We’ve paired this article with Laurie Hatten-Boyd’s AP Tax Compliance webinar. Get your Executive Summary to find out how FATCA requirements impact organizations with a global supplier base.

In general, nonresident aliens who receive income in the United States are subject to U.S. federal taxes. This income of non-U.S. citizens can be in the form of earned income or other types of payment. The Internal Revenue Service wants to know about these payments in order to receive income tax returns from these taxpayers.

It’s important to know what IRS Form 1042-S is and how the process works by reading these FAQs.

This article isn’t intended to give you tax or legal advice. Consult your CPA or attorney and read IRS instructions for Form 1042-S and Form 1042, including procedures, tax laws, and TIN matching, on the U.S. federal government Internal Revenue Service website at irs.gov.

What is Form 1042-S?

Form 1042-S is an IRS form titled Foreign Person’s U.S. Source Income Subject to Withholding. Form 1042-S is an information return filed by a withholding agent to report the amounts paid to foreign persons, as described under the “Amounts Subject to Reporting on Form 1042-S.” Form 1042-S applies even if filers didn’t withhold any income tax.

IRS Form 1042-S is a required document for reporting money paid to foreign persons (or those presumed to be foreign) by a U.S.-based business or institution.

According to Form 1042-S Instructions, “If you file Form 1042-S, you must also file Form 1042, Annual Withholding Tax Return for U.S. Source Income of Foreign Persons.”

Who Uses Form 1042-S?

Non-US citizens or non-US groups, including foreign partnerships, corporations, estates or trusts, use Form 1042-S to report any US-based income they may have received to be accurately taxed on that income, according to US standards. In cases where a tax treaty or other exception to taxation exists, the IRS will still require Form 1042-S to be completed.

More specifically, the IRS instructs:

- “Use Form 1042-S to report income described under Amounts Subject to Reporting on Form 1042-S, later, and to report amounts withheld under chapter 3 or chapter 4.

- Use Form 1042-S to report specified federal procurement payments paid to foreign persons that are subject to withholding under section 5000C.

- Use Form 1042-S to report payments of eligible deferred compensation items or distributions from nongrantor trusts to covered expatriates that are subject to withholding under section 877A. See Box 1, Income Code, later.

- Use Form 1042-S to report certain distributions that are made by publicly traded trusts and QIEs (as defined under section 897(h)(4)(A)). See Distributions Attributable to Dispositions of U.S. Real Property Interests by Publicly Traded Trusts and Qualified Investment Entities, later.

- Use Form 1042-S to report distributions of effectively connected income (ECI) by a PTP or nominee and amounts realized paid on certain transfers of PTP interests. See Publicly Traded Partnerships (Section 1446(a) and (f) Withholding Tax), later.”

What Types of Payments Do You Report on Form 1042-S?

A withholding agent uses Form 1042-S to report U.S. source scholarships and fellowship grants received by foreign students. Form 1042-S also applies to dividends from U.S. companies, deposit account interest, pensions, royalties, real estate income, most gambling winnings, compensation from services performed in the U.S., effectively connected income (ECI), and notional principal contract income (see income codes for Box 1).

When the 1042-S form is used to report a scholarship or fellowship grant of a foreign national, only the amount over the cost of tuition is reportable (see IRS section 117 for more details on exclusions).

Real estate income includes REMIC (real estate mortgage investment conduit) for income code 02 excess inclusions of allocated share of taxable income to a foreign partner.

“Notional principal contract payments that are not ECI or dividend equivalents.

Do not report on Form 1042-S amounts paid on a notional principal contract, other than a SNPC, if the amounts are not effectively connected with the conduct of a trade or business in the United States. All amounts paid on a SNPC that are treated as dividend equivalents should be reported as such on Form 1042-S.”

Compensation from services conducted in the U.S. includes:

• Compensation for independent personal services performed in the United States, and

• Compensation for dependent personal services performed in the United States (but only if the beneficial owner is claiming treaty benefits).

In cases where there is more than one type of income, multiple forms must be used. For example, if one person received pension income and royalties, you must use a 1042-S for each.

How is Reporting Income Handled using Form 1042-S?

Under the tax laws of the United States, Form 1042-S is not used to report wages for income tax purposes. Instead, Form W-2 should be used.

However, if earnings are exempt from income tax withholding because of a tax treaty (between the earner’s home country and the United States) that provides treaty benefits, then Form 1042-S can be used. This is to only report wages in excess of the amount that’s exempt from income tax withholding.

Take the treaty between Morocco and the United States. Moroccans who work as independent contractors in the U.S. are exempt from taxation up to $5,000 in total income. This is only under certain guidelines.

For example, if a Moroccan earns $7,250.19 in income, he would receive a W-2 showing $2,250.19 in gross income and a 1042-S reporting $5,000. Although Morocco and the United States have a tax treaty, both IRS forms need to be filed.

What Do You Need to Know about Filing Form 1042-S?

Form 1042-S must be filed with the IRS and a copy should also be sent to the business, student, entity, or employee payee to complete their U.S. federal tax return. It’s the responsibility of the withholding agent to complete the form. The withholding agent could be:

- An employer

- Business

- University

- Other institution

Form 1042-S should be filed regardless of whether (or not) tax is withheld.

Furthermore, one form must be completed for each tax rate. This is for any given type of income that’s paid to the same earner.

Although in some cases, Form 1042-S can be filed on paper the old-fashioned way, the IRS requires electronic filing of the form when a total of 10 or more information return forms of all types (including 1099 forms) are filed. The newer electronic method is actually required for withholding agents who have 10 or more forms to submit. Financial institutions are also required to file electronically.

When is IRS Filing on Time for Form 1042-S?

Only one 1042-S should be filed per calendar year. Copy A is due to the IRS and Copies B, C, and D to the recipient on March 15th of the year after the relevant payment was made. The withholding agent filing the 1042-S information returns keeps Copy E for their records. If March 15 falls on a Saturday, Sunday, or legal holiday, (as it does in 2025), the due date is the next business day.

If you need more time to file Forms 1042-S, the IRS will grant an extension. To gain more time, you will need to file Form 8809 (Application for Extension of Time to File Information Returns) by the due date of Form 1042-S. Keep in mind that there is no extension for the payment of tax.

Regarding tax compliance, failure to file a 1042-S on time without an extension or not paying any tax due could result in interest and penalties from Uncle Sam.

How are Forms 1042/1042-T vs. 1042-S Used?

The 1042-S form should not be used for income tax purposes. To report income, Form 1042 (Annual Withholding Tax Return for U.S. Source Income of Foreign Persons) should be used. Withholding agents should file 1042 with the IRS instead of with the employee.

If Form 1042-S is filed in paper-based, hard-copy format, it must be accompanied by Form 1042-T (Annual Summary and Transmittal of Forms 1042-S). One T Form should be used for each type of S form submitted.

Automatically calculate and reduce a payment by any U.S. income tax withholding on foreign supplier payments.

Automate global tax compliance for suppliers.

How To Fill Out IRS Form 1042-S

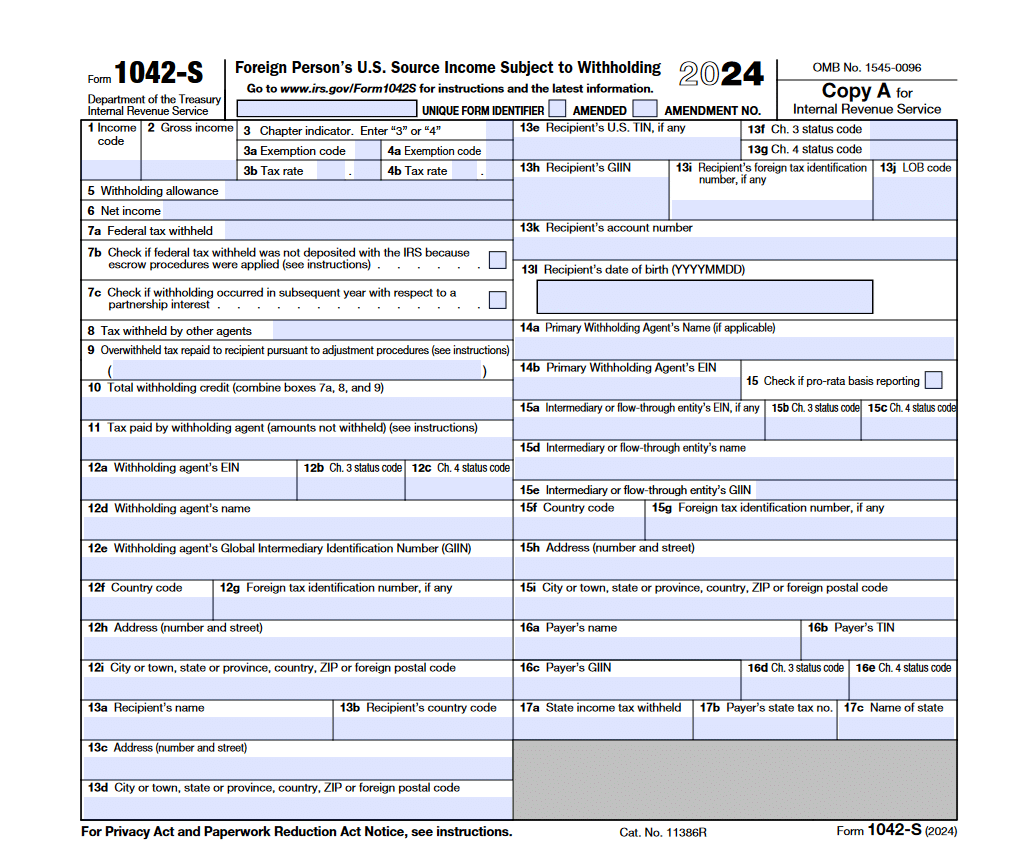

We describe some boxes (line items) in Form 1042-S and provide a screenshot of the IRS 2024 form. Read the IRS Form 1042-S Instructions for more details.

Refer to Instructions for Form 1042-S for a few code changes beginning for the 2024 calendar year, described in the What’s New section.

Box 1 – Income code

Box 1 on Form 1042-S is critical, as this requires the income code that classifies a payment. One form can only have one code. If you’ve received multiple payments from several codes, more than one form must be filed.

Box 2 – Gross income

In Box 2, for gross income (not net income), enter the entire amount paid to the recipient, including tax withholding, for each type of income.

Box 3 – Chapter indicator

Box 3 is the place to enter Chapter 3 or 4. The former is for withholdings that apply to foreign persons, while the latter is for entities that are foreign financial institutions. If you are reporting tax withheld under section 5000C, or backup withholding was applied under the presumption rules, enter “3” as if the tax were a chapter 3 tax.

Box 3a or Box 4a – Exemption code

Exemption codes are from Appendix B.

Box 3b or Box 4b – Tax rate

If the tax rate entered in Box 3b or 4b is zero, enter an exemption code 01 through 24 from IRS Appendix B of Form 1042-S Instructions in either 3a or 4a, depending on the chapter indicator.

Box 5 – Withholding allowance

Box 5 for withholding allowance applies only to the following Box 1 income codes: 16 for scholarship or fellowship grants, 17 for compensation for independent personal services, 18 for compensation for dependent personal services, 19 for compensation for teaching, 20 for compensation during studying and training, or 42 for earnings as an artist or athlete with no central withholding agreement, and there is a valid treaty claim that provides an exemption from withholding up to a specific amount. Report the amount exempt from withholding here. This box should not be used for reporting a personal exemption. If you are a designated withholding agent that has entered into a central withholding agreement with the IRS, leave this box blank and report the gross amount paid to the recipient in box 2.

Read the Form 1042-S Instructions for special rules applying to a designated withholding agent with a central withholding agreement with the IRS.

Box 6 – Net income

Complete this box only if you entered an amount in box 5. If no amount is in box 5, leave it blank.

Box 7a

Enter the total amount of U.S. federal tax you actually withheld in box 7a under chapter 3 or 4. If you did not withhold any tax, enter “-0-.”

Box 7b

If the withholding agent withheld taxes but didn’t deposit them with the IRS because escrow procedures specified in 7b instructions were used, check box 7b.

Box 7c

Check box 7c only if a partnership withheld tax for a foreign partner’s share in the subsequent year for the preceding calendar year.

Box 8

For a withholding agent reporting income subject to withholding already by another withholding agent, report the amount withheld by that other withholding agent.

Box 9 – Overwithheld tax repaid to recipient pursuant to adjustment procedures

This box should be completed only if you repaid a recipient under the reimbursement or set-off procedure during the 2025 calendar year in accordance with the requirements of Regulations section 1.1461-2(a)(2) or (3) (for withholding under chapter 3), or Regulations section 1.1474-2(a)(3) or (4) (for withholding under chapter 4).

Box 10 – Total withholding credit (combine boxes 7a, 8, and 9)

According to IRS Form 1042-S Instructions, “Box 10 must be completed in all cases, even if no tax has been deposited.” Box 7a is federal tax withheld; box 8 is tax withheld by other agents; and box 9 is overwithheld tax repaid to recipient pursuant to adjustment procedures.

Box 11 – tax paid by withholding agent (amounts not withheld)

Box 11 is the tax paid by the withholding agent from their own funds and not withheld from the payment to the recipient. This amount should not be included in line 10.

Box 12a – Withholding agent’s EIN

Enter the withholding agent’s employer identification number. Apply with the IRS for an EIN if you don’t have one yet.

Box 12b – Ch. 3 status code and Box 12c – Ch. 4 status code

Enter the withholding agent’s Chapter 3 status code in box 12b and Chapter 4 status code in box 12c from Appendix B to the Form 1042-S Instructions.

Boxes 12d and 12e Withholding agent’s name and GIIN

GIIN is the withholding agent’s Global Intermediary Identification Number.

Box 12f – Country code

For the withholding agent, enter the country code of your residence (under that country’s tax laws) from the IRS list of foreign countries accessible from Form 1042-S Instructions in Box 12f or OC if that country isn’t included in the IRS list. “Enter US in box 12f if the withholding agent is a U.S. person or a foreign branch of a U.S. person.”

Box 12g – Foreign tax identification number, if any

Enter the withholding agent’s foreign tax ID number, if any.

Boxes 12h and 12i – Address (number and street), City or town, state or province, country, ZIP or foreign postal code

Enter the withholding agent’s complete address, using these two boxes.

Boxes 13a through 13d – Recipient’s name, country code and address

Enter the recipient’s name, country code of residence under that country’s tax laws, OC (other country), or US in box 13b.

Box 13e – Recipient’s U.S. TIN, if any

Certain types of recipients specified in the Form 1042-S Instructions are required to have a U.S. TIN.

Box 13f – Ch. 3 status code or Box 13g Ch. 4 status code

In Box 13f or 13g enter the recipient status code from IRS Appendix B to Form 1042-S Instructions.

Box 13h – Recipient’s GIIN

You must include a GIIN if you are required to collect a GIIN for the recipient under the requirements documenting the payee under chapter 4. If you make a payment to a disregarded entity or branch that is identified in Part II of Form W-8BEN-E, then report the GIIN of the disregarded entity or branch provided in that section.

Box 13i – Recipient’s foreign tax identification number, if any

Enter the recipient’s identification number used in their country of residence for tax purposes. In certain cases specified in the Form 1042-S Instructions, a foreign tax ID number is required.

Box 13j – LOB code

If you are making a payment for which a beneficial owner that is an entity has claimed a reduced rate of withholding under an income tax treaty and has provided documentation that establishes the limitation on benefits (LOB) article under which the beneficial owner qualifies, enter the applicable LOB code from Appendix B of Form 1042-S Instructions.

Box 13k – Recipient’s account number

This is the recipient’s financial account number from an FFI.

Box 13l – Recipient’s date of birth

Enter the recipient’s date of birth, (YYYYMMDD).

Boxes 14a and 14b – Primary withholding agent’s name (if applicable)/EIN

This box is used by an intermediaries and flowthrough entity reporting in Box 8 the amount withheld by another withholding agent called the Primary withholding agent. Enter the primary withholding agent’s name and employer identification number. If there is more than one primary withholding agent, enter the name and EIN of only one in boxes 14a and 14b. If there are no primary withholding agents, leave the boxes blank.

Box 15 – Check if prorata basis reporting

This checkbox is used by a withholding agent to report to the IRS that “an NQI that used the alternative procedures of Regulations section 1.1441-1(e)(3)(iv)(D) failed to properly comply with those procedures.”

Boxes 15a through 15i – Intermediary/Flow-Through Entity’s Name, Status Code, Country Code, Address, EIN, GIIN, and Foreign Tax Identification Number

Enter the information for the intermediary or flow-through entity in boxes 15a through 15i. The EIN and FTIN box captions indicate, if any. The status codes are in separate boxes for chapter 3 and chapter 4.

Boxes 16a through 16e – Payer’s Name, TIN, GIIN, and Status Code

Boxes 16a through 16e apply to the payer. Enter the information required, including the Ch. 3 status code in box 16d and the Ch. 4 status code in box 16e.

Box 17a – State income tax withheld

Boxes 17a through 17c relate to any state income tax withheld.

Box 17b – Payer’s state tax no.

In Box 17b, enter the payer’s state tax number.

Box 17c – Name of state

In Box 17c, enter the state name.

In Conclusion

If you are still unsure about which forms to file, it’s always best to read Form 1042-S Instructions, visit the IRS website at ww.IRS.gov, or contact the IRS directly and consult your CPA or tax attorney. Don’t take a guess and make a costly mistake. For more foreign and domestic supplier tax rules to improve tax compliance, access the white paper.