Invoice approval workflows can be a time-consuming and frustrating process in a manual system.

Prone to errors, delays, and rework, manual invoice workflows can create a ripple effect, impacting timely vendor payments, reconciliation, cash flow, and ultimately, the bottom line.

In this article, we explain the steps in the AP invoice approval workflow, the top challenges in invoice approval, and how modern invoice workflow automation helps businesses realize tangible benefits.

What is an Invoice Approval Workflow?

The invoice approval workflow is a series of steps required in accounts payable before paying a supplier invoice.

It includes verification of the supplier and quantities received, three-way matching with a purchase order and receiving report, exception handling, document review, and approval by the designated approver(s) before invoice payment.

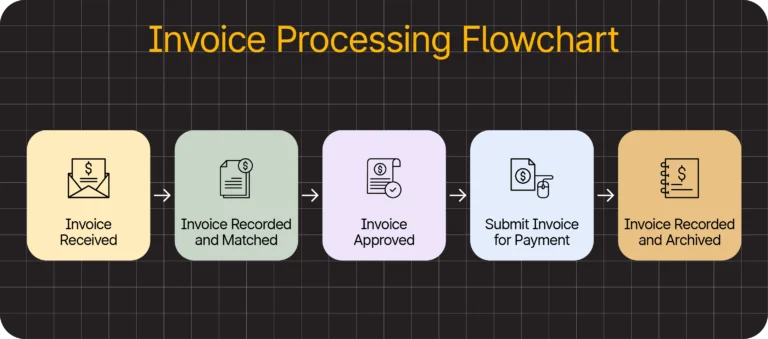

Steps in an Invoice Approval Workflow

An invoice approval workflow consists of a series of steps that ensure invoices are accurate, authorized, and ready for payment. While the process may differ by organization, the goal is the same: verify invoice details, route invoices to the right approvers, and prevent errors or delays before payment is made.

Typical steps in an invoice approval workflow are:

- Receive and enter invoices into the accounts payable system

- Verify invoice details

- Perform 3-way matching with purchase orders and goods receipts

- Handle exceptions and discrepancies

- Route invoices to approvers for review and authorization

- Schedule invoices for payment and begin payment processing

The invoice approval workflow is relevant to the entire invoice-to-pay process.

The invoice-to-pay flow starts with receiving an invoice that may be related to a purchase order and ends with making a payment after verifying the goods and the invoice details.

In a manual system, an invoice approval workflow typically requires additional steps to follow up with approvers. In an automated system, the process is efficient.

Invoice Approval Workflows: Key Challenges

Here are the biggest obstacles in an invoice workflow using a manual invoice approval process or an inefficient invoice processing system.

Inefficient Manual Processes

According to IFOL’s Accounts Payable Automation Trends 2025 report, 57% of AP professionals name manual data entry as the top challenge, while 53% report that the resultant errors delay the approval process.

The most time-consuming aspects of the invoice approval workflow in a paper-based system are:

- Finding and filing paper documents for invoice matching and requesting missing or lost documents

- Physically routing matched documents to the approver and following up by messaging the approver when approval delays occur

- Following up with vendors on reissuing invoices with exceptions for discrepancies

- Manually keying paper invoices into the system

- Answering endless phone calls and emails from suppliers when their bills aren’t paid on time

As invoice volumes increase, these manual steps make it challenging for accounts payable teams to keep pace with the demands of the invoice approval workflow, especially when operating with limited resources.

Waiting for Supporting Documents

Approvers rely on the following documents to verify invoice accuracy:

- Purchase order (PO) to confirm the order was authorized.

- Goods or services receipt to verify that the items or services were delivered.

- Invoice data, including vendor name, address, invoice number, GL code, date, payment method, and amount.

- Additional supporting documents, such as contracts or receipts.

Losing or misdirecting paper documents is a real risk in organizations that work with paper. IFOL’s above-cited survey also found that only 39% of AP departments have completely digitalized AP document storage.

Lack of centralized digital storage can hinder easy access to documents that approvers require, further delaying approval.

Communication and Collaboration Issues

28% of finance professionals say that communication gaps between departments slow down AP processes, according to Tipalti’s 2025 research report, The Global Finance Outlook: Ambition vs. Readiness.

For high-value purchases, approvers often need to confirm details with relevant team members, such as verifying the budget or confirming that goods or services were received before approving an invoice.

When invoices are missing key details or supporting documents, approvers typically send them back to the AP team for clarification, causing additional back-and-forth and delays in processing.

Disparate systems or lack of integration within AP, payments, procurement, invoicing, and vendors disrupts data flow and collaboration, reducing the efficiency of invoice approval workflows.

Lack of Visibility Into the Invoice Flow

26% of AP professionals spend time chasing invoice approvals, according to Tipalti’s research.

Without a centralized system to track invoice intake, data capture, and approval status, AP teams often lack real-time visibility into the current status of an invoice in the process.

For instance, they may not know which approver is currently reviewing a specific invoice or why an invoice is not approved.

This results in manual effort to follow up with approvers via individual emails or phone calls, slowing down the entire workflow.

Blind spots in AP workflows can also raise the risk of duplicate payments and fraudulent transactions, which impact the organization’s bottom line.

An Unclear or Inconsistent Invoice Approval Matrix

Excessive approval levels, lack of clear thresholds, and undefined approval deadlines are some signs of a poorly designed invoice approval matrix.

In the absence of a standardized approval matrix, the risk of sending an invoice to the wrong approver is also high.

All the above-listed obstacles in the invoice approval workflow can have a ripple effect on a business’s financial health by affecting payment terms and early payment discounts.

For instance, QuickBooks’ Small Business Late Payments study found that businesses facing cash flow problems due to late payments are 1.4 times more likely to raise prices, with an average price increase of 16% compared to those who receive payments on time.

The sustainable way to eliminate inefficiencies and human errors in invoice approvals is through intelligent automation.

Fix invoice approval bottlenecks—without sacrificing control

Approval delays slow down your entire AP process. Learn how modern finance teams automate invoice approvals, reduce manual touchpoints, and keep every approval auditable and compliant, without adding complexity.

How Can Automation Optimize the Invoice Approval Workflow?

Automation is now a business imperative, no longer something that’s “nice to have.”

The right AP automation solutions optimizes invoice management by supporting invoice approval automation across every stage of the process, including:

- Capturing invoice data accurately with OCR, AI, and ML

- Automating invoice matching with PO and goods receipt

- Dynamically routing invoices to the right approvers

- Using thousands of algorithmic rules and several reliable online databases to validate the legitimacy of vendors

- Offering a central repository for invoices and supporting documents

- Streamlining communication and collaboration between departments

- Providing notifications on invoice approval and payment status to suppliers

- Automating payment and reconciliation for faster monthly close

- Providing end-to-end visibility into the invoice cycle with a clear audit trail and a central dashboard

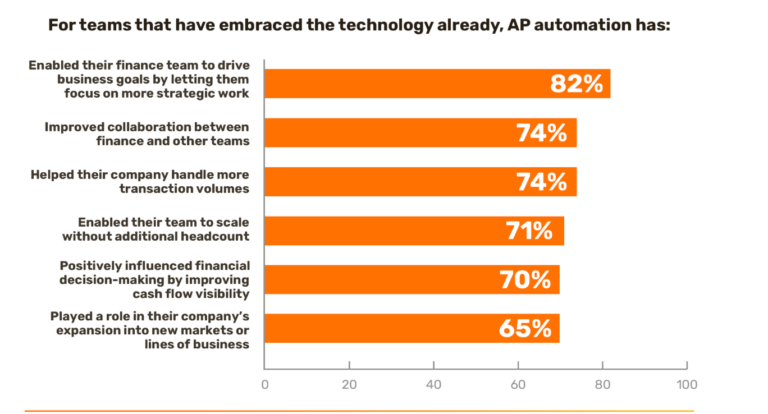

Tipalti’s Global Finance Outlook study reveals that organizations using AP automation experience a clear business impact.

In fact, 82% say automation enables finance teams to focus on more strategic work rather than manual tasks. As invoice volumes grow, 71% report being able to scale without adding headcount. Automation also improves financial decision-making, with 70% citing better cash flow visibility as a key benefit.

The key benefits of AP automation

Taken together, these improvements help reduce the overall cost and effort of invoice processing. By minimizing manual work, errors, and rework, invoice automation allows finance teams to process invoices more efficiently and redirect resources to higher-value activities.

Pro Tip: Try Tipalti’s invoice processing payment calculator to find out how much you may be able to save with automated invoice processing.

What to Look for in AI-Powered Invoice Approval Automation

Modern invoice automation platforms use AI to remove friction across every stage of the invoice approval workflow, from data capture and coding to approvals, exception handling, and compliance.

Below are the core capabilities finance teams should evaluate when modernizing invoice approval workflows, illustrated through examples from Tipalti’s AI-powered platform.

AI-Powered Invoice Data Capture and Coding

Accurate invoice data is the foundation of an efficient approval workflow. AI-powered automation reduces manual entry, improves data quality, and accelerates downstream approvals.

The efficiency of the invoice approval workflow depends on the accuracy and speed of invoice data extraction. This is where Tipalti’s Smart Scan AI shines.

Leveraging the combined power of OCR, generative AI, and ML, Tipalti AI extracts invoice data quickly and accurately. The AI captures both header and line-level data, becoming smarter as it learns from each transaction.

Auto-Coding AI for Assigning GL Accounts, Tax Codes and Departments

Manual coding is known to be error-prone and time-consuming, further delaying approvals.

Tipalti’s Auto-Coding AI predicts the correct GL for each line with up to 95% accuracy. It learns to predict other bill fields, including cost centers, expense accounts, location, projects, departments, and more.

This can save several minutes of coding time per invoice, adding up quickly at scale. This means that if you process a thousand invoices, you can save ten working days per month that would otherwise be lost to manual coding.

In addition, Tipalti AI automates tax coding by matching invoice tax amounts with the correct rates and codes.

Intelligent Approval Routing and Exception Management

Approval delays often stem from unclear rules, manual handoffs, and exceptions that require constant follow-up. Intelligent automation applies business logic and historical context to facilitate smooth approvals.

Lack of a standardized process, unclear roles, bottlenecks, and limited visibility are typical factors that slow down the approval process.

Tipalti’s Approval Routing AI effectively addresses these pain points.

With the help of AI and ML, the system determines the correct approver based on factors like amount, department, and vendor type.

Tipalti handles simple and complex approval routing

The intelligent system analyzes historical data and applies company-specific rules to accelerate both simple and complex approval flows.

Exception Handling AI for Flagging and Resolving Mismatches

Tipalti’s intuitive Exception Handling AI helps shorten the invoice cycle time and minimize exceptions.

Users can create tolerance thresholds based on amounts, percentages, bill, or line level. Tipalti AI matches bills within these thresholds to improve match rates and cut costs.

Tipalti makes it easy to configure exception approval rules, and users can approve or reject them via email directly.

Tipalti AI helps minimize exceptions

Color-coding and a clear view of where exceptions occur and how to resolve them help users take timely action.

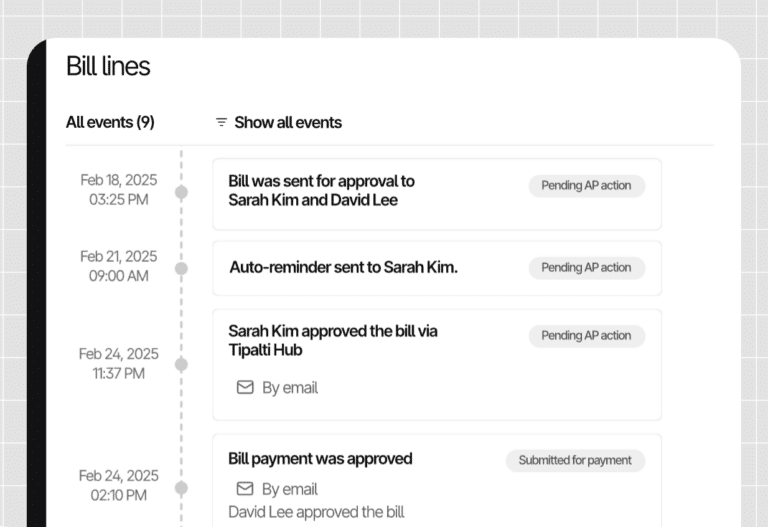

Proactive Visibility, Alerts, and Risk Detection

Limited visibility and reactive follow-ups create bottlenecks in invoice approvals. AI-driven monitoring and alerts help teams identify issues early and take action before delays escalate.

The capabilities of Tipalti AI extend to:

Automated approval alerts

Tipalti provides automated alerts to approvers to ensure they instantly know when an invoice is awaiting action, preventing delays from stalled or forgotten approvals.

Duplicate invoice detection

The smart system identifies duplicate invoices and anomalies early to prevent overpayments.

Predictive analytics to optimize cash flow

Tipalti’s AI agents use predictive analytics to analyze historical invoice and payment data, identify trends, predict cash flow issues, and optimize payment schedules.

Smooth supplier communication

Automating supplier communications minimizes back-and-forth in the invoice workflow.

Tipalti Detect™ for fraud monitoring

Tipalti Detect prevents payment fraud by screening KYC, AML, and OFAC compliance to strengthen financial controls.

Audit trail to eliminate bottlenecks

Tipalti’s platform provides a complete audit trail for every invoice, approval, and payment, consolidating data from multiple entities into a single unified view.

A clear audit trail removes confusion and bottlenecks

These powerful features of Tipalti AI optimize approval accuracy and speed while building trust in its users.

Driving AP and Business Success with Invoice Automation

According to IFOL’s report, AP professionals cite the need to speed up the invoice cycle, reduce financial risks, and improve visibility as key reasons for adopting AI-enabled automation.

AI in finance has evolved beyond task automation, with modern platforms applying intelligence across invoice workflows to support faster approvals and more informed decision-making.

Tipalti’s invoice automation platform brings these capabilities together to improve accuracy, increase visibility, and help finance teams address today’s most pressing AP challenges.

Modernize Invoice Approvals with Intelligent AP Automation

AI-powered automation helps finance teams accelerate invoice approvals, improve accuracy, and gain better visibility across AP. Tipalti’s platform brings these capabilities together to support faster, more resilient invoice workflows.

Invoice Approval Workflow FAQs

A few frequently asked questions (FAQs) and answers about the invoice approval process follow.

How do I set up an invoice approval workflow?

The invoice approval workflow is much more efficient using automated invoice approval instead of a manual system.

AP automation software uses invoice approval best practices and the necessary AP department or company-related information to streamline the flow.

To set up an invoice approval workflow, you can use pre-designed invoice approval templates, designate the authorized stakeholders, and define the rules (such as thresholds, required documents, and other criteria).

How do you approve an invoice?

In the AP invoice approval process, your company must authorize you for invoice approvals.

Once authorized, you can approve a business invoice by reviewing the supplier and invoice for validity and comparing the invoice with matched supporting documents, including a related purchase order and receiving report.

Which is the best invoice approval workflow software?

The best invoice approval workflow software depends on your business needs.

While choosing an electronic invoice approval workflow software, focus on capabilities, such as:

• End-to-end invoice automation with OCR, AI, and ML-based data capture and GL coding

• Automated approval routing and the ability to handle complex approval flows

• Integration with payments, ERP systems, such as NetSuite, procurement, and expenses

• A clear audit trail and in-depth reporting

• Global payment support, strong compliance, and financial controls

Who approves invoices?

Designated supervisors and managers with budgetary control or small business owners approve invoices.

For invoices over a stated amount, company policy may require a second approval signature. That second approver would hold a higher-level company position.