Multinational buyers are diversifying suppliers in numerous countries, causing global supply chains to stretch. SMEs are under an inordinate amount of pressure to unlock the working capital trapped in their supply chains. The result is a win-win for all parties involved.

The buyer optimizes working capital and the seller generates extra cash flow. This process is known as supply chain finance (SCF) and it minimizes the risk of global trade, speeds up the supply chain, accelerates invoice processing, and future-proofs your business.

In this article, we’ll take a deeper dive into how supply chain finance works, examples, key benefits, and the SCF brands at the top of the market.

What is Supply Chain Finance (SCF)?

Supply chain finance is a type of supplier finance that allows a supplier to cash in their receivables (invoices) earlier than the due date; thus freeing up working capital. It’s a beneficial process for both the buyer and supplier that accelerates cash flow and optimizes working capital. While buyers get more time to pay off their balances, suppliers gain quicker access to the money they are owed. The extra cash on hand can then be used to fund other projects and keep the business running smoothly.

Unlike other receivables finance strategies, like invoice factoring, supply chain finance is established by the buyer (instead of the supplier). Another main difference is that suppliers can access SCF at a cost based on the buyer’s credit rating (rather than their own). As a result, suppliers are usually able to receive supply chain finance at a lower cost than other financial services.

At times, the term “supply chain finance” is used generically to describe a broader range of supplier financing solutions. This is for things like dynamic discounting, in which a buyer funds the program by allowing suppliers access to early payment in invoices in exchange for a discount. The term for this process is more commonly referred to as reverse factoring.

How Supply Chain Finance Works

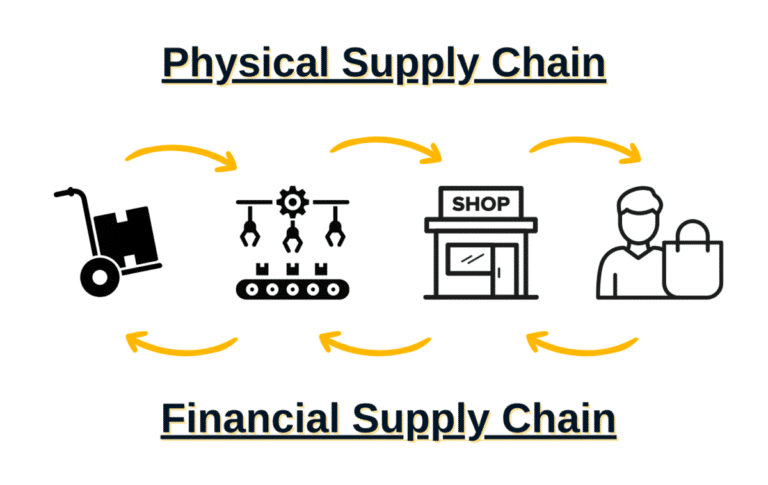

Supply chain finance works through a mutual collaboration between buyers and sellers, which counters the competitive dynamic that typically defines the relationship. Traditionally, buyers will attempt to delay payment, while sellers always want to speed it up.

SCF works best when the buyer has a better credit rating than the seller, and can source capital from a bank or other financing options at a lower cost. This allows buyers to negotiate better terms from the seller, like extended payment schedules. Meanwhile, the seller is able to unload product faster, while receiving immediate payment from the third-party financing body.

Once a buyer has entered into an agreement with a supply chain finance provider, they will then invite suppliers to the program. While some supply chain finance programs are funded by a single bank or other finance provider, other programs are supported on a multi-funder basis through a dedicated platform.

Supply Chain Finance Process

Buyers who implement supply chain finance programs will need to make sure SCF is classified as an on-balance sheet arrangement, rather than a bank debt. The typical SCF process goes something like this:

- The buyer finds a bank or other financial institution (sometimes multiple lenders) that agrees to fund the initiative.

- The purchaser looks through outstanding invoices and chooses suppliers to approve early payment. The buyer then posts this to an SCF system.

- The supplier registers for the program and can log in to view these approved invoices. It chooses the ones for which it would like to receive payment early.

- The supplier pays a financing or transaction fee and the money is released to their account.

- The purchaser pays back the lender at a later date (after the initial invoice due date), depending on the terms of the loan. The buyer pays the supplier directly by the due date for anything that wasn’t paid early.

While buyers traditionally onboard their 30-50 biggest suppliers, tech-led solutions allow businesses to offer supply chain finance to hundreds (if not thousands) of suppliers across a global supply chain. This is made possible through user-friendly software programs which make it simple to onboard large numbers of suppliers with minimal effort and zero need for paper-based financial documents.

How do you diversify revenue streams without complicating accounting?

There are many ways to scale payables for multi-entity companies.

Example of Supply Chain Finance in Action

An example of extended payables finance is as follows:

A buyer from Company A purchases goods from Supplier B. Under usual circumstances, Supplier B ships the product then submits an invoice to Company A.

Company A then approves the payment based on the standard terms of 30 days. But, if Supplier B is in need of cash, they may be looking for immediate payment (rather than waiting 30 days).

In this case, they have to offer Company A an incentive to pay early, which is typically in the form of an early payment discount. Company A may then choose to use its affiliated bank to fund the transaction.

If this is granted, the bank will issue payment to Supplier B immediately, while simultaneously extending the payment period for Company A an additional 30 days. This allows for total credit terms of 60 days, rather than the 30 days mandated by the supplier contract.

This is a mutually beneficial situation for all parties involved. The buyer gets to hold on to their working capital a little longer without hurting the supplier relationship. The supplier gets paid immediately, giving them more working capital management of their own. The bank also benefits, by collecting interest.

Benefits of Supply Chain Finance

If your company is trying to improve its cash conversion cycle, you may want to consider putting suppliers on extended payment terms. However, this may negatively impact suppliers, which is where supply chain finance comes in.

SCF mitigates the negative impacts by providing suppliers access to accelerated payments on open invoices. Thus, the buyer is able to optimize working capital through strategic sourcing, while the supplier improves their cash flow. This, in turn, minimizes risk and maximizes supply chain sustainability. Additional benefits of supply chain finance include:

For Buyers

When optimizing working capital, supply chain finance is invaluable for buyers. Here are a few of the advantages specific to procurement:

Improves Supply Chain Health

By offering suppliers easy SFC, buyers can reduce the likelihood of future disruption that could affect their own operations. When working with global companies, it’s not unheard of for a supplier to go down without warning. This can throw a wrench in the operations of customers who are counting on them for upcoming deliveries.

Finding a replacement is much easier said than done, especially at a time when everyone, from small businesses to Fortune 500’s, is facing issues getting what they need. Supply chain finance is designed to give these partners money when they need it, thus keeping them afloat in tough times, reducing the risk inherent in global networks, and facilitating spend management.

Optimize Working Capital

Buyers will improve their working capital position with SCF strategies, as many companies choose to implement supply chain finance strategy programs in tandem with an initiative to harmonize payment terms. Just as SCF gives suppliers more working capital, it also enables buyers to hold onto their money longer. More access to cash means more working capital to invest in growth.

Greater Negotiating Power

Buyers can negotiate bigger discounts and better prices on larger orders. SCF gives them greater leverage and bigger margins, which is particularly helpful at a time when profitability is of the utmost importance. Negotiation can cover more than just prices too. A buyer may be able to get faster shipping times for the same price.

Centralization of Payments

One complexity of supplier management is remitting payments to a ton of companies. However, if most (or all) suppliers join an SCF program, payments can be routed to the financer, and they can handle it from there. This helps to simplify accounts payable and reduce related costs.

Strengthens Supplier Relationships

Buyers can improve their relationship with suppliers by providing them with access to low-cost funding, which puts them in a stronger negotiating position. Supply chain finance is a competitive differentiator since the customer is offering the supplier cheap capital. This can make the buyer a well-regarded and more important customer, with early inventory notice and first priority.

For Suppliers

Supply chain finance is also important for suppliers since they have access to extra capital without having to extend their own line of credit. This means they can benefit from a buyer’s credit rating over their own. Additional benefits include:

Access Lower-Cost Funding

The cost of funding is lower for suppliers than it would be if they went through other funding sources, like factoring. Although some suppliers have better credit than others, supply chain finance gives companies money at a lower cost than they could find elsewhere. This is especially valuable when interest rates on loans are higher than usual.

Working Capital Improvements

By accessing supply chain finance, suppliers can receive payment on their invoices earlier than they typically do. As a result, their days sales outstanding (DSO) is greatly reduced, and working capital is improved.

Since the majority of suppliers are in capital-intensive industries, it puts a strain on cash flow. SCF helps suppliers by providing cash (thus adding current assets) when needed.

Greater Forecasting Accuracy

When suppliers access SCF, they’ll gain a greater level of certainty over the timing of incoming payments. This makes it easier to accurately forecast future cash flows.

Popular SFC Companies

If you’re ready to start shopping around for supply chain finance programs, here are a few popular brands:

Demica

Demica offers innovative supply chain finance solutions that allow clients to extend days payable outstanding (DPO), help suppliers secure low-cost funding, and capture early payment discounts; all while improving their own margins. The brand specializes in non-investment grade programs and solutions that operate cross-border.

The company offers a uniquely flexible technology platform with innovative structures. It provides a tailored solution to every client that maximizes their return from the program.

Taulia

Taulia offers dynamic discounting by converting invoices into revenue opportunities and increasing supplier liquidity by automating early payment on 100% of invoices. One of the brand’s main solutions, Supply Chain Finance Plus, is a flexible feature that allows a business to fund early payments to its entire supply chain without using extra cash.

The Taulia platform helps to strengthen supplier relationships and extend payment terms, while still providing suppliers with access to cash. The company offers early payment discounts to your entire supply chain, using your own, or third-party cash.

NetSuite

Netsuite offers a cloud accounting solution that allows buyers to track and monitor all invoices, so they can easily tell the financer which to approve for early payment. The program automatically records supply chain finance transactions in the appropriate ledgers, for crystal-clear audit trails.

The Netsuite solution can quickly generate the three financial statements every company needs to show money owed to financial institutions in the near future (if this becomes a requirement).

Additional SFC Companies to Consider

- Orbian

- Ariba

- PrimeRevenue

- GT Nexus

Automation and Supply Chain Finance

Supply chain finance platforms are an emerging market of fintech-based solutions that aim to lower financing costs and improve efficiency for both buyers and sellers linked in a sales transaction. SCF strategies work by automating invoice processing while monitoring the approval and settlement processes (from initiation to completion).

SCF software automates the multi-step process of reverse factoring to the point where it is mostly self-serve and requires very little work from the lender or buyer. Additionally, you can choose more than one lender. Some companies use a combination of banks and other entities to fund the initiative.

FAQs

Do you need a bank for supply chain finance?

You don’t necessarily need a bank to use supply chain finance. It is offered by diverse financial institutions as well, like supply chain finance providers. Choosing the right provider starts by looking at the size of your business, your existing ERP, and the extent of your supplier network.

What is the difference between supply chain finance and trade finance?

Trade finance is a broad set of payment strategies for commerce. One example is a letter of credit from an importer’s bank to the exporter, that guarantees payment upon proof of an event, like shipping an order.

SCF is a type of trade finance that can reduce the risk for the seller (trading partner), but must be set up and managed by the buyer. Supply chain finance offers faster payment to the supplier and longer terms for the buyer.

Is supply chain finance the same as factoring?

Supply chain finance is also known as reverse factoring and is different from regular factoring based on one key detail. Under factoring, the supplier initiates the funding process by selling their invoices to a third party, who the buyer later pays.

In reverse factoring, it is the buyer who initiates the transaction by requesting the third-party pay the supplier. This means:

• Factoring = supplier drawing on credit

• Reverse factoring = buyer’s credit rating used

Conclusion

Supply chain finance benefits everyone involved, from the buyer to the bank and seller; it helps to strengthen business relationships and get suppliers paid quickly. It’s a buyer-led type of financing, often referred to as “reverse factoring” that boosts working capital, while supporting the long-term viability of suppliers.

If you’re looking to transform your business for growth and open up to new revenue streams, how do you manage all of these entities in one spot? Find out in our free ebook: How Multi-Entity Businesses Scale Payables.