Return on equity (ROE) is an important financial metric you can use to measure business performance. Optimize return on equity by using levers within the DuPont formula for ROE. Shareholders and employees will reap rewards when the company reaches its annual profitability and asset turnover goals, which are reflected in return on equity.

What is Return on Equity (ROE)?

Return on equity (ROE) is a metric for the annual percentage return earned on shareholders’ equity. Calculate ROE as net income divided by average shareholders’ equity. ROE can also be calculated using a 3-step DuPont analysis formula that considers net profit margin, asset turnover, and financial leverage. The more complex DuPont formula helps businesses optimize their return on equity.

Understanding Return on Equity

Return on equity measures your company’s rate of net profitability in relation to the average shareholder equity capital it uses. Your company’s net income increases when it makes profitable sales and service revenue transactions. A higher growth rate with profitable products and controlled expenses increases ROE.

The faster that assets turn over, including inventory, the more sales that your company makes in a year. These sales add to profitability if goods are priced above cost, with a favorable contribution margin.

Most assets are recorded at historical book value rather than fair value. Inventory uses a flow assumption for valuation and cost of goods sold that’s the average cost, FIFO (first-in-first-out), or LIFO (last-in-first-out).

The accounting equation calculates Shareholders’ Equity = Total Assets – Total Liabilities from the financial statements. Debt financing is a liability, whereas, equity financing, such as common stock or preferred stock, and retained earnings, are classified as shareholders’ equity, also called stockholder equity.

ROE doesn’t include return on debt capital. Therefore, the mix between equity capital and debt capital in your company’s capital structure will impact the ROE financial ratio results. It’s reflected in the 3-step DuPont analysis formula for ROE by including total assets to shareholders’ equity in the calculation.

To understand your company’s ROE, benchmark its return on equity with similar companies in your industry. You may be able to find business statistics, including return on equity, using your company’s SIC (standard industrial classification).

How to Calculate Return on Equity

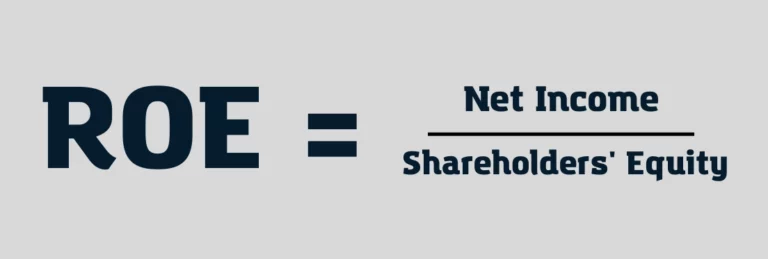

The return on equity (ROE) formula is:

Calculate return on equity with either a simple formula, as shown below, or a more complex formula known as the DuPont Analysis formula or DuPont formula, shown in the next section. You’ll use both the income statement and the balance sheet to compute ROE. Use average shareholders’ equity in the calculation.

What is DuPont Analysis?

DuPont analysis uses a multipart formula to analyze return on equity (ROE) by separating it into multiple formula components. The benefit of using the DuPont Analysis formula is that you can analyze the factors responsible for generating the return on equity and use these levers in your business to improve ROE.

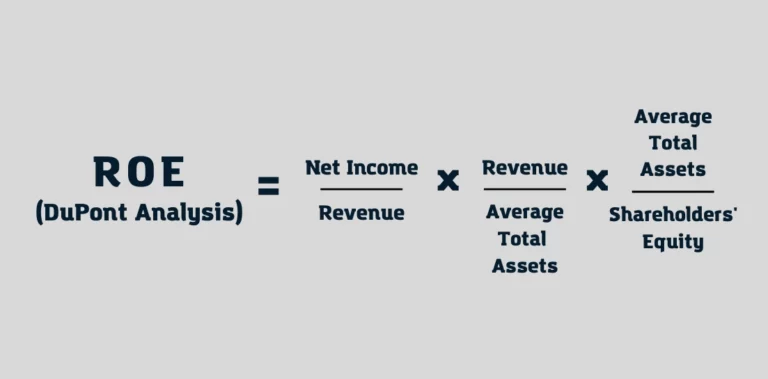

The 3-step DuPont Analysis formula is:

The terms of the DuPont formula create valuable metrics. Net Income divided by Revenue measures the net profit margin. Revenue divided by Average Total Assets is asset turnover. Average Total Assets divided by average Shareholders’ Equity is a financial leverage metric called the equity multiplier.

How to Improve ROE using the DuPont Analysis Formula

To improve profits in the net profit margin, devise and implement a business strategy for increasing revenues, improving operational efficiency to cut costs, and reducing discretionary expenses. With a strategic finance approach, rank potential investments that will produce revenues or cost savings using discounted cash flow techniques like net present value and IRR.

To improve the company’s asset turnover, first, focus on ways to optimize inventory turnover by selling goods faster. Improve physical controls over inventory and manufacturing processes.

Minimize waste, scrap, and rework in manufacturing companies by improving methods and identifying defects early. Automated shop floor software using IIoT (Industrial Internet of Things) sensors for data acquisition and software notifications are useful advanced ERP system features to achieve these manufacturing improvement goals.

The higher the financial leverage (equity multiplier), the more debt is included in the capital structure, which can increase risks and return on equity. To minimize risk, the company’s management should avoid excess debt.

Share buybacks (reacquired stock) will reduce shareholders’ equity when Treasury stock is recorded as a negative amount in the Shareholders’ Equity section of the company’s balance sheet.

Share buybacks increase a company’s debt to equity ratio and also increase the equity multiplier, representing financial leverage in the third-step formula for DuPont analysis. This increase in equity multiplier occurs because the ratio of Total Average Assets to lower Shareholders’ Equity is a higher number. The result is a higher ROE percentage.

Deloitte Consulting uses the concept of value maps. It expands the concept of DuPont analysis financial drivers by linking them to operational drivers to “link operational performance to business results” in a strategic finance initiative.

Examples of ROE

Two ROE example (return on equity) calculations are shown. The first ROE calculation example uses the basic ROE formula. The second ROE calculation uses the expanded DuPont analysis formula.

The assumptions for these ROE examples are shown in the following table.

| Formula component | Amounts | Formula(s) for assumption |

|---|---|---|

| Net income | $ 1,720,000 | Basic & DuPont Analysis |

| Average Shareholders’ Equity | $ 1,425,000 | Basic & DuPont Analysis |

| Revenue | $18,100,000 | DuPont Analysis |

| Average Total Assets | $ 5,500,000 | DuPont Analysis |

Basic ROE Calculation

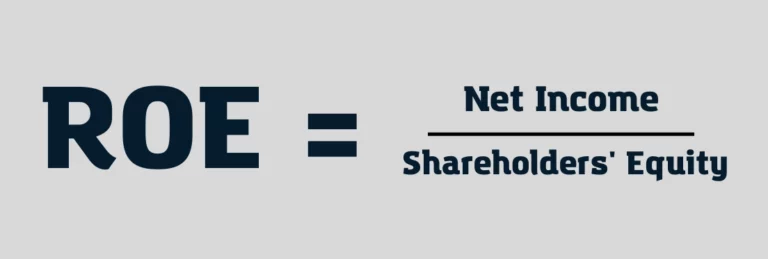

Use the basic ROE formula as a simple example of how to calculate ROE:

ROE = $1,720,000 = 20.7%

$1,425,000

DuPont Analysis ROE Calculation

Use the 3-step DuPont Analysis formula to calculate ROE:

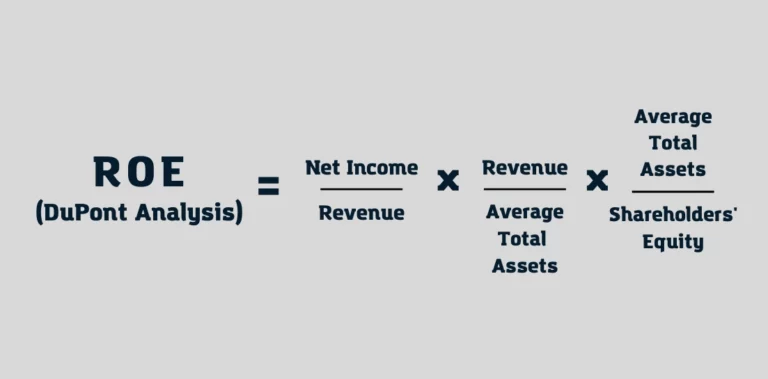

ROE (DuPont Analysis) = $ 1,720,000 x $18,100,000 x $ 5,500,000

$18,100,000 $ 5,500,000 $ 1,425,000

ROE (DuPont Analysis) = 0.09503 x 3.29 x 3.86

ROE (DuPont Analysis) = 20.7%

Besides generating an ROE metric of 20.7%, which is the same as calculated in the basic ROE formula, the DuPont analysis calculation produces other valuable metrics. The DuPont formula shows that the net profit margin is 9.5%, asset turnover is 3.29 times and financial leverage, as measured by Average Total Assets divided by Shareholders’ Equity is 3.86 times in the business analyzed.

The 20.7% return on equity is considered very good.

If the calculated return on equity for your business needs improvement to reach a higher ROE, consider ways to improve net profit margin, asset turnover, and shareholders’ equity in relation to average total assets, from the DuPont formula.

ROE vs Other Business Performance Measures

ROE vs Return on Assets vs Return on Invested Capital

ROE vs return on assets (ROA) vs return on Invested Capital (ROIC) are different performance measurement metrics.

ROE measures the percentage return in terms of Net Income divided by Shareholders’ Equity. Return on assets measures asset utilization with the formula of Net Income divided by Total Assets. Return on invested capital uses the formula Net Operating Profits after Tax (NOPAT) divided by Total Invested Capital, where Invested capital is Debt plus Equity minus Cash & Cash Equivalents.

For return on invested capital, NOPAT can be calculated as EBIT times (1minus the income tax rate).

Return on Equity (ROE) vs Return on Capital Employed (ROCE)

The difference between return on equity (ROE) and return on capital employed (ROCE) is that ROE measures net income divided by shareholders’ equity and ROCE measures EBIT (earnings before interest and taxes) divided by total assets minus current liabilities. Using the accounting equation, the ROCE formula can be rearranged as EBIT divided by shareholders’ equity plus long-term liabilities.

When comparing ROE and ROCE, ROE considers net income, which is after interest and income taxes in the numerator, and doesn’t add long-term liabilities to shareholders’ equity in the denominator. ROCE uses EBIT in the numerator and adds total liabilities to shareholders’ equity in the denominator.

Return on Equity (ROE) vs Return on Investment (ROI)

The main difference between the return on equity (ROE) and return on investment (ROI) is that return on equity measures business performance based on net income divided by shareholders’ equity. Return on investment measures the performance of an investment based on final investment value minus initial cost of investment x 100 divided by the cost of initial investment.

Return on Equity FAQs

Frequently asked questions (FAQs) and answers about return on equity (ROE) follow.

What is a Good ROE Ratio?

A good ROE ratio is between 15% and 20%; an excellent ROE is 40%.

The NYU Stern School of Business maintains return on equity by sector statistics before and after adjusting it for R&D. The unadjusted average ROE for the total U.S. market of 7,229 companies in January 2022 was 18.12%. Several sectors had a very high ROE in the 40% range (one outlier sector was 95.71%), and other sectors had lower ROE metrics, including a few with a negative ROE.

Is a high or low ROE ratio better?

A high ROE is better because it means that the return on shareholders’ equity is higher. Analyzing ROE computed with the DuPont formula, companies with higher profit margin, asset turnover, and financial leverage increase their return on equity, for a better ROE.

What Does 20% Return on Equity Mean?

A 20% return on equity means your company has an impressive ROE because its net income divided by shareholders’ equity is 20%. It’s managing equity capital well to provide an excellent return to shareholders. Your company probably has a high profit margin, turns over assets (including inventory) frequently, uses these assets efficiently, and maintains a favorable capital structure.

Why does the 3-step DuPont formula get the same result as the basic ROE formula?

The result is the same because when they’re all multiplied, the terms in the numerator and denominator for Revenue and Average Total Assets can equate to 1 (canceling the effect of these terms in the DuPont formula). As a result, the DuPont Analysis formula can be simplified to the basic ROE formula of Net Income divided by Shareholders’ Equity.

Why is ROE So Important?

The ROE (return on equity) financial metric is extremely important because the performance measurement gives you feedback as to how well you’re managing your business and if you’re effectively using shareholder capital. A higher ROE percentage indicates the good financial health of a business, which benefits stakeholders.

Using the DuPont formula, you can significantly improve your company’s performance by improving net profitability and asset turnover and optimizing financial leverage, also known as the equity multiplier.