Learn how to expertly execute global payments for streamlined accounts payable and business efficiency.

In the U.S., banks, credit unions, and payment processors, including clearinghouses, use a routing number and an account number to process many types of financial transactions besides the paper checks on which they’re printed.

We define routing number and explain routing number uses, what the routing number digits mean, and how to find your bank routing number.

What is a Routing Number?

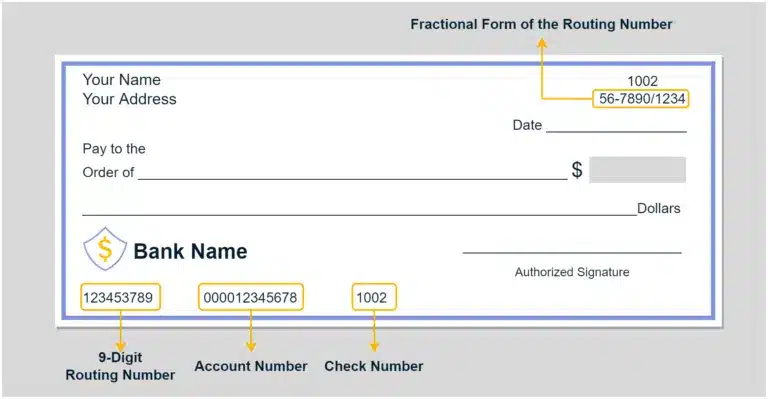

A routing number is a nine-digit number located on the bottom left corner of a check. It identifies the specific bank or credit union where you set up your bank account. Financial institutions use the routing number with your bank account number for transactions.

A payee’s bank routing number and account number are also needed for bank transfers or electronic payments.

Banks have many routing numbers. The routing number identifies the state or region where your bank account is located and the transaction type.

American Bankers Association (ABA) assigns routing numbers to financial institutions. Routing numbers are used for both checking accounts and savings accounts.

What are Other Names for Routing Number?

In the U.S., a routing number may also be called a routing transit number (RTN), ABA routing number, or ABA number. The U.S. routing number system was established by American Bankers Association (ABA) in 1910.

What is a Routing Number Used For?

Routing numbers are used for multiple payments and direct deposit methods. These methods include:

- Paper check and electronic check processing,

- Online banking and electronic funds transfers (EFTs)

- ACH (Automated Clearing House) bank transfers (including payments and direct deposit),

- Domestic wire transfers, and

- Payments by phone.

If PayPal is connected to your U.S. bank account, they will need your routing number and account number. Some payment apps, including PayPal, may use only an email or phone number to make payments instead of using a routing number.

The routing number used for an international wire transfer or another type of transaction may be different at your bank. Ask your banker which routing number to use.

For ordering checks (either business or personal checks), you’ll need to provide a routing number and account number.

When you authorize automatic one-time or recurring ACH payments, you’ll need to include the routing number and account number on the authorization form. You may need to submit a voided check with the routing number and account number for some payment types.

In the U.S., a lender uses a routing number and account number to send money to your bank account and receive loan repayments of principal and interest.

What Do the Digits of a Routing Number Mean?

Bank routing numbers are generally nine digits, consisting of eight digits in two parts and a ninth check digit. The first four digits are the Federal Reserve District routing number identifier. The next four digits (five through eight) uniquely identify a bank or credit union. The ninth digit is a mathematical check digit.

What are the Four Digits for the Federal Reserve District included in a Routing Number?

The Federal Reserve Banks, through FRBservices.org, provide the key to the first four-digit Federal Reserve District Routing Numbers that are included in a bank routing number. For the 12 Federal Reserve Districts, the first two digits represent the district number. The second set of these four digits represents some specific cities related to regions within the Federal Reserve District. Most of the cities are large enough to be assigned multiple codes.

The key to Federal Reserve District routing numbers includes a footnote:

“In Federal Reserve Districts 1-9, routing transit numbers for thrifts & credit unions have a 2 as the first digit. In Districts 10-12, routing transit numbers for thrifts & credit unions have a 3 as the first digit.”

Based in Dallas, Texas, the Eleventh Federal Reserve District includes multiple routing numbers for Dallas, El Paso, Houston, and San Antonio. Cities not explicitly listed are assigned a Federal Reserve routing code from one of the listed cities included in the key.

For example, Eleventh District Federal Reserve routing codes for Houston, Texas, identified in the key as 1130 and 1131. Windsor Locks, Connecticut in Hartford County uses First District Federal Reserve routing codes 0111, 0118, 0119, 0211, 0116, and 0117.

Adding a digit for thrifts & credit unions is possible because routing numbers may be between eight and 11 instead of nine digits.

The Federal Reserve key for routing numbers also lists unique routing numbers for a treasury check, postal money orders, and savings bonds.

How Do I Find My Bank’s Routing Number?

You may find your bank’s routing number on the bottom of your checks, your bank’s website, the ABA online lookup tool, your bank app, or by contacting your banker.

Finding the Bank’s Routing Number on a Check

A bank routing number is the set of numbers printed on the bottom left of a paper check, followed by a bank account number and check number to its right. These numbers are printed with MICR ink (magnetic ink character recognition) to make them machine-readable.

A second version of the routing number is presented near the top right of the check. It’s above the line for the Date. This backup version of the routing number is called a fraction because it includes a numerator and denominator.

The fraction includes sets of different numbers, although it shows the same Federal Reserve District routing number as the denominator. The fraction routing number is used when the routing number on the bottom of the check isn’t readable.

Finding the Bank’s Routing Number on Bank’s Website

Banks and credit unions have a lookup tool for routing numbers on their website. A bank may have different online lookup pages for business accounts and personal accounts for this online search of the bank routing numbers list.

Finding the Bank’s Routing Number on a Bank Statement or Mobile App

Banks sometimes include the routing number on a bank account statement in addition to the account number. We don’t use paper checks often as online banking takes the lead. It may be easier to find your routing number on the bank account statement that you can access online through the mobile banking app for your financial institution.

ABA Routing Number Online Lookup

Use the ABA routing number lookup to find your bank’s routing number online through the American Bankers Association website.

Finding the Bank’s Routing Number by Contacting Your Banker

If you’re unsure of the routing number to use for a particular type of transaction, contact your banker to ask.

Routing Number vs Account Number

Routing number and account number are used together for bank transactions. See routing number vs account number for an overview of these terms and differences between them.

FAQs

Why is a Different Routing Number on a Deposit Slip?

According to Citizens Bank, deposit slip routing numbers are a financial institution’s internal numbers differing from the external routing number printed on a check. The purpose of an alternative routing number is to record the deposits as a credit instead of a payment debit like a check paid through a checking account. The internal routing number on a deposit slip

may be an eight-digit number instead of a nine-digit external routing number on the check.

Is the Number on Your ATM Debit Card a Routing Number?

No. The number on an ATM debit card is not a routing number. Debit cards and credit cards don’t use routing numbers. The financial institution links the ATM debit card to your bank account through its banking system.

Is a Routing Number Confidential?

No. All bank account holders with accounts set up in the same area have the same routing number. Routing numbers are readily available through online lookup tools.

However, a bank account number should be considered confidential to avoid fraud resulting in the loss of funds. Treat a bank account number with the same degree of confidentiality as a Social Security Number.