Best way to mass-pay partner networks

Tipalti provides a complete end-to-end workflow that ensures efficient, accurate processes and finance-protecting controls.

Tipalti’s fully-brandable global mass payables automation solution for performance-based business models minimizes manual effort, maximizes self-service, and dramatically increases scalability and auditability. Here’s how it works to elevate your finance team.

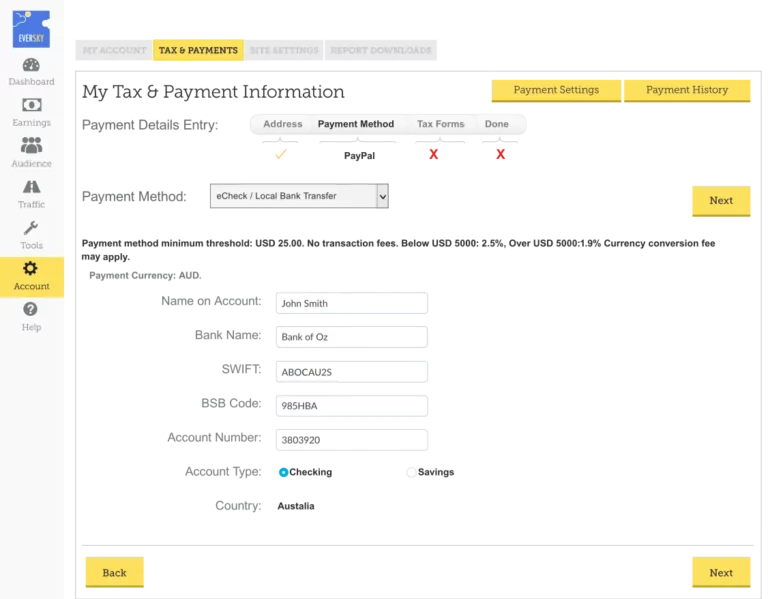

The most critical step comes first: onboarding your partners to ensure they’re payable.

You invite partners to register on a white-labeled IFRAME portal to provide their contact, billing details, and tax identification.

- The responsibility is on the partner to provide information, incentivizing them to do it right in order to be paid.

- This step is vital to ensuring that no one is paid that your business hasn’t authorized.

- Seamless brand experience

- Deepen partner relationship

- Collect and verify tax IDs

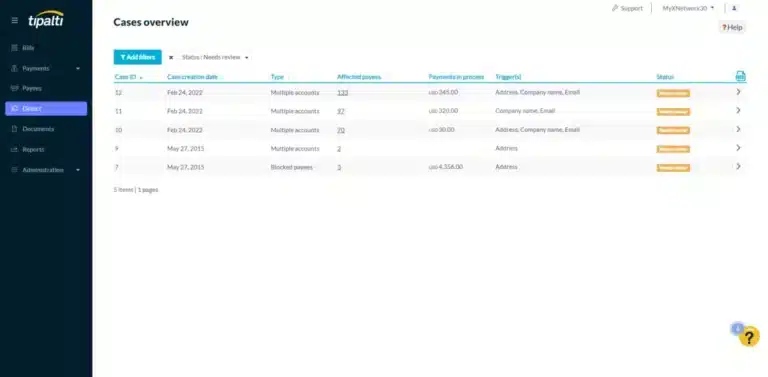

[Optional] Partners are validated with the Tipalti Detect™ risk module to reduce potential fraud.

Mitigate payee fraud exposure with proactive detection.

- Track relevant datapoints (e.g. contact details, account numbers, emails, and payments).

- Identify suspicious payee activity.

- Maintain suspicious activity records

- Check every payment made to partners

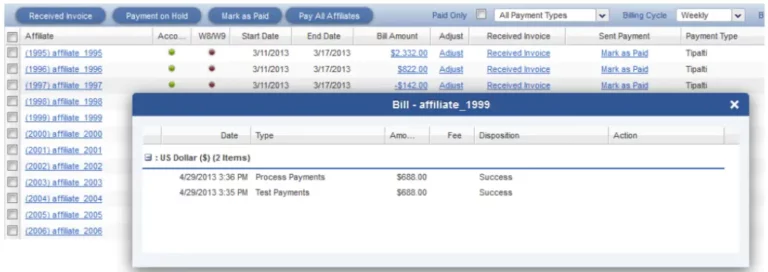

Your performance system links to Tipalti to determine how much and when to pay partners.

Performance data to trigger payments can be linked to Tipalti via API, CSV payment file, or direct integration into tracking systems.

- Direct integrations with CAKE, Everflow, HitPath, LinkTrus, Paladin, and TUNE.

- Ideal for homegrown performance systems used in online marketplaces, affiliate and performance networks, publisher networks, gaming, digital media, and crowd-based services.

- Maintain invoice records

- Set up straight-through processing and approvals

- Frees up manual effort

[Optional] Self-Billing module simplifies workflow for regions that require it.

- Support for multiple workflows

- Maintains full compliance record

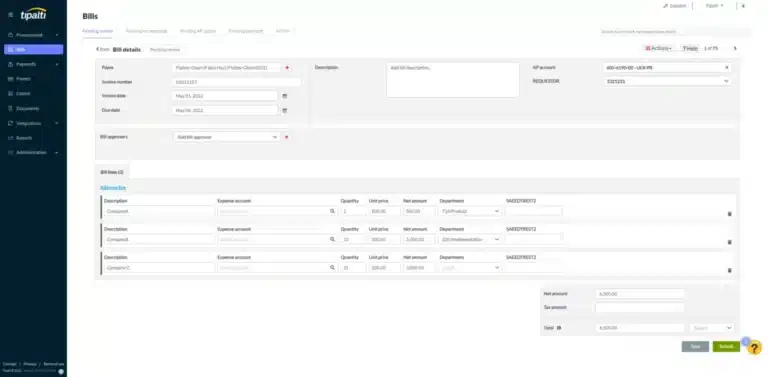

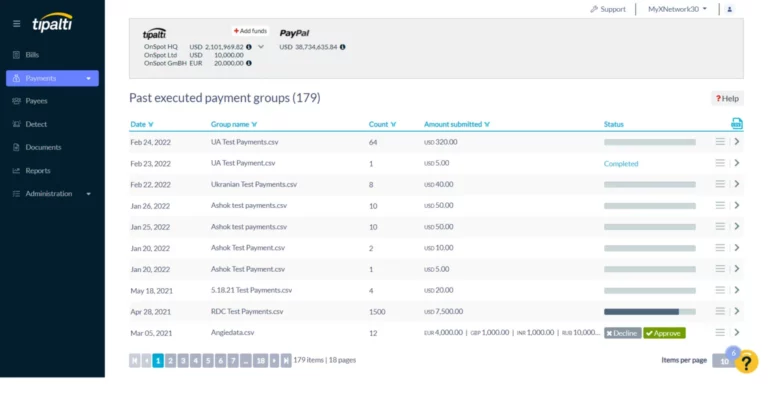

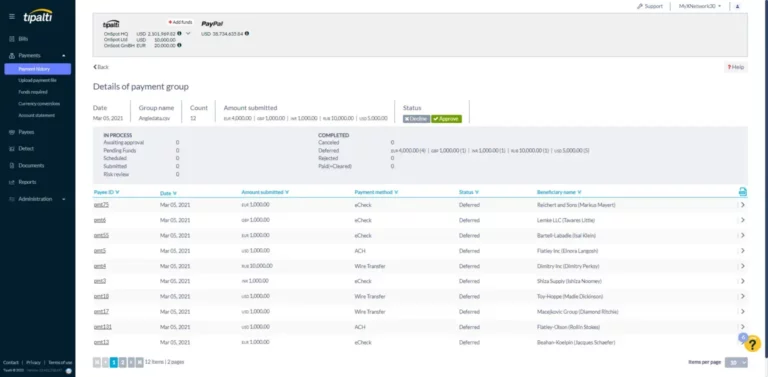

Payments are automatically scheduled and await an approver to confirm payment.

- Hassle-free approvals for stakeholders

- Clear audit trail for approval workflow

- Pay across multiple payment methods in a matter of clicks

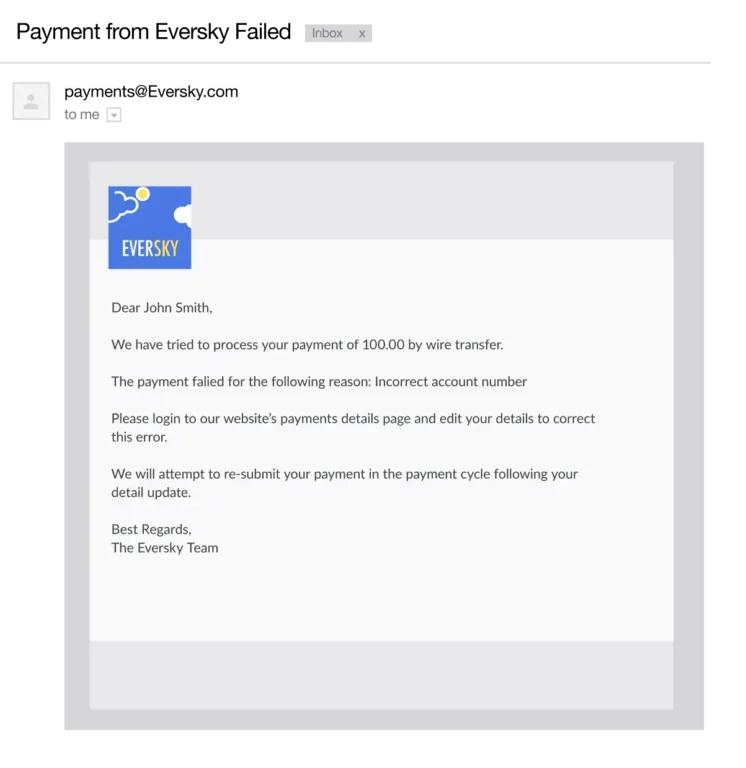

Partner communications are automated.

Partners will be notified when a payment is made or if there’s a problem.

- Emails come from your business and have your branding to ensure trust

- If there’s a problem, the email prescribes a solution, often asking the partner to update or provide additional information through the portal

- Reduced payment inquiries

- Proactive communication

Reconciliation happens in real time.

Once the payment lands and clears, Tipalti is automatically updated with the successful result. No manual bank reconciliation is required.

- Payment data is sent to any connected ERPs or tracking platforms

- Complete details of transfer or conversion fees are included

- Faster reconciliation to accelerate the financial close

- Accurate, updated payment data

Let’s get more productive

Talk to an expert and learn how you can take control of your payables.