Finance trends shift fast—explore 5 key processes & tips to stay ahead.

Fill out the form to get your free eBook.

Trends in finance processes change as often as CFOs check their dashboards. This guide takes a look at five key finance processes, offering a step-by-step breakdown of the latest trends and best practices to stay ahead of the curve.

The budgeting process is an essential business function that’s bound to make even the most organized managers stress. What could be more important to the daily operations of the company than its cash flow? Messing up in this field could result in disrupted projects or, at worst, insolvency.

And yet, studies have shown that only 20% have finalized their budgets for 2025, with nearly half still in preliminary planning stages.

If your organization is taking on some new projects and you need a flexible budget to make sure that the funding stays sufficient, then studying the budgeting process is the best next step to take. Find out how to not only keep track of expenses and revenue but also gain more value out of your purchases and procurement process.

What is a Budgeting Process?

The process of reviewing past budgets and planning budgets to forecast revenue is known as the budgeting process. It includes aligning with upper management in order to analyze budget data and establish goals for the future to better allocate funds and control spending.

When deciding on a budget, a business allocates resources to certain company projects and strategic objectives. Controls are put in place to enforce budgeting policies and prevent overspending. We can generally look at three different types of budgets:

• Operating budgets involve both the revenue generated and the expenditures made during daily operations. Employee salaries and benefits are included in this category.

• Capital expenditure involves major purchases like physical properties and equipment. Budget managers consider this category by setting priorities and making decisions to control risks.

• Cash flow is another form of budgeting that looks at the relationship between income and expenses. Specifically, it makes sure that you have enough cash on hand at any time to cover immediate expenditures.

The budgeting procedure covers all the steps involved in determining and setting a budget, which can include:

• Reviewing past financial quarters and using the data to forecast future expenses and revenues.

• Developing a plan to manage the budget and implementing it. Allocate resources to cover the company’s projects and departments.

• Regularly checking up on progress by monitoring budget levels throughout the quarter.

• Evaluating the performance of the budgeting process in the end and seeing what can be learned.

But we need to go beyond just definitions and look at the role of budgeting in corporate and project management.

The Primary Goals of Budgeting

In addition to the obvious benefit of controlling spending and keeping tabs on financial activities, budgeting is taken seriously because it also:

• Helps with project planning: What happens if market conditions change and the business needs to address problems later down the line? Budgeting is the perfect way to prepare financially.

• Coordinates collaboration: Since the budget impacts everyone, the budgeting process must involve all departments and teams working together for the well-being of the company as a whole.

• Motivates management: Upper management teams who are aware of budgeting efforts are more likely to understand the goals and initiatives of the business. They are motivated to hold everybody accountable for a stable budget.

• Measures performance: Budgeting forces you to look at the financial figures and determine whether or not you’re meeting your targets. If any cash flow issues arise, you will be able to know early on.

A detailed budget sets realistic goals for your projects and ensures proper resource allocation to prevent costly spending overflows.

Why the Budgeting Process Is Vital

Companies balance their budgets for the same reason individuals do. By keeping track of the timing and amounts of expected income and expenditures, it’s possible to set realistic goals, track deviations in planning, and enforce corrective action.

Without enough cash, a business cannot sustain itself, but the advantages of the budgeting process are a little more complex than that.

• Setting expectations: Once a budget sets a spending target for a particular project, then the teams can work with those expectations in mind. They can set their own deadlines and allocate resources according to the company’s master budget.

• Aligning resource allocation to the goals of the business: Think about what part of the company deserves more money this quarter. For instance, if product sales are down this month, it may be wise to allocate more of the budget to sales and marketing.

• Facilitating collaboration: Departments should not be siloed. Budgeting is the perfect opportunity to connect the finance teams with the rest of the business. Everyone gets a chance to talk about priorities, expectations, funding, and goals, and the finance department gets to share guidance.

A company with a strong budgeting process in place is also seen as more trustworthy when it comes to third-party partnerships. For instance, if you ever need to borrow a business loan, your lender will likely want to know how well you’ve followed budgets in the past.

How Does One Approach Budget Management?

Budget management cannot be perfected overnight, and neither is it possible to achieve for one person. It requires collaboration among upper management, the finance department, and the various budget and project managers across the company.

A budget can be developed in a top-down approach, where upper management begins the decision making process by looking at business objectives and current resources to prepare a budget plan. It then passes down the responsibility of enforcing this plan to the department managers, who themselves can set their own guidelines based on the overall budget allocation.

Top-down works out in most cases because lower management can save time and effectively hit the ground running since most of the work has been done externally.

Alternatively, budgeting can occur from the bottom-up, essentially an inverse of the top-down. Planning begins at the departmental level and goes up; that is, each department prepares its own budget plans, and cost estimations, and upper management combines them all into one big, inclusive budget process.

Bottom-up is more time-consuming, but it also results in a more suitable budget since the people who will conduct daily operations and actually spend the money have a larger voice in how resources will be allocated. Each department is also likely to be more motivated to achieve financial goals this way since it was the one who made the budget to begin with.

In a non-business example, New York City famously continues its own bottom-up strategy known as Participatory Budgeting with a new initiative in 2024. The plan gives control of the public budgeting process to community members.

Struggling with inefficient spreadsheets and manual workflows?

Upgrade to a smarter approach. Discover how leading finance teams streamline operations and enhance efficiency.

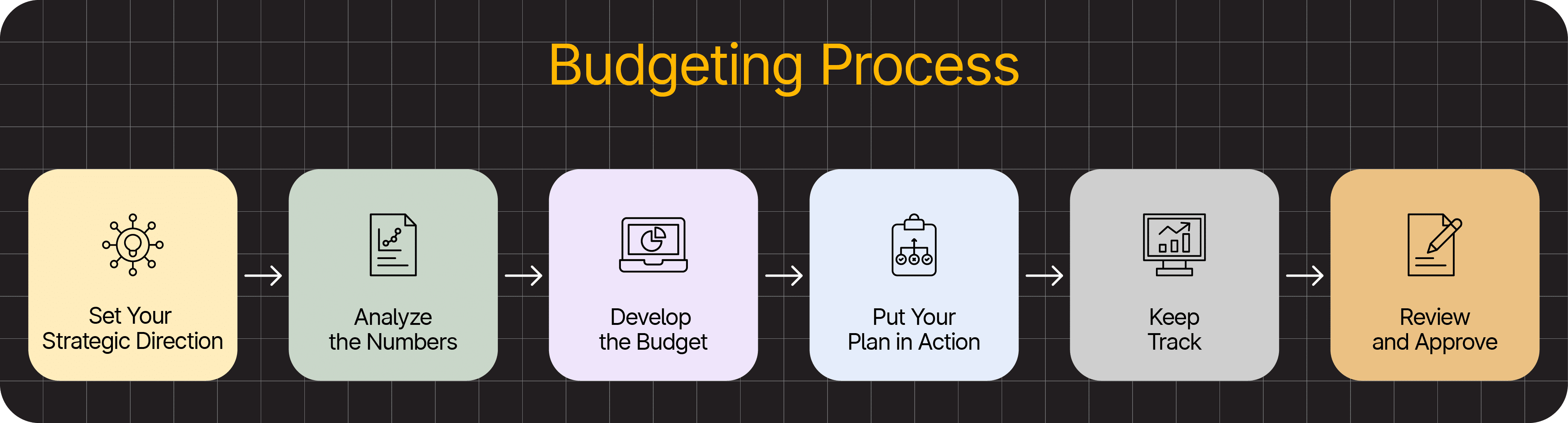

What Steps Does the Budgeting Process Involve?

No matter which budgeting approach you choose, you’ll need to turn your plans into real business actions. Think of your budget as your financial roadmap—it guides your actual spending and decisions and helps track progress toward your goals. Let’s break down each stage of the process to make it practical and actionable.

Stage 1: Set Your Strategic Direction

Look at your market conditions, sales patterns, and available financial resources. What does your company need right now? Maybe you’re pushing for growth, maintaining your position, or cutting costs.

Your goals need to be clear and measurable. Get your key team members involved early–you’ll need their support to make your budget work. Think about timing too. When do you need to hit these targets?

Stage 2: Analyze the Numbers

Take a good look at last quarter’s numbers. Did you spend more or less than planned? Were your sales predictions accurate? Ask your department heads what challenges they faced with their budgets.

Market changes, new competitors, or shifting customer needs–all these factors affect your financial planning. Use this information to make better assumptions for your next budget.

Stage 3: Develop the Budget

Start with what you know, your fixed costs. These are your predictable expenses like rent, core staff salaries, and regular bills. Understanding your fixed expenses gives you a baseline for budget planning and helps identify areas where costs are predictable and controllable. Then map out your variable costs, too—things like seasonal staff, marketing campaigns, and software upgrades.

Think about timing here too. When will you need extra cash for big purchases or projects? Create different budget scenarios such as conservative, middle-ground, and optimistic. This helps you plan for various situations.

Stage 4: Put Your Plan in Action

Getting your budget running smoothly takes careful planning. Make sure your tracking software is set up right. Create clear steps for approving expenses. Who can approve what, and up to what amount?

Train your team on using these tools and following the new processes. Set up your monitoring systems before you start using the new budget.

Stage 5: Keep Track

Watch your numbers closely–-monthly for big-picture items and weekly for cash flow. Are departments staying within their limits? Where are the variances, and why? Look for patterns in your spending and revenue.

When things don’t match your plan, figure out why quickly. Maybe your market changed, or new opportunities came up. Use this information to adjust your forecasts.

Stage 6: Review and Improve

Set up quarterly budget reviews—these are your chances to step back and look at the bigger picture. What’s working well? Where are the bottlenecks?

Use these sessions to update your budget assumptions based on what’s actually happening in your own business environment. Document what you learn. These insights will make your next budget cycle even better.

Remember that your budget needs to breathe. It’s not just a document you create and file away. Instead, keep checking and adjusting it as your business changes. Stay organized but flexible enough to handle new challenges and opportunities.

Who is Responsible for Managing the Budget Process?

Managing your budget takes teamwork from everyone in your company. The success of your budgeting process depends on clear roles and responsibilities across all levels of the entire organization.

Financial Leadership

Your CFO and finance team set the direction for budget planning. They look at market conditions and decide how much money your company can spend and invest.

The treasury team watches your cash flow, making sure you have money available when you need it, while controllers keep track of spending and make sure everyone follows the budget rules.

Departmental Managers

Department managers own their area’s budget—they know exactly what their teams need and how much things cost. They plan future spending, watch current expenses, and spot problems early on.

When department managers understand their budgets well, they make smarter spending choices because they know their team’s daily needs.

Cross-functional Teams

Your accounting team keeps all financial records up to date and accurate. They track every dollar spent and help you understand where the money goes so you can keep accurate records of your company’s actual performance relative to the budget.

As for the procurement team, they work with vendors to get you the best deals, typically delivering 5-15% in cost savings, whereas operations managers tell you key insights on what resources their team needs to get work done. Think of a department’s resources, capacity, and productivity needs.

Executive Oversight

Your CEO and board make the final calls on big spending decisions that are in the budget. They make sure your budget matches what your company wants to achieve, and when markets change or new opportunities arise, they decide if your spending plans need to change too.

Support Functions

Your IT team keeps your budgeting systems running smoothly, whereas HR handles all the costs related to your people—from salaries to benefits, which should typically represent 40-80% of your operating budget.

As for your legal team, they make sure your company’s financial decisions comply with financial regulations and reporting requirements, helping you avoid costly penalties.

Remember–-good budget management needs ongoing collaboration between all these teams. Regular communication and clear accountability help ensure your company’s financial performance and the achievement of your company’s strategic objectives and goals.

Budgeting Process Techniques and Best Practices

Corporate budgeting is a critical activity that even experienced management teams need time to get right. Thankfully, it isn’t too difficult with a bit of practice and an understanding of how the process generally works.

In addition to the above steps, know that budgets will often change with time. Many businesses operate in fluctuating markets where demand goes up and down depending on the month, which are conditions that call for seasonal budgeting. Also, be honest in your estimations. Don’t exaggerate sales or expenditures, and be sure to include variable expenses, even small charges.

Know the “Why” Behind the Numbers

A budget manager works with a lot of numbers, but have you ever stopped to think about the “why” beyond those numbers? What assumptions is your budget based on, and how would you interpret those numbers?

To illustrate, think about the key causes of high expenses the next time you calculate them. Are you in need of additional staff, hence the increased investment in salaries? Or are your sales teams short on tools, and you need to spend more on marketing initiatives?

On the revenue side of things, remember what products and services you sold to customers each quarter. Did the sales reach your intended goals, or did they fall short and cause cash flow problems early on? Are you able to adjust product pricing accordingly to address the problem, or is there an underlying need for more robust marketing strategies?

A budget is more than just a spreadsheet. It’s a guide to how your business plan of operations should be laid out.

Key Performance Indicators (KPI)

The budgeting process is also heavily KPI-based. Think about how resource allocation should reflect the overall goals of your organization. Key performance indicators tie your efforts to those business objectives and keep you going in the right direction as the budgeting process continues.

Some examples of KPIs often used by budgeting teams are:

• Sales Numbers

• Customer Churn

• Employee turnover rates

Regardless of which ones you use, make them clear and easily measurable to get the most out of them.

Use Current, Accurate Data

Have you thought about how current your budget data really is? Your projections need to match reality, not wishful thinking. Take time to gather fresh information from your accounting records and sales reports.

Fast-growing companies especially need to keep a closer eye on their numbers. Remember that outdated data leads to costly mistakes, while current information helps you make smarter choices.

Make It a Collaborative Process

Think about it–-your operations teams know exactly what resources they need. When everyone works from the same set of numbers and understands the same assumptions, you avoid confusion and save valuable time.

Build in Flexibility

Your budget can’t be set in stone. Markets shift, opportunities arise, and challenges pop up unexpectedly. Are you prepared for these changes?

Think about setting aside contingency funds for those “just in case” moments. Regular check-ins help you catch problems early. Try scheduling quarterly reviews to see if your assumptions still make sense and adjust as needed.

Streamlining Budget Processes with Automation

Managing budgets manually can be challenging, even for experienced teams. But have you considered how automation could transform your budgeting process? With solutions like Tipalti’s AP automation, you can bring efficiency, accuracy, and scalability to your financial operations.

Think about your current closing process—how long does it take? With automated solutions and real-time ERP integration, you could close your books 25% faster. When it comes to manual data entry and error checking, AI-powered invoice processing and built-in compliance checks eliminate these tedious tasks while keeping your financial controls strong.

Budgeting isn’t just about crunching numbers anymore. It’s about using smart technology to make better financial decisions. Want to learn more about modernizing your financial operations? Download our Guide to Driving Efficiency with Modern Finance and discover how automation can transform your budgeting process.