Businesses with accounts payable automation software for invoice management and processing can reduce costs, better analyze spending, minimize fraud and errors, maximize early payment discounts, and strengthen supplier relationships through timely payments and effective communication.

Modern AP automation and global payments software for invoice management replaces manual paper invoice processing with streamlined and efficient electronic invoice processing, including validation, approval, and simple global invoice payment and reconciliation.

Improve the efficiency of your business invoice capture, payables, and payment processes with this guide to optimizing invoice management.

Key Takeaways

- Invoice management for accounts payable involves processing invoices from receipt through payment and reconciliation.

- The invoice management process consists of steps for receiving, verifying, and matching invoices, followed by approval and payment.

- Streamlining invoice processing with automation is important for gaining supply chain flexibility, reducing costs, and efficiently paying global suppliers.

What is Invoice Management?

Invoice management is the process of processing invoices from receipt to payment. It spans invoice receiving and storage, validating suppliers and invoice amounts for goods or services ordered and received, approving invoices for payment, paying invoices, and recording and reconciling transactions.

Invoice management for accounts payable, also known as invoice processing, encompasses all business processes from receiving the supplier invoice to paying it within the invoice-to-pay cycle and reconciling payments.

Steps in the Invoice Management Process

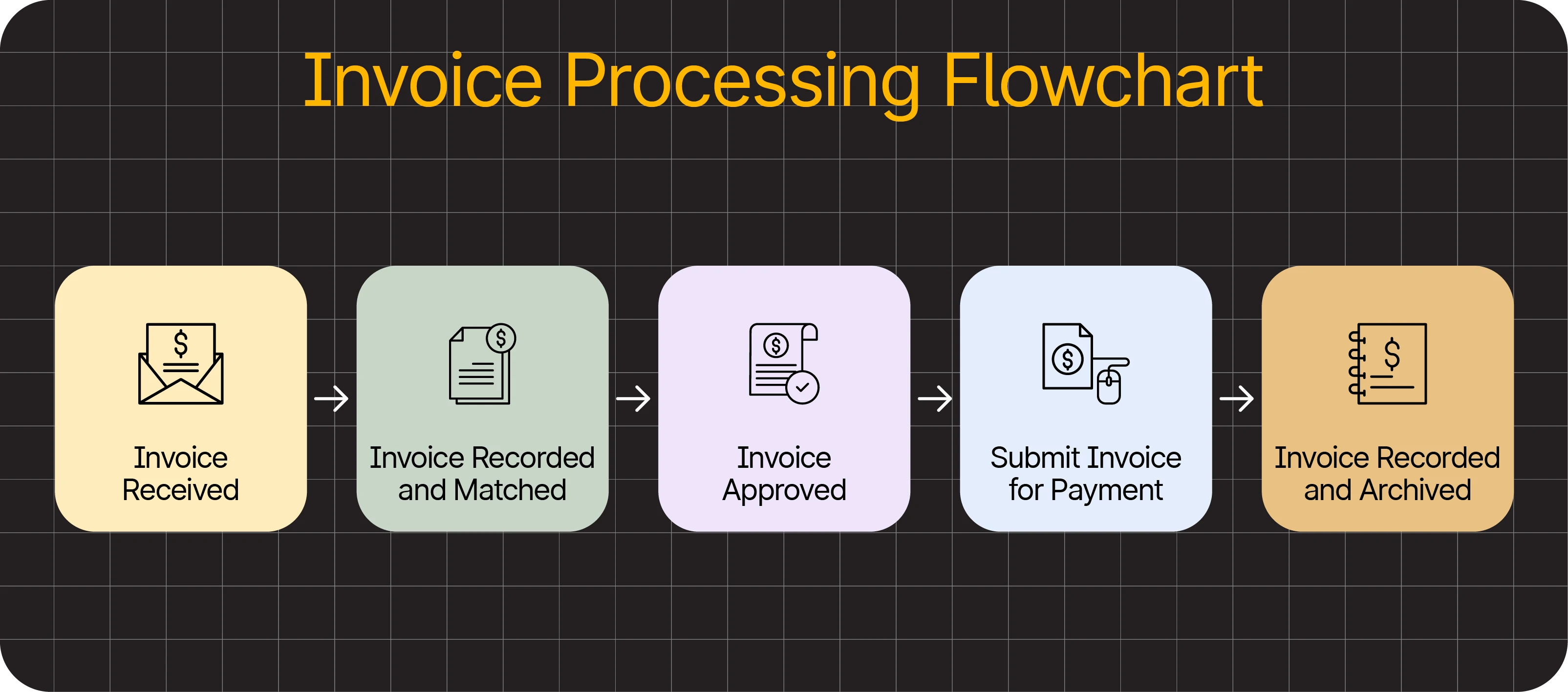

Key steps in invoice management/invoice processing are:

1. Receive invoice

2. Record and match the invoice

3. Approve the invoice

4. Submit the invoice for payment and processing

5. Record payment and archive the invoice

1. Receive Invoice

Businesses receive invoices from their suppliers and process them manually as paper invoices or efficiently capture digital invoice data by headings and line items through AI/ML-driven OCR scanning and invoice data extraction from emailed or uploaded documents.

2. Record and Match Invoice

Before recording invoices, the accounts payable staff or AP automation software verifies the accuracy of invoices, including totals, and identifies potential duplicate invoices and fraudulent vendors. Human errors can occur in the prevention of fraud and the detection of errors. AP automation software is more effective at detecting fraud and errors through supplier validation and rules-based error-checking, which can result in flagged exceptions that require investigation.

The payables staff or AP automation software records and matches invoices in 3-way matching with the purchase order (PO) and receiving report (GRN-goods received note) or 2-way purchase order matching with the related invoice. With manual recording, the accounts payable team uses manual data entry to record and code invoices. AP automation uses AI to automate invoice coding.

3. Approve Invoice

In manual approval processes, the payables staff routes the invoice, supporting PO, and receiving documents to the appropriate approver(s). AP automation automatically matches invoice data with purchase order and receiving data, allowing approved tolerances in the automated matching process. Invoices may be approved or rejected for payment by the designated approvers.

4. Submit Invoice for Payment and Processing

Companies select Invoices for batch payments based on the due dates and cash availability. AP automation software indicates cash requirements for payables, which assists in cash forecasting and determining required financing amounts.

Businesses and nonprofit organizations using traditional manual systems often rely on inefficient and fraud-prone paper checks for making supplier payments. Their CFOs or controllers may spend too much time arranging global payments through expensive wire transfers. The payment process cannot happen remotely.

AP automation software enables payers to utilize more electronic fund transfer (EFT) payment methods, simplifying global payments in multiple local currencies across numerous countries.

5. Record Payment and Archive Invoice

When the accounts payable staff runs a batch payment, the ERP or accounting software system records the payments. AP automation software automatically records payments.

With manual paper-based systems, current-year paper invoices are filed in alphabetical order in file cabinets. Prior-year paper invoices are boxed and stored in off-site warehouses. Optionally, some companies scan paper invoices to archive them, which is a time-consuming process.

AP automation (or mass payments software for payouts) maintains digital invoice data, which can be archived electronically in the system, saving money.

Common Challenges of Manual Invoice Management

With slow manual invoice processing, the accounts payable department spends unnecessary time:

- Chasing down missing or lost paper invoices, POs, and receiving reports

- Manually recalculating and correcting invoice data to verify accuracy

- Managing labor-intensive approval workflows that delay processing and require constant follow-up

- Absorbing high time and staffing costs due to inefficient invoice handling and verification

- Missing early payment discounts because of slow processing

- Manually printing checks, stuffing envelopes, and mailing payments to multiple vendors

- Repairing strained supplier relationships and managing shipment delays caused by late payments

- Tracking down lost paper records from off-site storage issues, fire, or misplacement

- Rebuilding broken audit trails and retrieving missing documentation for financial reporting and tax compliance

Traditional invoice management processes performed by the payable team are too expensive. Human error can result in duplicate invoice payments, paying fraudulent invoices, paying the incorrect amount, or getting IRS TIN numbers wrong, resulting in IRS 1099 penalties. For 1099 tax compliance, small businesses with outdated systems may be using inefficient Google or Excel spreadsheets to track supplier payments. Bottlenecks and excessive communications are frustrating for an AP team that relies solely on manual processes.

Curious about how much money your business might be losing from inefficient invoice processing? Get an estimate with Tipalti’s invoice processing and payment calculator.

If manual invoice processes are broken and not just really slow, your unpaid vendors/suppliers may decide to stop making new inventory shipments to your business until the bills that are due are paid. Significantly late payments not only negatively impact supplier relationships, but they will also hurt your customer relationships if customer orders can’t be shipped on time when raw materials or finished goods inventory is out of stock.

Why Effective Invoice Management is More Important Than Ever

Although supplier invoice management is always essential, companies need to gain efficiencies, onboard new suppliers, and reduce costs immediately. AP automation helps global businesses more easily achieve these goals.

Effective invoice management is important for:

- Enhancing flexibility

- Providing scalability

- Improving the efficiency of complex global business processes

- Lowering costs with digitization and automation

- Enabling real-time spend visibility

- Reducing fraud and errors

- Improving cash flow forecasting

- Efficiently achieving tax and global regulatory compliance

- Creating an audit trail

- Strengthening supplier relationships and communications

The invoice management process is important because it streamlines invoice processing and payment and creates an audit trail. Automated invoice management reduces fraud, duplicate payments, and other errors. Invoice management involves receiving and verifying invoices, matching digital invoice documents with purchase orders and receiving documents, and approving and paying invoices. It provides exception notifications and payment status communications.

Global Growth Environment

With growing tariff uncertainty and announced trade barriers, effective invoice management and supply chain impact management, including shifting and onboarding geographic suppliers, are essential. Complex global business processes also make effective invoice management and invoice processing important.

The World Bank Group’s Global Economic Prospects report dated June 2025 indicates these global growth rates in challenging times:

Against this backdrop, global growth is set to slow this year [2025], to 2.3 percent—substantially weaker than previously projected amid the impact of higher trade barriers, elevated uncertainty, increased financial volatility, and weakened confidence. Thereafter, growth is forecast to firm to about 2.5 percent over 2026-27, as trade flows continue adjusting to higher tariffs such that global trade edges up, while policy uncertainty moderates from record-high levels.

1. Enhancing Flexibility

With effective invoice management, your global business can quickly onboard new suppliers using self-service options in multiple languages. This flexibility includes proactively changing your supply chain to a supplier base in a different country to reduce tariff rates.

2. Providing Scalability

As your business experiences global growth and acquires other companies through M&A, scalable AP automation software lets it handle payables with more complex, multi-entity, and multinational structures and process a higher volume of invoices with reduced hiring needs.

3. Improving the Efficiency of Complex Global Business Processes

Effective invoice management, combined with AP automation and advanced foreign exchange software, enables more efficient global business processes.

Global issues include regulatory compliance and payments to various countries. Using cost-effective currency conversion and electronic payment methods is essential. Businesses should consider hedging payables for foreign currency fluctuations.

4. Lowering Costs with Digitization and Automation

Digitization and AP automation will lower costs for businesses and non-profit organizations. The cost reductions include staff time required for processing payables and additional early payment discounts that can be earned through timely supplier invoice processing.

The cost of manual invoice processing and payment averages $12 per invoice, although this invoice management cost can range from $5 to $15-$20 per invoice (or more with increasing compensation rates). AP automation substantially reduces invoice processing costs.

Tipalti provides an invoice processing and payment calculator. Use it to calculate the estimated invoice processing cost for your business before switching to Tipalti AP automation software. The Tipalti invoice processing cost calculator takes into account your company’s average salary rate for payables processing (including account reconciliation), the number of invoices processed, and some key performance metrics.

5. Enabling Real-Time Spend Visibility

Your invoice management system must provide near real-time visibility into business spend by category, enabling users to determine the actual amount spent and identify opportunities to reduce costs through informed decision-making. AI tools can help your business analyze spending patterns and provide business intelligence.

6. Reducing Fraud and Errors

An automated invoice management system includes supplier validation tools to reduce fraud and thousands of payment rules to detect and trigger exceptions that identify potential errors.

7. Improving Cash Flow Forecasting

AP automation software for payables invoice management provides real-time insights into cash flow requirements for paying batches and the amount of outstanding payables by due date. This information can be used to improve cash flow forecasting. Without AP automation, invoice recording may be delayed, resulting in your company having less insight into actual payable amounts due.

8. Efficiently Achieving Tax and Global Regulatory Compliance

Supplier tax compliance becomes more efficient with AP automation. Through the supplier onboarding process, global suppliers submit W-9 or W-8 forms data before receiving the first payment. Therefore, your staff doesn’t need to spend time chasing down these forms at year-end to submit 1099s after the calendar year-end. AP automation also provides easy tax preparation reports and may offer optional integrated e-filing methods.

Global regulatory compliance includes screening against sanctions blacklists and enforcing other payment rules unique to different countries. When global regulatory compliance is automated, businesses can easily fulfill their compliance obligations.

9. Creating an Audit Trail

AP automation software creates a real-time audit trail that is useful for security, internal control, and auditors.

10. Strengthening Supplier Relationships and Communications

To strengthen supplier relationships, AP automation enables businesses to make timely payments to suppliers in the supplier’s preferred local currency and cost-effective payment method. As part of the communications process, suppliers can view automated payment status and receive payment notifications, allowing them to manage their cash flow more effectively and improve cash forecasting.

How Invoice Management Has Evolved

Supplier invoice management has evolved through invoice digitization, AP automation, and extended global reach.

Invoice Digitization

Invoice digitization through OCR (optical character recognition) and AI-driven invoice capture structures invoice data by headings and line items. This digitized invoice information is used for invoice verification, three-way or two-way matching with the purchase order and receiving data, approval routing, batch payments, data syncing, and instant payment reconciliation with the ERP or accounting software.

Suppliers may submit invoice data via email or e-invoicing in accepted formats, such as PDF files, through portal uploads, EDI systems, or scanning with OCR technology. E-invoicing for accounts payable involves vendors or suppliers using invoicing software to send digital invoices to customers rather than paper-based invoices.

Automation

AP and invoice processing automation eliminates paper-based invoices and manual processes. Invoice management through AP automation leverages artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA) to automate routine tasks.

AP automation can apply thousands of algorithmic rules to detect potential invoice errors and flag exceptions. Automation spans end-to-end payables processes, from self-service supplier onboarding guidance to invoice capture and invoice processing, including verification, approval routing, and global payments execution.

Extended Global Reach

Invoice management and processing encompass domestic and international invoices in various languages and currencies, which often require foreign exchange (FX) currency conversion for global payments in different local currencies. Businesses may also choose solutions for hedging foreign currency fluctuations in accounts payable invoices between the payment date and the due date.

Compare Manual vs. Automated Invoicing Steps

| Step | Manual | Automated |

|---|---|---|

| Receiving | Paper/email invoices filed by hand | Data auto-extracted via OCR |

| Verification | Totals checked manually, errors missed | AI flags errors and validates suppliers |

| Data Entry | Manually keyed into ERP | Auto-coded and synced to ERP |

| PO Matching | Manual 2-/3-way paper matching | Automated digital matching with rules |

| Approvals | Routed by email or hand, often delayed | Auto-routed with approval workflows |

| Follow-ups | Staff chases missing docs/approvals | Alerts and centralized access reduce delays |

| Payment Status | Frequent supplier calls for updates | Status auto-notified or viewable via portal |

| Payments | Paper checks or manual wires | Electronic payments in local currencies |

| Reconciliation | Spreadsheet-based, time-consuming | Auto-synced, instant reconciliation |

| Archiving | Filed in cabinets or off-site boxes | Secure, searchable digital archive |

Powering Smarter Invoice Management Through AP Automation

Using AP automation and mass payments software for payouts as an invoice management platform is a solution that:

- Provides time and cost-saving benefits from the automated AP process, guided invoice approval process, and payment process

- Strengthens financial controls and enterprise risk management

- Improves tax and global regulatory compliance

- Improves visibility of payables processes and supplier payments

Tipalti Integrations

Tipalti software is cloud-based. The Tipalti SaaS add-on app is connected to your ERP system or accounting software through API or flat-file integration. Tipalti integrates with most accounting and ERP systems, including Sage Intacct, some Sage ERPs, QuickBooks, Xero, NetSuite, Acumatica, Microsoft Dynamics 365, SAP S/4HANA, and SAP Business One.

Benefits of Using Tipalti Payables Automation

With Tipalti AP automation software, your company and AP department will operate leaner and achieve better results. Your finance, accounting, and AP teams can spend more time on other projects that add value to the business.

Results from using Tipalti AP automation software features for automated invoice processing are:

- End bottlenecks by streamlining AP, invoice automation, and payment processes

- Replace time-wasting manual workflow with efficient automation to reduce payables processing time by 80%

- Reduce errors by 66% and mitigate fraud risk

- Automatically achieve global regulatory compliance

- Get IRS 1099 reporting or optionally eFile 1099s using partnered software with 12 calendar months of Tipalti payments data

- Simplify global payments, use FX options, and increase payment method and currency choices with Tipalti AP automation and mass payments software

- Automate payment reconciliations to accounting systems for large batches in real-time

- Gain real-time multi-entity and consolidated company visibility into payables and metrics

Tipalti AP automation software lets your business complete the invoice management process in time to take valuable early payment discounts, substantially reducing the cost of purchases. Although Tipalti calls its software AP automation and mass payments, you can think of it as automated invoice management software. To add purchase order management automation (part of the procure-to-pay cycle), you can select the Tipalti Procurement SaaS software product.

Tipalti AP automation software offers suppliers and other onboarded payees a choice of over 50 payment methods and 120 local currencies for receiving payments in 200 countries.

Tipalti Advanced FX Solutions

Other Tipalti finance automation products include advanced global currency solutions, Multi-FX, and Tipalti Hedging for payables. Multi-FX enables your company to make global payments for payables across all subsidiaries through a centralized virtual payment account, utilizing 30 supported currencies without the need to establish a regional international banking network.

Case Study: Zola Automates 600K+ Invoices a Year Using Tipalti

Zola, an e-commerce wedding registry and planning company using Sage Intacct accounting software integrated with Tipalti AP automation, has been a Tipalti customer since 2018. Zola achieved invoice processing optimization and efficiency, reduced hiring needs with Tipalti automation software scalability, and kept suppliers happy with a choice of payment methods and timely payments.

According to the Tipalti customer story, “EDI can contain hundreds or thousands of invoices at a time, and when Zola’s vendors submit invoices using this method, they’re read and processed automatically with Tipalti.” Tipalti AP automation also accepts invoices via email or upload.

Last year, we processed more than 600,000 invoices. And this year, volumes are increasing, so being able to keep up with this workload without adding headcount was the need of the business. We needed to build a scalable infrastructure to avoid having to hire a large AP staff.

Shayon Donaldson, Accounts Payable Manager, Zola

How to Start Future-Proofing Your Invoice Management

By adopting digitization and add-on payables automation software, your business can digitally transform for the future, cutting its invoice management processing costs for payables, reducing fraud and errors, and improving its near real-time visibility and cost structure.

Automate Invoice Management. Cut Costs by Up to 80%.

See how Tipalti helps you automate the entire invoice management process, from capture and matching to global payment execution.