We’ve paired this article with Laurie Hatten-Boyd’s AP Tax Compliance webinar. Get your Executive Summary to find out how FATCA requirements impact organizations with a global supplier base.

Fill out the form to get your free eBook.

Laurie Hatten-Boyd, Principal at KPMG LLP, shared her insights on the impact of US tax compliance rules for companies paying their global suppliers. In this summary of her one-hour webinar, Hatten-Boyd explains how FATCA requirements impact organizations with a global supplier base and the legal and financial penalties they may face for non-compliance. Read the executive summary to get the must-have takeaways from the webinar. – An overview of US tax rules for companies paying global suppliers, including FATCA requirements – Steps your organization can take to avoid legal and financial penalties – How to ensure your payees select the correct form based on their country and corporate structure – How to determine which payees require tax withholding by treaty – The basics around end-of-year 1099/1042-S tax reporting

Globalization is bringing international commerce to our doorsteps. But doing business with a foreign entity requires a well-planned process that complies with the tax laws of every country involved.

Under U.S. tax regulations, a mandatory 30% must be withheld by any company paying a foreign entity conducting business within the United States.

This happens when a foreign country has an income tax treaty with the United States. Under these treaties, residents (not necessarily citizens) of these countries may be eligible for tax at a reduced rate or exempt from U.S. income taxes on certain items of income received.

If the foreign entity is from a country with a U.S. tax treaty, it can fill out and submit a Form W-8BEN-E. This will exempt them from the 30% withholding (and other applicable American tax laws).

Note that the tax withholding rate for the transfer of an interest in a partnership is 10% instead of 30%, per the Tax Cuts and Jobs Act -TCJA enacted in 2017, unless an exception applies.

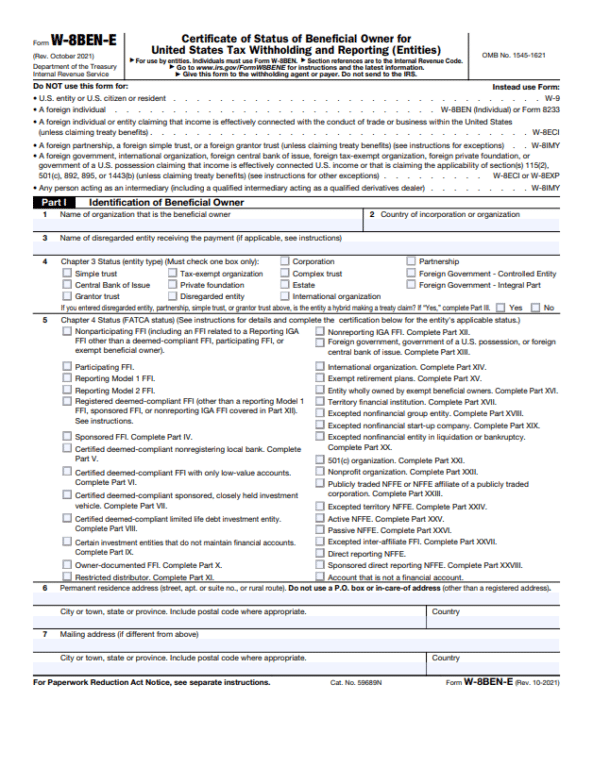

What is Form W-8BEN-E?

IRS Form W-8BEN-E is used by foreign entities to establish beneficial ownership and foreign status, and avoid 30% withholding for U.S. taxes on U.S. source income. It’s also used to claim income tax treaty benefits with respect to income (other than compensation for personal services).

Form W-8BEN-E is titled Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities).

W-8BEN vs. W-8BEN-E: Whatʼs the Difference?

The W-8BEN form is used only for foreign individuals or sole proprietors (excluding personal services income), while the W-8BEN-E form is used for non-US entities, such as businesses and organizations.

Table: W-8BEN vs W-8BEN-E

| W-8-BEN | W-8BEN-E | |

|---|---|---|

| Completed by | Individual non-resident alien | Foreign entity |

| Effectively connected income to U.S. trade/business? | No, use W-8ECI (with exceptions*) | No, use W-8ECI (with exceptions*) |

| Foreign partnership, simple trust, or grantor trust? | N/A | Only if foreign entities claim treaty benefits |

*If claiming treaty benefits, W-8-BEN or W-8-BEN-E should be used. Individuals with personal services income use Form 8233 instead of W-8BEN.

Form W-8ECI is for foreign persons reporting effectively connected income to a U.S. trade or business.

The W-8BEN tax form works to:

- Establish that an individual or sole proprietor qualifies as a foreign person subject to the tax rate of 30% on domestic income earned by a foreign entity.

- Claim that an individual or sole proprietor is an NRA (nonresident alien).

While both forms require very similar information, the W-8BEN-E form is more complex. It requires a detailed description of the foreign business entity involved.

What is a W-8BEN-E Form Used For?

The motivation behind filing the W-8BEN-E is to document status for tax return reporting purposes. It’s an IRS-mandated form that collects the correct data, including Nonresident Alien (NRA) taxpayer information for businesses, to ensure accurate reporting and collection.

Who Needs to Fill Out Form W-8BEN-E?

Any foreign (non-U.S.) company that receives payment from an American business must fill out the W-8BEN-E form and submit it to the withholding agent, payer, or FFI (foreign financial institution) requesting the form, but not the Internal Revenue Service (IRS).

(A U.S. entity, U.S. citizen, or resident alien uses Form W-9 instead.)

A common entity type using Form W-8-BEN-E is foreign corporations (such as Canadian corporations). Foreign partnerships are other entities that commonly submit W-8BEN-E (only when claiming tax treaty benefits).

According to IRS Form W-8BEN-E Instructions:

Give Form W-8BEN-E to the person requesting it before the payment is made to you, credited to your account, or allocated.

Separate Form W-8BEN-E forms must be given to each withholding agent, and a withholding agent may require a separate W-8BEN-E form for each type of income.

W-8BEN E is complex and high-risk. This risk exists for both the submitter and form requester (business making payments or withholding agent) if completed incorrectly. The Form W-8-BEN-E submitter may be subject to 30% withholding tax rate and possibly severe fines for making a false statement under penalty of perjury. The business making payments could be liable for the 30% withholding tax, interest, and penalties.

Controller’s Responsibilities for Collecting Form W-8BEN-E

Controllers often manage multinational corporations and make recurring cross-border payments. In businesses that source goods and services and operate internationally, Controllers onboard vendors from around the world.

The onboarding process includes collecting W-8 or W-9 forms and validating the accuracy of the taxpayer ID number (TIN). Requesters must perform due diligence on forms that they receive from payees. The IRS outlines due diligence requirements for requesters in its Instructions for the Requester of Forms W–8BEN, W–8BEN–E, W–8ECI, W–8EXP, and W–8IMY.

Streamline W-8BEN-E Compliance With Automated Tax Controls

W-8BEN-E workflows can quickly become manual and high-risk at scale. Automated tax compliance helps AP teams collect documentation, validate payee data, and keep records audit-ready—before payments are released.

Chapter 3 and Chapter 4 FATCA Status Explained

Chapters 3 and 4 of the Internal Revenue Code are about tax withholding and FATCA. As a Controller, Chapter 3 and Chapter 4 FATCA status directly affect your responsibilities for withholding and IRS reporting.

Chapter 3 status under the Internal Revenue Code means that a 30% withholding tax applies to foreign persons on the gross amount of certain types of income (FDAP or U.S. source gains) not effectively connected with a U.S. trade or business.

Chapter 4 status for FATCA is a classification of entities and individuals listed on IRS Form W8-BEN-E to certify their specific status to a withholding agent or payer for withholding or tax exemption. FATCA is the Foreign Account Tax Compliance Act covered by Chapter 4 of the Internal Revenue Code.

The purpose of Chapter 3 and of Chapter 4 under FATCA is to determine whether a withholding agent or payer must withhold 30% tax on income and also prevent tax evasion by U.S. individuals with foreign bank accounts. Participating foreign financial institutions (FFIs) and non-financial foreign entities (NFFEs) provide information to the IRS under FATCA.

Payers of foreign entities are responsible for any applicable withholding and tax compliance, including collecting W-8 forms to document their Chapter 3 or claimed Chapter 4 status. If the required withholding isn’t paid through a payment reduction, then the withholding agent may be responsible for the required tax withholding amount.

Download the Official W8-BEN-E Form

IRS Form W-8BEN-E is a fillable PDF available for your entity to complete online on the IRS website, then download for submission to the requester.

How To Fill Out Form W-8BEN-E (Step-by-Step)

Any foreign entity doing business with the United States must fill out a W-8BEN-E form (unless included in an exception category printed on the top of the form). The document can be downloaded at www.irs.gov and completed online or by hand.

The W-8BEN E form has 30 different parts with multiple pages, so if you’re unsure, it’s best to hire a U.S. tax advisor for solid tax advice. Most foreign entities only need to fill in 4 parts, according to the entity type.

Step-by-Step Guidance for W-8BEN-E

Below are some brief instructions on how to fill in the top required parts of the form:

Part I – Identification of Beneficial Owner

This is the most important section of the W-8BEN-E form. It must be a complete part when turning in the paperwork. Take your time here to ensure all data is accurate and in the right spot.

1. Name of Organization That is the Beneficial Owner

This is the foreign entity name. Instead, for a disregarded entity or branch, enter the legal name of the owner or the entity the branch is a part of. Special Instructions apply to a disregarded entity that is a hybrid entity filing a treaty claim. Account holders providing the form to an FFI solely to document themselves as an account holder should consider the title on line 1 to be account holder rather than beneficial owner.

2. Country of Incorporation or Organization

This is the country of residence (where the business is registered). For a corporation, it is the country of incorporation. If you are another type of entity, enter the country under whose laws you are created, organized, or governed.

3. Name of a Disregarded Entity

See form W-8BEN-E Instructions.

4. Chapter 3 Status

In this section, the most commonly checked box is “Corporation”. The majority of foreign entities that are doing business fall under “Corporation” or “Partnership” status. Other options include:

- Foreign government – Controlled Entity

- Foreign government – Integral Part

- Estate

- Simple trust (grantor and complex, too)

- Central Bank of Issue

- Tax-exempt organization

- Private foundation

- International organization

- Disregarded entity

The W8-BEN-E form line 4 section also requires you to check a Yes or No box and complete Part iii if Yes for disregarded entities and certain other types of entities, if it is a hybrid entity making a treaty claim.

5. Chapter 4 Status (FATCA Status)

The most common choice here is Active NFFE. This means the business is an Active Non-Financial Foreign Entity. If none of the other categories fit, Active NFFE is the best option.

Your FATCA (Foreign Account Tax Compliance Act) status will determine which parts of the W8BEN-E form you fill out later.

If you are presenting a Form W-8BEN-E to a Foreign Financial Institution (FFI) (bank, insurance, or investment fund) only to document yourself for chapter 4 as an account holder maintained by the FFI, then you do not need to complete line 4.

6. Permanent Residence Address

This is the foreign company’s permanent resident address. Your permanent residence address is the address in the country where you claim to be a resident for purposes of that country’s income tax. If you are giving Form W-8BEN-E to claim a reduced rate of, or exemption from, withholding under an income tax treaty, you must determine residency in the manner required by the treaty.

7. Mailing Address

Skip this section if it is the same as the permanent residence address.

8-10. Tax Identification Information (if required)

Enter your U.S. employer identification number (EIN). An EIN is a U.S. taxpayer identification number (TIN) for entities. If you do not have a U.S. EIN, apply for one on Form SS-4, Application for Employer Identification Number, if you are required to obtain a U.S. TIN.

In some cases, as a non-US entity, you don’t need a U.S. taxpayer identification number. Read Form W-8BEN-E instructions to determine when you need to provide a U.S. taxpayer identification number and when you provide a foreign TIN (FTIN) instead.

In addition, if you are not using Form W-8-BEN-E to document a financial account as an account holder, you may provide the FTIN issued to you by your jurisdiction of tax residence on line 9b for purposes of claiming treaty benefits (rather than providing a U.S. TIN on line 8, if required). In some cases, a GIIN (global intermediary identification number) is provided on line 9a or line 9b.

Part II – Disregarded Entity or Branch Receiving Payment

Form W-8BEN-E indicates that Part II should only be completed (after reading the W-8BEN-E instructions) if a disregarded entity with a GIIN or a branch of an FFI in a country other than the FFI’s country of residence.

11. Chapter 4 Status (FATCA status) of disregarded entity or branch receiving payment

If you are required to complete Part II, check the appropriate box from these choices:

- Branch treated as nonparticipating FFI.

- Participating FFI.

- Reporting Model 1 FFI.

- Reporting Model 2 FFI.

- U.S. Branch.

12. Address of disregarded entity or branch (street, apt. or suite no., or rural route). Do not use a P.O. box or in-care-of address (other than a registered address).

13. GIIN (if any)

A GIIN number is a 19-character number issued by the IRS to foreign financial insti

Part III – Claim of Tax Treaty Benefits

This is for Chapter 3 purposes only. In this section, you simply need to check the appropriate boxes and fill in the country of origin.

- 14a – check the box and fill in the country (where you are a resident for income tax treaty purposes)

- 14b – check the box only

- 14c – check the box – applies only to income tax treaties effective before January 1, 1987, and not renegotiated

- 15 – complete only if special rates and conditions are applicable

Part XXV – Active NFFE

In this part of the form, you simply need to check box 39 to certify that:

- The entity in Part I is a foreign entity that is not a bank or financial institution

- Less than 50% of the gross income for the preceding calendar year is passive income

- Less than 50% of assets held are assets that produce or are held for the production of passive income (calculated as a weighted average of the % of quarterly passive assets).

*It should be noted that Part XXVI deals with Passive NFFE and differs entirely from Part XXV above.

Part XXX – Certification

The most important part of the document is the certification and signature. Here, in writing, there needs to be a first name, last name, and date (on which the form was signed). The person signing the W-8BEN-E form must be authorized to sign on behalf of the beneficial owner for this certificate of foreign status of beneficial owner tax form.

Still have questions?

Read the IRS instructions for Form W-8BEN-E.

Common Form W-8BEN-E Mistakes and Controller Challenges

Common mistakes and omissions made by the Form W-8BEN-E submitter are:

- Entering the wrong version of the foreign entity’s name on line 1 (requires legal name)

- Selecting an incorrect status on lines 3 and 4 (for withholding and FATCA compliance)

- Including an Incorrect or missing TIN (taxpayer ID number)

- Improperly claiming tax treaty benefits

- Not updating their Form W-8BEN-E when information changes

Controllers and their staff may struggle to obtain a completed Form W-8-BEN-E from foreign entities before their business’s first payment is made. Understanding lines 3 and 4 (relating to Chapters 3 and 4 of the Internal Revenue Code) is another challenge when performing IRS-required due diligence of W-8-BEN-E forms received from payees.

For tax compliance due diligence, Controllers or Accounting staff should also match TINs to entity names and investigate whether tax treaties are in effect with each submitter’s country of tax residence and the terms of those treaties. They must deduct the required tax withholding from payments to avoid being liable for those amounts.

TIN matching is important. For incorrect TINs on a W8 (or W9) form, the IRS may require backup withholding of taxes (at 24%).

Best Practices for Managing W-8BEN-E Compliance

A crucial role in modern accounts payable and accounting is managing the flow of inbound and outbound international payments. Another vital task is ensuring all of those foreign entities have the proper tax paperwork and IRS forms on file.

As the payer and withholding agent, a U.S. person or business has the onus of accuracy. To avoid confusion and legal risks, there must be close oversight from AP on any foreign business conducted.

Controller Considerations

Controllers managing W-8BEN-E compliance face many challenges. A high volume of forms requested from foreign entities requires timely collection, control, and management, with validation steps to ensure accuracy. Foreign entities must update their forms whenever changes occur. That’s another issue that requires best practices, such as automated tax compliance.

Manually-prepared forms may require your staff to enter data, increasing the risk of errors. Manual systems require staff to follow up near year-end to ensure all W-8BEN-E forms (and other W-8 or W-9 forms) have been collected to meet IRS deadlines. With W-8BEN-E, the additional risk is being liable for 30% withholding tax if the amount isn’t withheld from payments to foreign entities throughout the year.

The manual collection of W8 forms involves a variety of steps that are better off automated, including:

- Perform due diligence on each supplier to determine the proper W8 data

- Accurately capture all required information without the need for manual entry

- Calculate the exact withholding requirements based on entity status

- Ensure accurate and full completion of all W8 forms

Manual W-8BEN-E collection doesnʼt scale for Controllers managing many foreign entities in mid-market or larger businesses. Automation reduces errors, follow-ups, and audit risk.

Here are a few ways to streamline the collection of these important documents and ensure all foreign entities are covered.

- Whenever possible, collect all tax and ID forms digitally before the first payment is made. Manual collection can contribute to inaccuracies and heighten the risk of legal trouble.

- Since the W-8BEN E is a complex document with many sections, a company should use web-based questionnaires and other digital tools to ensure that all payees fill out the forms accurately.

- Verify all tax forms and data with automation tools.

- Leverage software that automatically tracks the latest changes to tax laws and any new regulations, laws, or restrictions.

How Long is a W-8BEN-E Valid For?

The simplest answer is three years. It starts on the date the W-8BEN-E is signed and ends three consecutive years from that date. It expires on the last day of the third succeeding calendar year.

You are required to file a new form W-8BEN-E within 30 days if any certification on this form becomes incorrect. It should be noted, if any changes in circumstance cause the data on the form to be incorrect, it will render the entire document invalid.

What Happens if You Don’t Fill Out a W-8BEN-E Form?

If a foreign entity doesn’t provide a completed Form W-8BEN-E (or provides an inaccurate form), the payer may be required to apply default withholding—typically 30%—and the payee may lose the ability to claim applicable treaty benefits. In some cases, missing or invalid documentation can also trigger additional withholding requirements and compliance risk for the payer.

Form W-8BEN-E may also be relevant in situations where withholding applies under IRC Section 1446(f) (generally 10%, unless an exception applies) related to gain from the disposition of a partnership interest by a non-U.S. transferor.

Bottom line: Collecting and validating W-8BEN-E forms before payment helps reduce withholding risk, rework, and downstream compliance exposure.

How Tipalti Supports Finance Teams Managing W-8BEN-E Compliance

W-8 BEN-E management is typically an AP responsibility that directly impacts payment readiness at scale. Tipalti AP Automation and Mass Payments software streamline workflows and help your finance team efficiently process invoices for payment and manage W-8BEN-E tax compliance. Automation reduces errors, follow-ups, and audit risk.

Tipalti payables automation:

- Centralizes W-8BEN-E collection within AP-led vendor onboarding, helping ensure foreign entities are properly documented before payments are released

- Validates entity and tax information early in the AP process, reducing downstream payment issues as vendors move into Mass Payments workflows

- Calculates required tax withholding

- Minimizes manual tracking and follow-ups for AP teams managing large volumes of foreign payees across regions and currencies

- Improves audit readiness by keeping W8BEN-E records organized, current, and accessible as part of a broader AP and Mass Payments compliance framework

You need accurate automated tax form collection as W-8s or W-9 forms for vendors or payees that are U.S. persons.

Tax compliance is one of the top issues that can quickly escalate into a series of stresses when not handled correctly. The earlier you instill processes for W-8BEN-E collection, management, and compliance, the less likely it is that issues will arise down the road.

Reduce rework and compliance risk while keeping global payments moving with automated W-8 workflows through Tipalti Automated Tax Compliance.