting automation and its adoption, consider this overview of AI inclusion, challenges, and future trends.

AI in Accounting Automation

The use of artificial intelligence (AI), including its machine learning (ML) component, enhances accounting automation. Using AI (including AI agents and AI assistants) in automation software improves efficiency in completing accounting processes. Businesses can automate accounting processes using AI agents for OCR document capture, PO matching, tax compliance, account coding, flagging errors and fraud risk exceptions, and routing approvals.

In business management, AI-driven automation provides more accurate and timely financial reporting and business intelligence, enabling more informed decision-making. Automated software users receive AI assistance in detecting pattern anomalies and answering queries to provide business intelligence for decision-making.

Accounting Automation Challenges

A career trajectory (upward or downward) is related to the adoption of new systems and the ability to enhance personal and business performance. Your business can adopt strategies to make implementation quicker and overcome its challenges.

Implementation Challenges

Challenges from potential obstacles in adopting accounting automation include:

- Resistance to change: Automated accounting represents a paradigm shift that requires employees to use add-on software, altering their customary workflow. Change management coaching and top executive system support will help overcome employee resistance.

- Understanding business processes is crucial: A thorough understanding and streamlining of business processes are necessary for successful system implementation.

- Integration with existing systems: Add-on automation software should seamlessly integrate with ERP systems or accounting software (such as QuickBooks Online) using API or flat-file connections (e.g., CSV).

- Data migration issues: Cleaning data and performing data migration with proper field mapping is required. Test the new system in a sandbox environment before going live.

- Need for employee training: Train the implementation team and users on how to use the new automation software through webinars, user conferences, live training courses, and online documentation.

Tipalti offers consulting services to help your team implement software more efficiently.

Future Trends of Accounting Automation

Future trends in accounting automation include the increasing use of AI-driven tools, including AI agents, to perform routine tasks with reasoning and logic. AI agents will also be used more in customer support.

Global regulatory compliance will improve for businesses operating internationally. Real-time reporting will increase for companies needing recording and visibility without time lags that distort financial statements and delay decisions to correct course.

New ways to apply accounting automation through feature updates and added functionality will expand the widespread adoption of finance and accounting automation, driven by digital transformation that replaces manual processes.

Real-World Applications and Case Studies

Accounting automation delivers measurable impact across AP and mass payouts—from saving time and reducing errors to improving approvals, visibility, and supplier or creator relationships.

Tipalti integrates seamlessly with leading ERPs to automate the entire payables cycle, including supplier onboarding, invoice capture, approvals, global payments, and instant reconciliation. Tipalti AI Agents work alongside finance teams to autonomously handle repetitive tasks, surface real-time insights, flag anomalies, and accelerate decision-making—helping teams operate with greater speed and accuracy, especially in multi-entity environments like NetSuite.

For organizations managing large-scale international payouts, Tipalti’s Mass Payments solution automates payments to creators, affiliates, publishers, and contractors, including royalties and performance-based payouts.

Proedge Customer Case Study and Testimonial

Prodedge, a mid-market company that provides a marketing and consumer insights platform, uses Tipalti’s unified AP automation mass payments products (integrated with NetSuite ERP) to automate accounting for supplier payments and payouts.

We do a lot of high-volume transactions as part of our business for the publisher network. Having the ability to do big batches of payments with Tipalti is super helpful. Additionally, our acquisitions have become more sophisticated and more globally diversified. [Tipalti] can quickly spin up a new subsidiary, and nothing will go missing.

Oliver Shaw, SVP, Prodege

Proedge achieved these results:

- Replaced manual payables and payout processes with automation to increase efficiency and reduce hiring needs

- Makes significantly more efficient global payments and payouts

- Simplified multi-entity integrations and achieved scalability

Thematic Customer Case Study and Testimonial

Thematic provides services to YouTube creators and pays them royalties using automated Tipalti mass payments software. Thematic works with 625,000 creators in 200 countries, including music artists. The Thematics business model curates music for content creators in the YouTube marketplace and matches music artists to creators.

We hit a friction point—paying each of these artists individually on a monthly basis, or once they reach a certain earnings amount, was a complicated process to manage. Our artists love [Thematic’s payment process] so much more because they’re getting paid faster in their preferred method of choice. They have more options and more flexibility based on when and how they want to get paid—we’re making them happy.

Audrey Marshall, Co-Founder, Chief Operating Officer, Thematic

With Tipalti mass payments automation software, Thematic:

- Makes fast, reliable global payments in large batches

- Streamlines tax compliance forms and bank data collection during onboarding

- Enables payees to receive their royalties in local currencies, PayPal, and debit or credit cards

These real-world examples show how accounting automation isn’t just a convenience, it’s a catalyst for scale, accuracy, and better partner experiences. Whether optimizing AP workflows or managing large-volume global payouts, Tipalti helps organizations operate with greater confidence and agility. By reducing manual effort and unlocking deeper visibility, Tipalti enables finance teams to focus on strategic growth rather than administrative burden—bringing the full promise of automation to life.

AP Automation: A Critical Driver of Finance Digital Transformation

Reduce costs, improve financial controls, gain real-time visibility, and save time with AP automation.