As companies expand globally and add entities, AP becomes harder to manage. Different currencies, tax rules, and approval workflows create complexity that manual processes can’t keep up with. Ardent Partners reports that over half of AP leaders struggle with global visibility and standardization, leading to delays, errors, and compliance risk.

Automation simplifies this by improving speed, accuracy, and control. Smart AP platforms use Optical Character Recognition (OCR), auto-routing, and validation rules to cut cycle times and reduce errors. According to Forrester, automation also enhances compliance and frees finance teams to focus on strategy. For global AP, automation is essential.

Key Takeaways

- Global AP complexity is rising due to multi-entity structures, varying tax laws, and currency requirements, making manual processes inefficient and risky.

- 55% of AP leaders (Ardent Partners) report challenges managing visibility and standardization across global operations.

- Automation enhances speed and accuracy with tools such as OCR, auto-approvals, and real-time validation, reducing errors and delays.

- Standardizing AP processes across entities becomes easier with automation, helping organizations scale efficiently without duplicating headcount.

- Automated audit trails and real-time reporting improve transparency, making it easier to meet regulatory requirements in multiple jurisdictions.

Must-Have Core AP Automation Features

You’ve been promised automation before. You’ve probably seen systems that created more headaches than they solved. The foundational AP automation features you need are not about simply digitizing your old, broken processes. They are designed to build an intelligent, resilient core for your entire financial operation.

1. Invoice capture and data extraction

Where does a modern AP process truly begin? It starts by eliminating the time-consuming process of handling physical paper invoices and the manual data entry that follows.

The old way was brittle, template-based OCR, where a vendor merely changing their invoice layout could grind your workflow to a halt. The modern standard optimizes this with Intelligent Document Processing (IDP).

Unlike older technology that only saw pixels, modern IDP is designed to understand the intent behind the words on the page. Using a blend of computer vision and natural language processing, it knows that “Invoice #” and “INV-ID” are the same concept, no matter where they appear. The critical feature to demand here is Confidence Scoring. For every piece of data it pulls, the system assigns a score—say, 99.5% confidence. This allows you to build real trust into the system with rules like, “If all fields score above 95%, the invoice approval process begins without a single human touch.”

2. Automated approval workflows

But perfect data is useless if it’s stuck. This is where your AP platform must provide dynamic, conditional approval workflows. Far more than simple A-to-B routing, you need the power to build logic that mirrors your actual company policies.

For example, an invoice over $10,000 from marketing must get the CMO’s approval, not just the manager’s. The goal is to manage this approval matrix yourself, without ever needing to file a ticket with IT.

3. PO matching

Invoice data can look right but be completely wrong. Your system must validate every bill against the original commitment. For services, 2-way matching (comparing the invoice to the PO) is your baseline.

But if you move physical goods, anything less than 3-way matching, which adds the goods receipt note to confirm delivery, is a gamble. A truly practical system will also let you set tolerance levels to automatically approve tiny discrepancies, reducing the chance of human error in the invoice matching process and keeping the business moving.

4. Duplicate detection and fraud prevention

Validation is one thing, protection is another. Checking for duplicate invoice numbers is standard—it’s the bare minimum. The modern standard, however, must include automated vendor bank account validation.

This feature cross-references banking details against external databases to confirm their legitimacy, acting as a crucial shield against sophisticated Business Email Compromise.

5. Payment execution

This is the last mile of the race, and it’s where many AP platforms stumble. They approve a bill and then drop the final, critical step right back on your team. A true end-to-end AP automation solution acts as a payment hub.

It handles the execution of global payments across a variety of rails—from low-cost domestic methods like ACH to international wires via SWIFT—all from a single, unified interface that allows for automated payment scheduling to optimize cash flow.

Advanced Capabilities for Scaling Teams

As your business grows, the AP payment processes that once felt manageable begin to buckle under the weight of new supplier relationships, new currencies, and new legal entities. Simply doing things faster isn’t the answer. Your intelligent AP platform must prove its worth with a sophisticated architecture built to manage global complexity without forcing you to hire an army of accountants.

This is where you need a true multi-entity architecture. It’s a critical technical distinction. A genuine multi-entity system is designed from the ground up to mirror your corporate structure, allowing you to segregate vendors, banking, and workflows by legal entity.

At the same time, it must give you a consolidated view from the top, a financial command center showing real-time visibility of your total payables. This is the only way to balance local autonomy with centralized control.

Automate AP. Eliminate Errors. Close Faster.

Reduce payment errors by 66%, speed up your month-end close by 25%, and cut 80% of your AP workload with Tipalti.

Collaboration Features That Actually Speed Up Approvals

The single biggest source of delay in your entire accounts payable process isn’t a system—it’s a person.

An invoice can be processed by a system in seconds, only to sit for weeks in an approver’s inbox, buried under an avalanche of other messages. Your ap team’s time is then consumed by the frustrating task of chasing approvals, creating friction across the entire business, and with key stakeholders.

The solution is to bring the whole conversation inside the AP platform itself, rather than a barrage of email reminders.

1. Invoice-level collaboration

Think about how you resolve a question today. It’s likely a painful toggle between your AP system and an archaeological dig through old email threads. This is not only inefficient—it’s a black hole for audit purposes. A key feature to demand is centralized, invoice-level communication.

This creates a single workspace where every question, comment, and approval justification is permanently attached to the specific invoice record. When an approver has a question about a line item, they don’t send an email into the void.

They post a comment directly on the digital invoice, instantly notifying the right team member and keeping the entire conversation history in one logical place.

2. Audit-ready communication history

This centralized communication creates another powerful benefit by default: a flawless, self-generating audit trail. With audit-ready communication history, the system is a processor and perfect record-keeper at the same time. Every single action—from the moment an invoice is viewed to the final click of approval—is captured, timestamped, and logged with the user’s digital identity.

Imagine an auditor asks why a particular invoice was approved. Instead of searching for emails, you can show them the exact conversation where the approver provided their justification. This creates an irrefutable digital record, satisfying auditors and internal control requirements without any extra work.

3. Vendor self-service tools

How much of your team’s day is spent fielding low-value vendor calls and emails? Answering questions like “Have you received my invoice?” or “When will I get paid?” is a significant drain on productivity. A crucial collaboration feature that solves this is a vendor self-service portal.

By empowering your suppliers with direct access, you offload a massive administrative burden. Through this secure portal, vendors can onboard themselves, entering their own banking and tax information, which shifts the liability for accuracy from you to them.

They can also submit invoices electronically and, most importantly, check on the status of their payments 24/7. This simple feature drastically reduces inbound inquiries and fosters a more transparent, positive relationship with your valued partners.

4. AI-Powered AP: Moving from Rules to Intelligence

Artificial intelligence is the core competency that separates a merely efficient AP system from a truly intelligent one. While the features we’ve discussed so far create a powerful automated foundation, AI is the engine that drives genuine autonomy.

It moves your operations beyond a world of static, pre-defined rules and into a dynamic state where the system learns, adapts, and even predicts. This is how you finally transition from simply processing transactions to managing a self-learning financial function.

5. AI for GL coding and error detection

Ever see systems that suggest a General Ledger code based on a vendor’s history? True AI in accounts payable goes layers deeper with Multi-Factor Predictive Coding. It asks, “Who is the vendor?” and analyzes the invoice holistically.

Using Natural Language Processing, it reads the line-item descriptions to understand that “AWS S3 Storage Fees” belongs to an IT infrastructure account, while “LinkedIn Sponsored Content” is a marketing expense—even if both were paid with the same corporate card.

The AI also considers who initiated the purchase and inherits the precise coding from the original purchase order. This culminates in a high-confidence prediction that can be automatically posted to your ERP, requiring human review only when the AI itself flags uncertainty.

6. Smart approval routing

How do you protect against threats you don’t even know exist? Rule-based fraud checks are essential, but they can only catch what you tell them to look for. AI-driven anomaly detection, by contrast, looks for what doesn’t belong.

The system builds a complex “behavioral fingerprint” for every vendor, learning their typical invoicing patterns. It can then flag an invoice that breaks no specific rule but is statistically improbable. For instance, an invoice from a trusted vendor that is for an unusually high amount, submitted on a weekend.

It can even perform a Benford’s Law analysis on invoice amounts, a statistical technique used by auditors to identify fabricated numbers. This is a dynamic, intelligent shield against sophisticated fraud schemes that simple rulebooks would miss.

7. Anomaly detection

Maybe the most powerful application of AI for finance teams today is the concept of Human-in-the-Loop (HITL) AI. Your AP automation platform shouldn’t be a rigid black box—it should be a collaborative partner that gets smarter over time.

With HITL, the machine learning model handles the vast majority of routine work autonomously with miniminal manual intervention, but is programmed to know when its confidence is low and it needs human decision making. When it escalates an issue—like an uncertain GL code—and your AP specialist makes a correction, the AI model learns from that action.

It updates its own logic, ensuring it is less likely to make the same mistake in the future. This creates a virtuous cycle where your team’s expertise continuously trains the machine, making the entire AP function more accurate and more autonomous with every invoice processed.

What to Look For in an AP Automation Platform

When you begin evaluating AP automation software, the datasheets and demos can quickly become a blur of similar-sounding claims. How do you cut through the noise?

You need a clear framework, one focused on the technical capabilities that truly determine a platform’s value and scalability. Before you sign any contract, ensure your potential partner can provide a definitive “yes” to these five critical questions.

1. How Deep is the ERP Integration?

You must dig deeper than “seamless integration.” Ask them: Is your integration built on a real-time, bi-directional API?

Does it sync not only approved bills into the ERP but also payment statuses back to the ERP, automatically closing the loop and eliminating manual reconciliation?

2. Can the Platform Truly Handle Global Scale?

If your business has any ambition for international growth, this is non-negotiable. “Supporting multiple currencies” is just the start. You need to verify if the platform has a true multi-entity architecture, allowing you to segregate workflows and bank accounts by legal subsidiary.

Furthermore, inquire about their payment infrastructure. Do they support local, in-country payment rails to reduce fees and settlement times, or are they relying solely on expensive SWIFT wires?

3. What is the “Intelligence” in Your AI?

“AI-powered” is the most overused marketing term of the decade. Your job is to understand what it actually means.

Ask them: Is your “AI” simply template-based OCR, or does it use a more advanced Intelligent Document Processing (IDP) engine? Does it provide confidence scoring on extracted data?

And most importantly, does the AI learn from human corrections? A system that cannot learn is not truly intelligent.

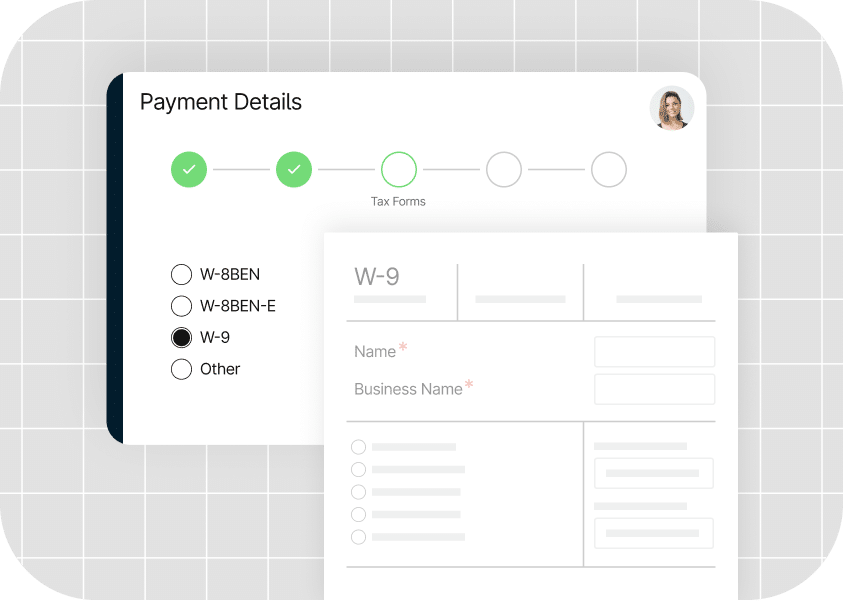

4. Is Compliance an Integrated Feature or an Afterthought?

Compliance cannot be a separate, manual data entry process. It must be woven directly into the fabric of the platform. Inquire about their process for managing global supplier tax compliance.

Does the platform streamline and automate the collection and validation of W-9 and W-8 series forms during vendor onboarding? A system that places the burden of tax compliance entirely on your team is offloading one of the highest-risk parts of the AP process.

5. Does the System Manage the Entire End-to-End Process?

Finally, you need to confirm the AP platform’s scope. Many solutions are excellent at capturing and approving invoices, but effectively abandon you at the most critical moment: payment.

Ask them directly: Does your platform manage the entire lifecycle, from invoice intake all the way through to payment execution and reconciliation? A solution that doesn’t finish the job only solves half the problem.

How Tipalti Powers Modern, Scalable Finance Teams

Understanding the essential features is one thing. Seeing how they come together in a single, unified system is another. The Tipalti platform was built from the ground up to be the command center for the entire accounts payable operation, designed specifically to address the challenges of high-growth, global companies.

End-to-end global payables

We believe in providing a truly end-to-end global payables solution. From the moment an invoice is received, our AI-driven data capture and approval workflows manage the process. But critically, the platform doesn’t stop there.

It handles the final, complex mile of executing timely payments to 196 countries in 120 currencies, using a network of payment rails that includes local bank transfers to ensure speed and reduce costs. The process is only complete when that payment is automatically reconciled back to your ERP.

Built-in compliance and tax automation

Embedded within this workflow is a powerful engine for built-in compliance and tax automation. The platform not only reminds you about tax forms, but also automates their collection and validation.

The self-service supplier portal intelligently presents the correct digital tax forms (W-9, W-8 series, etc.) to your vendors during onboarding, validating their submissions against government databases. This reduces your compliance risk before you even process the first invoice.

Multi-entity support

This global capability is supported by a true multi-entity architecture. For companies managing multiple subsidiaries, Tipalti allows for the complete segregation of financial controls and workflows by legal entity.

This is all accomplished while providing a consolidated, real-time view at the parent level, balancing local autonomy with centralized oversight.

AI-driven efficiency

The entire system is infused with AI-driven efficiency. This moves beyond basic automation to include an Intelligent Document Processing engine for accurate data capture, AI-powered fraud detection that identifies suspicious patterns, and smart logic that learns from your team to continuously improve.

Seamless ERP integrations

Finally, none of this works without a deep, reliable connection to your financial core. Tipalti offers seamless, bi-directional ERP integrations with platforms like NetSuite and Sage Intacct.

This API-first approach ensures your AP system and your general ledger are always in perfect sync, transforming accounts payable from a transactional back-office function into a strategic pillar of your financial operations.

Future-Proofing Your Payables with the Right Tools

Imagine looking back a year from now. You won’t just be processing invoices faster—you will have built a resilient financial operation, one that provides a real-time, trustworthy view of your company’s cash flow and risk.

The right AP automation software allows finance leaders to realize the full benefits of AP automation, elevating accounts payable from a simple calculator that processes transactions into the command center of your company’s financial nervous system.

This transformation is no longer just an ambition. With Gartner predicting that by 2026, over 90% of all finance teams will have an AI automated solution, it has become a mandate. It’s time to build the function that can meet that challenge.