Ready to modernize your purchasing process and reduce your AP workload through automation? Let’s dive in.

Fill out the form to get your free eBook.

If you’ve outgrown your purchasing process you probably notice unnecessary delays, friction, and clunky approvals. Not only does it hold back your daily purchasing efforts, but it creates more work overall for AP. By streamlining your purchasing process you can overcome the messy approvals, bottlenecks, and limited visibility that come with an outdated process. It also means AP can say goodbye to surprise invoices and late payments. Download the eBook and discover:

- How to recognize the signs you’ve outgrown your purchasing process

- How to design a modern purchasing process that allows AP to get involved earlier in purchasing decisions

- How to launch this process quickly and seamlessly

Businesses in a market economy use the concept of supply and demand when setting prices for goods and services. They also consider their cost structure and competition. Buyers may decide to adjust the quantities of their purchases based on their perception of pricing attractiveness if the relationship between supply and demand is elastic.

This article defines supply and demand, explains the effects of price changes and driving factors for supply and demand, and provides real-world examples of supply and demand.

What is Supply and Demand?

Supply and demand is a microeconomics theory describing the effect that the available level of goods or services has on pricing, buying volume, and subsequent production level. As supply decreases, sellers increase prices, and the level of buyer demand decreases. As supply increases, the price of a product or service drops, and buyer demand increases.

What is the Law of Supply?

The law of supply is that sellers will provide more goods or services for sale when the price of these goods or services increases to increase their profitability. Conversely, when the price of goods or services drops, sellers will produce a smaller volume of goods or services for sale.

Factors Affecting Supply

Factors affecting the supply of raw materials, parts, and components or services include:

- Scarcity of natural resources

- Natural disasters

- Weather patterns and climate change affecting crop growth, construction, etc.

- Pandemic or endemic disease shutdowns

- War and other geopolitical disruptions

- Shipment delays from supply chain disruption

How can you scale multi-entity payables?

Download our white paper: “How Multi-Entity Businesses Scale Payables” to learn how your growing business can optimize and consolidate global payables for all its business units.

Use best practices to scale your growing multi-entity business, consolidate payables, gain financial visibility, and achieve controls and compliance with an AP automation software platform.

What is the Law of Demand?

The law of demand is that buyers will choose to buy fewer goods or services when the price increases. Through an inverse relationship, they may buy a higher quantity of goods or services when the price falls.

Factors Affecting Demand

Factors affecting business or consumer demand for goods or services include:

- Price elasticity of demand

- Consumer income effect (or business cash flow)

- Essential needs or trends and fads for discretionary purchases

- Substitute goods

- Number of potential buyers

- Carrying extra inventory in response to supply chain disruptions

The marginal utility of buying one additional unit means that the consumer benefits and has higher satisfaction when the price (their marginal cost) declines.

Elasticity in Supply and Demand

Elasticity is a concept related to supply and demand. Consumers may buy a higher quantity of goods when prices decline and a lower quantity when prices increase. These goods have elasticity. However, consumers may buy about the same amount of relatively inelastic gasoline when fuel prices increase and they can’t change their driving needs.

Gasoline demand is considered “comparatively inelastic”, according to the Dallas Fed. Buyers may be required to drive substantially the same number of miles in connection with work when prices rise. But they can change their discretionary driving patterns and the number of discretionary miles driven. Over the long run, gasoline is somewhat elastic because drivers can choose to move closer to work, buy electric cars or trucks instead, or switch to more fuel-efficient vehicles.

In this same Dallas Fed article, the economic concept of elasticity is quantified:

“An elasticity value of -1, for example, means that for every 1 percent increase in the real price of gasoline, gasoline consumption falls by 1 percent. An elasticity value of 0, in contrast, means that consumption does not respond to a change in the price of gasoline.”

More recent studies from 2017 and 2019 cited in the Dallas Fed article found price elasticity of -0.37, which means that the price of gasoline is somewhat elastic. Earlier studies computed gasoline elasticity closer to zero. The Dallas Fed thinks that the earlier studies had time-series aggregation bias issues.

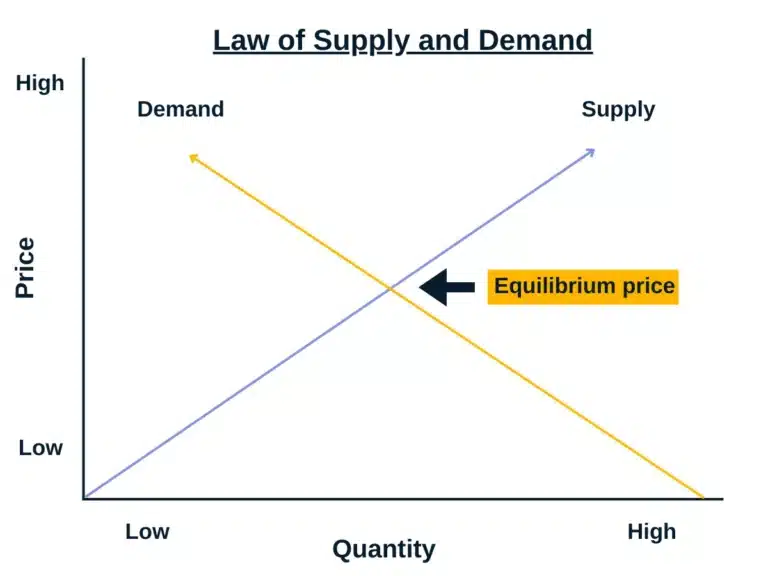

The Relationship Between Supply and Demand

The relationship between supply and demand is that price rises when demand is high and supply is low; prices are lower when supply is high and demand is low. When supply equals demand, the market is at equilibrium.

Market equilibrium means sellers and buyers agree on the market price for the goods, and purchasers will buy all available units. Another name for equilibrium in this type of competitive market is market-clearing price.

In a supply curve shift demonstrating the elasticity of supply, producers make more goods when prices are high. For goods with price elasticity in a free market, purchasers buy higher quantities when prices are low and lower quantities when prices are high. This demand shift illustrates the elasticity of demand.

A supply curve and demand curve is shown in the graph below, intersecting at the equilibrium price. The vertical axis is Price; the horizontal axis is Quantity. The supply curve is upward-sloping because producers provide more goods when prices are high. The demand curve is downward-sloping because purchasers buy less at higher prices.

Examples of Supply and Demand at Play

Supply and demand forces are at play in many industries including eCommerce and B2B, toll roads, airlines, energy, and food. Some examples follow.

Real-Time Supply and Demand Pricing Models

Some eCommerce companies and toll road business models use pricing innovation models with real-time supply and demand discovery to set the price.

eCommerce Real-Time Supply and Demand Pricing Example

Real-time market pricing software like Zilliant enables eCommerce companies to use dynamic pricing with intelligent automation rules and automated order approval workflow as triggers. Dynamic pricing can also be used by B2B companies to consider supply and demand factors, according to Martech Zone.

In the linked article, Martech Zone defines dynamic pricing:

“Dynamic pricing – while something of a buzzword – means that your customers see prices that are relevant to market conditions at any given point in time. In other words, Real-Time Market Pricing.”

Toll Road Supply and Demand Congestion Pricing Example

Toll road pricing is a type of congestion pricing that uses the law of supply and demand to determine the level of driver usage. When toll road prices are higher, some drivers elect not to use the toll road, reducing traffic congestion.

The Federal Highway Administration within the U.S. Department of Transportation defines congestion pricing. Congestion pricing applies to toll roads and some other industries:

“Congestion pricing – sometimes called value pricing – is a way of harnessing the power of the market to reduce the waste associated with traffic congestion. Congestion pricing works by shifting some rush hour highway travel to other transportation modes or to off-peak periods, taking advantage of the fact that the majority of rush hour drivers on a typical urban highway are not commuters. By removing a fraction (even as small as 5 percent) of the vehicles from a congested roadway, pricing enables the system to flow much more efficiently, allowing more cars to move through the same physical space.”

“Similar variable charges have been successfully utilized in other industries – for example, airline tickets, cell phone rates, and electricity rates. There is a consensus among economists that congestion pricing represents the single most viable and sustainable approach to reducing traffic congestion.”

Types of congestion pricing described by the Federal Highway Administration include:

- Variably priced lanes (Express or High Occupancy Vehicles)

- Entire toll roads or bridges

- Cordon charges for driving in congested areas

Examples of congestion pricing include San Diego, CA HOV lanes, toll roads that change prices in real-time based on toll road traffic volume in Austin, TX, and the latest iteration of a politically-charged plan for cordon charges in New York City that New Jersey is opposing.

Supply and Demand in the Airline Industry

The COVID-19 pandemic has resulted in a steep decline in demand for airline travel. According to the consulting firm McKinsey & Company, demand destruction in the more profitable business traveler category will take longer to recover than leisure travel.

McKinsey states that business travel, which includes business class and last-minute higher-priced bookings, will only experience an 80% recovery from pre-pandemic levels by 2024. This demand decline is partly due to the increased popularity of remote (and hybrid) work.

Higher-priced airline tickets are expected by McKinsey, with fewer staffed airplanes in use from lower travel demand and higher costs from increased debt financing. Non-stop flight pricing may decrease because fewer business travelers need an efficient travel schedule taking less flight time.

McKinsey suggests that airlines invest in IT digitalization, automation for efficiency, customer service improvement, and big data analysis for decision-making to improve their business results.

Butter Shortage and Price Increases as Supply and Demand

A butter shortage in the fourth quarter of 2022 results from”inflation, supply and demand, and labor shortages,” according to Better Homes & Gardens. Inflation relates to the costs of raising dairy cows and fuel for transporting goods, according to the Wall Street Journal source used by Better Homes & Gardens. The BH&G article states that the butter production decline is also due to bad weather events, including “extreme temperatures, storms, floods, [and] droughts.”

Some of the factors affecting butter supply, including inflation and labor shortages, are macroeconomic issues.

Better Homes and Gardens points to a 22% one-year decline in butter storage from 363 million pounds in August 2021 to 283 million pounds in August 2022, leading to a 24.6% price hike over the same period.

The supply curve could shift in future years to a period of excess supply which would lower prices in connection with the economic theory of supply and demand.

Supply, Demand, and Your Business

In business, consider supply and demand when setting or adjusting your product or service prices. Monitor economic developments and inflation. Track supply and demand and pricing changes in your industry and supply chain. Consider your competitors’ actions and business results. Use rolling forecasts and budgets to detect changes early and make budget adjustments when needed.

When demand drops in your business, inventory could increase if your inventory management is weak. With supply chain disruptions reducing timely supply, you may choose to increase business inventory safety stock. Stay on top of inventory availability and cut production levels quickly when necessary.

Prepare cash flow forecasts often to ensure adequate cash flow and financing. Collect accounts receivable as quickly as possible to avoid write-offs and improve your cash flow. Match accounts payable timing to accounts receivable collection, if possible. AP automation software lets you pay invoices on the schedule that you set and take early payment discounts when possible, saving your business money.

Vendor management, including strategic sourcing, is essential. Your suppliers can give your company needed insights into supply and demand changes, and whether it’s causing a supply chain disruption in the raw materials you’ll need to produce products. With your products sourced internationally, global supplier management matters. And eCommerce supplier relationships matter to online sellers.

Suppose a supplier that you depend on in your supply chain for raw materials is having financial or production difficulties resulting in inferior goods. That could result in a lower supply of goods you need to produce your product.

Consider buying or merging with this company using a backward integration strategy. Backward integration is a type of vertical integration. If you decide to expand your business by buying other companies selling products in your same industry, it’s considered horizontal integration. Horizontal vs vertical integration are M&A strategies to consider.

Decide whether to install a real-time dynamic pricing software system to keep up with supply and demand changes. It could help you optimize sales and profits on your company’s income statement.

Importance of the Law of Supply and Demand

In the economic system of a market economy, the law of supply and demand is important.

Supply and demand affect prices from vendors in your supply chain which will, in turn, impact your product costs. Higher prices for elastic goods may result in a lower sales volume. Lower prices may trigger increased sales. When setting price levels, consider marginal cost and contribution margin, the gross margin of your business, and competitor pricing to maintain profitability when possible.

Ready to level up your online marketplace payments process? Download our Top Strategies for Online Marketplaces eBook.