Ultimate Guide to Xero Accounting Software

Our guide covers everything you need to know about Xero Accounting Software, including integration, market fit, pricing, features, and comparisons. Access our free e-book to learn more about automating accounts payable and global mass payments with Xero.

What is Xero Accounting Software ERP?

Xero is cloud-based accounting software for startups, small businesses, growing companies, and established companies. Although Xero isn’t an ERP for complete enterprise resource planning, third-party add-on software integrations extend its functionality and range of business processes. Xero has a SaaS subscription pricing model. The company, Xero, is based in New Zealand.

Xero accounting software automates bookkeeping and small business accounting. Xero’s online accounting software includes a chart of accounts, general ledger, financial reporting, Xero dashboard, bank account reconciliation, cash flow management, bill capture and receipts with Hubdoc, purchase orders, customer quotes, order management, invoicing, accounts receivable, inventory management, accounts payable, and business management.

In Xero, your business can set up user roles with Standard, IO+ categories (Invoice Only), Read-only, Adviser, or Administrator access. Then, you can grant specific additional permissions to a user for more Xero functions or abilities.

Xero competes with QuickBooks Online. Xero allows unlimited users for scalability as a company grows. But a subscriber’s users could hit informal monthly transaction limits or speed slowdowns. These indicate when to upgrade your growing business to mid-range ERP or accounting software like Sage Intacct, NetSuite, Microsoft Dynamics 365, or a SAP ERP product for SMBs called Business One or ByDesign.

Xero cloud Accounting Software is accessible on either Windows or Mac computers. The Xero Accounting mobile app can be used on Apple iOS and Google Android mobile devices.

Features

Key Features and Benefits of Xero Accounting Software

Xero accounting software has features and benefits for small businesses and some midsized companies.

Low-cost

Xero is budget-friendly SaaS software and often discounts its software pricing for the first few months for new users. Adding Gusto payroll starts with its Simple Plan at $40 per month and includes an extra $6 per person charge in addition to the added monthly subscription cost.

Unlimited users included in every plan

With an unlimited number of users included in its pricing plans (excluding optional Gusto payroll), your business doesn’t need to pay more initially or as it grows.

“Established” plan supports multi-currency, online invoicing, and sending customer quotes

The Xero Established pricing plan adds multi-currency to the Growing plan which also enables online invoicing and sending quotes. When invoicing customers, your business can offer customers different payment methods, including pay by check, credit cards, debit cards, or ACH payments.

Manually enter, approve, schedule, and batch pay bills and supplier invoices in Xero accounts payable

Although Xero is a manual system for paying supplier invoices in accounts payable, it does offer Hubdoc to capture bills and receipts in all pricing plans. In accounts payable, Xero lets your business use its invoices with an email to bills feature to electronically enter invoice data and get a PDF image of the supplier invoice instead of manually entering all invoice data.

Manually enter payout information not requiring a supplier invoice to pay amounts due

Xero lets you manually code and make payouts for payables not requiring an invoice, like paying royalties to creators. Xero doesn’t include a specific mass payout solution for making global payments to creatives, freelancers, contractors, publishers, and affiliates.

Enter purchase orders for procurement in Xero and invoice payment upon receipt, and view PO status

With Xero, purchase orders are created manually and manually matched with supplier invoices, with no PO lookup through the bill to make matching easier.

Set up your business credit card and bank accounts for recording transactions in Xero

Xero lets you manually set up your business credit cards with related bank accounts for making payments. Xero doesn’t issue a corporate spending card.

View a Xero dashboard with a bar chart of invoices by due date to plan cash flow

Xero provides a cash flow dashboard for short-term cash forecasting.

Bank Reconciliation

Xero provides automatic bank account reconciliations between each bank statement and cash general ledger sub-account. Cash and cash equivalents are combined as Cash on the balance sheet. A Xero Central support article for Bank Reconciliation describes the bank account reconciliation process:

“The aim of bank reconciliation in Xero is to match each statement line in the bank account to an existing transaction in Xero, or create a transaction during the reconciliation process. Statement lines are the bank transactions imported from your bank account via a bank feed or they’re manually imported. When they’re in your online banking, they’re referred to as bank transactions, then when they’re imported into Xero we call them bank statement lines.”

Bookkeeper and accounting firm practice tools

Bookkeepers and accountants use Xero software in their practice and offer simple Xero Cashbook or Xero Ledger to their clients through a Xero partner plan. Bookkeeper and accountant tools include Xero HQ to centralize practice and client data, dashboards, and customizable reporting with report templates. Xero Practice Manager and Xero Workpapers enhance productivity. Bookkeepers and accounting firms also receive a free subscription to the Xero premium plan.

Simple integration with LivePlan software and many other third-party apps.

Xero users can seamlessly integrate Salesforce or other CRM software, supply chain software, and payables automation software third-party add-ons to increase Xero efficiency, features, and capabilities.

Xero accounting data is connected and syncs to LivePlan software in real-time. Use Xero accounting data to create business plans and budgets, reports, infographics, and dashboards with the LivePlan app in the Xero app marketplace. Spreadsheets like Excel aren’t needed.

Employee expense reports

Xero has an expense tracker app to snap receipts of invoices for reimbursement of employee expense claims.

App Integrations

Xero Accounting Software Third-Party App Integrations

Xero doesn’t have accounting software modules but does allow third-party app integration to increase its functionality and make it more like an ERP system.

AP automation and mass payments

Xero needs AP automation integration because its accounts payable functionality requires manual data entry and doesn’t automate PO matching with supplier invoices. AP automation increases efficiency, automates account coding, validates suppliers, facilitates tax compliances, and reduces fraud and errors. AP automation software from Tipalti includes self-service supplier onboarding, choice of global payment method, and automated payment status communications. Tipalti also offers a product for easily and efficiently making global payouts like royalties, influencer and streaming payments, and ad network payments. It integrates with Xero and some performance marketing systems.

CRM automation

Xero users can integrate Salesforce or their choice of customer relationship management software that integrates with Xero.

Gusto payroll

Gusto payroll, partnered with Xero, is an optional third-party integration available through the Xero pricing plan page.

Ready to optimize Xero with Tipalti AP automation?

We’ve paired this article with a free e-Book to help companies bridge the gap between Xero accounting software and AP processes. Download “The Last Mile of Xero: What Finance Leaders Must Address.”

Industries

Industries Using Xero Accounting Software

Xero is used by small businesses, small business owners, bookkeepers, accounting firms, and non-profits. The software appeals to companies with global customers, enabling multi-currency features in the Established plan.

Retail, eCommerce, and Amazon sellers

High tech

Business services

Legal

Bookkeepers and CPA firms

Education

Non-profits

Hospitality and Tourism

Restaurants

Construction

Creatives, including artists and music

Healthcare

Farming

Manufacturing and wholesale

Real estate

Insurance

Franchising – franchisees and franchisors

Implementation

How to Implement and Use Xero Accounting Software

Xero online accounting is easy to use and simple enough to implement on your own or with help from a bookkeeper or CPA with experience in your industry. Xero Central is a centralized source of customer support and learning information, including links to online topics and courses.

Step 1

Form an Implementation Team

Small businesses can appoint an implementation leader and include an employee team for collaboration and Xero implementation.

Step 2

Consider Including Your Bookkeeper or CPA

Although Xero implementation is relatively easy, you may be more productive when your bookkeeper or CPA is part of the implementation team.

Step 3

Develop an Implementation Plan

Determine which third-party add-on software to integrate with Xero for automation and additional functionality. Set goals for system implementation, task assignments to each specific employee, and milestones with due dates.

Step 4

Schedule Training Sessions for Key Personnel

Xero training available includes online resources, including Xero Central and courses. A designated and fully-trained employee may teach functional areas of Xero to other employees who will be users.

Step 5

Conduct a Post-Implementation Review

At completion, gather suggestions for improvement to make later implementations more productive.

How Does AP Automation Software Integration Work With Xero Accounting Software?

Xero Accounting Software integration with AP automation software uses a flat file or API connection. Tipalti has flat-file integration with the Xero accounting system. The Tipalti add-on app automates and streamlines workflows for accounts payable and payments, offering multi-currency global mass payments using a choice of payment methods. Use Tipalti payables automation software through the Xero login.

Tipalti AP automation software features include:

- Self-service supplier onboarding through a Supplier Hub

- Invoice data capture with AI-assisted OCR by heading and line items

- Payment status and history and invoice dates and amounts can be viewed in the Supplier Hub

- Automated invoice processing

- Invoice verification using 26,000+ payment rules

- 3-way or 2-way matching with PO and receiving data

- Automatic general ledger account coding with generative AI

- Automated global regulatory compliance, including checking sanctions blacklists like OFAC and AML

- Intelligent routing to approvers for approval via email or Slack

- Batch payment scheduling with cash requirements preview

- Global payments in 196 countries and 120 currencies, with EFT payment method choices

- Data syncing with the Xero accounting system

- Real-time payment reconciliation

- Spend analytics by category

- Ask Tipalti AI℠ digital assistant to answer your spend queries for business intelligence

- Simple 1099-MISC, 1099-NEC, and 1042-S tax preparation reporting

The self-service onboarding process collects supplier W-9 or W-8 tax form data before the first payment, contact information, and preferred payment method details. Tipalti automatically validates suppliers with TIN (taxpayer ID number) matching for fraud prevention and to ensure accuracy when your company prepares 1099-MISC and 1099-NEC forms at tax time.

Your company has the choice of using Tipalti’s calendar year tax preparation reports for preparing your own 1099-MISC and 1099-NEC information returns or buying and using partnered Tax1099 software from Zenwork to import 12 months of Tipalti payments data, automatically eFile 1099-MISC and 1099-NEC forms, and distribute the copies to recipient payees.

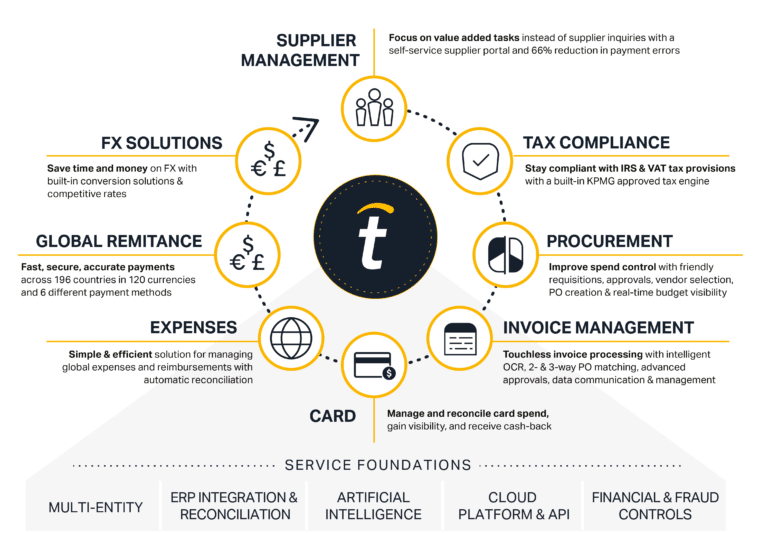

All of Tipalti’s finance automation software products integrate with Xero (or other ERP or accounting software) and work together on a unified Tipalti software platform. In addition to AP automation for accounts payable, Tipalti’s other automation software products are:

Tipalti mass payments automation software lets your company make payouts to independent contractors, freelancers, and creatives like musicians and artists, publishers, streamers, influencers, and affiliates extremely efficient. With Tipalti mass payments, payouts can be made in extremely large batches for efficiency. Tipalti mass payments can also be integrated with some performance marketing system platforms that calculate payment amounts due to the payees.

Tipalti Expenses works with AP automation software and a mobile app to automatically create expense report claims from photos, check for compliance with your company’s travel & expense policy to flag exceptions, approve or reject expenses, and then reimburse employees.

Tipalti also offers the Tipalti Card to approved business users who apply for corporate spending cards. Your company assigns the spending cards to designated employees to control their business spending when purchase orders from the procurement department aren’t required. With the Tipalti Card, the company is charged directly for the expenses, so no employee reimbursement for business expenses is required.

Multi-FX for payables is an advanced FX software product that simplifies global cross-border payments and locks in foreign exchange rates on invoices before payment is due.

Multi-FX works with Tipalti AP automation for accounts payable and mass payments software for payouts. It lets your business use a centralized virtual payment account to make international payments for all subsidiaries in up to 30 supported currencies without needing a regional network of international banks for these payments. Your company will receive competitive foreign exchange rates through the Tipalti advanced foreign exchange software.

Tipalti Procurement automation software lets employees submit purchase requisitions (giving all relevant stakeholders a common view) and includes automated approval routings. It is used to onboard and manage suppliers, including digitized contracts and other documents. Tipalti Procurement software automatically creates purchase orders from approved purchase requisitions.

How Much Does Xero Cost?

Choose a Xero pricing plan matching your business needs. The level of features varies with each Xero pricing plan for Early at $20 per month (with 20 invoices and 5 bills per-month limit), Growing at $47 per month, and Established businesses at $80 per month. The Xero Established plan adds multi-currency, expense capture and expense claim management, and project management time-tracking and cost-tracking. When combined with Gusto, the Xero Accounting Software system offers payroll plans in the United States starting at $40 per month + $6/person per month.

Recommendations