Finance trends shift fast—explore 5 key processes & tips to stay ahead.

Fill out the form to get your free eBook.

Trends in finance processes change as often as CFOs check their dashboards. This guide takes a look at five key finance processes, offering a step-by-step breakdown of the latest trends and best practices to stay ahead of the curve.

Calculating contribution margin (the difference between sales revenue and variable costs) is an effective financial analysis tool for making strategic business decisions.

What is Contribution Margin?

Contribution margin (CM) is a financial measure of sales revenue minus variable costs (changing with volume of activity). CM is calculated overall or by each product and per unit. After variable costs of a product are covered by sales, contribution margin begins to cover fixed costs.

Understanding Contribution Margin

Contribution margin (sales revenue minus variable costs) is used to evaluate, add and remove products from a company’s product line and make pricing and sales decisions. Management accountants identify financial statement costs and expenses into variable and fixed classifications. Variable costs vary with the volume of activity, such as the number of units of a product produced in a manufacturing company.

At the product level In a manufacturing company, variable costs change, depending on the volume of production. As more units are produced, total variable costs for the product increase. But the variable cost per unit remains the same. Fixed costs remain constant over any level of production.

Typical variable costs include direct material costs, production labor costs, shipping supplies, and sales commissions. Fixed costs include periodic fixed expenses for facilities rent, equipment leases, insurance, utilities, general & administrative (G&A) expenses, research & development (R&D), and depreciation of equipment.

A subcategory of fixed costs is overhead costs that are allocated in GAAP accounting to inventory and cost of goods sold. This allocation of fixed overhead isn’t done for internal analysis of contribution margin.

The contribution margin can be calculated as an overall number for your company, on an individual product basis, or as a contribution margin ratio metric that divides the contribution margin by revenue to express it as a percentage.

If all variable and fixed costs are covered by the selling price, the breakeven point is reached, and any remaining amount is profit.

Who Should Use the Contribution Margin Formula?

Cost accountants, financial analysts, and the company’s management team should use the contribution margin formula. CM is used to measure product profitability, set selling prices, decide whether to introduce a new product, discontinue selling a specific product, or accept potential customer orders with non-standard pricing.

How to Calculate Contribution Margin

Calculate contribution margin for the overall business, for each product, and as a contribution margin ratio. Each type of contribution margin formula is shown below. Calculations with given assumptions follow in the Examples of Contribution Margin section.

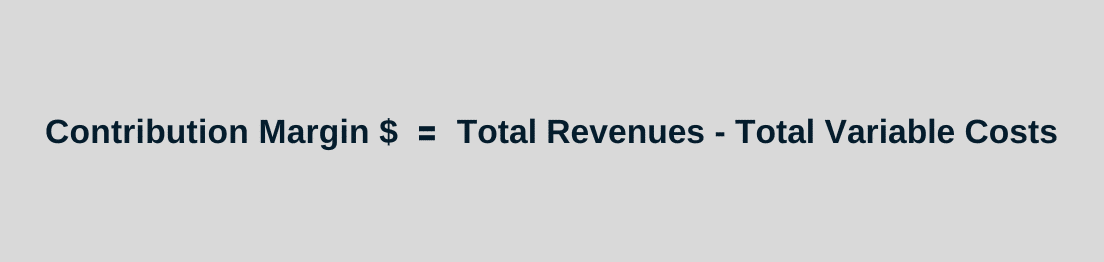

Contribution Margin for Overall Business in Dollars

The overall contribution margin is computed using total sales and service revenue minus total variable costs.

Contribution Margin $ = Total Revenues – Total Variable Costs

Contribution Margin by Product

To calculate contribution margin (CM) by product, calculate it for each product on a per-unit basis. After you’ve completed the unit contribution margin calculation, you can also determine the contribution margin by product in total dollars.

You can use a spreadsheet, such as Google Sheets or Microsoft Excel, to include columns by product, enabling you to compare the contribution margin for each of your business products.

The per-unit contribution margin formula for a product is:

Per-Unit Contribution Margin = Selling Price per Unit – Variable Costs per Unit

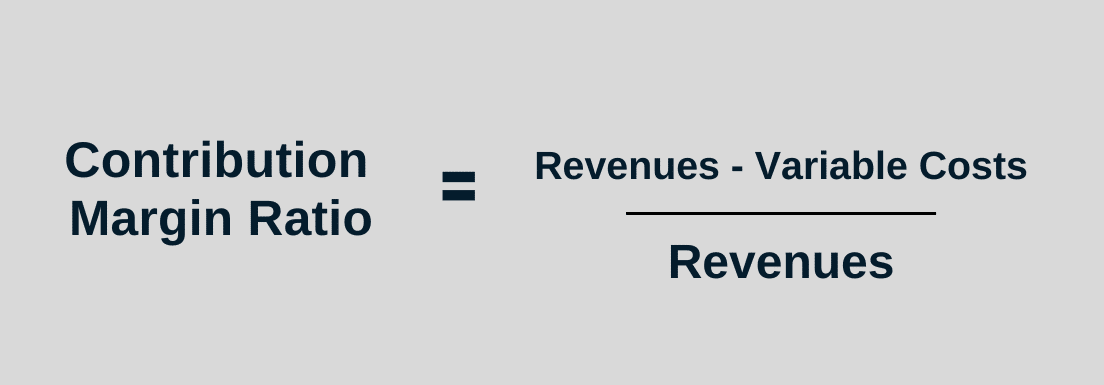

Contribution Margin Ratio

The following formula shows how to calculate contribution margin ratio. The contribution margin ratio (CMR) expresses the contribution margin as a percentage of revenues. CMR can be computed either in total dollars or per unit.

Examples of Contribution Margin

The following examples show how to calculate contribution margin in different ways.

Contribution Margin for Overall Business in Dollars

Assume that League Recreation, Inc, a sports equipment manufacturing company, has total annual sales and service revenue of $2,680,000 for all of its sports products. Total variable costs total $1,500,000. Its overall dollar contribution margin is $1,180,000. The business has a companywide contribution margin ratio of 44%.

Contribution Margin by Product

For League Recreation’s Product A, a premium baseball, the selling price per unit is $8.00.

The variable costs to produce the baseball include direct raw materials, direct labor, and other direct production costs that vary with volume. Total variable costs for Product A are $4.95.

Therefore, the unit contribution margin (selling price per unit minus variable costs per unit) is $3.05. The company’s contribution margin of $3.05 will cover fixed costs of $2.33, contributing $0.72 to profits.

By multiplying the total actual or forecast sales volume in units for the baseball product, you can calculate sales revenue, variable costs, and contribution margin in dollars for the product in dollars. Selling price per unit times number of units sold for Product A equals total product revenue.

If the annual volume of Product A is 200,000 units, Product A sales revenue is $1,600,000. The dollar contribution margin is $610,000.

Contribution Margin Ratio

Using the above example, the contribution margin ratio (CMR) is calculated as:

CMR = ($8.00 -$4.95) / $8.00 = $38.125%

Contribution margin ratio will be the same when computed using total dollars, as follows:

CMR = ($1,600,000 – $990,000) / $1,600,000 = 38.125%

What is Contribution Margin vs Gross Margin vs Profit?

Cost accountants, FP&A analysts, and the company’s management team should use the contribution margin formula. CM is used to measure product profitability, set selling prices, decide whether to introduce a new product, discontinue selling a product, or accept potential customer orders with non-standard pricing.

Contribution Margin FAQs

The following frequently asked questions (FAQs) and answers relate to contribution margin.

What is a Good Contribution Margin?

Contribution margin, gross margin, and profit are different profitability measures of revenues over costs. Contribution margin measures revenues minus variable costs. Gross margin is shown on the income statement as revenues minus cost of goods sold (COGS), which includes both variable and allocated fixed overhead costs. Profit is gross margin minus the remaining expenses, aka net income.

Gross margin is also called gross profit. Gross margin is calculated before you deduct operating expenses shown in the income statement to reach operating income. The net profit margin is net income divided by revenue. Each profit measure can be expressed as total dollars or as a ratio that is a percentage of the total amount of revenue.

What is a Good Contribution Margin?

A good contribution margin is one that will cover both variable and fixed costs, to at least reach the breakeven point. A low contribution margin or average contribution margin may get your company to break even. A high contribution margin adds profit to the bottom line.

Can Contribution Margin be Negative?

Yes. A business has a negative contribution margin when variable expenses are more than net sales revenue. If the contribution margin for a product is negative, management should make a decision to discontinue a product or keep selling the product for strategic reasons.

Does the Contribution Margin Calculation include Services Revenue?

Yes. To calculate contribution margin, a company can use total revenues that include service revenue when all variable costs are considered. For each type of service revenue, you can analyze service revenue minus variable costs relating to that type of service revenue to calculate the contribution margin for services in more detail.

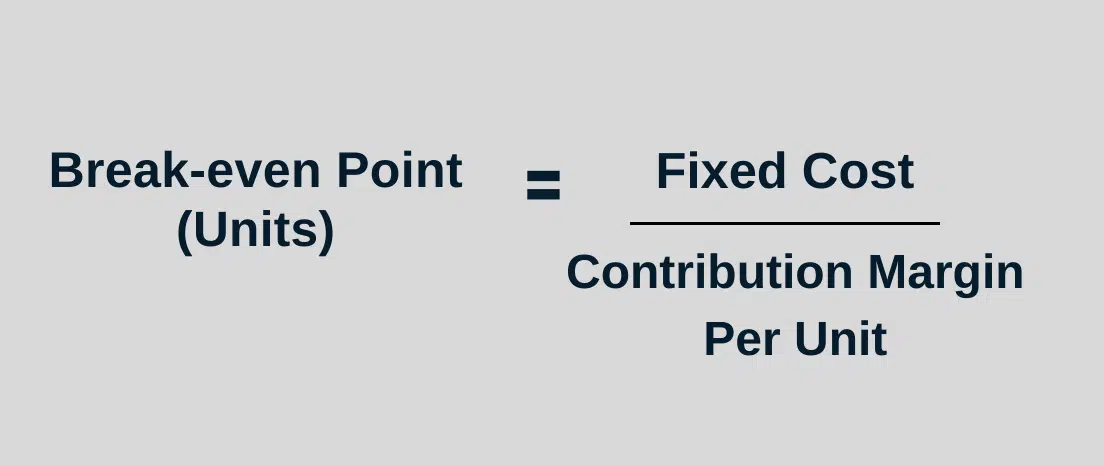

The break-even point formula in units is:

If total fixed cost is $466,000, the selling price per unit is $8.00, and the variable cost per unit is $4.95, then the contribution margin per unit is $3.05. The break-even point in units is calculated as $466,000 divided by $3.05, which equals a breakeven point in units of 152,787 units.

Why is the Contribution Margin Important?

The contribution margin is important because it helps your business determine whether selling prices at least cover variable costs that change depending on the activity level. Knowing your company’s variable vs fixed costs helps you make informed product and pricing decisions with contribution margin and perform break-even analysis.

More specifically, using contribution margin, your business can make new product decisions, properly price products, and discontinue selling unprofitable products that don’t at least cover variable costs. The business can also use its contribution margin analysis to set sales commissions.

When it splits its costs into variable costs and fixed costs, your business can calculate its breakeven point in units or dollars. At breakeven, variable and fixed costs are covered by the sales price, but no profit is generated. You can use contribution margin to calculate how much profit your company will make from selling each additional product unit when breakeven is reached through cost-volume-profit analysis.

As another step, you can compute the cash breakeven point using cash-based variable costs and fixed costs. Compare the lines for determining accrual basis breakeven and cash breakeven on a graph showing different volume levels.

Businesses calculate their contribution margin as a total contribution margin or per-unit amount for products. You can show the contribution margin ratio as CM relative to sales revenue. And you can also compute the variable expense ratio, which is the percentage of variable expenses divided by sales.

Calculating the contribution margin for each product is one solution to business and accounting problems arising from not doing enough financial analysis. Calculating your contribution margin helps you find valuable business solutions through decision-support analysis.