If you’re looking for Deel competitors, you’re likely weighing global payroll tools against scalable mass payment solutions for contractors. This guide breaks down the top options—especially for businesses managing high-volume contractor payouts—so you can choose the platform that best fits your global payment needs.

5 Signs You’ve Outgrown Deel or Any Basic Mass Payments Tool

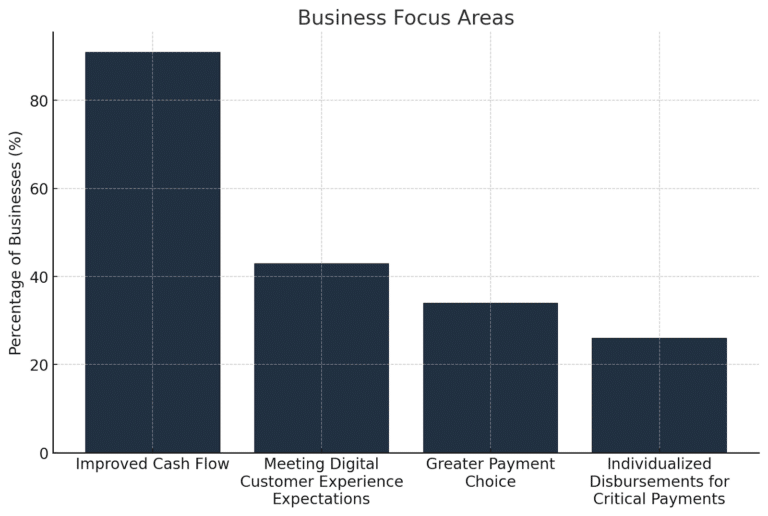

As your business grows, so do the demands of managing global and contractor payments. Businesses today view improving cash flow, offering flexible payment options, and optimizing the payee experience as keys to success.

If your current mass payments tool isn’t helping you achieve these goals, it may be time to consider an upgrade.

The key mass payment focus areas for businesses

Here are five signs it’s time to upgrade from Deel or any basic mass payments solution:

- Too much manual work: Bottlenecks from disconnected systems and a lack of automation.

- Specialized needs: Industries such as AdTech, the Creator Economy, and marketplaces require tailored workflows.

- Payee frustration: Errors and limited payout options damage growth and trust.

- Global expansion limited: Weak currency and tax support block scaling.

- No visibility: Lack of real-time insights delays decisions.

What to Look for in a Scalable Mass Payments Solution

Prioritizing these capabilities helps you avoid the common pitfalls of basic mass payment platforms and choose a solution built for high-volume, cross-border payout operations.

- Automated end-to-end global payables

- Built-in global tax and regulatory compliance

- Multi-entity and multi-currency support

- AI-driven invoice and payment data capture

- Self-service vendor onboarding with KYC/AML validation

- Deep ERP and accounting software integrations

Pro Tip: For a deeper look at global payment methods and what matters most in a scalable payout solution, explore our Global Payment Method Guide.

Top Deel Competitors to Consider

We’ve rounded up the top Deel alternatives to consider for different use cases.

- Tipalti: Best for global mass payment automation

- Payoneer: Best for debit cards with a high spending limit

- Wise: Best for real-time FX conversion

- Stripe: Best for e-commerce and third-party payments

- Hyperwallet: Best for batch payments

Comparison: Deel vs Other Competitors

| Feature | Deel | Tipalti | Payoneer | Wise | Stripe | Hyperwallet |

|---|---|---|---|---|---|---|

| Payee Management | Basic bran ding & bank verification | Branded portal, AML/OFAC, high-risk screening, comms, fee splitting | Logo only, no comms or fee split | Minimal validation | Dev resources needed, Stripe Identity verification | Limited, no validation or comms |

| Tax Compliance | ❌ Collection only | KPMG-approved engine, collection, withholding, prep | Outsourced withholding | ❌ No compliance | ❌ Third-party form collection | ❌ Basic W-9 focus |

| Global Remittance | 150 countries, 23 currencies | 200+ countries, 120 currencies, 50 methods | 190 countries, 70 currencies | 70 countries, 50+ currencies | 50 countries, 135 currencies | 115 countries, 24 currencies |

| Fraud Prevention | ❌ None | AML/OFAC + region-specific screening | Past OFAC violations | AML checks only | Strong verification | Limited onboarding checks |

| FX Solutions | 20 currencies, no FX | 30+ currencies, payer & payee FX | 30 currencies, no FX | 40+ currencies, payer & payee FX | ❌ No intercompany FX | 20 currencies, payer & payee FX |

| Integrations | NetSuite, QBO, Xero | All major ERPs + API | Xero, QBO only | QBO, Xero, NetSuite, Sage | Strong APIs, limited ERPs | Xero, QBO, Zoho |

| Self-Billing | Partial | Automated invoices & approvals | ❌ | ❌ | ❌ | ❌ |

| Multi-Entity Support | ❌ | Unified dashboard, entity-specific flows | ❌ | Group funds only | Shared API key | Multiple programs but limited |

1) Tipalti: Built for High-Volume, Global Mass Payments

Tipalti is an award-winning global mass payments and compliance solution for businesses across industries.

In addition to automating global mass payments, the platform has robust tax compliance and fraud prevention capabilities. The all-in-one platform supports companies with multiple subsidiaries, offering a range of features including entity-specific tax compliance, local accounts, and FX hedging.

Top Features

- Scalable global payments in 120+ local currencies across 200+ countries via 50+ payment methods

- Branded self-service payee experience

- Proactive payment status communication

- Tipalti Detect® and robust financial controls to prevent fraud

- Built-in tax and regulatory compliance

Serviceable Market

Tipalti serves businesses of all sizes, from small businesses to enterprises in industries like SaaS, digital marketplaces, e-commerce, and media. It’s the right choice for companies looking for a fast and secure way to manage a high volume of global payments.

Strengths

- Global mass payments with entity-specific tax compliance

- Corporate cards with user-friendly spend controls

- Pre-built connectors to ERPs, performance marketing platforms, and other popular tech stack

- Detailed audit trails and rich payment insights

- Advanced FX solutions

Pricing

Tipalti offers two pricing plans for mass payments:

Accelerate

- Customizable, embeddable payee self-onboarding

- W9/W8 collection and TIN validation

- 50+ payment methods to 200+ countries in +120 currencies

- Two-way API sync with leading performance tracking software and ERPs

- Global multi-entity and multi-currency infrastructure

- Option to add Expenses

Plus

- Access to Tipalti Developer Hub and APIs

- Option to add AP, Procurement, Expenses, and Card

- Includes all Accelerate features

- Tipalti Detect® risk module for fraud monitoring

- Self-billing with payee approvals

Experience Seamless, Scalable Mass Payments with Tipalti

How Other Deel Competitors Stack Up

2) Payoneer

As a global payment platform, Payoneer helps freelancers, businesses, and marketplaces send and receive payments. The platform also offers global HR solutions, such as Employer of Record (EOR) services and employee benefits management.

While there are some useful features, such as a mobile app, virtual bank accounts, and an invoice generator, users have faced issues with slow customer service, transfer delays, and inadequate payment security.

Top Features

- Accounts in USD, EUR, GBP, and more

- Free invoice generator

- Connects with 2000 marketplaces, freelance, and seller platforms

- Mass Payouts to make up to 500 payments at once

- Payoneer Commercial Mastercard with spend limits

Serviceable Market

Payoneer operates in over 190 countries and is ideal for freelancers, online sellers, digital marketers, and service providers.

Strengths

- Target exchange rate feature for withdrawal

- Multiple bank accounts in the same currency

- Easy withdrawals to local bank accounts

- Robust APIs for integrations

Pricing

Payoneer charges 3.20% + $0.49 for credit card and 1% for ACH payment in the US. A 3% transaction fee applies when withdrawing from a different currency to the local currency.

Payoneer’s FX fee is 3.5% while an annual charge of $29.95 applies to accounts that receive less than $2,000 over twelve months.

3) Wise

Formerly known as Transferwise, Wise facilitates international money transfers. Compared to most other Deel competitors listed here, Wise is more cost-effective for large transfers as it charges a fixed fee for payments and a real-time exchange rate.

Businesses can open a multi-currency account to send and receive payments to clients and staff in local currencies.

Top Features

- International payments in 70 countries

- Physical and virtual business debit card with spend controls

- Batch payment feature to send up to 1000 payments

- Expense tracking and API integration

Serviceable Market

Wise caters to freelancers, contractors, and small—to midsize companies that work with vendors and employees worldwide.

Strengths

- Transparent pricing with no hidden fees

- Mid-market FX rates

- Auto convert feature

- Fast and reliable transfers

Pricing

Businesses need to pay a one-time fee of $31 to set up local bank accounts to receive payments in 23 currencies. The platform charges a percentage of the transaction for sending payments based on the currency and amount, with volume discounts for higher amounts. FX fees for Wise range from 0.35% to 1.5% (it will vary by currency).

Automate mass payments to 200+ countries in 120 currencies with built-in compliance, flexible payout options, and real-time tracking.

4) Stripe

Founded in 2010, Stripe facilitates online and in-person payments for businesses of all sizes. The platform offers a range of developer tools, making it a suitable choice for marketplaces and tech companies.

Companies can create a custom package tailored to their specific needs, ranging from simple payments and international transactions to recurring billing and embedded payment components.

Top Features

- Online and in-person payment processing

- Global payouts to 50+ countries

- Invoicing and billing management

- Stripe Connect for managing third-party payments

- Stripe Radar for fraud prevention

Serviceable Market

Stripe primarily caters to e-commerce, SaaS, marketplaces, and enterprise-level companies.

Strengths

- Powerful APIs for integrations

- Scalable for organizations at any stage

- Built-in tools for improving payment acceptance rates

- Deep integration capabilities for online payments

- Local and global payment methods

Pricing

Stripe charges 2.9% + 30¢ per transaction (domestic payments using cards) and 0.8% for ACH direct debit. The platform charges 1.5% of the payout volume for Instant Payouts. Additional fees apply for other features, such as Radar, dispute prevention, invoice, and a custom domain.

Global payouts carry a fixed charge of $1.50 per payout plus a cross-border fee of 0.25-1.25%, and an FX fee of 1% of the amount for US senders.

5) Hyperwallet

Hyperwallet, a PayPal service, supports mass payouts in 115 countries and territories. In addition to nine payment methods, Hyperwallet offers features like payment tracking, compliance, and detailed reporting.

Top Features

- Payouts in 24 currencies and nine payment methods

- Mass payments (up to 5000 payments with PayPal Payout Web)

- Compliance and tax reporting with KYC and AML checks

- Virtual and physical prepaid cards

- Detailed reports (payee, reconciliation, tax)

Serviceable Market

Like other Deel competitors we’ve discussed, Hyperwallet is ideal for businesses in the gig economy, marketplaces, or affiliate networks that require large-scale global payouts.

Strengths

- Embedded and white-labelled payout environments

- Payment tracking technology

- Compliance and security protocols (SOC 2 compliance, encryption, SSO)

- REST API for deep integration

Pricing

Hyperwallet’s website does not list the pricing for making or receiving payments. However, for batch payments, PayPal Payout’s fees will apply. PayPal charges 2% of the transaction amount for domestic and international PayPal payouts.

Currency exchange fees range from 2.5% to 3.5%, depending on the currency. In some cases, there are setup or maintenance fees.

Tipalti vs Deel: Which Solution Is Best for Your Business?

Choosing between Tipalti and Deel comes down to your company’s priorities. Tipalti is designed for organizations that require robust, scalable solutions for global mass payments and financial workflow automation. Deel, on the other hand, is designed to simplify international hiring, payroll, and workforce compliance.

When to Choose Tipalti

Your business needs an efficient global mass payments solution.

Choose Tipalti if your business requires a robust mass payments platform that can handle a high volume of global transactions. With its support for multiple countries, currencies, and over 50 different payment methods, Tipalti scores over most Deel competitors.

You need to streamline and integrate financial workflow automation to improve efficiency.

Do you need more than mass payments? Tipalti’s end-to-end solution offers mass payments and integrated tools for procurement, expense management, supplier onboarding, tax compliance, and more in a single, cohesive platform.

This enhances operational efficiency and strengthens financial controls.

You need to streamline and integrate financial workflow automation to improve efficiency.

Do you need more than mass payments? Tipalti’s end-to-end solution offers mass payments and integrated tools for procurement, expense management, supplier onboarding, tax compliance, and more in a single, cohesive platform.

This enhances operational efficiency and strengthens financial controls.

You require comprehensive, global payment compliance.

If your organization needs to comply with international payment regulations, Tipalti provides strong compliance capabilities. These include managing tax documentation and ensuring adherence to global financial regulations.

Trusted by Finance Leaders. Backed by Industry Awards.

Users rate Tipalti highly for its ease of use, customer support, and high impact on operational efficiency. The brand has received awards and recognition in categories like global payments, AP automation, and financial operations.

These awards reflect the trust high-growth SMBs and enterprise companies place in Tipalti.

When to Choose Deel

Your business needs help with international hiring and payroll.

Deel is a great option if your business is focused on growing a global workforce and requires automated HR solutions. Deel’s strengths lie in hiring and managing payroll for international employees and contractors, which helps to ensure compliance with local regulations.

You seek localized employment compliance.

If your business needs help understanding and complying with global employment laws, Deel may be the answer. Its localized compliance support helps reduce legal risks associated with international hiring.

Your business requires help with talent management

Deel has tools to support bias-free performance appraisals, career development, learning, and benefits planning. Deel Engage integrates with Slack and HRIS to simplify talent management from a single, centralized location.

Final Thoughts: Why Growing Companies Choose Tipalti Over Deel

Despite the availability of mass payment tools, 80% of small businesses report facing challenges in sending and receiving payments, including slow payment systems and high processing fees.

This highlights the importance of selecting the right payment tool with end-to-end automation capabilities. While Deel is best suited for payroll and HR management, Tipalti’s core strength is global mass payment automation.

With its connected AP, supplier management, and procurement suite, you can minimize manual work, boost productivity, and optimize your return on investment.

Ready to switch from Deel? Simplify mass payments at scale

See how Tipalti helps you automate global payouts, streamline compliance, and deliver a seamless experience to payees—no matter how fast you grow.