Forms 1099-NEC and 1099-MISC are IRS information returns used to report nonemployee compensation of $600 or more and other types of miscellaneous income paid during the calendar year.

The 1099 threshold for 1099-NEC and 1099-MISC is increasing to $2,000 for 2026 calendar-year payments and will be indexed for inflation in later years.

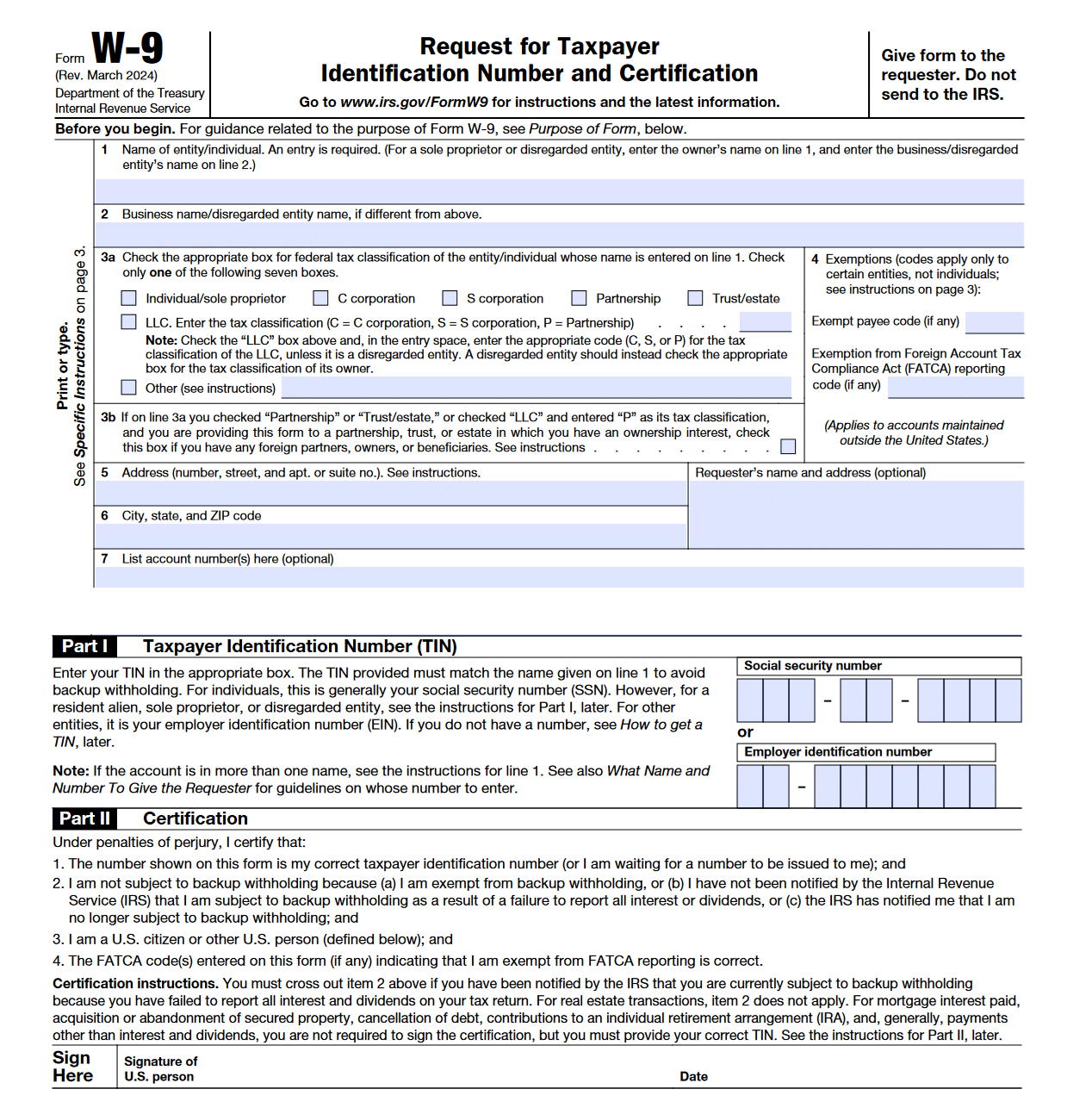

Form W-9, prepared by the payee, furnishes their non-employee and other payee information, including TIN (taxpayer ID number), required by businesses to complete and file the relevant 1099 forms with the IRS. We further explain the differences between using the 1099 form and the W-9.

Knowing the difference between a W-9 and a 1099 is basic compliance; automating the entire workflow is how modern finance teams eliminate risk and scale efficiently.

This article isn’t intended to give you tax or legal advice. Consult your CPA or attorney. For specific miscellaneous information and amounts to report on IRS Forms W-9, 1099-NEC, and 1099-MISC, refer to the IRS instructions for each tax form.

W-9 vs. 1099: Fundamental Differences for Finance Managers

The main difference between the W-9 form and the 1099 tax form is that the supplier or independent contractor fills out a W-9 to provide their tax and payment information to the payer.

In contrast, payers provide 1099 forms to document the supplier’s or contractor’s gross earnings and any backup withholding with taxing authorities, which payees also use to file income taxes.

Quick Comparison Table: W-9 vs. 1099

| Differences | IRS W-9 Form | IRS 1099 Form |

|---|---|---|

| Prepared by | Payee | W-9 requesting trade or business |

| Submitted to | Trade or business that makes your payments | IRS & applicable states with income tax |

| Used for | Businesses to prepare 1099 information returns | Income verification; recipients preparing income tax returns |

In addition to being submitted to income tax agencies, copies of each 1099 form are also submitted to the payment recipients.

Businesses use W-9 forms submitted by some U.S. suppliers and independent contractors to complete IRS forms 1099-MISC and 1099-NEC. W-9 forms are also required for other transactions besides reporting self-employed contractor income on 1099-NEC.

According to the IRS, a W-9 form is required from a payee for:

- “Income paid to you

- Real estate transactions

- Mortgage interest you paid

- Acquisition or abandonment of secured property

- Cancellation of debt

- Contributions you made to an IRA.”

The payer receiving the W-9 form from the payee uses the payee’s information to complete a 1099 information return or other IRS tax form if required. The IRS uses Form 1099-NEC and Form 1099-MISC information by comparing them to a payee’s federal income tax returns for a tax year.

The above list of W-9 purposes may not be exhaustive, but it includes examples of transactions requiring payees to submit a W-9 to payers.

IRS Form W-9

The image of an IRS Form W-9 follows:

IRS Form 1099-NEC

The image of an IRS Form 1099-NEC for Nonemployee Compensation reporting by payer follows:

IRS Form 1099-MISC

The image of an IRS Form 1099-MISC for Miscellaneous Information reporting by payer follows:

Who Gets W-9 and 1099 Forms?

Certain suppliers—such as independent contractors and small business owners who are U.S. citizens or resident aliens—must complete Form W-9. In general, payees submit a W-9 to the business paying them (the payer) so the payer has the correct taxpayer identification number (TIN) for tax reporting.

A TIN may be a Social Security Number (SSN), Employer Identification Number (EIN), or (in some cases) an ITIN for resident aliens. The IRS issues EINs to approved business entities, non-profits, and trusts. Special W-9 rules for TINs and certifications apply to disregarded entities, resident aliens, and pending TIN applications tied to backup withholding.

Using the W-9, businesses prepare Form 1099-NEC and Form 1099-MISC to report calendar-year payments by category. Form 1099-NEC is generally required for nonemployee compensation of $600 or more, and may also be required for fishing boat proceeds, certain attorney/professional service payments, and other cases outlined in IRS instructions.

Businesses must file Form 1099-NEC or 1099-MISC if backup withholding was taken (Box 4). Forms are filed with the IRS (often in batches), and copies are sent to payees and relevant state tax agencies when applicable.

Optimize Payout Operations—Not Just During Tax Season

The best teams don’t wait for January to find gaps. Learn how growing companies reduce manual tax form work, improve payee data quality, and build payout workflows that scale smoothly year-round.

What Constitutes an Independent Contractor?

An independent contractor is a self-employed worker offering business or professional services. The independent contractor is paid for results, not for how and what work is performed. Independent contractors may be service providers, like accountants or dentists, or perform project work as freelancers.

Contractor vs. Employee

W-2 employees are hired through payroll and typically work under the employer’s direction, meaning the business controls what work is done, how it’s done, and expects employees to follow internal policies. If a self-employed worker doesn’t meet the IRS criteria for an independent contractor, the IRS may reclassify them as an employee.

At a high level, the IRS focuses on control. As the IRS explains: “The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work…” In other words, independent contractors are generally considered self-employed when the payer controls the outcome of the work, not the details of how the work is performed.

Independent contractors are responsible for their own taxes, including self-employment tax, which generally covers the equivalent of both the employer and employee portions of FICA (Social Security and Medicare).

Important Considerations for Independent Contractors

As a best practice, finance managers should proactively manage contractor onboarding and automate global payment workflows and tax compliance.

If you are a finance manager, paying global independent contractors accurately and on time is essential to retaining them and reducing churn. Payment automation software (Tipalti Mass Payments) enables you to achieve these goals for contractor satisfaction. Your business can efficiently and accurately meet its 1099-NEC tax compliance requirements, avoiding significant IRS penalties.

Does a 1099 Require a W2?

No. Form 1099 doesn’t require a W2. Although 1099 and W2 are IRS forms, 1099 requires a W-9 or comparable form (such as a W-8 from foreigners) instead of W2. 1099-NEC reports non-employee compensation. A W-2 form is used to report employee compensation.

When to Request or Issue a W-9 and 1099

In the case of an independent contractor supplier, it’s best to require the payee who will receive at least $600 (in calendar year 2025, or $2,000+ in later calendar years) for services income to submit a W-9 form to the payer when initially onboarding (and definitely before receiving the first payment).

To ensure that you have collected W-9 or W-8 forms from all required payees, payers should request W-9 or W-8 forms from all independent contractors and suppliers upfront, regardless of their payment threshold. Tipalti’s Mass Payments (and AP Automation software for supplier invoice processing) has onboarding functionality that requires W-9 (or W-8) form data collection from all payees before the first payment.

The payer can deduct backup withholding from payment if required and have the W-9 on file in time to complete 1099 information returns by the deadline.

The contractor fills in Form W-9 by supplying the required contractor information, including their legal name, taxpayer identification number (TIN), and contact information, and certifies that they are exempt from backup withholding and have provided accurate information, including their taxpayer identification number (TIN). The payer keeps the W-9 forms received but doesn’t file them with the IRS.

In addition to providing instructions for payees completing Form W-9, the IRS also offers Instructions for the Requester of Form W-9 on its irs.gov website.

According to the IRS instructions for the Requester of Form W-9, the payer should request Form W-9 from each U.S. person required to submit a W-9 to them. According to these IRS instructions:

“For federal tax purposes, a U.S. person includes but is not limited to:

- An individual who is a U.S. citizen or U.S. resident alien;

- A partnership, corporation, company, or association created or organized in the United States or under the laws of the United States;

- Any estate (other than a foreign estate); or

- A domestic trust (as defined in Regulations section 301.7701-7).”

Note that a foreign person, including a non-resident alien, may be required to complete a Form W-8 or other required information tax form issued by the IRS.

IRS Tax Deadlines for Forms W-9, 1099-NEC, and 1099-MISC

The IRS sets different information return deadlines for tax forms W-9, 1099-NEC, and 1099-MISC. When a tax deadline falls on Saturday, Sunday, or a legal holiday in the District of Columbia or where the return is to be filed, the due date is the next business day.

Form W-9 Tax Deadlines

The IRS doesn’t provide a deadline for submitting Form W-9. However, the payee should submit the W-9 before receiving the first payment. The payee needs to submit a W-9 by the end of the year (on a calendar-year basis), so the requester can complete the 1099 forms and submit them to the IRS by the deadlines.

Form 1099-NEC Tax Deadlines

Form 1099-NEC is generally due to the IRS on January 31, after the end of the calendar year, for both paper and electronic filers. The due date for furnishing electronic or paper copies of Form 1099-NEC to recipients is normally January 31st. However, January 31, 2026, is a Saturday; therefore, the due date for reporting 2025 calendar-year payments on Form 1099-NEC (and distributing copies to recipients instead of January 31st) is Monday, February 2, 2026. The PATH Act eliminated the option to file a 30-day extension for filing Form 1099-NEC.

Form 1099-MISC Tax Deadlines

The 1099-MISC deadline for electronic filers is March 31, 2026. For paper filers, Form 1099-MISC is generally due on February 28th (unless that date falls on a weekend or holiday), after the end of the calendar year. The 2026 due date for paper filers of Form 1099-MISC will be March 2, 2026, because February 28th, 2026, is a Saturday.

The due date for furnishing copies of Form 1099-MISC to recipient payees is February 2, 2026 (instead of Saturday, January 31st), or if amounts are reported in boxes 8 or 10, it is February 17, 2026 (instead of February 15th, which falls on a weekend). Recipients use copies of the 1099 form to prepare their income tax returns during tax season.

Penalties for Forms W-9 or 1099

Form W-9 IRS Penalties

If required payees don’t submit Form W-9, they are not furnishing their tax ID number (TIN) to the requester. The payer’s penalty for not furnishing a TIN on a 1099 form is $60 per occurrence unless it’s a case of reasonable cause rather than willful neglect.

Besides the W-9 requester’s $60 IRS penalty for failing to submit a TIN to the IRS, the requester must deduct backup withholding of 24% from the payment and submit that tax withholding amount to the IRS.

The IRS regulations impose a $500 civil penalty when a W-9 filer provides false information that results in no backup withholding.

The IRS imposes criminal penalties for willfully falsifying certifications or affirmations. Criminal penalties include fines and prison terms for offenders.

Conversely, if a W-9 with a payee’s TIN is submitted to the requester, the IRS imposes penalties for requesters disclosing or misusing payee TINs as a violation of federal law. Penalties for requesters are civil and criminal.

Form 1099-MISC and Form 1099-NEC IRS Penalties

IRS penalties for information returns (detailed with maximum amounts in Section O – Penalties, included in the General Instructions for Certain Information Returns) are the same for Form 1099-NEC and 1099-MISC.

IRS penalties assessed differ for large businesses with gross receipts of more than $5 million and non-federal government entities vs. small businesses with gross receipts up to $5 million.

The $5 million gross receipts threshold is computed as average annual gross receipts for the 3 most recent tax years (or for the period you were in existence, if shorter) ending before the calendar year in which the information returns were due.For 1099 information returns due in calendar 2026, we show IRS information return penalties in the table below.

| Timelines for penalties | Penalty amount per return or statement | Maximum penalty amount |

|---|---|---|

| Large businesses (over $5 million gross receipts) and non-federal government agencies: | ||

| Not more than 30 days late | $60 | $683,000 |

| 31 days late to August 1 | $130 | $2,049,000 |

| After August 1 or not at all | $340 | $4,098,500 |

| Intentional disregard | $680 | No limitation |

| Small businesses (up to $5 million gross receipts): | ||

| Not more than 30 days late | $60 | $239,000 |

| 31 days late to August 1 | $130 | $683,000 |

| After August 1 or not at all | $340 | $1,366,000 |

| Intentional disregard | $680 | No limitation |

Use Form W-9 to Complete Forms 1099-NEC and 1099-MISC

Form W-9 is prepared by a required U.S. person, as defined by the IRS. We have included the IRS definition of a U.S. person. The U.S. person may be a sole proprietor with a legal form of sole proprietorship, corporation (including LLC), partnership, estate, or domestic trust.

Generally, an independent contract worker or freelancer who received at least $600 in compensation for services in calendar year 2025 (increasing to $2,000 for 2026 payments and inflation-adjusted in later years) must file Form W-9. Some other transactions specified by the IRS also require filing a W-9 form.

The payer receives W-9 forms (or W-8 or equivalent forms from foreign persons and non-resident aliens) from payees and keeps these W-9 forms. W-9 forms may be either paper or electronic.

From the W-9 forms, the payer prepares information tax returns, Form 1099-NEC (nonemployee compensation) and Form 1099-MISC (miscellaneous information). These 1099 tax forms include the business name, payee name, contact information, and required tax information.

The payer deducts 24% of the total amount from a payee’s payment for backup federal income tax withholding when the payee is not exempt fxrom the backup withholding. A payer files a 1099-NEC form for any amount of backup withholding taken during the tax year.

The payer submits a copy of the 1099 forms to the payee and also Copy 2 of the state form to the payee for filing their state tax return, if applicable. The payer also sends a copy of the 1099s (with a transmittal form only if paper filing is used) as an information tax filing to the IRS and states with income taxes.

Effective January 1, 2024, the IRS has changed the threshold, now requiring electronic filing of information returns like 1099 forms to 10 or more forms instead of 250 forms (calculated as an aggregate of all information returns filed).

Automating W-9 Collection and 1099 Reporting: A Strategic Imperative for Modern Finance

Finance automation software for global mass payouts and accounts payable invoice processing enables efficiency, scalability, and de-risking of financial operations through integrated payment and tax compliance workflows.

Common Challenges Automation Helps Address

Tipalti helps reduce operational burden and compliance risk tied to manual tax workflows, including:

- Time-consuming, error-prone manual data entry

- Payment fraud risk and data exposure

- Approval bottlenecks that delay payments

- Tax and regulatory non-compliance risk and penalties

- Missing W-9s and incomplete payee records

- Incorrect TINs and validation errors

- Missed or inaccurate backup withholding

- Payments that don’t meet domestic or international regulations

- Last-minute follow-up to collect forms and resolve issues before year-end filing deadlines

Centralize Payee Onboarding and Payment Workflows

Tipalti Mass Payments integrates with your ERP, accounting software, and performance management systems. It also provides a self-service portal to onboard payees, collect required tax forms (W-9 or W-8) before the first payment, and give payees visibility into payment status and history.

Automate Validation, Withholding, and Tax Prep Reporting

For automated tax compliance, Tipalti Mass Payments and AP Automation help teams:

- Validate TINs through automated TIN matching

- Track calendar-year payments for reporting thresholds

- Automatically calculate backup withholding when required

- Generate tax preparation reports for 1099-MISC, 1099-NEC, and 1042-S

Streamline 1099 Filing with Tipalti’s Zenwork Tax1099 Integration

Tipalti also supports year-end filing workflows through its Zenwork Tax1099 integration, allowing teams to automatically e-file 1099-MISC and 1099-NEC forms using calendar-year payment data synced from Tipalti. This reduces manual uploads and rework, while improving control and consistency across filing and recipient delivery.

Reduce Downstream Penalties and Corrections

Tipalti’s automated tax compliance helps prevent issues that often lead to penalties or additional remediation work, including:

- Missing 1099 information returns

- Failure to apply required backup withholding

- Inaccurate or missing TINs on 1099 forms

If backup withholding isn’t collected when required, the payer may owe the full amount that should have been withheld. Tipalti Mass Payments helps automate backup withholding workflows for independent contractors, creators, affiliates, and other high-volume payee models.

How to Stay Compliant as Your Contractor Volume Grows

A W-9 form is completed by each payee or supplier, which may be an independent contractor or seller of goods or services from which your company purchases. IRS W-9 forms provide the buyer with the name, contact information, and TIN of the person receiving payment for these goods or services. The payer uses supplier-submitted IRS W-9 forms to prepare the required 1099 forms for calendar-year payments, ensuring IRS tax compliance.

Automate Contractor Payments and Tax Compliance at Scale

Automating W-9 and 1099 workflows helps finance teams reduce risk and simplify reporting. Tipalti handles tax collection, 1099 generation, and global contractor payouts in one secure platform.

W-9 vs. 1099 FAQs

Is a 1099 and a W-9 the same thing?

No, 1099 forms and W-9 forms are not the same. A trade or business prepares 1099-NEC and 1099-MISC forms using the information provided by its payees on Form W-9.

Which tax form shows end-of-year earnings for independent contractors?

Form 1099-NEC shows the total amount of independent contractor earnings through the end of a calendar year when their earnings meet or exceed the dollar threshold for a payer to submit the information return to the IRS.