We’ve paired this article with Laurie Hatten-Boyd’s AP Tax Compliance webinar. Get your Executive Summary to find out how FATCA requirements impact organizations with a global supplier base.

Fill out the form to get your free eBook.

Laurie Hatten-Boyd, Principal at KPMG LLP, shared her insights on the impact of US tax compliance rules for companies paying their global suppliers. In this summary of her one-hour webinar, Hatten-Boyd explains how FATCA requirements impact organizations with a global supplier base and the legal and financial penalties they may face for non-compliance. Read the executive summary to get the must-have takeaways from the webinar. – An overview of US tax rules for companies paying global suppliers, including FATCA requirements – Steps your organization can take to avoid legal and financial penalties – How to ensure your payees select the correct form based on their country and corporate structure – How to determine which payees require tax withholding by treaty – The basics around end-of-year 1099/1042-S tax reporting

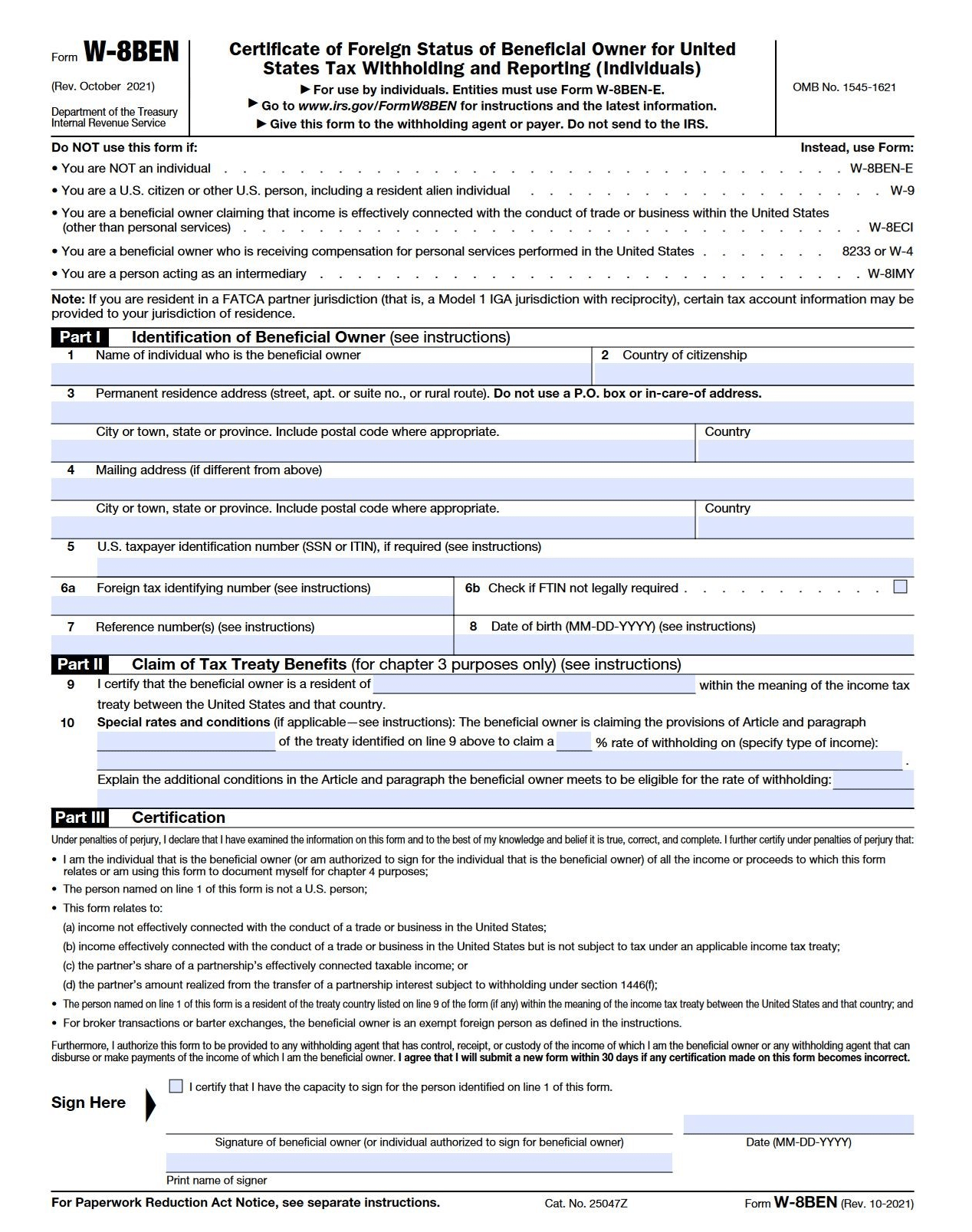

This guide defines what IRS Form W-8BEN is, what a W-8BEN form is used for, whether the IRS requires it, when and who should submit it, and to which parties it should be sent. How to fill out the tax form using IRS Form W-8BEN Instructions is also covered.

W-8BEN is for foreign individuals (not entities or US persons). The payee needs to file Form W-8BEN before the first payment to avoid withholding of the full 30% of U.S. income tax. Finance managers and operations leaders who pay international contractors or vendors must comply with IRS withholding rules.

Do not rely on this W-8BEN guide alone as a source of tax advice. Refer to the official IRS Instructions on the IRS website and consult your attorney or CPA.

What Is Form W-8BEN?

W-8BEN is an IRS form used by individual nonresident aliens (NRAs) to report information to withholding agents, payers, or FFIs if they are the beneficial owner of an amount from U.S. sources subject to income tax withholding or the NRA account holder at a foreign financial institution (FFI).

The individual filing Form W-8BEN is eligible for a reduced rate of tax withholding, or is exempt entirely, due to an income tax treaty between his home country and the United States.

IRS Form W-8BEN is titled Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals).

Only non-U.S. persons who are individuals should use Form W-8BEN. U.S. citizens and resident aliens are considered U.S. persons. U.S. persons file Forms W-9, W-4, and others. Non-U.S. entities use Form W-8BEN E instead.

Form W-8BEN is required to be filed with withholding agents, payers, and FFIs by non-resident alien individuals who may be subject to withholding of U.S. taxes at a 30% tax rate on payment amounts received from U.S. sources, regardless of their ability to claim a withholding exemption.

You need to complete a W-8BEN tax form for each requester, and some withholding agents may require a separate Form W-8BEN for each type of income.

Who Needs to Fill Out Form W-8BEN?

Non-resident alien individuals who may be subject to 30% withholding of U.S. federal taxes on U.S.-source income must fill out Form W-8BEN before they receive their first payment from the requester, even if they can claim an exemption from withholding or a reduced tax rate.

When subject to withholding of U.S. taxes, the single owner of a disregarded entity, NRA-classified account holder of a foreign financial institution (FFI), and the non-U.S. transferor of an interest in a partnership for a connected gain are also required to file Form W-BEN. If the disregarded entity is claiming treaty benefits as a hybrid entity, complete Form W-8BEN-E instead of Form W-8BEN.

Form W-8BEN may also be used to claim an exception from domestic information reporting and backup withholding (at the backup withholding rate under section 3406) for certain types of income.

Note that the tax withholding rate for the transfer of an interest in a partnership is 10% instead of 30%, per the Tax Cuts and Jobs Act -TCJA enacted in 2017, unless an exception applies.

What Is Form W-8BEN Used For?

The Internal Revenue Service requires W-8BEN because foreign individuals are generally subject to 30% tax withholding, but they may qualify for a reduced tax rate. W-8BEN helps to establish this eligibility, although other factors also play a role, such as income type.

Many foreign governments have tax treaties with the U.S. Under these agreements, residents of eligible foreign countries (who are not necessarily citizens of those countries) may be eligible for a reduced rate of withholding for taxes on U.S. source income. These tax treaty countries are located on every continent except Antarctica. Some U.S. tax treaties make certain types and amounts of income tax-exempt.

To establish a claim of tax treaty benefits under the Internal Revenue Code, individual non-resident foreign persons who earn eligible income need to fill out Form W-8BEN. Tax treaties can reduce withholding if the form is completed correctly.

Where to Download Form W-8BEN

The IRS publishes both the official Form W-8BEN (fillable PDF) and its instructions. Once completed, the form should be submitted to the withholding agent, payer, or foreign financial institution (FFI)—not the IRS.

Streamline W-8BEN Collection During Payee Onboarding

Tipalti helps teams collect and validate W-8BEN forms through self-service onboarding—so you can support compliant cross-border payouts without constant manual tracking.

Step-by-Step: How to Fill Out Form W-8BEN

Following the instructions presented here to fill out the W-8BEN and reading the IRS Instructions for Form W-8BEN will help prevent you from having to go back and correct mistakes. W-8BEN accuracy (including using the correct taxpayer ID number (TIN) matters for compliance and penalty avoidance.

Steps to Fill Out Form W-8BEN

Following the instructions presented here to fill out the W-8BEN and reading the IRS Instructions for Form W-8BEN will help prevent you from having to go back and correct mistakes.

First, read the W-8BEN tax form NOTE for residents of FATCA partner jurisdictions, which states that these FATCA jurisdictions may receive certain tax information.

Part I – Identification of Beneficial Owner:

Line 1: Enter your name as the beneficial owner.

Add your full name on this line.

Line 2: Enter your country of citizenship

If you’re not a resident of the country of your citizenship, you should enter your country of residence (instead of your country of citizenship). If you’re a dual citizen, you should enter the country where you are both a resident and a citizen on the date you complete the form. If you hold U.S. citizenship (with or without citizenship with another country), you should not fill out Form W-8BEN.

Line 3: Enter your permanent residence/mailing address

For the purposes of W-8BEN, this is your tax residence home for income tax purposes. It should be a permanent residence address, not a P.O. Box or address of a financial institution. Be sure to include your postal code and country.

Line 4: Enter your mailing address, if different

If your mailing address isn’t the same as your permanent resident address, enter it here.

Line 5: Enter your U.S. taxpayer identification number.

This should be either a Social Security Number (SSN) or an individual taxpayer identification number (ITIN) if it is required. If you don’t have either, you can skip to line 6.

Line 6: Enter your foreign tax identifying number

If you don’t have an SSN or ITIN (or have applied for it) and meet certain purposes: In 6(a), enter your foreign tax identification number (FTIN). In 6(b), check the box if an ITIN is not legally required.

Line 8: Enter your date of birth.

Make sure it’s in mm-dd-yyyy format.

Part II – Claim of Tax Treaty Benefits:

Line 9: Enter the foreign country under whose tax laws you claim tax benefits.

This, of course, needs to be one of the countries with which the U.S. has a tax treaty.

Line 10: Special rates and conditions (if applicable)

Foreign individuals who are students and researchers should enter specific withholding rates.

The withholding rate may be a special rate negotiated for the treaty country. Other persons may need to complete this line if they claim benefits that require them to meet conditions not addressed on W-8BEN. Fill in the requested details.

Part III – Certification:

Here, you’ll need to certify with your signature under penalties of perjury that everything on the form is true and correct and that you aren’t a U.S. person. Insert the date of form completion and certification in a mm-dd-yyyy format.

Submitting a Completed and Signed or Updated Form WBEN

Do not send Form W-8BEN to the IRS, and do not file it with a tax return. Instead, you should submit the completed W-8BEN form to the party that requests it. Typically, this is the person or group from whom you received payment, the withholding agent, or an FFI. The tax form should be completed before the first payment is made; otherwise, the withholding agent may have to withhold the full 30% that is normally withheld under U.S. tax law.

Form W-8BEN will remain valid for at least three calendar years. A Form W-8BEN expires on the third complete calendar year after it is signed. For example, if you sign a W-8BEN on July 28, 2024, it will expire on December 31, 2028. You need to file a new W-8BEN sooner if circumstances change and the information on a previously submitted W-8BEN becomes incorrect.

According to the IRS Instructions for Form W-8BEN, “you must notify the withholding agent, payer, or FFI with which you hold an account within 30 days of the change in circumstances and you must file a new Form W-8BEN or other appropriate form.”

W-8BEN vs. W-8BENE vs. W9

W-8BEN is used by “foreign person” individuals, whereas businesses that are foreign entities should file Form W-8BEN-E (Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting – Entities). U.S. persons, including U.S. citizens and resident aliens, use Form W-9 instead.

Foreign businesses are subject to the same tax rate (30%) that foreign individuals are subject to, and like individuals, they too may qualify for a reduced tax rate if their home (permanent residence) country has a tax treaty with the U.S.

Understand why you need a W9 for vendors and other payees receiving payouts.

Which W8 Form Should I Use?

Controllers often over-report to avoid under-reporting, but clogging the system with unnecessary forms creates its own risks. You generally do not need to file a 1099-NEC for payments made to C-Corporations, S-Corporations, or LLCs that elect to be taxed as C or S Corps.

You also exclude payments for merchandise, telegrams, telephone, freight, and storage. There is also a checkbox for payers who made direct sales of $5,000 or more of consumer products to a recipient for resale. However, this is a distinct reporting trigger.

In total, there are five W-8 forms:

- Form W-8BEN

- Form W-8BEN-E

- Form W-8ECI

- Form W-8EXP

- Form W-8IMY

Other W-8s, in addition to the W-8BEN and W-8BEN-E forms, are described below.

Form W-8ECI. This one has a rather long name (Certificate of Foreign Person’s Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States) and is designed for nonresident aliens who conduct a business or trade in the U.S. other than personal services. (If you are a beneficial owner receiving compensation for personal services performed in the United States, file Form 8233 or W-4 instead.)

Form W-8EXP. As the name of this one suggests (Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding and Reporting), only foreign governments or other specified groups, including foreign private foundations, use this form to claim a reduction in tax withholding.

Form W-8IMY. The last form on our list (Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting) is only used by intermediaries, flow-through entities, and certain U.S. branches.

| IRS Form W-8 or W-9 | Used By | Exception* |

|---|---|---|

| W-8BEN | Foreign person NRA individuals | |

| W-8-BEN-E | Foreign person NRA entities | |

| W-8ECI | Foreign persons with ECI | Personal services ECI, Form 8233 or W-4 |

| W-8EXP | Foreign governments, private foundations, etc. | |

| W-8IMY | Intermediaries, flow-through entities, and certain U.S. branches | |

| W-9 | U.S. persons (citizens and U.S. resident aliens) |

Where ECI is “effectively connected income” with a U.S. trade or business.

*For solely claiming foreign status or treaty benefits, foreign person NRAs use W-8BEN for individuals or W-8BEN-E for entities instead of W-8ECI.

How Tipalti Helps Manage W-8BEN Compliance

This seems basic, but it is the source of most error notices. Ensure the Recipient’s TIN (Taxpayer Identification Number), whether it is an Employer Identification Number (EIN) or a personal Social Security Number, matches their Name exactly as it appears in the IRS database.

Handling W-8BEN is a required step for enabling compliant international payouts at scale, helping companies determine withholding and process payments to non-US individuals accurately and on time. Tipalti finance automation software helps your business reduce time-consuming and frustrating manual W-8BEN tax form collection and validation.

Automated W-8BEN Collection and Validation at Scale

Tipalti Mass Payments is designed for efficient and compliant global payouts, including the collection and validation of W-8BEN and other W-8 or W-9 forms used to prepare 1099s.

Tipalti Mass Payments provides a self-service onboarding portal in which payees enter their W-8 or W-9 information. For tax compliance, Mass Payments automates TIN matching to ensure accuracy and help your business avoid IRS penalties, and it calculates and tracks any backup withholding on payments.

W-8BEN collection and validation are accounts payable responsibilities during vendor onboarding and payment setup, where accuracy directly affects withholding, payment delays, audit readiness, and ongoing compliance.

For accounts payable, Tipalti also offers end-to-end AP Automation software that collects and processes IRS Form W-8BEN data and other W-8 or W-9 forms through its Supplier Hub. It also automates TIN matching.

Tipalti helps you do the right [vendor] background checks, making sure thereʼs no issue with the bank accounts, and helps collect the necessary tax information which is really beneficial when doing 1099s at the end of the year.

—Becca Simmons, Head of Finance, EMEA, Vivino

W-8BEN accuracy matters for compliance and penalty avoidance. Manual W-8BEN collection is error-prone; automation reduces risk. To improve your company’s efficiency, accuracy, and compliance, learn more about Tipalti’s automated tax compliance.