Save time and empower your finance team with Tipalti. The most complete AP solution loved by 5,000+ businesses.

The best accounts payable software for small businesses helps reduce manual work, gain better visibility, enhance supplier relationships, and scale operations effectively.

With numerous options available, selecting the best accounts payable system can be a challenging task.

To help you shortlist the best fit, we’ve compared the top 7 AP software based on their core features, integrations, and target market.

Top 7 AP Solutions: Feature Comparison

| Feature | Tipalti | BILL | QuickBooks | Stampli | Xero | Beanworks | Melio |

|---|---|---|---|---|---|---|---|

| Supplier Self-Onboarding | ✅ | ✅ | ❌ | ✅ | ❌ | ✅ | ❌ |

| Global Payments | ✅ | ✅ | ❌ | ✅ | ❌ | ❌ | ✅ |

| OCR + AI Coding | ✅ | ✅ | ❌ | ✅ | ✅ | ✅ | ✅ |

| Tax Compliance Engine | ✅ | ❌ | ❌ | ✅ | ❌ | ❌ | ❌ |

| Multi-Entity & Consolidated Views | ✅ | ✅ | ❌ | ✅ | ❌ | ✅ | ✅ |

| Best for | Scaling businesses, end-to-end AP automation | Payments within the BILL network | Third-party integrations | Visibility of AP processes | Real-time bank feeds | Invoice processing | Free ACH transactions |

Ready to Stop Letting Manual AP Hold You Back?

As your business scales, so do your payables—and manual processes can’t keep up. Tipalti grows with you, eliminating up to 80% of AP work and giving your team time back to focus on strategic growth.

Tipalti: Best for Scalable End-to-End AP Automation

Tipalti ranks as one of the best AP automation software for growing small businesses.

By automating the entire process, Tipalti significantly reduces AP workload.

With a combination of generative AI, Optical Character Recognition, and ML, Tipalti’s invoice automation capabilities greatly minimize errors.

Given that finance professionals spend nearly 72 days a year on low-value but time-consuming tasks, such as error resolution and reconciliation, it’s easy to see how Tipalti fast-tracks time to value.

Tipalti AI boosts speed and accuracy in the AP cycle

As a licensed money services business (MSB), Tipalti streamlines global mass payments.

It also differentiates itself from the other AP automation software for small businesses by providing comprehensive multi-entity support, automating tax compliance across entities, and strengthening financial controls.

Tipalti’s robust fraud prevention system has saved its clients over $4 million in potential losses.

Top Features

- Automated invoice processing: OCR, ML, and AI-powered invoice capture, GL coding, and dynamic approval routing.

- Vendor management: Self-service supplier onboarding, proactive, white-labeled email updates on invoice and payment status, built-in payee validation.

- Multi-currency payouts: Payouts to 120 currencies across 200+ countries via 50+ payment methods, including global ACH, wire, debit card, and PayPal.

- Built-in tax compliance: KPMG-approved tax engine with 3,000+ validation rules, withholding calculation, and VAT compliance in 60+ countries.

- Multi-entity support: Entity-specific payable workflows, payment methods, and tax compliance with a unified view of AP processes.

- Quick reconciliation: Integrates with all major ERP systems to facilitate seamless reconciliation.

- Fraud prevention: Tipalti Detect screens OFAC, AML, and KYC lists to flag suspicious payees and uncover fraud patterns.

Integrations

Tipalti’s platform integrates with multiple ERP systems and accounting software programs, including QuickBooks Online, Xero, Oracle NetSuite, and Sage Intacct.

Price Range

$ – $$ (See Tipalti’s pricing plans)

Customers

Tipalti has over 5,000 customers and boasts a high customer retention rate.

Here are some of the customer success stories and testimonials:

Skillshare Saves Time & Scales Financial Operations with Tipalti

Skillshare has been a fast-growing Tipalti customer (since 2018) using Tipalti AP automation integrated with QuickBooks in the online education industry.

We used to spend three hours a week making payments. Now, it’s down to minutes. We have a seamless way of doing things now—with automation, we’re moving in the right direction.

Leslie Pesante, Head of Finance, Skillshare

A European Family Office implemented Tipalti’s Accounts Payable software to streamline invoice management and vendor payments.

Tipalti has given us all peace of mind. It really doesn’t matter how much we scale and grow; we can easily handle any volume of invoices. I just check Tipalti to make sure our payments are moving forward according to plan, and they always are.

Lisa, Finance Director, European Family Office

Pro Tip: Learn how finance teams are scaling invoice volumes and boosting productivity by up to 80% with Tipalti.

Explore more customer success stories.

QuickBooks: Best for Bank Feed Integration

Owned by Intuit, QuickBooks is a popular AP automation tool for small businesses and freelancers. The software can be used in either a cloud-based version, QuickBooks Online, or as a legacy program, QuickBooks Desktop.

While QuickBooks Online has affordable plans and an intuitive interface, it has some limitations. The system’s ability to automate invoice data capture is limited, and users can only make international payments via third-party AP automation software.

Top Features

- Invoice management: Users can forward emails or bulk upload invoices to create pre-filled bills and customize invoice approval process flows.

- Automated bookkeeping: QuickBooks categorizes income and expenses based on historical data.

- AI-assisted reconciliation: Accounting Agent matches and posts transactions automatically while providing steps to resolve any issues.

- Automated bank feeds: Integrates with bank accounts directly and syncs transactions for real-time data.

Integrations

QuickBooks Online has API integration with third-party accounts payable solutions.

Price Range

$

Customers

QuickBooks customers range from startups to small businesses and some mid-size companies in various industries. QuickBooks Desktop offers some industry-specific versions.

Xero: Best For Third-Party Vendor Payment Integration

Small businesses on a budget can check out Xero for accounts payable automation.

In addition to affordable pricing plans, Xero offers online document storage, real-time foreign exchange rates, and a mobile app for accounting.

However, Xero’s accounts payable automation, reporting, and payment capabilities are basic when compared to other AP automation software for small businesses.

Top Features

- Invoice processing: Users can upload bills using Hubdoc and define roles for approvers while Xero AI captures data.

- Reconciliation: The platform automates transaction reconciliation from over 3500 banks and PDF bank statements.

- Dashboard for financial snapshot: A customizable dashboard to track account balance, profit, loss, and cash flow.

- Bill payment: Connects to third-party payment software for vendor payment.

Integrations

Xero has an open API for developers to integrate their third-party software with Xero accounting software. Xero integrates with over 1,000 third-party apps, including AP automation.

Price Range

$

Customers

Xero has 4.4 million subscribers in 180+ countries.

Beanworks (Quadient): Best for Touchless Invoice Processing

Quadient acquired Beanworks in March 2021 and renamed the platform as Quadient Accounts Payable Automation by Beanworks.

With a computer platform and mobile app, Beanworks helps AP offices quickly route purchase orders, payment approvals, and invoices.

The platform, however, lacks advanced features, such as tax compliance, dynamic approval workflows, supplier management, and fraud prevention tools.

Another drawback is the limited cross-border payment capabilities, as Quadient AP relies on payment partners in select countries.

Top Features

- Invoice data capture: Quadient AP by Beanworks uses Tungsten Automation Copilot to extract invoice data.

- GL coding: Leverages one-click GL smart coding to automatically apply account codes based on previous invoices.

- Workflow visibility: Tracks every step of your AP workflow, including approvals, dates, and comments, for easy reporting and audit readiness.

- Batch payments: Processes payment batches, allowing users to pay via ACH, e-checks, checks, or virtual cards.

Integrations

Beanworks-Quadient integrates with QuickBooks, Xero, Sage Intacct, and other small business accounting software.

Price Range

$ – $$

Customers

Small businesses in various industries use Beanworks.

Melio: Best for Bill Payment Via ACH Transfers

Melio, soon to be acquired by Xero, is a bill pay platform that small businesses use to automate accounts payable invoices.

With a free forever plan and free ACH transfers in all tiers, Melio is one of the cost-effective accounts payable software small business owners can consider.

Melio currently integrates only with Xero and QuickBooks, while its reporting features are basic.

Small businesses that prioritize supplier management tools, advanced financial reporting, and a connected suite may find platforms such as Tipalti a better fit.

Top Features

- Invoice processing: Melio offers multiple ways to import bills, utilizing AI to scan invoice data.

- Approval workflows: Multi-level approvals by team members, roles, payment amount, and vendor.

- Multiple payment methods: Users can pay via instant transfer, virtual card, checks, pay over time, and same-day ACH.

- Cross-border payments: Melio supports cross-border payments in 16 currencies.

Integrations

Melio integrates with QuickBooks and Xero small business accounting software.

Price Range

$ – $$

Customers

Melio’s small business customers operate in the following industries: professional services, food and beverage, wine and spirits, construction, retail, healthcare, nonprofits, logistics, and wholesale.

BILL: Best for SMBs with Simple AP Flows

If your business needs to automate both accounts payable and accounts receivable, BILL may be a suitable choice. BILL offers affordable plans and useful features, such as document storage, an audit trail, and a cash account that earns 3% APY.

However, BILL’s limited multi-entity capabilities, lack of a true vendor portal, and manual tax compliance features can make scaling your business more challenging.

Top Features

- Predefined user role: Six predefined roles with varying access levels in addition to custom approver roles.

- AI-powered data capture: AI identifies invoice patterns and extracts key fields.

- Automated invoice matching: The platform matches invoices with purchase orders and receipts.

- Global payments: BILL supports international and domestic payments in over 130 countries.

Integrations

BILL integrates with small business accounting software from Xero, QuickBooks, Sage Intacct, and some ERP systems.

Price Range

$ – $$

Customers

BILL primarily serves small businesses in different industries, although it has some midsize customers.

Stampli: Best for In-App AP Communication and Approvals

Stampli is the next in our lineup of accounts payable software for small businesses.

The platform automates the invoice cycle with the help of Billy, the AI copilot, which applies 83 million hours of finance experience, according to the company’s website.

Stampli is also known for fast implementation time and ERP integrations.

Its newly launched procurement platform does not have mature capabilities, while Stampli also lacks advanced tax compliance and multi-entity support that growing businesses need.

Top Features

- AI copilot for invoice management: Stampli’s AI assistant automates invoice data capture, GL coding, and approval routing.

- FX rate management: Users can set preferred foreign exchange rates, and the platform triggers payments when the desired rates are met.

- Centralized AP communication hub: All AP-related conversations, comments, and actions are stored with time and date stamps.

- Payments: With Stampli Direct Pay, businesses can pay vendors in 100+ countries.

Integrations

Stampli integrates with 70+ systems, including QuickBooks Online, QuickBooks Desktop, and Sage Intacct.

Price Range

$ – $$

Customers

Stampli’s customers are in various industries. It serves businesses of all sizes, from small businesses to medium-sized and enterprise.

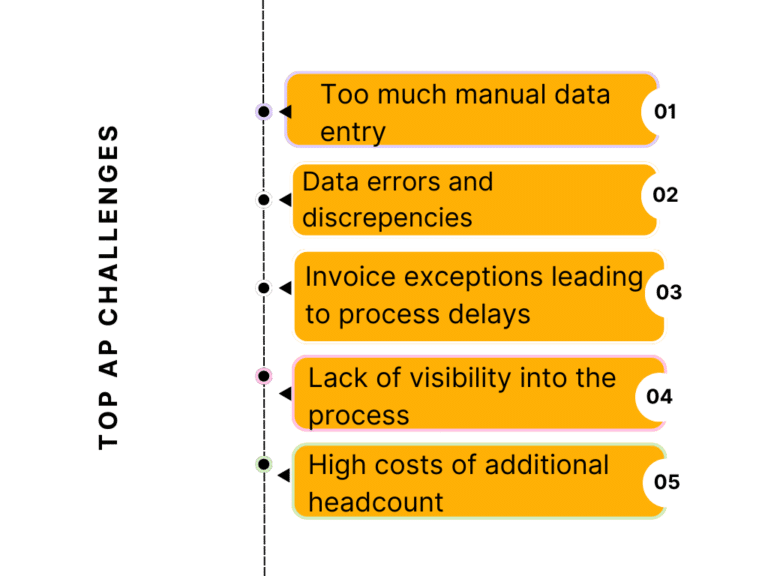

Common Small Business AP Challenges

Like many small business owners, you may have relied on manual financial processes that were sufficient for handling 10 vendors or 50 invoices.

However, as invoice volumes and vendors increase, these manual processes impact your efficiency and cash flow management.

Not surprisingly, AP teams name the following as the biggest challenges they face:

- Too much manual data entry

- Data errors and discrepancies

- Invoice exceptions leading to process delays

- Lack of visibility into the process

- High costs of additional headcount

These challenges make it difficult for CFOs and AP teams to contribute to decision-making and finance strategy.

That’s why forward-thinking finance leaders are turning to automation.

The Benefits of Choosing the Right AP Automation Software

To select the right software, consider your invoice volume, vendor location (domestic vs. international), and payment complexity to choose the most suitable software.

With sophisticated accounts payable automation software, small businesses can enhance efficiency, alleviate the AP team’s workload, and improve cash flow.

If you’re expanding globally, looking to reduce costs, or need a faster close, consider a user-friendly solution with built-in FX capabilities, tax compliance support, and AI-powered invoice processing.

How Tipalti Sets Small Businesses Up for AP Success

Choosing the right accounts payable software for small business growth is more than adopting a new tool—it’s building a scalable financial foundation. Tipalti helps small businesses modernize their AP operations by eliminating manual invoice tasks, strengthening financial controls, and ensuring global readiness from day one.

With AI-powered invoice processing, built-in tax and regulatory compliance, and seamless multi-entity support, Tipalti gives growing teams the automation depth they need to reduce risk and reclaim valuable time. Small businesses gain clearer visibility into cash flow, faster month-end close, and a more reliable, error-free process as invoice volumes scale.

For small business finance leaders looking to streamline payables, improve accuracy, and confidently support growth, Tipalti delivers an end-to-end solution built to scale with you.

Streamline Your AP and Scale Confidently With Tipalti

If your small business is outgrowing manual workflows, the right accounts payable software for small businesses can make all the difference. Tipalti automates up to 80% of AP tasks, improves accuracy, and gives you full visibility from invoice to payment.

Accounts Payable Software for Small Businesses FAQs

Can you use Excel for accounts payable?

Yes, small businesses can use Excel for basic AP tracking, but it lacks automation, audit trails, and scalability.

As invoice volume increases, consider switching to dedicated accounts payable software to reduce errors and save time.

What is the easiest accounting software for a small business?

QuickBooks and Xero are two of the easiest accounting software options for small businesses.

For businesses ready to scale or automate the payable process, Tipalti integrates seamlessly with both platforms—adding powerful AP automation without the complexity.

Is AP automation worth it?

Yes. AP automation can significantly reduce manual workload, minimize payment errors, and improve cash flow visibility. It’s especially valuable for small businesses as they scale or manage multiple vendors.