Nonprofit organizations (NPOs) use specialized industry GAAP accounting that differs from the accounting standards of for-profit businesses. From recording donations to handling grants and expenditures, nonprofits have unique accounting and accounts payable challenges.

Zippia research nonprofit statistics indicate there are 1.5 million non-profit organizations in the United States with $2.62 trillion in nonprofit revenue. These nonprofit organizations employ 10% of the U.S. workforce.

How do nonprofits provide the most impact from their donor contributions and grants received? One tip is to reduce the time required for accurate day-to-day accounting, including accounts payable invoice processing and payments, through automation as digital transformation. With this extra time, team members can focus on projects to reach these essential non-profit goals. Such projects could include more outreach to collect older pledges of donations not yet received.

Learn how AP and financial automation creates nonprofit hyper-efficiency. With accounts payable automation, nonprofit organizations will stay organized and mission-focused, and improve internal controls over expenditures to generate cost savings and achieve accountability.

What is Nonprofit Accounting?

Nonprofit accounting is recording transactions, budgeting, and issuing financial statements using specialized industry GAAP accounting standards for nonprofit organizations. Nonprofit financial statements produced from nonprofit accounting include the Statement of Financial Position (balance sheet), Statement of Activities (income statement), and Cash Flow Statement.

In nonprofit accounting and financial reporting, Net Assets (fund account) equals Total Assets minus Total Liabilities, unlike the accounting equation in for-profit accounting where Total Assets minus Total Liabilities equals Total Equity or Shareholders’ Equity.

How Does Nonprofit Accounting Work?

Nonprofits handle accounting and produce financial statements that include their activities and spending from the use of funds, net assets, and cash flow. Some funds received as grants and donations are restricted for spending to achieve a particular purpose.

Nonprofit accounting capabilities must include the ability to use a chart of accounts and accounts payable systems with advanced tags to record uses of particular types of funding by detailed functional expense or expenditure category. Accounting and financial management include the responsibility of properly controlling the amount and purpose of an organization’s expenditures to use its money wisely and adhere to each donor’s or grantee’s specific requirements.

Revenue recognition is another issue that GAAP accounting standards address for not-for-profit organizations. How to account for and acknowledge in-kind donations (non-cash) from other organizations is another accounting issue.

To establish trust with their stakeholders, nonprofits have annual audits conducted by independent CPA firms. They can also conduct internal audits to prepare for these external audits and the possibility of IRS exams. IRS audits could include reviewing tax returns and 1099 and 1042-S information returns, including proper withholding of supplier payment amounts and documentation, and accurate TINs (taxpayer ID numbers).

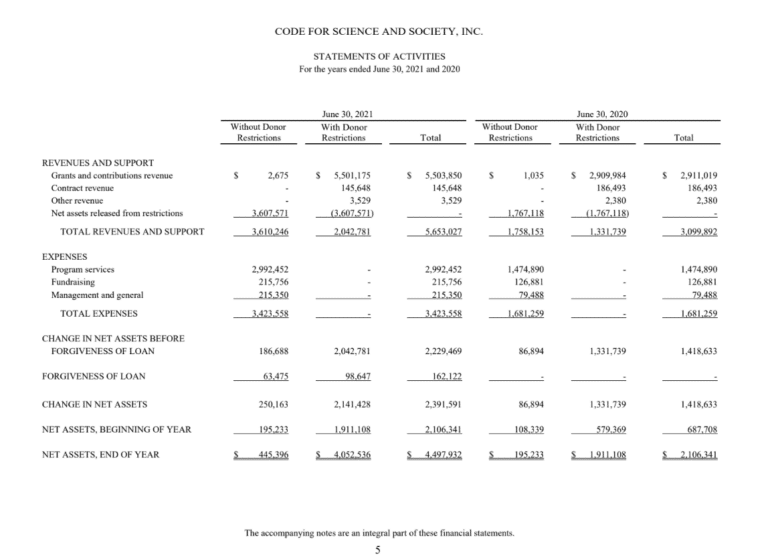

Example of Nonprofit Statement of Activities Document

The following is an example of a nonprofit’s statement of activities document, also known as an income statement. Image is sourced from Donor Box.

Auditing Procedure for a Nonprofit’s Accounts Payable

CPA firms perform standard procedures for an accounts payable audit. The accounts payable audit is part of the complete annual financial statement audit. Some states require nonprofit audits.

An accounts payable audit includes:

- Examining a sample of disbursement transactions by reviewing invoices with supporting documentation and recalculating invoices

- Reviewing invoice payment evidence

- Optionally confirming accounts payable balances with vendors

- Reviewing accounts payable invoices received subsequent to month-end for proper recording cutoff

- Tracing and reconciling accounts payable sub-ledger balances with the general ledger

- Reviewing payment reconciliations

- Conducting an analytic review of trends for reasonableness

- Reviewing financial statements and disclosures

- Issuing a report on internal control adequacy or deficiencies, including proper separation of duties

For a non-profit accounts payable audit, the CPA firm would also verify that funds are being used for their contractually-stated purposes and that expenditures are fully disclosed by use category.

The auditors use software systems with access to electronic transactions and balances to increase the efficiency of the auditing process through digitization. AP automation systems provide valuable audit trails that assist the auditors and provide evidence of system integrity. Additionally, AP automation systems use enterprise-level financial controls.

Making the Leap to Nonprofit AP Automation

It’s easy to make the leap to cloud-based AP automation software. AP automation software is a third-party SaaS add-on that you access and use through your current integrated ERP or accounting software solution.

AP automation software can keep up because it scales for large transaction volumes and additional functionality needed with growth, such as global expansion and global payments to overseas suppliers and vendors, and independent contractors.

How can your nonprofit improve accounts payable, expenses, and payments?

Download our eBook, “The Ultimate Accounts Payable Survival Guide,” to learn how your nonprofit organization can improve its accounts payable processes.

Use AP automation software with self-service supplier onboarding, payments tracking, and supplier verification processes to reduce fraud risk and errors, improve financial controls, automate global regulatory compliance, and simplify tax compliance.

Common Pain Points in Nonprofit Accounting

8 common pain points in nonprofit accounting are:

- Experiencing high nonprofit employee burnout and turnover rate

- Implementing adequate internal controls with limited staffing

- Being overwhelmed by paper documents and manual processes

- Experiencing late recording of accounts payable and expenses

- Overspending and making erroneous overpayments

- Preparing manual payment reconciliations with Excel or Google spreadsheets and journal entries

- Gathering information for annual IRS Form 990 and 1042-S information returns

- Not having adequate real-time visibility into metrics, payables, expenditures, and cash flow

High Nonprofit Burnout and Employee Turnover Pain

According to the fundraising platform Givebutter, nonprofit entities have a very high employee burnout and turnover rate, with adverse implications for a nonprofit’s workload and mission.

Givebutter advises:

When one employee leaves, the remaining employees are left with more work and less time to complete that work. Unless the organization is keen on extensive documentation, staff who managed a lot of tasks and relationships leave with institutional knowledge that their team may not have access to. All of this can cause large interruptions to a nonprofit’s mission.

If the employee has responsibility for nonprofit accounting, then a new employee must either know or learn intricate nonprofit accounting rules. The new employee must catch up on any lag in accounts payable in nonprofits, reducing the organization’s ability to manage its expenses, take early payment discounts on supplier invoices, and maintain good supplier relationships. Other employees may need to cover for the employee and respond to payment status inquiries from vendors (if there’s no AP automation system yet), diverting even more time from the nonprofit’s mission.

Internal Controls Pain

Like all organizations and businesses, nonprofits must establish and maintain adequate internal controls. Nonprofits with limited staff have an even greater challenge to overcome in achieving segregation of duties in bookkeeping, handling cash receipts, cash disbursements, or petty cash, and reconciling bank accounts.

Time-Consuming Paper Documents and Manual Processes Pain

Nonprofit organizations need to replace time-wasting paper document systems and manual data entry.

Late Recording of Accounts Payable and Expenses Pain

If your nonprofit entity doesn’t record its invoices on time as accounts payable, expenses, or other expenditures, it can’t attain proper oversight with monetary and cash flow control. Your nonprofit may lose lucrative early payment discounts, saving money that can be spent on more mission-enhancing essentials.

Overspending and Making Erroneous Payments Pain

Without adequate spend management, your nonprofit organization may overspend and pay fraudulent or duplicate invoices when bill paying.

Time-Consuming Manual Payment Reconciliations Pain vs. Automation

If your non-profit is spending too much time manually reconciling payments made in batches or skipping that step due to lack of time, you’re feeling the weight of this problem.

IRS Form 990 for Nonprofits and Form 1099/1042-S Pain

Preparing IRS 990, 1099, and 1042-S forms is inefficient and time-consuming. The reports may be inaccurate if errors occur in accumulating the information. And you may be spending too much time manually collecting W-8 and W-9 forms from suppliers to prepare the 1099/1042S information returns.

Visibility Pain

Nonprofits may experience a lack of real-time accounting, payables, and cash flow visibility.

Automation Relieves AP Pain Points for Nonprofit Organizations

United States Artists, a nonprofit organization, uses Tipalti AP automation software to relieve its payables and payments pain points. United States Artists provides a large number of grants to artists for both creative and personal needs (including pandemic relief grants).

By gaining AP automation, I’ve saved two days a week of manual work. We paid over 4,500 people through these grants, and we paid it in their payment preference. Whether it was through a check, ACH, a wire transfer, PayPal, etc., artists were impressed by our streamlined process. I wanted software that would eliminate paper use and include fraud-check capabilities. With the upgrade, Tipalti digitally verified and processed W-9s.

Anna Harris | Director of Finance & Administration, United States Artists

AP automation solves the 8 specific nonprofit organization accounting pain points addressed in this guide:

High Nonprofit Burnout and Employee Turnover Solution

When software system inefficiency gaps are filled by your end-to-end AP automation solution, your nonprofit eliminates many employee frustrations causing burnout and turnover. Through 80% payables time savings efficiencies provided by AP automation software, nonprofit organizations can ease employee workload stresses.

Besides its many other advantages, payment status is automatic, relieving staffers of the need to respond to interruptions from repetitive questions from suppliers about invoice payment timing. The guided self-service supplier portal provided by Tipalti shifts onboarding suppliers workload from your accounts payable team to the suppliers, also enhancing data accuracy.

Nonprofits can reduce their human resource hiring needs for additional headcount. That’s important when your nonprofit is experiencing:

- Difficulty retaining and hiring staff due to burnout

- Facing inflation that raises the cost of purchases

- Making possible budget cuts due to less money raised in challenging economic conditions

- Conducting initiatives to reduce unjustified costs

The reduced hiring needs could be for accounts payable staff and senior accountants.

Internal Controls Solution

Using a payables automation system that strengthens financial controls can mitigate some of the internal control risks that could result in improper or erroneous payments. Tipalti AP automation software reduces errors by 66%. Bank reconciliation is automated in most accounting software, with the ability to import bank transactions electronically.

Time-Consuming Paper Documents and Manual Processes Solution

Your nonprofit can automate accounting for invoice processing, including nonprofit accounts payable procedures for invoice matching to purchase orders and receivers, invoice payment approval, and payments. Automation relieves the pain point of time-consuming paper documents and manual data entry to gain efficiency and cost savings.

Late Recording of Accounts Payable and Expenses Solution

End-to-end AP automation software streamlines payable processes and saves up to 80% of the time in completing the workflows. Your nonprofit organization will timely record accounts payable and expenses. You will be able to save costs by taking early payment discounts when supplier and vendor invoice processing happens on time.

The Tipalti AP automation system uses database screenings and over 26,000 automated electronic payment rules to help you avoid making fraudulent and duplicate payments to suppliers. You’ll control spending better and have more visibility into spend categories to avoid overspending.

Time-Consuming Manual Payment Reconciliations Avoided with Finance Automation Solution

An AP automation system like Tipalti will prepare real-time reconciliations for batches with multiple payment methods, currencies, and entities at once. Automated payment reconciliation helps accelerate closing your books by 25%.

IRS Form 990 for Nonprofits and Form 1099/1042-S Solution

To prepare IRS 1099-NEC and 1099-MISC or 1042-S (non-U.S. person) information returns for supplier payments, you’ll need supplier W-9 or W-8BEN series forms on file. You can efficiently collect electronic W-9 or W-8 series forms through a self-service supplier portal provided by Tipalti AP automation software. Collect these forms before making their first payment with the payment information suppliers accurately enter into the portal.

Preparing your IRS 990 form doesn’t have to be a time-consuming process if your AP automation system, integrated with your ERP or accounting system, properly tracks information to simplify the process. Because anyone can access your 990 forms through the IRS Tax Exempt Organization Search Tool (TEOS), you need to ensure data accuracy.

Besides the pain of inefficiently preparing your Form 990s, you may already be dealing with issues with IRS delays in processing paper-filed 990-series forms filed since 2021. Even if eFiling 990 forms isn’t required by the IRS for your nonprofit, using eFiling rather than paper filing eliminates this type of pain point from IRS processing backlogs that could temporarily threaten your tax-exempt organization status.

For payments it makes to non-U.S. person suppliers in a calendar year, your organization needs to report payments and withholding amounts accurately to the IRS using Form 1042-S. AP automation software can make 1042-S tax form preparation simple through proper tracking of supplier payments.

Visibility Solution

An end-to-end nonprofit accounts payable system gives you real-time visibility into payables, cash use for payment batches, metrics, and spending patterns to assist you in reaching organizational goals. Visibility includes seeing multi-entity and consolidated payables, expenses by category and purpose, cash requirements for payment batches, and dashboards showing trends in your (AP) accounts payable turnover ratio and other essential metrics. Tipalti AP automation software provides this visibility.

Get More Out of Your Nonprofit Software with ERP Integrations

Tipalti finance and AP automation software has seamless integration as an add-on to your ERP system or accounting software like QuickBooks, Xero, or Sage Intacct. Tipalti software integrates with all ERP systems. You simply gain access to Tipalti through your ERP/accounting system login to solve your current pain points.

Tipalti can be implemented with any ERP system on your own or in an average of four weeks using Tipalti’s experienced software Implementation Services team for a fee. Tipalti offers a choice of two tiers of implementation services—Standard Implementation and Advanced Implementation.

The Future of Automation in Nonprofit Accounting

Automation’s future in nonprofit accounting includes continuous improvement to add new features and upgrades annually. When you evaluate finance automation software, consider the software vendor’s commitment and track record for making investments to improve its features over time.

In your nonprofit accounting software evaluation, also consider:

- Customer base count

- Customer support

- Customer retention rate

- Customer satisfaction rates

You can align your nonprofit’s destiny with proven solutions for nonprofit accounting, including accounts payable and global payments automation.

For example, Tipalti is willing to make a public commitment to future-proof its AP and finance automation software through continuous product investment, innovations, new product features, and supporting its customers.

Tipalti boasts a 99% customer retention rate and 98% customer satisfaction rate. Tipalti’s automation software is AI/ML-driven, with robotic process automation (RPA) and algorithmic validation and payment rules. This automated technology enhances your nonprofit’s efficiency and strengthens its financial controls. If you have a for-profit entity besides your nonprofit organization, Tipalti will capably handle those payables and payments processes for you too.

Does the future of automation in nonprofit accounting include using generative AI features like Microsoft’s ChatGPT or Google’s Bard? Although the concept of incorporating generative AI is currently gaining popularity, the extent to which it’s embedded in nonprofit accounting software remains to be determined.

Nonprofit Accounting FAQs

We provide answers to some frequently asked questions (FAQs) about nonprofit accounting.

What type of accounting do nonprofits use?

Nonprofits use fund accounting from generally accepted accounting principles (GAAP) issued and codified by the Financial Accounting Standards Board (FASB). Fund accounting considers restrictions on the funds received. The FASB issued Accounting Standard Updates (ASUs) for Not-for-Profit Financial Statements (2016) and Grants and Contracts (2018) to revise non-profit accounting requirements.

Do nonprofits have accounts receivable?

Nonprofits have accounts receivable, including trade receivables which are short-term, current assets for amounts that they will receive within twelve months from performing services for third-party customers. Nonprofits also have pledges receivable(net) and grants receivable (net) accounts for recording written contribution pledges or grant awards specifying the estimated time of funds receipt.

Can nonprofits use cash basis accounting?

Nonprofits can choose to use cash basis accounting or accrual accounting as their accounting method, with some requirements. The IRS has a 3-prior years average gross receipts test for allowing corporations or partnerships other than tax shelters to use cash basis tax accounting.

The larger the nonprofit, the more likely it will use GAAP-preferred accrual accounting instead of cash basis accounting used by small nonprofits.

The 3-year average gross receipts for allowing cash basis accounting is $26 million or less (indexed for inflation). The IRS annually publishes indexed amounts for the gross receipts test.

In cash basis accounting, revenue and expenses are recorded when cash is received. In accrual accounting, revenue is recorded when earned. The GAAP matching principle requires recording related expenses in the same accounting period as income is earned.

Summing It Up

Nonprofit organizations (NPOs) have unique day-to-day accounting and accounts payable requirements. These NPOs need to establish trust, accountability, and transparency with donors, grantors, and potential future contributors. Transparency includes properly coding payables to reflect the proper uses and categories of funds for expenditures and financial statements.

Nonprofits are looking for ways to become more efficient and enhance internal controls to prevent fraud and overpayments. Nonprofits need timely and accurate IRS reporting to avoid penalties and maintain their tax-exempt status. AP automation software solves many of the pain points and meets the needs of nonprofit organizations. Download our white paper, “The Holy Grail of Accounts Payable.”