We’ve paired this article with Laurie Hatten-Boyd’s AP Tax Compliance webinar. Get your Executive Summary to find out how FATCA requirements impact organizations with a global supplier base.

Fill out the form to get your free eBook.

Laurie Hatten-Boyd, Principal at KPMG LLP, shared her insights on the impact of US tax compliance rules for companies paying their global suppliers. In this summary of her one-hour webinar, Hatten-Boyd explains how FATCA requirements impact organizations with a global supplier base and the legal and financial penalties they may face for non-compliance. Read the executive summary to get the must-have takeaways from the webinar. – An overview of US tax rules for companies paying global suppliers, including FATCA requirements – Steps your organization can take to avoid legal and financial penalties – How to ensure your payees select the correct form based on their country and corporate structure – How to determine which payees require tax withholding by treaty – The basics around end-of-year 1099/1042-S tax reporting

When is a W-9 form required from vendors? The short answer is: always.

We’ll review the exceptions to this rule, but overall, businesses should always require their vendors to complete a W-9 form. Collecting W-9s during supplier onboarding reduces last-minute scrambles, improves compliance, and simplifies year-end 1099 reporting.

Ideally, businesses should have a vendor’s W-9 on file before issuing the first payment. Vendors should also be required to update their information whenever their legal name, entity type, address, or tax details change.

Key Takeaways

- Businesses require their U.S. person vendors to provide an IRS Form W-9 (or W8 for foreign persons).

- Using each vendor payee’s W-9, the requesters prepare 1099-MISC and 1099-NEC information returns for the IRS, applicable states, and recipient copies.

- W-9 compliance (with automation) is crucial for accurate, complete 1099 filings and to avoid IRS penalties.

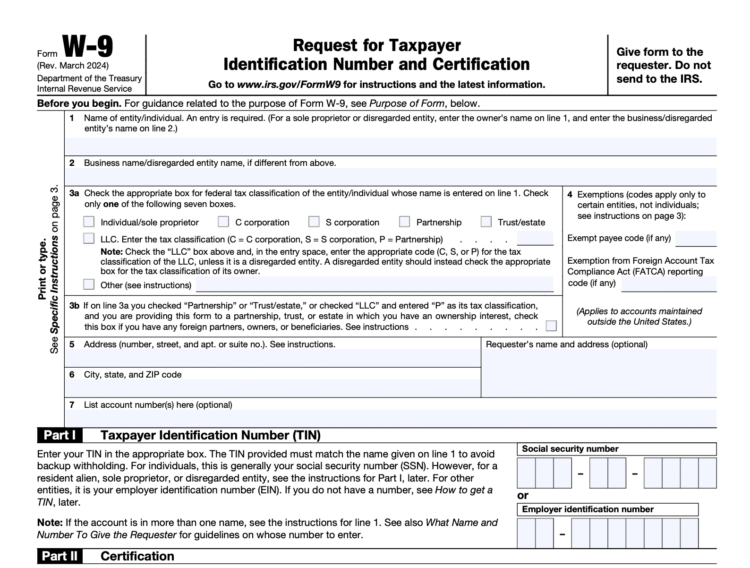

What is Form W-9?

Form W-9 is an IRS form that a vendor submits to a business that pays them, including a taxpayer identification number (TIN) and contact information. Payers use signed W-9 forms to file information returns, including Form 1099-MISC and 1099-NEC, by vendor name. W-9 requesters file 1099s to report amounts for a calendar year above an IRS threshold paid to specific types of vendors, backup withholding, and FATCA status.

Vendors or suppliers and independent contractors use Forms 1099-MISC and 1099-NEC received from the payer to file their federal and any required state income tax returns for the applicable tax year.

Pro Tip: For the most up-to-date tax forms, instructions, and official guidance, always refer to the IRS Forms, Instructions & Publications page.

What is Backup Withholding?

Payee vendors are subject to backup withholding at a 24% (or current) rate if they don’t provide their taxpayer identification number on a Form W-9 or the TIN provided is incorrect. Certain payees are exempt from backup withholding and should “enter an exempt payee code on Form W-9”.

W-9 management is a cornerstone of efficient and compliant global mass payments. Non-compliance with tax regulations can negatively impact your company. For example, if your business doesn’t perform the required backup withholding for W-9 providers, it assumes liability for paying the 24% withholding amount to the IRS and can incur penalties and interest.

What is FATCA?

FATCA (Foreign Account Tax Compliance Act) requires foreign financial institutions to report on U.S. taxpayers’ foreign accounts. Using any information from the payee on Form W-9 sent to the business payer isn’t sufficient for FATCA compliance.

According to the IRS, in its Form W-9 Instructions for Requesters of Form W-9: “A participating foreign financial institution (PFFI) should request Form W-9 from an account holder that is a U.S. person. If an account is jointly held, the PFFI should request a Form W-9 from each holder that is a U.S. person.”

What Type of Taxpayer Identification Number is Needed for Form W-9?

The payee’s taxpayer identification number (TIN) may be:

- A Social Security number (SSN)

- For an individual sole proprietor business owner, like a freelancer or other independent contractor

- An individual taxpayer identification number (ITIN)

- For individuals who can’t get a Social Security number

- For an individual sole proprietor business owner, like an independent contractor

- Used by a resident alien in filling out Form W-9

- An employer identification number (EIN) issued by the Internal Revenue Service

- Also known as a federal tax information number

- Used to identify a business entity.

The Importance of W-9 for Vendor Forms

Trades or businesses need to obtain W-9 Forms from U.S. vendors to prepare information returns, such as Forms 1099-NEC and 1099-MISC, required by the IRS to report calendar-year amounts paid to these suppliers or independent contractors or backup withholding of federal income taxes when at or above the calendar-year threshold.

If payers don’t collect backup withholding from applicable payees, they may be liable for uncollected balances, according to IRS Instructions for the Requester of Form W-9.

Note that foreign vendors typically file a different form, rather than a W-9. The equivalent to a W-9 for international vendors that are foreign persons includes Internal Revenue Service Form W-8-BEN, “Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals)” or “W-8-BEN-E (Entities)”, which is another required IRS form instead of Form W-9.

Summary Table: Why W-9s are Critical for Compliance

| W-9 Compliance Issues | |

|---|---|

| Avoiding penalties | Payer penalties for late 1099s, missing/incorrect TINs |

| Avoiding backup withholding triggered for payees | Payees’ backup withholding for missing/incorrect TINs |

| 1099 accuracy | IRS requires timely and accurate 1099s |

| Backup withholding details on 1099s | Payers calculate, withhold, and report backup withholding |

| FATCA status reporting | 1099s contain a FATCA status checkbox |

U.S. Persons vs Foreign Persons Use of Form W-9

Businesses need to get a W-9 form from U.S. persons. The IRS definition of U.S. persons who are individuals includes each U.S. citizen or U.S. resident alien. According to the IRS in Instructions for the Requester of Form W-9, besides these individuals, U.S. persons also include these entities:

- “A partnership, corporation, company, or association created or organized in the United States or under the laws of the United States;

- Any estate (other than a foreign estate); or

- A domestic trust (as defined in Regulations section 301.7701-7).”

Businesses also use IRS Form W-9 to request “certain certifications and claims for exemption” from their vendors. Certain payees are exempt from backup withholding and should enter the exempt payee code on Form W-9.

According to the IRS W-9 instructions, regarding foreign persons with amounts paid not reportable to the IRS from a W-9 form:

Advise foreign persons to use the appropriate Form W-8 or Form 8233, Exemption From Withholding on Compensation for Independent (and Certain Dependent) Personal Services of a Nonresident Alien Individual. See Pub. 515, Withholding of Tax on Nonresident Aliens and Foreign Entities, for more information and a list of the W-8 forms.

When is a W-9 Not Required?

A W-9 for vendors is not required when:

- Payments or backup withholding will be less than $600 in a calendar year for payments through December 31, 2025 (increasing via OBBBA (One Big Beautiful Bill Act) to less than $2,000 for non-employee payments for 2026 payments, with later years adjusted for inflation)

- Payments are not associated with conducting a trade or business

- The W-9 requester does not additionally need to report backup withholding for a vendor

- The vendor does not need to submit an exempt payee code on Form W-9 if exempt from backup withholding

- The vendor is a foreign person, submitting a W8 series alternative form instead

When vendor payments or backup withholding are less than $600 for payments through December 31, 2025 (or less than $2,000 in 2026, adjusted for inflation beginning in 2027) in a calendar year, the IRS does not require 1099 reporting for that vendor. However, it is a good idea to request a W-9 from all vendors, preferably before making their first payment.

When Should Your Business Receive a W-9 Form from Vendors?

Businesses should collect W-9 forms from vendors (payees) when:

- The vendor is a “U.S. person,” as defined by the IRS

- The vendor is new

- The supplier’s Form W-9 information changes

- The vendor’s legal business form changes

- Your business is a third-party settlement organization (like PayPal)

Types of Changes to W-9 Information

Examples of changes to W-9 information include changes to the vendor name (business name or individual legal name, if applicable), address, legal form of business organization, and taxpayer identification number (TIN).

1099-NEC and 1099-MISC Forms Preparation Using W-9s

Note that the vendor files a W-9 form with the payer before the total amount paid in a calendar year is known. The supplier may submit Form W-9 to the payer and not receive a Form 1099-MISC or 1099-NEC later because the total amount paid by the vendor’s customer or client in the calendar year is less than $600 for payments through December 31, 2025, or less than $2,000 for payments after that date (adjusted for inflation).

The difference in 1099-NEC vs 1099-MISC is that 1099-NEC is for reporting Nonemployee Compensation, whereas 1099-MISC is for reporting Miscellaneous Payments.

1099-K Forms and Vendor W-9s for Third-Party Settlement Organizations

PayPal and similar payment networks, which are Third-Party Settlement Organizations (TPSOs), also require vendors to submit W-9 forms when payments to these suppliers for goods or services reach the IRS threshold amount for the calendar year.

Beginning for 2025 payments (with an OBBBA tax regulation change), Third-Party Settlement Organizations are only required to issue 1099-Ks to applicable payees when both thresholds are reached: (1) over $20,000 in gross payments and (2) more than 200 transactions in a calendar year. The same thresholds apply to TPSO-related backup withholding.

Automate W-9 and 1099 Compliance Without the Manual Chase

See how Tipalti Automated Tax Compliance embeds W-9 collection, TIN validation, and 1099 preparation directly into mass payments—so tax compliance stays accurate, secure, and up to date as you scale.

Common W-9 Collection Challenges for Finance Teams

Common W-9 form collection challenges include:

- Understanding which vendors need to submit a W-9 form to the payer

- Getting the initial Form W-9 from vendors late (after their first payment)

- Receiving incomplete or incorrect information on W-9 forms

- Updating W-9 forms when vendor information or legal form changes

- Maintaining secure storage to protect supplier information privacy

Follow-up Time to Collect W-9s After First Vendor Payment

Collecting missing W-9 forms from vendors later in the calendar year may be challenging, especially if the supplier no longer does business with the payer. Requesting missing W-9 forms late in the calendar year (or at the beginning of the following year) requires extra staff time and may result in missing 1099 due dates, leading to IRS penalties for late or missing 1099 returns.

Incomplete or Inaccurate W-9 Information

Incomplete information requires staff follow-up time. Inaccurate W-9 information may include incorrect TINs, resulting in backup withholding for the payee and IRS penalties for the 1099 filer, depending on how long it takes to correct the TIN.

The following steps must be performed or automated to ensure that the W-9 is complete and accurate.

How to verify W-9 information:

- Ensure that all applicable lines of the W-9 form are complete.

- For paper W-9 forms that require accurate manual data entry, compare the system results to the paper forms.

- Match TINs and name combinations to the IRS database.

W-9 Update Required for Vendor Information Changes

It’s challenging to determine when vendor information changes require collecting a new W-9 form. When vendor change information is entered into your vendor master file, an automated notification should trigger a request for a new W-9 form from the vendor.

Legal Structure Change Triggers Form W-9 Update

An updated W-9 form is also required if the vendor’s legal business form changes.

On their W-9 form, vendors indicate the tax classification for their legal form of business entity, with choices provided for:

- Individual/sole proprietor

- C corporation

- S corporation

- Partnership

- Trust/estate

If the business is an LLC (Limited Liability Company), W-9 payees also indicate whether the legal form is a C corporation, an S corporation, or a partnership.

Data Security

W-9 form information should be encrypted on a system or stored securely when paper copies are obtained to protect data privacy and prevent misuse of the information.

Automating W-9 Collection with Mass Payments Platforms

Through automation, your business can achieve IRS compliance with greater accuracy and efficiency. Most W-9 challenges can be overcome by embedding automated tax compliance directly into mass payments workflows, rather than managing W-9s as a separate, manual process.

Tipalti’s Automated Tax Compliance, built into its Mass Payments platform, streamlines W-9 collection and 1099 compliance for high-volume vendor payments. This approach supports global payouts while ensuring tax data is collected, validated, and maintained continuously—before payments are ever released.

For W-9 automation and tax compliance, mass payments platforms with embedded tax compliance capabilities help businesses:

- Collect W-9 forms as part of supplier onboarding

- Securely store sensitive supplier tax information

- Automatically match TINs against the IRS database

- Trigger system notifications when vendor tax information changes

- Generate 1099 and 1042-S tax preparation reports or support optional e-filing

Accurate and Secure W-9 Data Collection During Supplier Onboarding

An efficient way to receive vendor W-9 forms is to have these suppliers use the self-service supplier onboarding portal that’s part of the payer’s SaaS add-on AP automation software. Payables automation software seamlessly integrates with the payer’s ERP system or accounting software.

The supplier portal is also a two-way communication platform with documents and status available to both the vendor and the business paying them (that uses the AP automation software).

Vendors accurately and securely enter their W-9 information online through the supplier portal, thereby reducing the workload of the accounts payable team. Members of the accounts payable team don’t need to manually enter paper W-9 forms from vendors (which could result in errors or lost W-9 documents) or constantly follow up to get completed forms.

With its Mass Payments Plus plan, Tipalti includes AI-enabled fraud-detection software (Tipalti Detect®) to monitor vendors’ online behavior patterns and help prevent payment fraud.

Automated TIN Matching

As part of automated tax compliance, Tipalti AP automation or mass payments software features TIN matching to automatically verify each tax ID number (TIN) against taxpayer names. AP automation also includes FATCA compliance software.

For information returns, such as tax Form 1099-MISC and 1099-NEC, the IRS charges filers (the payer) penalties as a dollar amount per form for inaccurate or missing vendor taxpayer identification numbers and missing vendor names. Therefore, submitting correct taxpayer identification numbers and other W-9 information is essential for IRS compliance.

Vendor Information Changes

In an AP automation system or mass payments software, the vendor enters their changing information, such as address changes, through the supplier portal. Without AP automation (with cleansed data migration), your ERP system may create multiple vendor master file records, making it difficult to detect changes to vendor information.

Tax Compliance Reporting or e-File

W-9 automation software functionality is within the AP automation or mass payments system. Tipalti creates an electronic Form W-9 from vendor data obtained through a self-service portal during the supplier onboarding process.

Tipalti’s finance automation software for payments:

- Uses a KPMG-approved tax engine and AI agents

- Automates W-9 forms collection

- Validates W-9s with TIN matching

- Calculates backup withholding

- Generates simple tax preparation reports for 1099s and 1042-S forms.

Optional E-Filing with Tipalti’s Zenwork Tax1099 Integration

When it’s time to file, Tipalti supports optional e-filing through its native integration with Zenwork Tax1099. This helps teams submit 1099-NEC and 1099-MISC forms using payee and payment data already captured in Tipalti—reducing manual exports, file formatting, and year-end rework.

Having all our payments processed on time has alleviated the manual work for my team. Now, they can grow in their career and build longer relationships with the company.

— Courtney Santry, Controller, Sensei

Why W-9 Management Is Critical for Vendor and 1099 Compliance

Vendors submit W-9 information or Form W-9 to the trades or businesses that pay them any amount.

The payer’s business files information returns like Form 1099-MISC or 1099-NEC if total calendar year amounts are paid to certain types of vendors:

- In the course of a trade or business

- Total at least $600 during a calendar year for payments through December 31, 2025

- Increasing to at least $2,000 for 2026 calendar payments

- Thereafter, inflation-adjusted beginning for 2027 payments)

Third-party settlement organizations (TPSOs) are required to collect W-9 forms from vendors and submit Form 1099-K for vendors when BOTH thresholds are met. Beginning with calendar 2025 payments, the thresholds for submitting 1099-Ks and performing backup withholding are:

- Over $20,000 in payments for the calendar year AND

- Over 200 transactions

The 1099 filer uses W-9 forms to prepare the information returns for each vendor meeting the thresholds and submits copies to the IRS and the applicable states. The 1099 filer (W-9 requester) also provides recipients with copies of their required 1099 forms. The IRS publishes instructions with due dates after calendar year-end, specifically for Forms 1099-MISC, 1099-NEC, and 1099-K.

If backup withholding is required and occurs, the payer business files Form 1099-MISC, 1099-NEC, or 1099-K to report any amount of U.S. federal income taxes withheld. The backup withholding rate is 24% (when writing this article). Consult the latest IRS Instructions for the Requester of Form W-9 for the current backup withholding rate for reportable payments.

For best results, automate your W-9 tax compliance and simplify 1099 tax preparation. Learn more about Tipalti Automated Tax Compliance and how Tipalti streamlines W-9 and 1099 compliance for your business.

W-9 for Vendors––FAQs

Do you need a W-9 for all vendors?

Businesses should request a W-9 or equivalent from all vendors in the course of conducting a trade or business. Specific vendors will be exempt from backup withholding but still need to complete Form W-9 to enter an exempt payee code and make certain certifications. Some vendors will fill out a form, such as a Form W-8 series or a similar form for foreign persons.

Although payers (W-9 requesters) aren’t required to file 1099-MISC or 1099-NEC forms for payments less than the IRS dollar threshold for the calendar year of payments, it is best practice to collect W-9 forms from all “US-person” suppliers (or W8 forms) before making their first payment.

How do vendors get a W-9 form to fill out?

Vendors that are required to submit a W-9 form to a W-9 requester (payer) can get a W-9 form from:

- The IRS website (official form)

- The payer requesting the W-9 form

- From data submitted through a supplier onboarding portal for finance automation software

How can vendor payees submit a W-9 form?

Vendors can submit a W-9 form to the requesting business by:

- Submitting a completed W-9 form as a PDF via email or file upload

- Submitting a paper Form W-9

- Providing W-9 data through a supplier onboarding portal for mass payments or AP automation

Do vendors need to submit a W-9 form to the IRS?

No, vendors or suppliers submit their W-9 forms only to the requesting payer, not the IRS.