Save time and empower your finance team with Tipalti. The most complete AP solution loved by 5,000+ businesses.

Quadient AP (formerly Beanworks) is an AP automation tool that helps businesses automate invoice capture, purchase orders, approvals, and payments.

However, if you’re looking for Quadient AP competitors, it may be because the tool’s limitations are hindering your organization’s growth and productivity.

To help you find the right fit, we’ve shortlisted the top five Quadient AP alternatives and compared their key features, serviceable markets, strengths, pricing, and customer reviews.

5 Signs You’ve Outgrown Quadient AP or Any SMB AP Tool

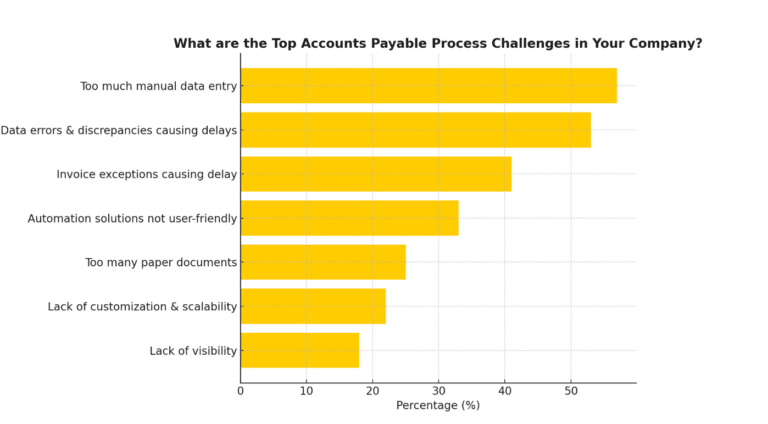

In their 2025 report, the Institute of Financial Operations and Leadership (IFOL) found that manual processes, data discrepancies, and process delays are some of the top pain points for finance professionals in accounts payable.

Here are five signs that indicate it’s time to replace your current AP tool:

- The AP team relies on manual or ad-hoc processes

Manual data entry, approvals, and reconciliation lead to errors and delays in the accounting cycle that impact vendor relationships and cash flow. - Your current system can’t keep pace with your company’s growth

Inability to handle an increased volume of invoices, purchase orders, payments, or subsidiaries impedes growth. - Integrations are falling short

Inability to handle integrations with your growing tech stack reduces productivity. - Struggling with compliance and spend visibility

Penalties and fines for non-compliance with tax and financial regulations are harming your reputation. - Inaccurate analytics

Lack of actionable, real-time insights across AP, procurement, and expenses is impacting cash flow projection and financial planning.

What to Look for in a Scalable AP Solution

- Scalable, end-to-end AP automation

- Global payment compliance

- Enterprise-grade security

- Multi-entity support for remote teams

- Artificial intelligence and ML-powered invoice data capture

- Automated two and three-way PO matching

- Branded, self-service supplier onboarding

- Effortless expense management and reimbursement

- In-depth ERP and accounting app integrations

Focusing on these key features helps avoid the limitations of outdated systems and fosters choosing a platform designed for high-volume on a global scale.

Pro Tip: Check out Tipalti’s newly-released AP Automation Playbook to better understand the “must-have” AP capabilities and common missteps to make when updating your system.

Top Quadient Competitors to Consider in 2026

These Beanworks alternatives may help you plug the gaps in your current system:

- Tipalti: Best for Global, End-to-End AP Automation

- Yooz: Best for Simple Integrations

- Stampli: Best for Invoice Management

- BILL: Best for Small Business AP

- AvidXchange: Best for Fast Implementation

Comparison: Quadient Competitors

| Category | Quadient | Tipalti | Yooz | Stampli | BILL | AvidXchange |

|---|---|---|---|---|---|---|

| Invoice Automation | Memorization GL coding | AI OCR + predictive GL | Vendor memorization | Low-accuracy OCR | Manual GL coding | OCR + memorization |

| Expense + Procurement | Basic tools, no intake | Advanced suite + intake | Basic tools, no intake | Immature, Launched 2025 | Beta, manual PO, no intake | Intake not user-friendly |

| Approval Routing | Rules-based | AI-based | Rules-based | AI-based | Rules-based | AI-based |

| PO Matching | 2- and 3-way | AI line-level | ✅ | Basic 2-way | Two-way | AI 2/3-way |

| ERP Integration | Sage, file-based only | In-house API + files | Sage-focused | API or file-based | QuickBooks, Xero basic | 220+ integrations |

| Data Capture | AI via Tungsten Copilot | AI OCR, self-learning | OCR + AI mapping | AI + manual checks | OCR + AI | Smart AI extraction |

| Tax Compliance | ❌ | KPMG tax engine + eFiling | ❌ | Manual forms | Manual W-9s | ❌ |

| Global Payments | BYO Bank, 3rd party | 200+ countries, 120+ currencies | 3rd party only | 100+ countries, no MTLs | 130 countries, 100+ currencies | ACH, checks,and limited cross-border |

| Custom Fields | ✅ | ✅ | Manual mapping | Some customization | Limited workflows | ✅ |

| Fee Splitting | ❌ | ✅ | Workarounds only | ❌ | ❌ | ❌ |

| Scalability | Moderate growth | High-volume growth | SMBs + mid-size scaling | Moderate growth | Moderate invoices | Small growth |

| Controls: Workflows | ✅ | ✅ | ⚠️ | ✅ | Basic approvals | ✅ |

| Compliance Tracking | ⚠️ | Fraud checks, 26k+ rules | Forensic validation | Vendor compliance | 3rd-party monitoring | ✅ |

1. Tipalti: Built for High-Growth AP Teams

Tipalti AI auto-codes invoices at the header and line-item levels

As a comprehensive AP automation solution for businesses of all sizes, Tipalti scales seamlessly from growing companies to global enterprises.

The platform offers advanced procurement, expense management, and AP automation features that Quaident lacks, like AI Smart Scan invoice processing technology, vendor management, built-in tax compliance, in-depth ERP integrations, and more.

Finance teams that outgrow SMB AP tools consistently cite Tipalti’s ability to handle scale without added complexity. Customers highlight faster processing, fewer manual steps, and greater confidence in global payables as their operations grow.

With Tipalti, we give our contractors until day five to submit their time, and then we pay everybody on the sixth—which takes just a few minutes. It has been fantastic.

Jessica Hardy, VP of Finance, Art of Problem Solving

Top Features

- End-to-end AP automation with integrated expense, payment, procurement, and AP modules

- Purchase order creation, 2 and 3-way PO matching

- Multi-entity AP support, including entity-specific workflows, tax compliance, payment methods, and more

- KPMG-approved tax engine with self-service partner onboarding

- Robust fraud prevention and data security tools

Serviceable Market

Tipalti is ideal for organizations looking to streamline the P2P process through automation and those seeking to manage complex, global payables. Whether a startup or a large enterprise, it’s a solution that fits all sizes and industries.

Strengths

- AI Smart Scan and auto-coding for faster payment processing

- Global, performance-based system for marketplaces, networks, and communities

- Significantly reduces payment errors and manual workload through 26,000 built-in validation rules.

Pricing

Tipalti’s AP Starter Plan is $99/month. It includes:

- AI Smart Scan invoice processing

- Branded, self-service supplier portal

- W9/W8 form collection and TIN validation

- Bill approval rules builder

- Domestic multi-entity infrastructure

- Card and expense tools

- Integrations with leading ERPs.

The Premium and Elite pricing plans offer additional features with a custom quote.

Customer Rating

G2: 4.4/5

Capterra: 4.6/5

Built to Scale AP Without Adding Complexity

Tipalti adapts as invoice volume, entities, and payment complexity grow—centralizing intake, approvals, payments, and reconciliation in one connected platform.

Tipalti vs. Quadient: Side-by-Side Comparison

| Tipalti | Quadient | |

|---|---|---|

| Invoice Management | AI-based OCR, predictive GL coding and approval routing, best-in-class approval emails, e-invoicing support. | ⚠️ Memorization for GL coding (no AI), |

| PO Matching | Two and three-way with automated reconciliation. | ⚠️ Supports two-way and three-way PO matching. Basic PO matching tolerance thresholds. |

| Reconciliation and Reporting | Fully managed in-house API and file-based integrations with leading ERPs, instant reconciliation. | ⚠️ Focus on Sage. File-based integrations only. Need to create payments in ERP and pay in Quadient for many ERPs. |

| Tax and Regulatory Compliance | KPMG approved digital tax engine, TIN validations, prep reports, withholdings, and eFiling. | ❌ None |

| Global Remittance | Pay to 200+ countries and territories in 120+ currencies via 50+ methods. Globally licensed, Bluechip bank partners, fraud protection. | ⚠️ Bring Your Own Bank or 3rd party payment partners impact reconciliation. |

| FX Solutions | Convert currencies, manage intercompany bank transfers, hedge FX risks. | ❌ None |

| Supplier Management | Self-service onboarding, payment validations, proactive status comms, supplier choice, and visibility. 26K+ rules validate payments, screen against OFAC/SDN lists. | ❌ None – generally done through ERP or 3rd party payment partners. |

| Bill Approval | Via email with no login or fee, with role-based workflows. | Access is free, and approvals are configurable by amount, role, and entity. |

| Expense Management | Mobile expense submission and approval, expense tracking, global reimbursement, and quick reconciliation | ⚠️Non-intuitive. Expense reports are submitted to the invoice module for approval. |

| Pay Fee Splitting | Split fees between payer and payee. | ❌ None |

| Multi-Entity | Manages payables for multiple subsidiaries with shared or separate workflows and automatic currency/entity mapping. | ⚠️ No onboarding and tax management per entity. |

| Scalability | Works for high-volume, global companies managing a multitude of payments each month. | ⚠️ Works best for mid-size organizations with moderate growth. |

How Other Quadient Competitors Stack Up

2. Yooz

Founded in 2010, Yooz is one of the top Quadient competitors with similar features in AP, expense management, and procurement.

The key areas where Yooz scores over Quadient are extensive ERP integration, document management, and robust payment fraud detection.

According to Yooz’s website, it has achieved an annual growth of 40% and is present in 44 countries.

Top Features

- Multi-channel invoice capture and smart data extraction

- AI and ML-based GL coding and PO creation

- Robust payment fraud detection

- Automatic splitting of multi-invoice files with YoozSmartSplit and YoozStamp

Serviceable Market

Yooz is the right fit for SMBs that need to manage a high volume of invoices and documents. Accounting firms, automotive, construction, trucking, and hospitality industries are the primary users of Yooz.

Strengths

- All-in-one pricing with no add-on modules

- Fast invoice and document processing

- Integration with 250+ ERPs and financial systems

Pricing

You can explore Yooz for free in a production environment for 15 days. The pricing of the Gold Edition plan, which allows unlimited users, depends on the volume of documents that a business processes.

Customer Rating

G2: 4.4/5

Capterra: 4.4/5

3. Stampli

Founded in 2015, Stampli is best known for its AP automation capabilities, from invoice capture and approvals to vendor collaboration, while also offering supporting P2P tools like a purchasing portal.

While Stampli has slightly higher ratings on review platforms compared to Quadient’s AP automation by Beanworks, users report issues with payment delays, ERP syncing of vendor data, and a lack of customization.

Top Features

- AI assistant (“Billy the Bot”) to extract data, code, and route invoices

- In-app AP and vendor communication tools

- Cognitive AI for 2-and 3-way PO matching

- Pre-coded AP cards with spending limits

Serviceable Market

Small and mid-sized companies looking for suitable Beanworks alternatives to improve invoice processing and supplier collaboration.

Strengths

- Fast implementation timelines

- Functions with legacy ERPs (like NetSuite, Sage Intacct, and QuickBooks)

- User-friendly interface

Pricing

Stampli offers a single all-inclusive package that combines AP, procurement, cards, and payment. For the exact price, contact sales.

Customer Rating

G2: 4.6/5

Capterra: 4.8/5

4. BILL

BILL features in the list of Beanworks competitors, given its comparable accounts payable, expense management, and procurement solutions for SMBs.

The key areas where BILL outperforms Quadient are payment processing, recurring billing, and vendor management tools. However, Quadient earns better ratings for customer support and user friendliness.

Top Features

- Invoice templates and OCR-based data extraction

- Approver groups, dual control, pre-defined, and custom user roles

- Extensive vendor network and international payments to 130 countries

- Physical and virtual cards linked to budgets and spend controls

- Centralized PO collaboration, AI-powered PO matching, and routing

Serviceable Market

BILL caters to small and mid-sized businesses in multiple industries, including healthcare, construction, retail, manufacturing, nonprofits, and hospitality.

Strengths

- Integrated platform to manage AP, AR, and expenses

- Two-way sync with leading ERP systems

- Strong data security and fraud prevention tools (PCI, HIPAA, SOC 2 compliance)

Pricing

BILL offers a subscription-based pricing model that provides flexibility and scalability for SMBs. The plans are as follows:

- Essentials: Small businesses with core AP tools

- Team: Intermediate with additional features for scaling

- Corporate: Advanced with comprehensive tools for larger companies

- Enterprise: Custom for large enterprises with specific touchpoints and high volumes

Customer Rating

G2: 4.5/5

Capterra: 4.2/5

5. AvidXchange

AvidXchange streamlines AP and procure-to-pay tasks, including invoice processing, PO creation, approvals, and payments for mid-market businesses.

In addition to industry-specific accounting software, such as AvidAscend for financial services, AvidXchange offers faster payment solutions.

However, unlike some of the Quadient competitors like Tipalti, AvidXchange does not offer expense management or tax and regulatory compliance support.

Top Features

- AI-enhanced invoice capture, PO matching, and invoice approval analysis

- Fast payments via Straight Through Processing

- AvidPay Network for ACH, virtual cards, and checks

- Purchase intelligence through AvidAnalytics

Serviceable Market

AvidXchange targets mid-market companies across various industries, like real estate, healthcare, and professional services.

Strengths

- A massive supplier network of over 1.3 million vendors

- Integrations with 240 platforms, including accounting, invoicing, and property management software

- 45-day implementation guarantee

Pricing

AvidXchange follows a subscription-based pricing model and is based on custom quotes. Additional charges apply for implementation and monthly licensing.

Customer Rating

G2: 4.4/5

Capterra: 4.4/5

Why Tipalti Is the #1 Alternative for AP Automation

Tipalti stands out from other Quadient competitors by combining end-to-end automation, global payments, and built-in compliance in a single, scalable platform.

360-Degree AP Automation

Tipalti streamlines the entire accounts payable process, from invoice capture and approval routing to automated PO matching and seamless ERP synchronization. With built-in goods receipt tracking and instant line-item updates, finance teams gain end-to-end visibility and control without manual intervention.

Intelligent Invoice Data Capture and Routing

Advanced OCR and AI Smart Scan capture data at every header and line-level, auto-code, route invoices, and match with POs. Suppliers, invoices, and workflows are all managed from one place.

Advanced Global Mass Payment Solution

Make fast and secure payments to 200+ countries in 120 currencies, using 50+ different payment methods. 26,000 global banking rules to validate supplier data.

Easily Manage Multiple Business Entities

Create entity-specific workflows, meet tax compliance in 60+ countries, and get a consolidated view of all subsidiaries.

Deep ERP Integrations

Process at the sub-ledger and entity-level with deep ERP integrations, reducing manual costs and helping teams close the books faster.

Powerful Financial, Regulatory, and Data Security Controls

KPMG-certified tax engine with global tools for W8/W9 form collection, OFAC screening, and 3,000+ payment validation rules.

Trusted by Finance Leaders. Backed by Industry Awards.

Tipalti continues to win awards for best-in-class AP automation

For the second time, IDC Marketscape recognizes Tipalti as a leader in mid-market AP automation. Industry analysts applaud the platform’s intuitive interface, global breadth, and measurable efficiency.

Backed by thousands of genuine reviews, the popular automation solution earns top honors across AP automation, cross-border payments, and financial operations, underscoring its trusted reputation with high-growth and global organizations.

Why Growing Companies Choose Tipalti Over Quadient AP and Its Competitors

While Quadient AP is a suitable option for businesses seeking customer communications management, document digitization, and mailing solutions, its platform lacks the breadth and depth in AP automation that fast-growing organizations require.

Finance professionals are seeking automation software that can expedite payables, mitigate payment risks, manage fluctuating invoice volumes, and reduce headcount, according to IFOL.

These are the core strengths of Tipalti.

The industry-leading brand offers a white-label experience worldwide, with recent accolades including Forbes Fintech 50 of 2025, G2’s Best Accounting and Finance Products of 2025, and Winner of the FinTech Awards for Best SaaS for FinTech in 2025.

If you’re looking for 360-degree P2P automation that takes the stress off finance teams and frees them to focus on strategic initiatives, Tipalti is the right choice.

Ready to Switch from Quadient AP? Scale Smarter with Tipalti

See how Tipalti helps finance leaders eliminate manual payables, increase global reach, and confidently scale.