We’ve paired this article with Laurie Hatten-Boyd’s AP Tax Compliance webinar. Get your Executive Summary to find out how FATCA requirements impact organizations with a global supplier base.

This guide defines what IRS form W-8BEN is, its purpose, whether the IRS requires it, when and who should submit it, and to which parties it should be sent. How to fill out the tax form using IRS Instructions for Form W-8BEN is also covered.

The payee needs to file the Form W-8BEN before the first payment to prevent withholding of the full 30% of U.S. income tax.

Do not rely on this W-8BEN guide alone as a source of tax advice. Refer to official IRS instructions on the IRS website and consult your attorney or CPA.

What is a W-8BEN?

W-8BEN is an IRS form used by individual nonresident aliens (NRA) to report information to withholding agents, payers, or FFIs if they are the beneficial owner of an amount from U.S. sources subject to income tax withholding or the NRA account holder at a foreign financial institution (FFI).

IRS form W-8BEN is titled Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals).

What is the Purpose of IRS Form W-8BEN?

The US has an income tax treaty in place and FORM W-8BEN will establish your eligibility for treaty benefits. The purpose of the form is to establish:

1. That the individual in question is the beneficial owner of the income connected to Form W-8BEN.

2. That the individual is a foreign person (technically a non-resident alien) and not a U.S. citizen.

3. That the individual is eligible for a reduced rate of tax withholding, or is exempt entirely, due to an income tax treaty between his home country and the United States.

Only non-U.S. persons should use Form W-8BEN. U.S. persons file Forms W-9, W-4, and others. Non-U.S. entities use Form W-8BEN-E instead.

Is Form W-8BEN Required?

Yes. Form W-8BEN is required to be filed with withholding agents, payers, and FFIs by non-resident alien individuals who may be subject to withholding of U.S. taxes at a 30% tax rate on payment amounts received from U.S. sources, regardless of their ability to claim a withholding exemption.

You need to complete a Form W-8BEN for each requester, and some withholding agents may require a separate Form W-8-BEN for each type of income.

Why Does the IRS Require Form W-8BEN?

The Internal Revenue Service requires W-8BEN because foreign individuals are normally subject to a 30% tax withholding, but they may qualify for a reduced rate of taxation. W-8BEN helps to establish this eligibility, although other factors also play a role, such as type of income.

Who Needs to Fill Out Form W-8BEN?

Non-resident alien individuals who may be subject to 30% withholding of U.S. federal taxes on U.S.-source income need to fill out Form W-8BEN before they receive their first payment, even if they can claim an exemption from withholding.

When subject to withholding of U.S. taxes, the single owner of a disregarded entity, NRA-classified account holder of a foreign financial institution (FFI), and the non-U.S. transferor of an interest in a partnership for a connected gain are also required to file Form W-BEN.

Form W-8BEN may also be used to claim an exception from domestic information reporting and backup withholding (at the backup withholding rate under section 3406) for certain types of income.

Note that the tax withholding rate for the transfer of an interest in a partnership is 10% instead of 30%, per the Tax Cuts and Jobs Act -TCJA enacted in 2017 unless an exception applies.

How Do I File Form W-8BEN?

Do not send Form W-8BEN to the IRS, and do not file it with a tax return. Instead, you should submit the completed form to the party that requests it. Typically, this is the person or group from whom you received payment, the withholding agent, or an FFI. The tax form should be completed before the first payment is made; otherwise, the withholding agent may have to withhold the full 30% that is normally withheld under U.S. tax law.

Form W-8BEN will remain valid for at least three calendar years. A Form W-8BEN expires on the third complete calendar year after it is signed. For example, if you sign a W-8BEN on July 28, 2024, it will expire on December 31, 2028. You need to file a new W-8BEN sooner for changes in circumstances causing information on a submitted W-8 BEN to be incorrect.

According to the IRS Instructions for Form W-8BEN, “you must notify the withholding agent, payer, or FFI with which you hold an account within 30 days of the change in circumstances and you must file a new Form W-8BEN or other appropriate form.”

Where Can I Download Form W-8BEN?

The Internal Revenue Service, America’s government tax authority, publishes all its forms and instructions at www.irs.gov, including the W-8BEN form and Instructions for Form W-8BEN.

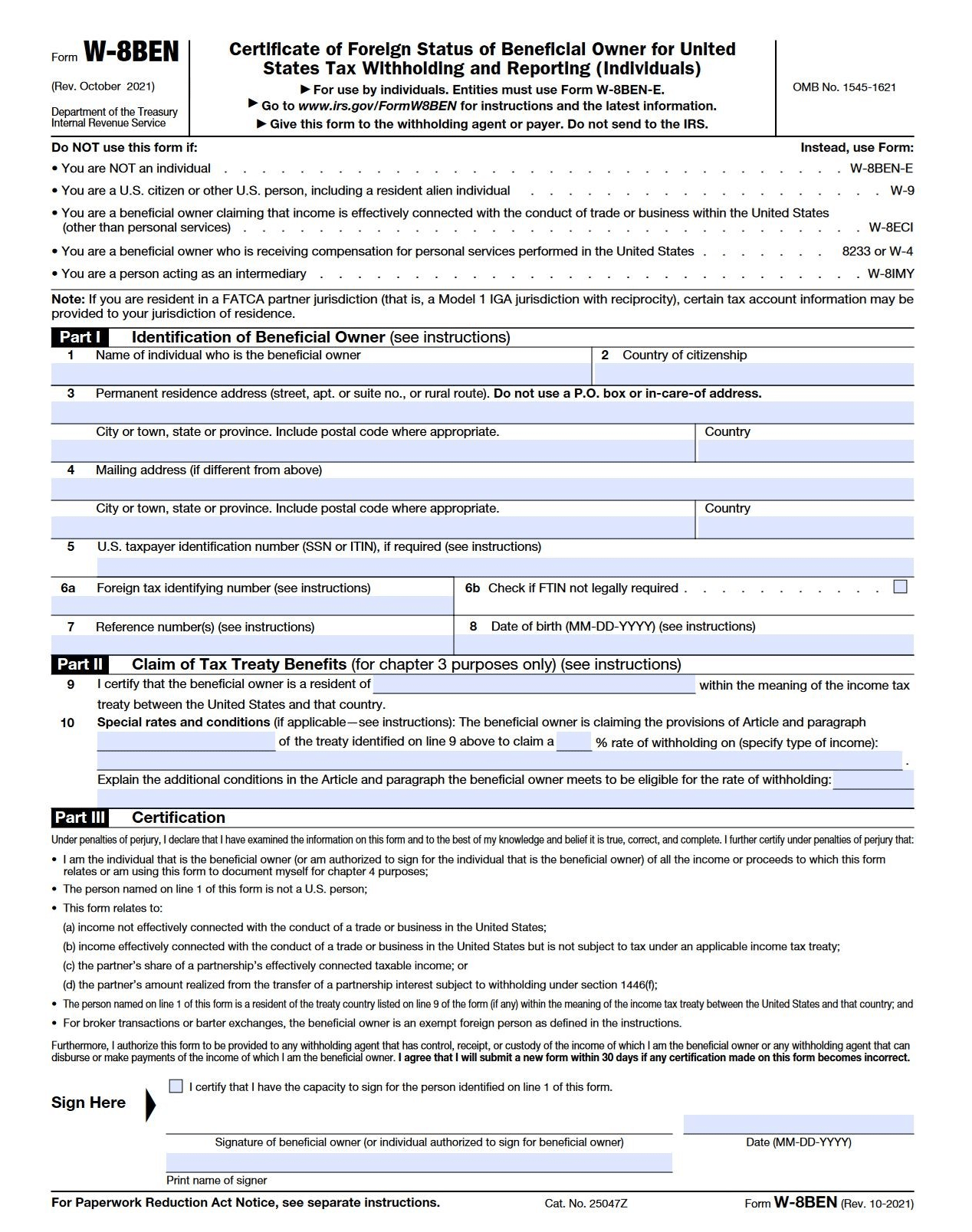

The screenshot below shows IRS Form W-8BEN.

Properly report foreign non-resident alien supplier payments

AP automation software automates foreign supplier payment compliance.

How Do I Fill Out Form W-8BEN?

After you’ve downloaded W-8BEN from the IRS’s website, it’s time to fill it out. Following the instructions presented here will prevent you from having to go back and correct mistakes.

Part I – Identification of Beneficial Owner:

Line 1: Enter your name as the beneficial owner.

Add your full name on this line.

Line 2: Enter your country of citizenship

If you’re not a resident of the country where you have citizenship, you should enter your country of residence (instead of your country of citizenship). If you’re a dual citizen, you should enter the country where you are both a resident and a citizen on the date you complete the form. If you hold U.S. citizenship (with or without citizenship with another country), you should not fill out Form W-8BEN.

Line 3: Enter your permanent residence/mailing address

For the purposes of W-8BEN, this is your tax home, which is where you reside for income tax purposes. It should be a permanent residence address and not a P.O. Box or address of a financial institution. Be sure to include your postal code and country.

Line 4: Enter your mailing address, if different

If your mailing address isn’t the same as your permanent resident address, enter it here.

Line 5: Enter your U.S. taxpayer identification number.

This should be either a Social Security Number (SSN) or an individual taxpayer identification number (ITIN) if it is required. If you don’t have either, you can skip to line 6.

Line 6: Enter your foreign tax identifying number

If you don’t have an SSN or ITIN (or applied for them) and meet certain purposes: In 6(a), enter your foreign tax identification number (FTIN). In 6(b), check the box if an ITIN is not legally required.

Line 8: Enter your date of birth.

Make sure it’s in mm-dd-yyyy format.

Part II – Claim of Tax Treaty Benefits:

Line 9: Enter the foreign country under whose tax laws you claim tax benefits.

This of course needs to be one of the countries with which the U.S. has a tax treaty.

Line 10: Special rates and conditions (if applicable)

Foreign individuals who are students and researchers should enter specific withholding rates.

The rate of withholding may be a special rate negotiated for the treaty country. Other persons may need to complete this line if they claim benefits that require them to meet conditions not addressed on W-8BEN. Fill in the requested details.

Part III – Certification:

Here, you’ll need to certify with your signature under penalties of perjury that everything on the form is true and correct and that you aren’t a U.S. person. Insert the date of form completion and certification in a mm-dd-yyyy format.

Which Countries Have Tax Treaties With the United States?

Many foreign governments have tax treaties with the U.S. Under these agreements, residents of eligible foreign countries (who are not necessarily citizens of those countries) may be eligible for reduced rates of taxation on U.S. sources of income. Some examples of countries that have tax agreements with the U.S. include:

• Canada

• Finland

• Israel

• Japan

• Mexico

• Philippines

• Switzerland

• Turkmenistan

• United Kingdom

• Venezuela

• And many others

In order to establish a claim of tax treaty benefits under the Internal Revenue Code, individual foreign person earners of eligible income need to fill out Form W-8BEN.

What is the Difference Between Form W-8BEN and Form W-8BEN-E?

Businesses that are foreign entities should file Form W-8BEN-E (Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting – Entities) instead of W-8BEN, which is for individuals only. Foreign businesses are subject to the same tax rate (30%) that foreign individuals are subject to, and like individuals, they too may qualify for a reduced tax rate if their home (permanent residence) country has a tax treaty with the U.S.

Which W8 Form Should I Use?

In total, there are five W-8 forms:

- Form W-8BEN

- Form W-8BEN-E

- Form W-8ECI

- Form W-8EXP

- Form W-8IMY

Other W-8 forms, besides W-8BEN and W-8BEN-E, are described below.

Form W-8ECI. This one has a rather long name (Certificate of Foreign Person’s Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States) and is designed for nonresident aliens who conduct a business or trade in the U.S. other than personal services. (If you are a beneficial owner receiving compensation for personal services performed in the United States, file Form 8233 or W-4 instead.)

Form W-8EXP. As the name of this one suggests (Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding and Reporting), only foreign governments or other specified groups, including foreign private foundations, use this form to claim a reduction in tax withholding.

Form W-8IMY. The last form on our list (Certificate of Foreign Intermediary, Foreign Flow-Through Entity, or Certain U.S. Branches for United States Tax Withholding and Reporting) is only used by intermediaries, flow-through entities, and certain U.S. branches.

Tax Savings Are Available to Those Who Persevere

Although filling out Form W-8BEN by foreign non-resident aliens may be a tedious task, due to the numerous tax treaties the U.S. government has with other countries, it will be well worth the time spent in many cases. For more global supplier tax compliance information, read the white paper.