Supplier Management Software

- Promote supplier onboarding self-service with brandable portal

- Manage supplier contracts with contract repository

- Make informed decisions with supplier database

- Collect and validate bank account information, IRS, and VAT Tax IDS

- Two-way sync supplier data with ERP and other system integrations

Features

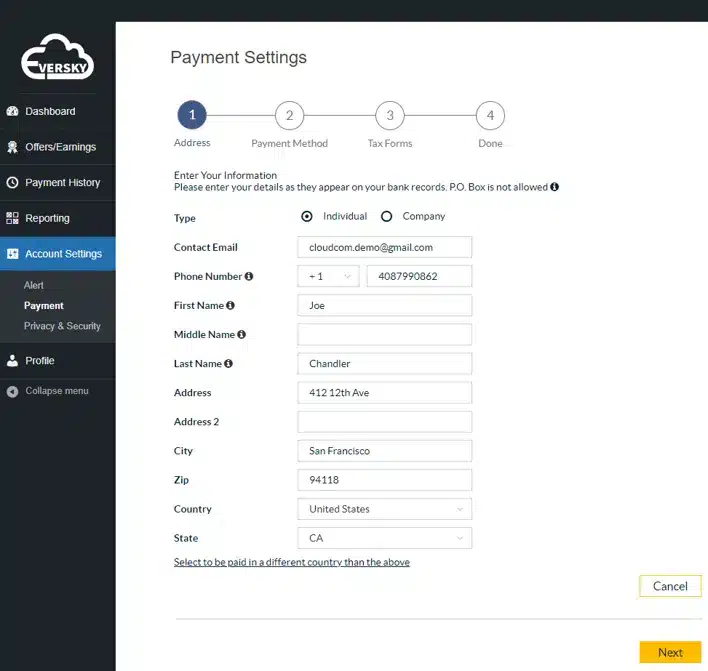

Customize the Supplier Hub & Streamline Data Entry

Tipalti lets your brand take center stage with our Supplier Hub that can either be hosted by Tipalti or a white-labeled iFrame that embeds securely in the HTML of your website. Self-service makes it easy for suppliers to onboard quickly.

- Customize the online Supplier Hub to your brand’s look and feel

- Put the responsibility of collecting and maintaining accurate data on your suppliers, cutting the time AP spends onboarding vendors

- Eliminates duplicate registrations for a clean vendor master database

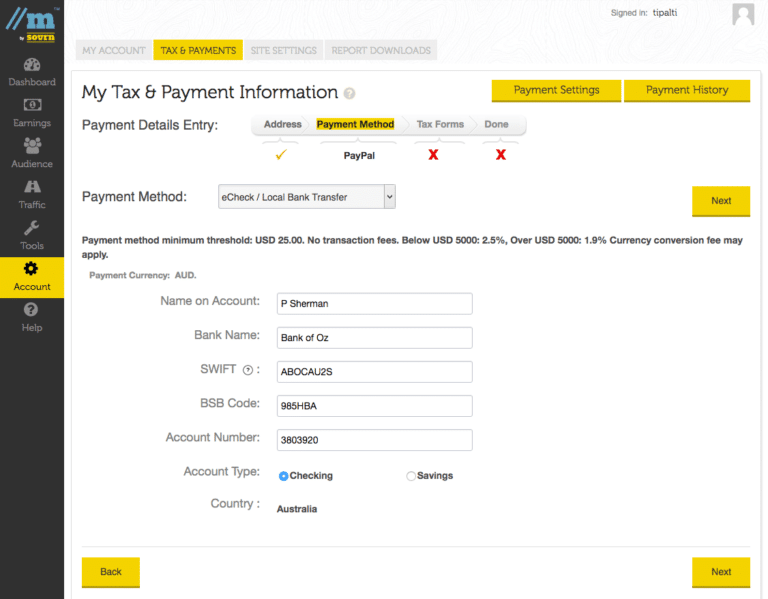

Optimize for Payments around the World

Tipalti gives global payees the flexibility to choose how they want to be paid and in what currency. Tipalti provides clear visibility into any related transaction fees, while helping keep your company in full tax and regulatory compliance.

- Suppliers choose their preferred payment method, currency, and payment thresholds

- Tipalti Supplier Hub is multilingual, with support for 11 languages

Securely Collect Information & Reduce Payment Errors

Tipalti’s proprietary rules engine, driven by 26,000 global rules, identifies payment issues before they happen to reduce payment error rates. Our rules vet and validate local bank routing details such as SWIFT and IBAN codes, screen OFAC blacklists, and more – all based on the payee’s country and payment method.

- Reduce payment errors by 66%+

- Get global payment intelligence and fraud prevention built in

Contract Repository

Effortlessly manage your supplier contracts with the Tipalti Contract Repository. Access and reference all your contracts from a centralized location to maintain complete visibility. Set up and receive renewal alerts for upcoming contract expirations via email, ensuring you never miss negotiation opportunities. Our system supports various contract types, enabling you to efficiently handle contract details.

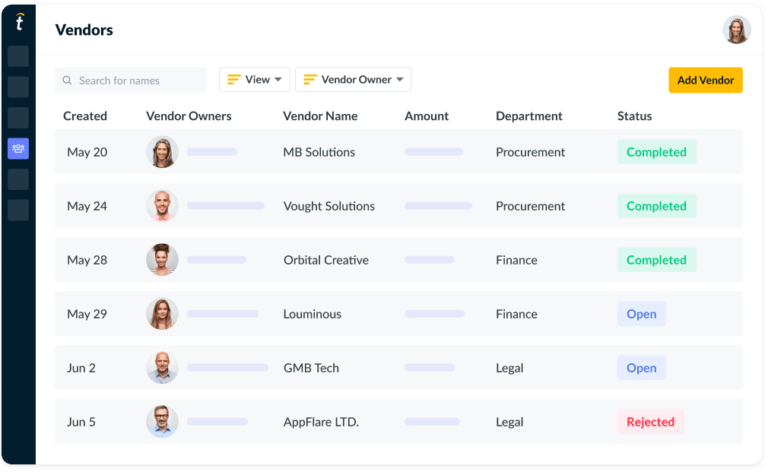

Unified Supplier Database

Empower your team to make informed supplier selections for their purchases with a centralized, all-in-one supplier directory. Easily access supplier data and essential information using the smart filter and search based on specific criteria.

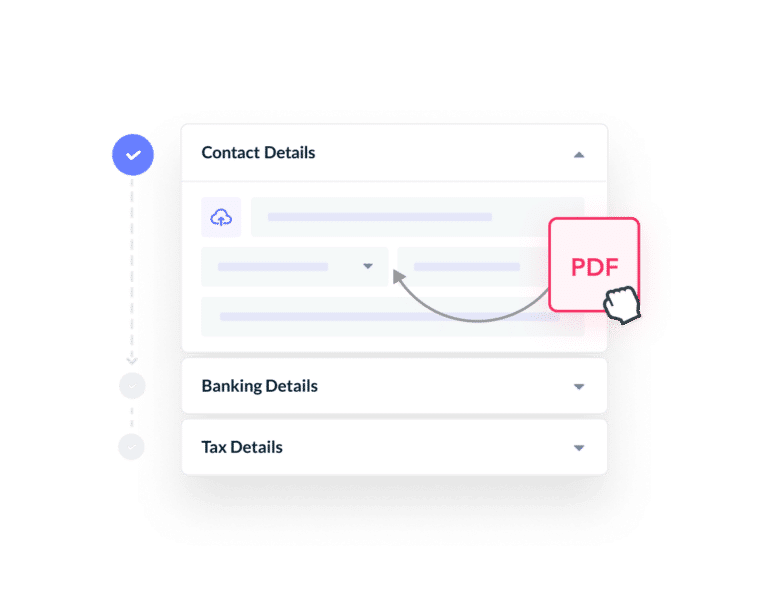

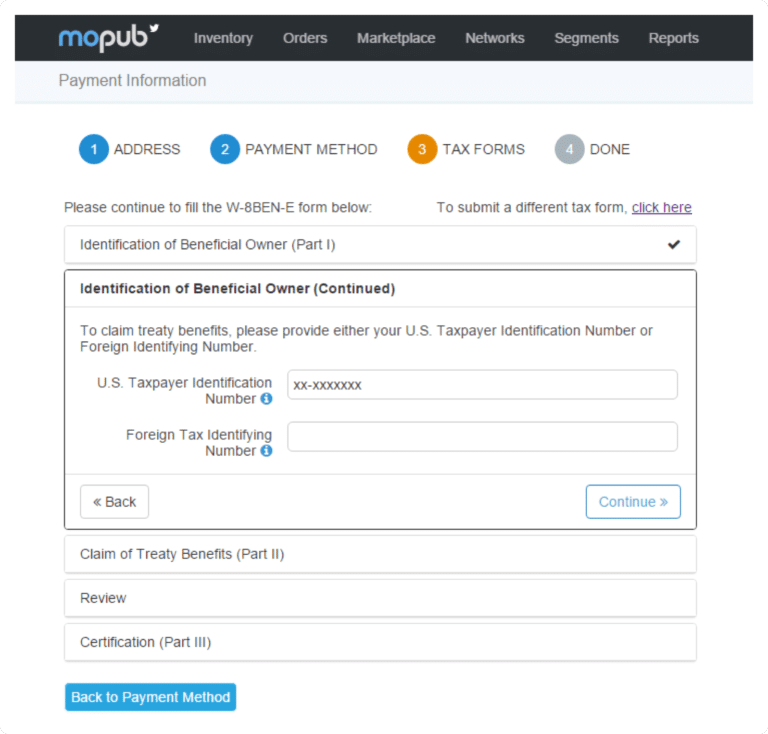

Vet & Submit Tax Forms Prior to Payment

Our tax form selection wizard guides payees to select and complete the correct tax form, while 1,000+ rules and TIN matching verify details. End-of-year 1099 and 1042-S reports provide a submission-ready file to help manage reporting to federal and state authorities, including withholdings. This tax compliance capability is KPMG reviewed and approved to meet IRS requirements. Non-US payers can take advantage of local tax/VAT ID collection in 49 countries.

- Collect W-9/W-8 tax forms seamlessly during onboarding

- Verify tax details to prevent backup withholding penalties

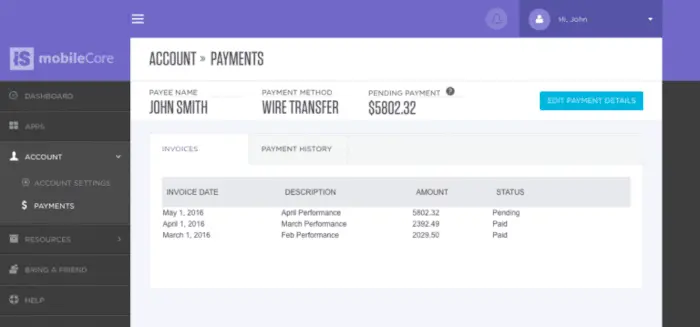

Provide Complete Supplier Visibility, Reduce Status Inquiries

Through the Supplier Hub, suppliers can update their payment information, see payment statuses (including issues that may prevent them from receiving funds), and view invoice and payment history.

- Suppliers receive proactive, white-labeled payment status email updates

- Suppliers can get a real-time view of payments and invoices

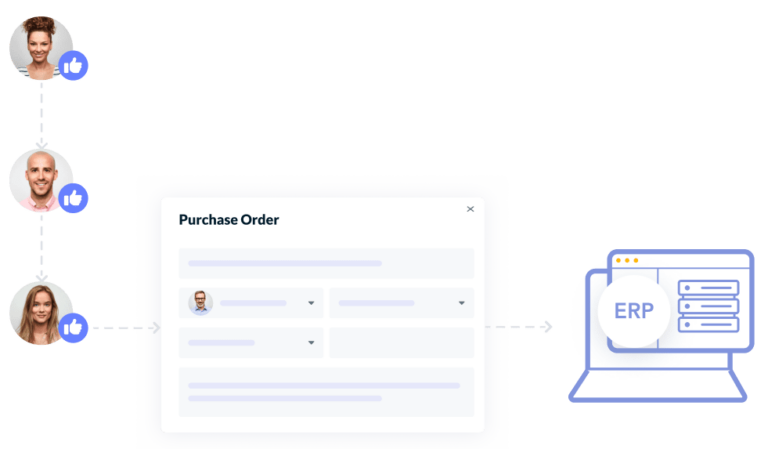

Optimize Supplier Data Sync

Tipalti’s prebuilt API integration syncs supplier data with your ERP, providing employees, finance, and procurement teams with complete access to all suppliers. Seamlessly sync this data to other systems via API, like third-party risk management systems, for an integrated procurement workflow and thorough supplier review process.

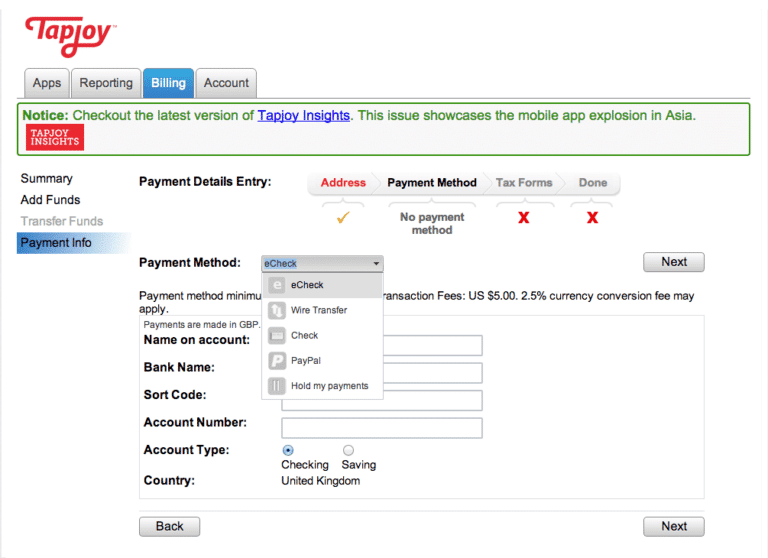

RICHMOND ANG | CONTROLLER AT TAPJOY

I don’t have to deal with all of the supplier email questions, problems, or discrepancies. It’s all done on the portal!

Innovation and efficiency

come built-in

Tipalti offers the most comprehensive payables technology to help your

business streamline, simplify, and evolve.

Invoice Management

Ditch the busy work with automated invoice processing with smart OCR. Advanced approvals with AI streamlines the approval process and minimizes delays.

PO Management

Manage spend all in one place. Streamline purchase requests, PO’s, approvals, and vendors with budget visibility to make informed decisions.

Global Payments

Send payments in 120 currencies in 196 countries through six unique payment methods.

Currency Management

Save time and money on FX conversion payouts with highly competitive exchange rates.

Payment Reconciliation

Speed up financial close by 25%+ by synching and reconciling multi-entity payables data with ERP and Accounting systems.

Self-Billing Module

Simplify self-billing processes with automated invoice creation and submission while ensuring global regulatory compliance.

ERP Integration

Best-in-class integration with your existing ERP and accounting systems and sync invoices, suppliers, payments and purchase orders.

Payments API

Integrate any system through our highly secure API that offers full-featured interfaces.

Money Transmitter License

Get peace of mind for global transactions, more transparent controls and compliance review process by leveraging Tipalti’s banking and compliance rails.

Artificial Intelligence/Tipalti AI

Take advantage of proactive, smarter processes for the entire payables operation as well as greater efficiency and risk mitigation.

Supplier Management

Effortlessly onboard vendors with a multilingual, self-service portal that’s brandable. Plus, give suppliers a real-time view of payment and invoice status.

PO Matching

Eliminate overspending and strengthen financial controls with automated 2-way and 3-way matching and enjoy a frictionless approval cycle.

Tipalti Card

Gain complete control and visibility over your corporate card spend with a solution integrated into the most powerful global finance automation solution with automatic reconciliation.

Multi-Entity

Manage unique payables workflows and centralize AP for subsidiaries and entities within a single instance.

Tax Compliance

Take the headaches out of collecting and validating IRS and VAT IDs. KPMG-approved for W-8/W-9 IRS requirements and generate 1099/1042-S tax prep reports.

Financial Controls

Enterprise-grade financial controls: Fraud, tax, regulatory, audit, spend and cash flow.

Fraud Detection

Tipalti Detect lets you proactively identify payee fraud risk and maintain a full audit trail.

Secure Cloud

Rest assured that data is collected, stored, and transmitted securely in the cloud. Tipalti is SSAE 18 and ISAE 3402 SOC 1 Type II and, SOC 2 Type I certified, and GDPR Compliant.

Simplify Performance-to-Pay

Easily sync data from marketplace platforms and tie performance analytics to pay partners.

Related Content

Let’s get more productive

Talk to an expert and learn how you can take control of your payables.