Save time and empower your finance team with Tipalti. The most complete AP solution loved by 5,000+ businesses.

The finance teams of mid-market businesses (with 100 to 1,000+ employees) can optimize their finance operations and cost structure by digitizing and automating manual NetSuite processes with an add-on AP automation solution. The best accounts payable automation integration improves invoice processing efficiency, reduces costs, fraud risks, and errors, and enhances internal controls.

In this guide, we’ll examine the manual NetSuite accounts payable system, identify payables tasks to automate, and explore Tipalti’s robust AP automation solution for NetSuite ERP or NetSuite OneWorld integration.

A Quick Overview of NetSuite

NetSuite (acquired by Oracle in 2016) is one of the leading integrated cloud ERP systems on the market. The NetSuite ERP platform, used in nearly all industries, enables businesses to track financials, host e-commerce stores, manufacture and distribute products, perform and manage business services, manage inventory, maintain customer relationship management (CRM) systems, and more.

NetSuite ERP (Enterprise Resource Planning) and NetSuite CRM are the two primary software packages offered by NetSuite. Both are cloud-based and include a selection of NetSuite modules that assist a business with a variety of tasks, like:

- General ledger accounting software and financial statements

- Accounts payable

- Accounts receivable

- Employee and staff management

- Processing credit cards, ACH, and other EFTs

- Basic inventory and project management

- Bank management and reconciliations

- Multi-currency and multi-language options

- Purchasing and invoice approval (Workflow Manager)

- Order and document management

NetSuite OneWorld is the optional global edition of NetSuite ERP for multi-entity (multi-subsidiary plus corporate) and multi-currency organizations.

Does NetSuite Have AP Automation?

NetSuite AP automation (run by its SuiteBanking product) helps a business improve profitability by making it easier to process bills and pay vendors. As a result, organizations can better control cash flow and scale their end-to-end AP processes.

The AP tool embeds financial technology into cloud ERP, giving quick access to a single dashboard. This allows all departments to seamlessly share information for tasks such as budget monitoring, approval workflows, and spend management.

Although NetSuite’s optional AP automation solution may be ideal for small businesses, many NetSuite customers continue to select and use the third-party award-winning and scalable Tipalti AP automation integration to optimize their payables in the procure-to-pay cycle.

Automate AP and Invoices for NetSuite

AP automation software automates core NetSuite AP and invoice processing. The best end-to-end AP automation system integrates with the NetSuite ERP solution or global, multi-subsidiary, multi-currency NetSuite OneWorld to:

- Digitize the receipt and entry of supplier or vendor invoices

- Establish opportunities for effective management

- Use rules for vendor bills verification

- Automate invoice approval routings

- Accomplish efficient global payment processing using a range of payment options

- Automatically and instantly reconcile payments

- Enable taking more early payment discounts on time

- Present real-time visibility by entity and combined corporation

- Use AI-driven analytics

Invoice digitization eliminates paper invoices traditionally used in manual invoice processing. Integrated NetSuite AP automation tools automate invoice processing, help improve controls, and provide better oversight of cash flow and payments.

Invoice processing is the responsibility of accounts payable. A smart invoice processing automation solution can handle effective automated invoice management and the multitude of manual AP tasks inherent in a traditional accounting system.

AP and invoice automation for NetSuite improves business efficiency. These tools extend the capabilities of the core NetSuite accounts payable solution by providing useful features, including smart document optical character recognition (OCR), data capture, approval workflows, document indexing, reconciliation, and more. They also capture, process, and deliver important data back to the NetSuite system through syncing.

AP automation enables automated processing, eliminating the need for the AP team to input data, verify, and match invoices manually. Approvers can sign off with the click of a button. The automation tools also provide dashboards and analytics that enable a business to instantly identify problems and make more informed decisions. Since all AP data is digitized and stored within a single system, which utilizes an automated audit trail, it’s easier to audit and search for information.

Key Accounts Payable Tasks to Automate

Key accounts payable and invoice processing tasks to automate include:

- Invoice data capture with OCR/AI (replacing manual data entry)

- Invoice management automation

- Supplier validation with TIN matching after onboarding

- Invoice verification and exceptions triggering

- Fraud detection monitoring

- Three-way or two-way matching

- General ledger coding (using AI technology)

- Automated approval routing and communications

- Global regulatory compliance

- Global EFT payments

- Payment reconciliation (in real-time)

- Tax preparation reports

- Analytics for business intelligence and informed decision-making

Solve Global Payables Challenges with NetSuite + Tipalti AP Automation

Unlock touchless invoice processing, multi-entity management, and seamless global payments — all fully integrated with NetSuite. Tipalti helps finance teams eliminate manual work, improve control, and scale with confidence.

How to Choose AP Automation Software for NetSuite

When choosing an AP automation integration platform that works best for your business, you must ask the right questions. Begin by compiling a list of all third-party apps, current software, and legacy systems. Ask teams from different departments to do the same, then get together and discuss. Identify critical tools and business processes that you must keep. This will help you decide what software to select for finance automation.

When choosing the right software, consider some of these factors:

- Top 3-5 business needs

- User-friendly integration with NetSuite ERP or OneWorld

- Versatile and future-proof solution

- Pick a scalable system

- Choose something your business can afford

- Ensure that security is strong

Each workflow should have a pre-defined process to help determine the best NetSuite integration.

How can you be sure which accounts payable automation software is the best fit for your business? Which yields the most functionality and benefits within your company’s budget, allowing it to scale for growth?

Tipalti AP automation offers the robust features and scalability that your business needs for organic and M&A-fueled global growth.

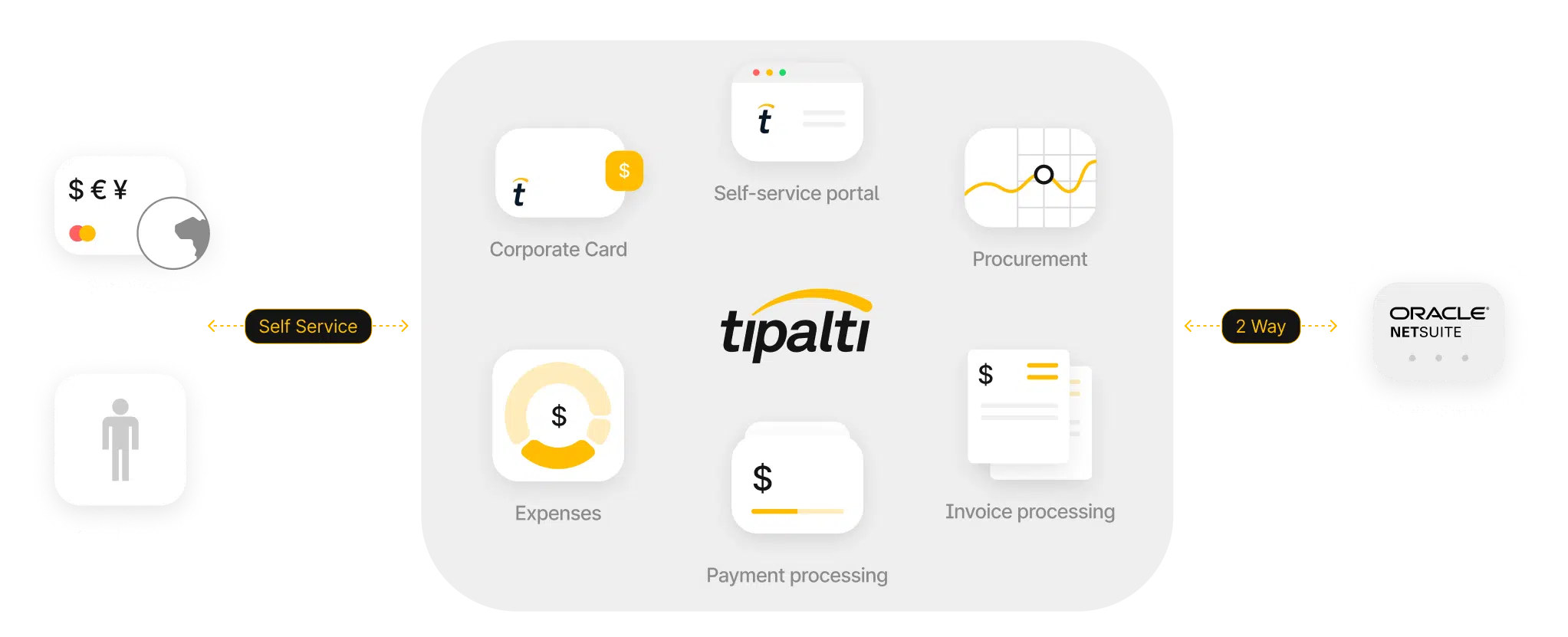

Top AP Automation Integration for NetSuite: Tipalti

The Tipalti NetSuite integration for AP automation streamlines purchase order management with procurement, and invoice processing and multi-method payments to suppliers with AP automation software. The platform helps a business save time and significantly accelerate the financial close. Tipalti helps to provide payment status to suppliers 24/7, automates vendor setup, and simplifies tax form collection.

Tipalti enhances your payables process and helps global businesses scale quickly by automating key tasks, such as processing supplier invoicing, paying shipping costs, and managing orders. The brand offers payment methods in 200+ countries in 120 currencies worldwide using a Money Transmitter License (MTL).

Features

- AI, machine learning (AI Smart Scan), OCR (Header and line level scan and capture) in 145+ languages and Managed Services

- Integrated and unified PO and payables solution to help streamline company purchases and improve spend controls

- Multi-entity management, including entity-specific workflows and view real-time spend by entity and total HQ view

- Quickly onboard vendors with a branded portal that includes preferred payment methods, currency, and payment thresholds

- 26K+ rules to validate payments and screen against OFAC/SDN lists

- Exceptions flagging for staff follow-up

- 2 and 3-way PO-Matching with automated tolerance thresholds

- Autocoding with AI

- Optional Tipalti Detect® for behavioral fraud monitoring

- KPMG-approved tax engine enables you to collect W8 and W9 tax forms, collect and validate VAT tax ID, 1099 and 1042 prep reports, and validate against 3,000+ rules

- Accelerate the approval process with automated routing and Slack integration for instant communication

- Batch payment scheduling and approval, with cash requirements

- Make global payments with a choice of 50+ payment methods, including Tipalti Card

- Secure, regulated payment infrastructure in the US, Canada, EU, and UK

- Automated payment status for suppliers

- Advanced global FX options for making FX payments between entities and centralized supplier payments for all subsidiaries (Multi-FX) and FX hedging for payables

- Sync to NetSuite subledgers for accounting and automatic payment reconciliation

- Tipalti syncs suppliers, POs, GRNs, bills, payments, and supplier credits

- Extend AP automation with optional Tipalti Procurement and Expenses software

- Enable AI-generated queries for spending business intelligence

Pricing

Tipalti uses a subscription-based (SaaS) pricing model with a customized quote. To upgrade from the basic platform, a business can add advanced functionality and users as needed.

AP Automation with Tipalti

Tipalti AP automation software is ‘Built for Oracle NetSuite” and was named NetSuite’s Suite App of the Year in 2019. Tipalti was named as NetSuite’s Growth Partner of the Year in 2024. Tipalti AP automation software has outstanding customer reviews on this NetSuite SuiteApp page and other software rating sites.

We are honored to receive this recognition as this year’s SuiteCloud Growth Partner of the Year. It’s a testament to our strong collaboration with NetSuite and shared goal of delivering strong ROI to customers through financial automation. This has been a remarkable partnership over the years, and we look forward to many more years of shared success helping finance teams drive efficiency and business growth.

—Rob Israch, President of Tipalti

How Tipalti Enhances NetSuite for End-to-End Payables Automation

Tipalti is a tool that can help maximize your investment in NetSuite ERP or OneWorld and automate AP and the invoice process. From intelligent supplier onboarding to tax data collection, real-time payment reconciliation, invoice automation workflows, and more, it’s the ideal third-party NetSuite ERP integration solution for all of your accounts payable needs.

NetSuite and Tipalti finance automation software enhances your payable process in many ways. The automation of accounts payable processes provides computer security, role-based segregation of duties, an audit trail, auto-coding, better detection and exceptions flagging to reduce fraud and errors, and instant payment reconciliation. These AP automation features improve Internal Control over Financial Reporting (ICFR).

You can add more functionality with optional Tipalti Multi-FX and Tipalti Hedging products (for advanced currency management solutions) and Expenses that combine with Tipalti AP automation software. Also consider Tipalti’s Procurement product for simpler purchase requisition intake, stakeholders’ visibility for approvals, and automatic purchase order creation.

Accounts payable can be the single most time-consuming function in finance but it doesn’t have to be. It often costs your company too much without AP automation. Tipalti offers the best mid-market AP automation for NetSuite and other products in its unified finance automation platform. It’s time to get started with Tipalti + NetSuite digital transformation by requesting a demo.

See how end-to-end AP automation can transform your financial processes

Tipalti helps finance leaders eliminate manual payables, increase global reach, and confidently scale.