Explore the top 7 ways you can solve common Quickbooks problems with automation.

Fill out the form to get your free eBook.

There comes a time in every business when you have to find better ways of doing things. This is especially true with accounts payable processes, which has traditionally meant paying people to pay people. Even with QuickBooks, organizations still have to extract information from suppliers and vendors, manage invoices, and make payments. Thankfully, there’s hope in the form of automation technology. In 7 QuickBooks Payables Problems Solved with Automation, learn the biggest payables problems automation solves for QuickBooks users. Read the eBook to discover: – The challenges of global payables – How to reduce exposures to AP risk – Missed strategic opportunities within finance – The growing impact of payables transformation

Ever heard of AP automation? You can significantly lower costs by switching from manual accounts payable (AP) entry to best practices using advanced automated procurement to pay (P2P) software.

Additionally, this transition enhances internal controls, reducing the likelihood of paying duplicate or fraudulent vendor invoices. Corporate governance, especially concerning accounts payable and cash flow, is your responsibility.

We’ll explain how you can use add-ins that offer seamless integration with Intuit’s QuickBooks Online software to make use of AP automation for your business.

How Valuable is Accounts Payable Automation?

Various industry reports highlight the cost-saving potential of AP automation. It’s important to look at benchmarks specific to the UK. For instance, accountingweb.co.uk states that manual invoice processing can cost up to £15 per invoice, although this can be much higher if the processes are complex, while automation can reduce this cost typically by 60-80%.

By using automation tools, you can reduce the costs related to your Accounts Payable operations, improving profitability and cash flow. These cost-savings arise through numerous factors, such as avoiding late fees and reduced processing times. It also minimises errors, allowing your business to focus on growth.

The increasing focus on Making Tax Digital (MTD) compliance in the UK also adds to the benefits of AP automation, helping to avoid costly errors and delays.

Furthermore, businesses are increasingly moving toward automation, with 41% planning to automate their AP processes within the next year (Tipalti, 2022), and those using automation tools typically reduce manual data entry by up to 80%, saving a huge amount of time and effort.

A Brief Overview of QuickBooks

QuickBooks is accounting software owned by Intuit, with QuickBooks Online and QuickBooks Desktop product lines. QuickBooks is used by startups for bookkeeping, small businesses, and some medium businesses.

Versions of QuickBooks vary, but in general, QuickBooks Online often requires manual data entry. This includes inputting invoice data and managing paper invoices. Manual entry continues to be the case unless recurring payments and electronic banking transaction downloads are selected.

Many small to medium businesses in the UK will need to use manual entry without an AP automation solution.

QuickBooks Online Advanced

QuickBooks Online Advanced, released in the UK in 2022, is specifically designed for growing companies, providing the capacity to multiple users.

It introduces more robust functionality and automation tools including automated workflows, advanced batch invoices as well as expense processing and presents an upgrade from QuickBooks Online Pro.

Many QuickBooks Online Advanced users come from using QuickBooks Desktop Enterprise software. They can utilise the automation functionality of QuickBooks Online Advanced to enhance their productivity and reduce human error.

With the phasing out of Quickbooks Desktop, many users are looking for seamless cloud-based solutions and AP automation via third parties such as Tipalti.

QuickBooks for Accountants and Bookkeepers

QuickBooks offers wholesale discounts to some chartered accountants, other accountants, and users in the UK. These accountants purchase subscriptions in bulk for their clients, charging them as part of their services.

Also, they extend wholesale discounts to accountants for QuickBooks Online and QuickBooks Online Advanced.

API Integration with QuickBooks Online or QBO Advanced

Incorporating new features to QuickBooks Online (QBO) or QuickBooks Online Advanced (QBO Advanced) can significantly improve how your business manages its accounts payable, especially when it comes to costs.

To get the best results, you need an app that seamlessly integrates with QuickBooks, for example via API, making it feel like a natural part of your software.

Many businesses, however, find that using separate, external apps can be confusing and inefficient. A seamless integration means you avoid having to jump between different systems, which helps streamline your work and save you time.

Making AP Smarter with AI and RPA

AP automation utilises intelligent technologies like Artificial Intelligence (AI) and Machine Learning (ML) rules, or algorithms, to validate suppliers and invoices. In the UK, 65% of financial institutions are integrating AI into their processes.

This greatly reduces the possibility of fraud. Robotic process automation (RPA) is also often deployed to automate routine AP workflow processes. Many systems have AI functionality that assists with the work to be done, making the whole process more efficient.

Automatic Invoice Approval Routing

Automation tools make it easier to manage the approval process, using customisable levels for each approver and role within the company. This multi-level approval system is useful especially for larger businesses.

Automatic Coding, Batch Processing and Expense Management — AP automation enhances the efficiency of coding and batch processing supplier invoice payments and other business transactions.

The payment processing functionality generates employee expense payments from Expenses software, used in conjunction with AP automation and other cash disbursements, making everything easily trackable.

Flexible Payment Options

The most efficient software will adapt to the preferred payment type and global currency of each vendor. Payment types may include credit cards, prepaid debit cards, PayPal, cheques, Global ACH payments, BACS payments, Faster Payments or electronic fund transfers (EFT).

Open Banking powered payments, utilising Variable Recurring Payments (VRPs) for regular invoices, are also becoming more popular.

Open banking is being prioritised in the UK through initiatives like the National Payments Vision with the introduction of Variable Recurring Payments (VRPs) being adopted to streamline recurring invoice payments.

While some AP automation software providers may offer wire transfers, electronic payments like BACS and Faster Payments are generally more secure, and offer faster processing, particularly considering the potential for wire transfer information being exploited by fraudsters.

Instant payments via Open Banking also provide enhanced security through secure authentication measures, alongside a quick and traceable method for payment.

Easy Supplier Onboarding

The leading AP automation software includes a self-service supplier onboarding portal that works as a simple software hub. This functionality assists in the smooth processing of all invoice information.

Suppliers can enter their contact details and VAT IDs, and also upload their own invoices directly into the system. Shifting some of the AP workflow onto the vendors themselves will save you time and reduce the amount of processing required from your AP teams.

This can also help to minimise errors and cut costs. Self-service supplier portals reduce the workload on your AP team, streamlining your invoice processing, whilst saving you time.

AP Automation Features for Invoice Processing

After vendor onboarding, your company takes over the processing of line items. AP automation software reconciles paperless invoices with digital purchase orders and receiving documents.

Optical character recognition scanning (OCR) is typically used to automatically capture and extract key line item data fields from each invoice. This saves an enormous amount of time and effort by cutting down on the manual processing necessary.

OCR technology also contributes to data accuracy, with many vendors claiming up to 98% success rates, however this can vary, and along with AI-driven tools, automates invoice processing, saving vast amounts of time. This may be lower for hand-written or poorly formatted documents.

The leading AP automation accounting systems employ vendor verification databases. Automating AP includes an electronic push approval workflow, attaching PDF documents as part of the process.

These systems also secure financial operations by granting authorised personnel, such as the CFO and Controller, with sole access to cash accounts.

You can dispense with inefficient paper cheques by opting for electronic payment processing — either through large batch processing or on-demand cash disbursement, called online bill pay.

The system manages payment data for independent contractors like freelancers and also provides informative, real-time reports of the whole AP process, making cash flow more transparent and easier to monitor. By providing real-time dashboards and tracking of payables status, automation tools assist companies in better management of their cash flow as well as reducing invoice processing times.

Internal control features you should seek in accounts payable automation software include:

- Tax compliance and global regulatory compliance

- Audit trails

- Role-based views

These essential features mitigate risks and ensure compliance with UK laws and regulations. A system adapted to HMRC guidelines helps you save time on your annual return.

Does QuickBooks Have AP Automation?

QuickBooks doesn’t provide AP automation in-house, but it offers an upgrade to some third-party apps that provide AP automation. These upgrades may not be as robust as the best software from the following list of AP integrations for QuickBooks.

Maximize your Quickbooks ROI with AP automation

AP automation reduces costs, minimizes manual work, and frees up time for high-impact projects.

Top 5 AP Automation Integrations for QuickBooks

Here’s a look at some of the leading AP automation solutions that integrate with QuickBooks, offering features to streamline your AP processes:

We highlight the features and pricing of each of these AP automation software products that seamlessly integrate with QuickBooks, with a focus on their availability and compliance in the UK.

1. Tipalti

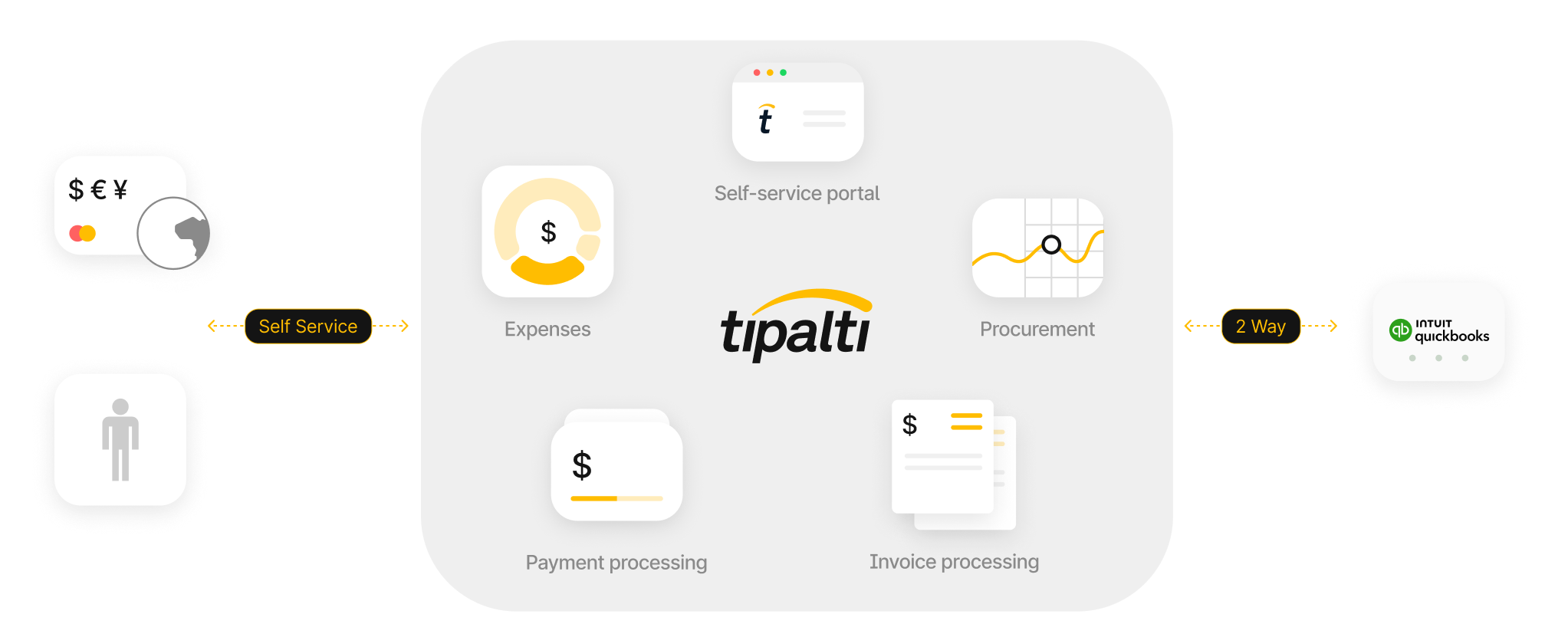

Tipalti AP automation software provides end-to-end accounts payable process automation, including automated invoice processing and global payments. Cloud-based Tipalti software is a robust AP automation integration for QuickBooks (and any ERP or accounting software) that will accomplish all of your business needs for accounts payable, including straight-through automated invoice processing.

Tipalti has a physical presence in the UK with an office in London and actively expanding its operations.

Tipalti replaces manual data entry for payables and payments by your AP team with finance and accounting automation, reducing human error. Also, Tipalti’s AP automation solution has enterprise-grade security and offers scalability for business growth.

Tipalti’s platform is localised for the UK, including VAT compliance. It operates with an e-money license approved by the FCA and adheres to financial compliance standards.

Features:

- Self-service supplier onboarding through a Supplier Portal

- Automated VAT compliance tools: Simplifies VAT compliance for UK businesses.

- Choosing the preferred global payment method and local currency from 6 methods for 200+ countries in 120 currencies

- Automated invoice receipt and payment status notifications

- Electronic invoice data capture by line item and headings using AI-driven OCR via portal upload or email

- Automated 3-way or 2-way invoice matching with purchase order (and receiving report)

- Validating vendors and achieving automated global regulatory compliance

- Automatically routes invoices and guides invoice approvals

- Electronic global payments in large batches with quick automated reconciliation

- AI-driven business intelligence and visible spend management

Pricing:

Tipalti’s SaaS pricing model in the UK starts from £99 per month for the basic “Starter” platform. This includes features like a supplier portal for onboarding, VAT ID collection and validation, AI Smart Scan invoice processing, and a flexible bill approval rules builder.

66% fewer payment errors. 25% faster close. 80% less AP workload.

2. Rillion

Rillion provides cloud-based AP automation software designed to streamline invoice processing and improve financial control. While Rillion does not have a local UK presence at the moment, they can be contacted through their UK partner: Stratas Business Solutions LLP.

Rillion’s system includes automated VAT calculations as part of its invoice processing capabilities

Features:

- Automated invoice capture

- AI-powered data extraction and coding

- Automated matching to POs and receipts

- Customisable workflow and approval processes

- Real-time reporting and analytics

Pricing:

Rillion’s pricing is typically based on a custom quote, depending on the business’s specific needs and size.

3. Beanworks (Quadient AP)

Quadient AP by Beanworks provides accounts payable and accounts receivable automation software integrating with QuickBooks. The accounts payable software covers the procure to pay process, beginning with purchase orders. Quadient launched Beanworks in the UK in 2022.

The solution is designed to comply with UK regulations, offering support for UK VAT and helping users comply with data privacy laws, including the UK GDPR.

Features:

- End-to-end payables

- AI-powered data entry

- Automated invoice processing workflows

- 3-way invoice matching

- Automated approval routing

- Real-time dashboards and spend management visibility

- Document repository with access

- Strong controls

Pricing:

Beanworks has separate pricing based on custom quotes for Purchase Orders, Invoices, Expenses, and Payments.

4. SAP Concur

Concur Invoice is an AP automation software offered by SAP, with a strong presence in the UK.

SAP Concur is designed to help UK businesses comply with VAT regulations, supports electronic invoicing standards that are becoming increasingly important for MTD compliance, and emphasises the security and privacy of customer data.

Features:

- Invoice capture by mail, email, or electronically

- OCR and machine learning for header and line item invoice data capture

- Invoice processing

- Invoice goes to employee purchaser to enter distribution codes and percentage for the purchase, then employee clicks submit to send to approvers

- Approvers can approve via mobile app

- AP completes final review

- Audit trail of status changes

- Invoice payment via credit card voucher, cheque, or partnered payment provider

Pricing:

SAP Concur Invoice pricing is based on a custom quote.

5. Zahara

Zahara offers cloud-based purchase-to-pay (P2P) and AP automation software designed for SMEs, with a significant presence in the UK market. Their platform helps businesses control spending, automate invoice processing, and streamline payment workflows.

Their solution adheres to UK tax law, including Making Tax Digital (MTD) initiatives.

Features:

- Purchase order management

- Invoice automation with OCR

- Automated approval workflows

- Budget management and reporting

- Integration with accounting software

Pricing:

Zahara’s pricing model consists of various plans tailored to different business sizes and requirements and starts at £118 per month.

How Can I Learn More About Accounts Payable Automation?

Many accountancy and financial institutions provide valuable resources for the adoption of AP automation. It’s highly recommended to review materials provided by such groups to make a move towards AP automation.

To improve efficiency, control, and spend analysis using digital transformation, consider adding an AP automation software solution to your QuickBooks software.

Note: This text is based on information as of February, 2025 and is subject to change. For the most up-to-date and accurate pricing information for your specific business requirements, contact the software providers directly. The information provided here is for general guidance only and does not constitute professional tax or legal advice.

See how end-to-end AP automation can transform your financial processes

Tipalti helps finance leaders eliminate manual payables, increase global reach, and confidently scale.