Tipalti Accounts Payable

Get Hours Back Every Week with Complete

AP Automation Software

Powered by AI, Tipalti Accounts Payable automates the manual, time-consuming AP tasks, freeing your team to focus on higher-value initiatives.

Rated 4.5/5

based on 350+ Reviews

Leader in the IDC 2024 Marketscape

Worldwide Accounts Payable Automation Software for Midmarket

Trusted by Mid-Market Leaders

End-to-End AP Automation Platform

From supplier onboarding, invoice management to reconciliation,

all in one system

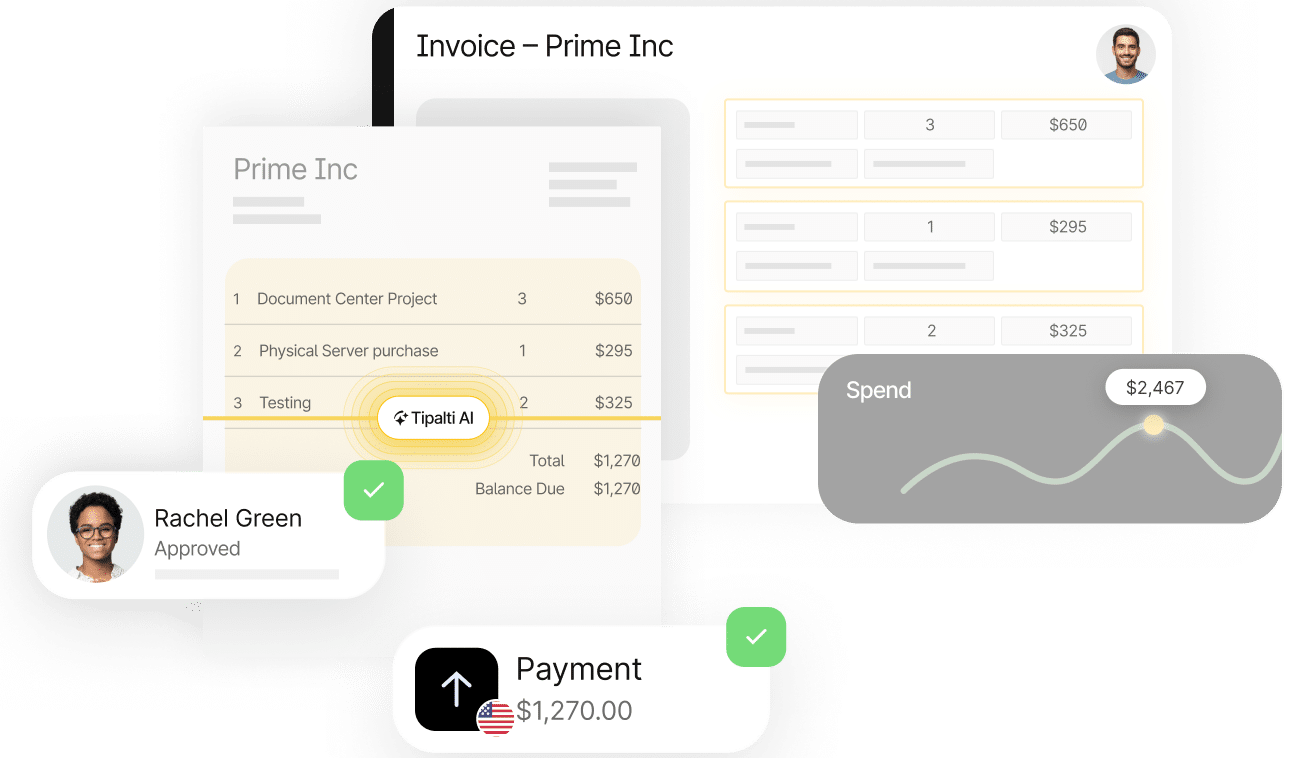

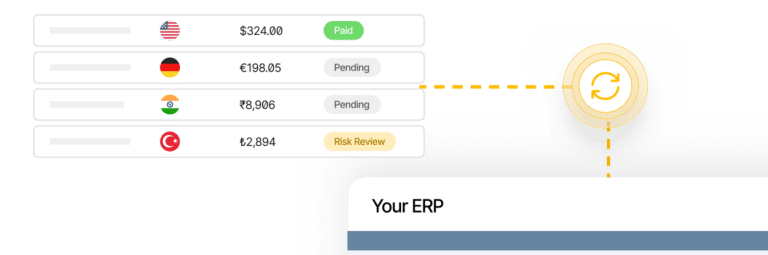

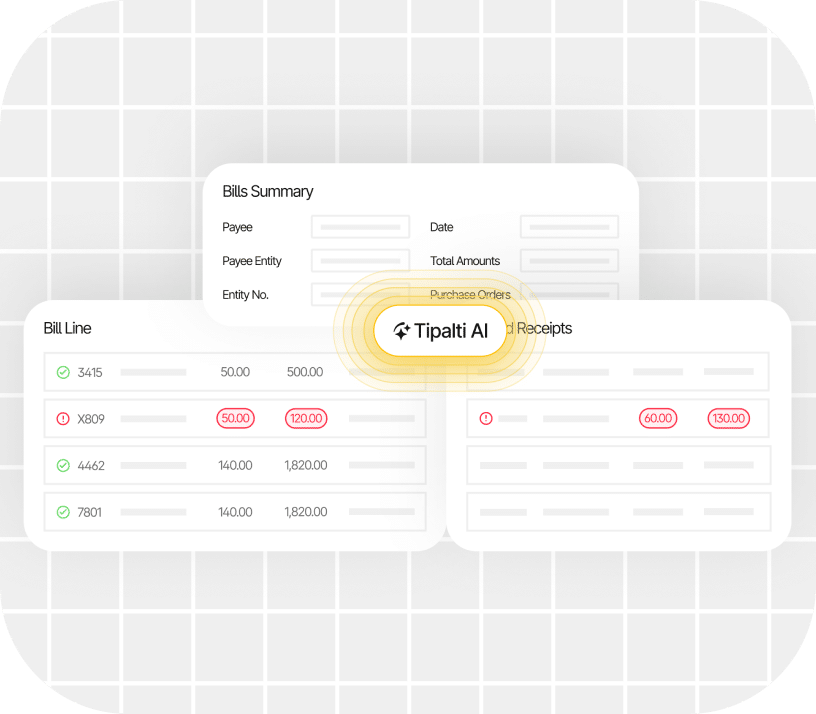

AI-Powered AP

Tipalti AI Assistant and Agents drive efficiency at scale by automating the AP process from capture and coding to approval and payment, while giving you visibility and insights to make better decisions.

Proven Impact Delivered to Our Customers

Up to

80%

Reduction in time spent

managing AP workflows

Over

25%

Faster book close

Data derived from Tipalti research and case studies. Results reflect companies upgrading from manual processes.

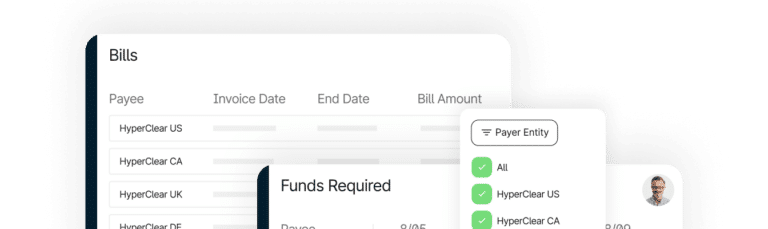

Pre-built ERP Integrations to Extend Automated Workflows

Integrate with leading ERP and accounting systems, such as NetSuite, Sage Intacct, QuickBooks, Microsoft Dynamics, and SAP.

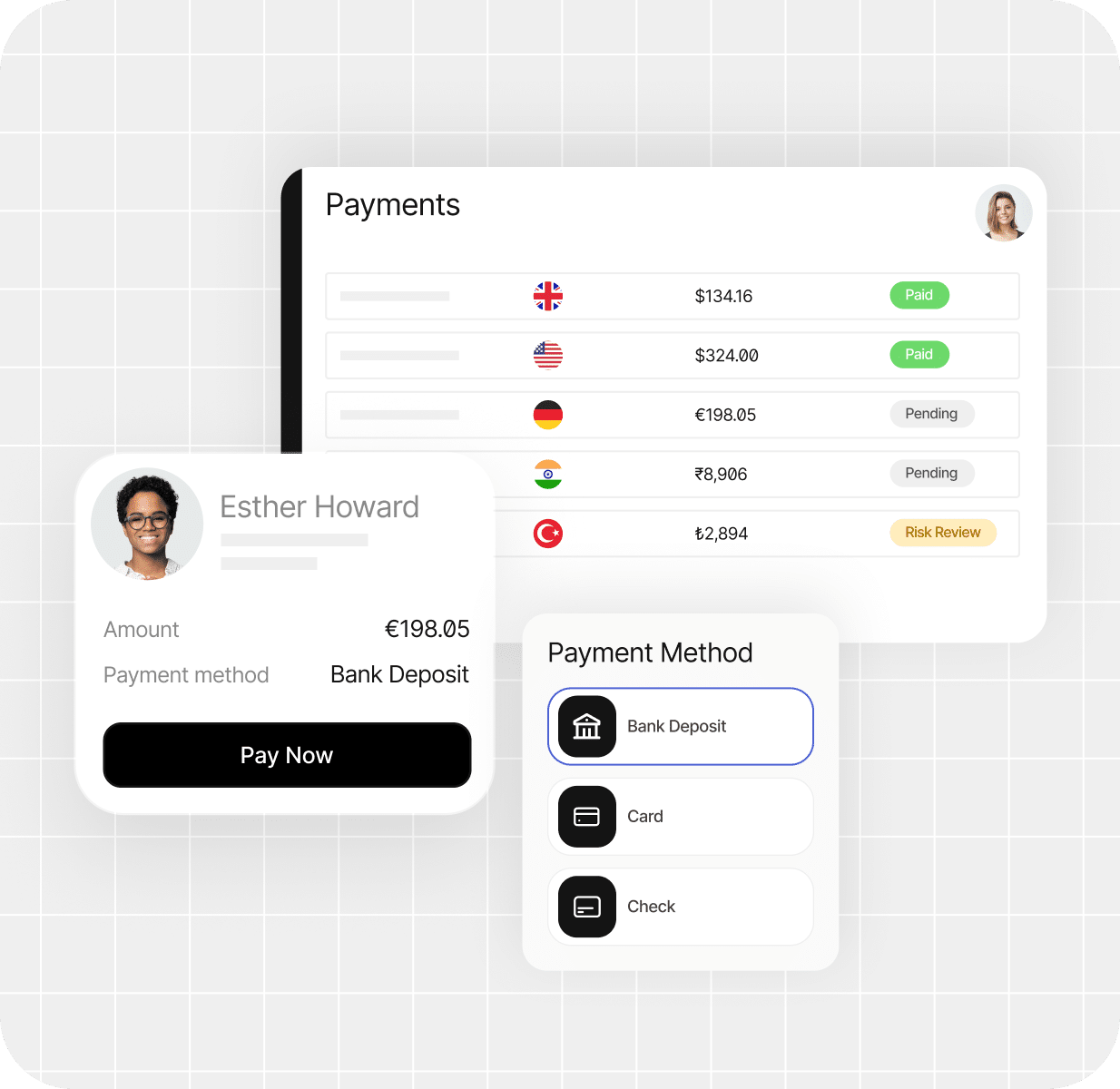

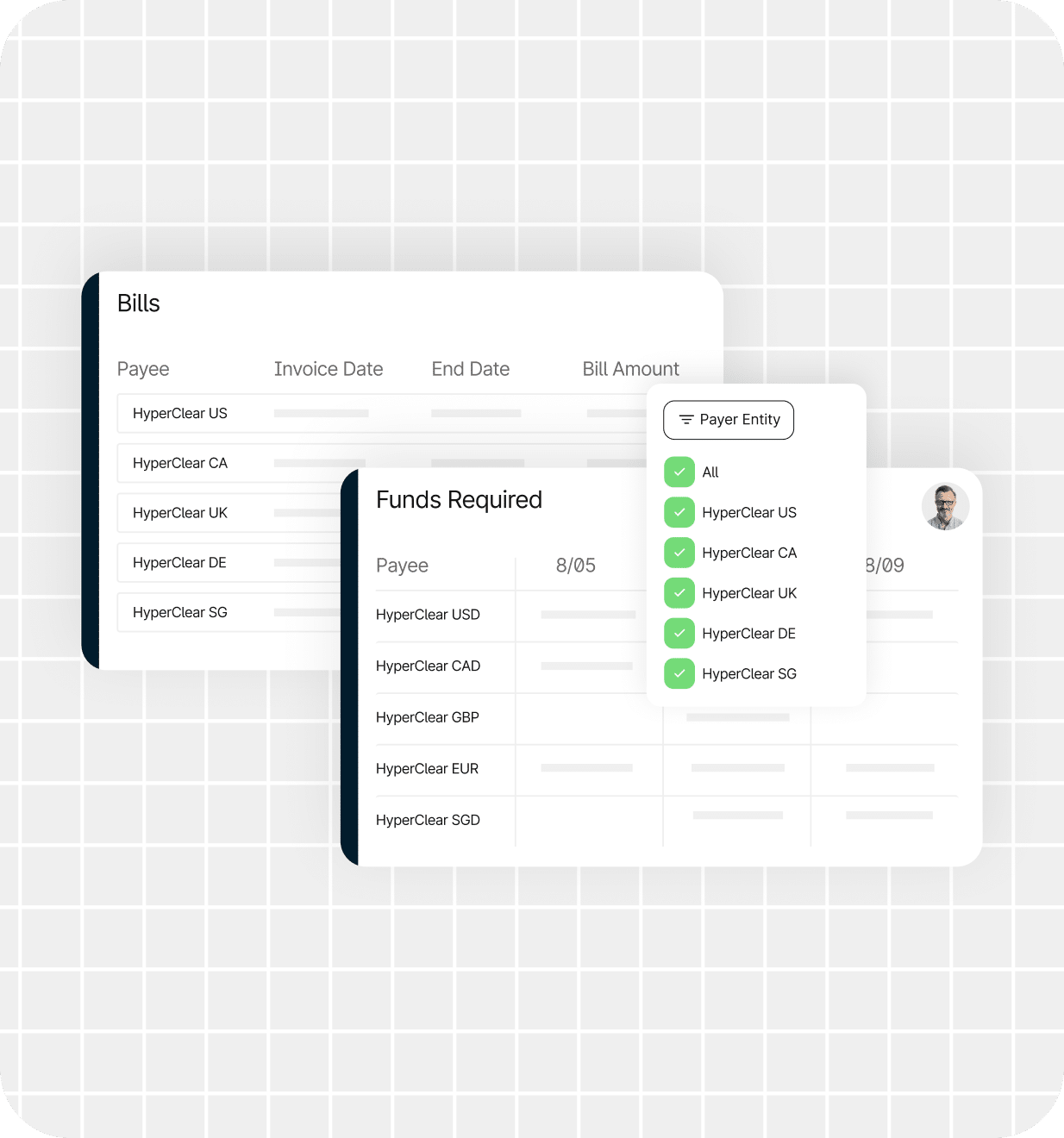

Real-Time Spend Visibility

See every payment, entity, and exception clearly and in real time, with the data you need to take action.

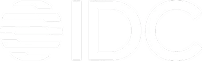

Multi-Entity Management

Roll up of spend data across entities into a consolidated headquarters view for easy monitoring and analysis.

Real-Time Reconciliation

Close your books 25% faster by integrating real-time, accurate spend data with your ERP.

AI-Driven Insights and Reporting

Tipalti AI Assistant is your 24/7 expert that connects data points to uncover opportunities and deliver actionable insights at your fingertips.

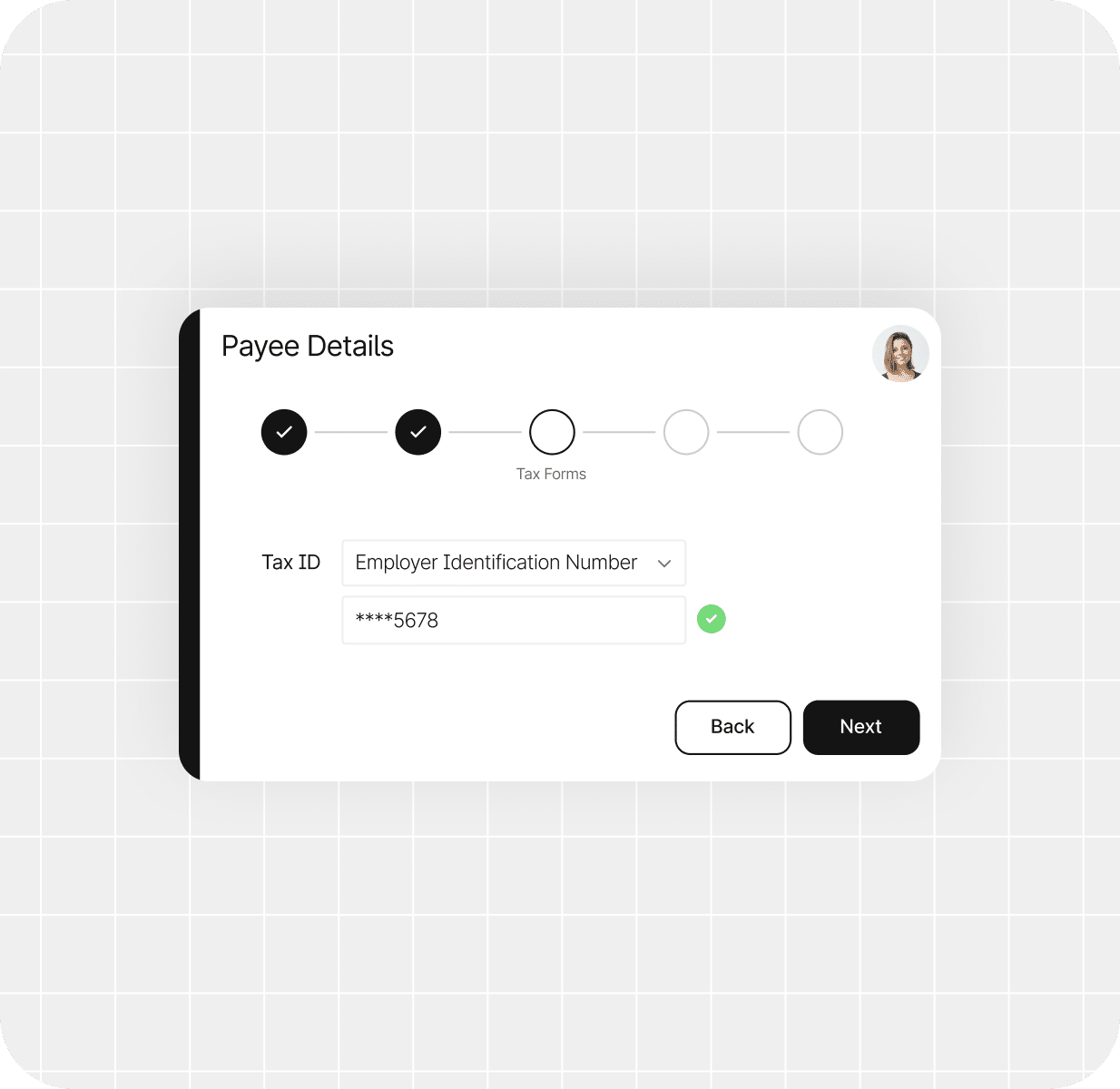

Transacting $75B+ in Annual Global Payments

Tipalti’s global infrastructure makes it easy to scale, stay compliant, and pay suppliers anywhere with confidence and control.

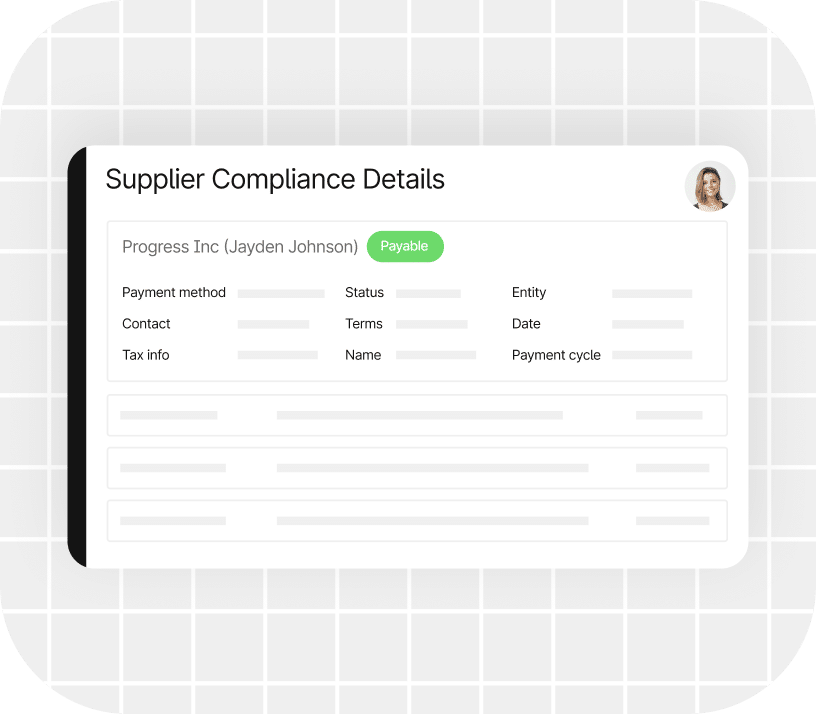

Built-In Financial and Regulatory Controls

From PO-matching to tax compliance and data security, Tipalti helps you stay ahead of risk while keeping operations running smoothly.

Automated PO-Matching

Prevent overspending with approval workflows, audit trails, automated two- and three-way PO matching, and centralized entity management.

Built-In Tax Compliance

Stay compliant with our KPMG-approved supplier tax automation, global tax ID validation, and streamlined year-end reporting.

Financial Compliance

Built-in safeguards to protect customer data and help you stay compliant with regulations, including industry certifications, encryption, access controls, and SSO integration.

Don’t Just Take Our Word for It, See What Our Global Customers Are Saying

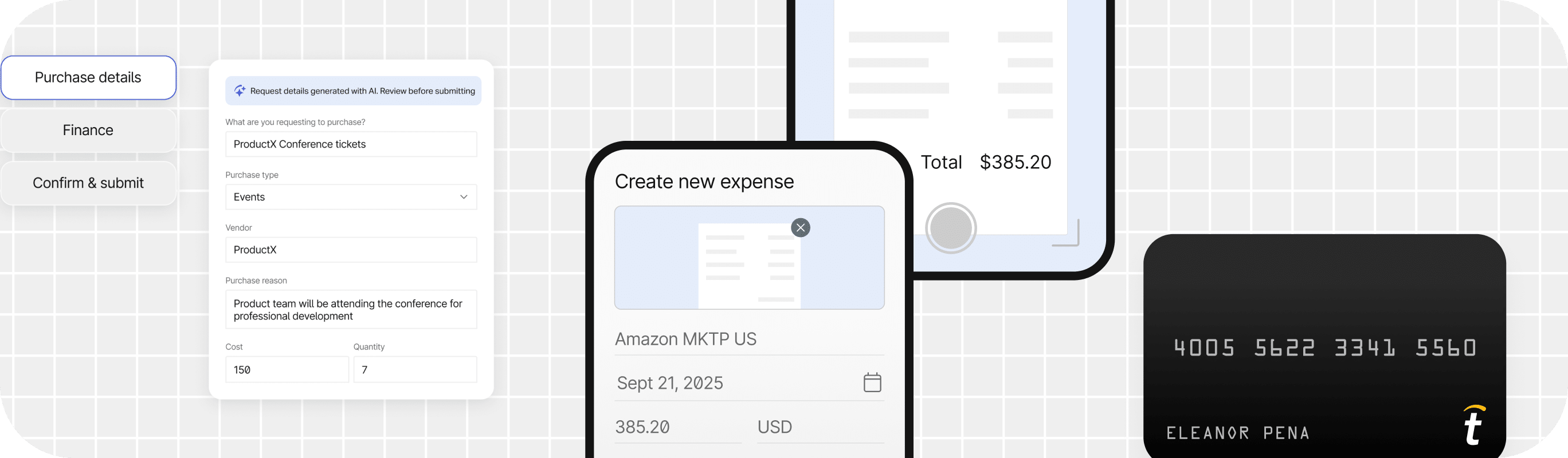

Extend to Procurement, Expenses and Card

Streamline your financial workflow by integrating Tipalti Procurement, Tipalti Expenses, and Tipalti Card in one platform.

Tipalti Procurement

Automate your entire procure-to-pay process. Unify purchasing and payments within a single platform to unlock end-to-end spend visibility and stronger controls.

Tipalti Expenses

Review, approve, reconcile, and reimburse employee expenses from one platform, so every step of the workflow happens in one place.

Tipalti Card

Use Tipalti Card to pay T&E expenses, pay invoices, and handle online or recurring virtual transactions—all from the same unified platform.

Customer Stories

See How the Top Teams

Automate AP

Compare

See how we stack up

| Features | Tipalti | BILL | Stampli | Concur | Airbase |

|---|---|---|---|---|---|

|

Supplier Management |

|

Limited functionality | Limited functionality |

|

Limited functionality |

|

Payments Network |

|

Limited functionality | Limited functionality | Limited functionality | Limited functionality |

|

Corporate Cards |

|

|

|

Limited functionality |

|

|

Invoice Management |

|

Limited functionality |

|

Limited functionality | Limited functionality |

|

Tax and Regulatory Compliance |

|

Limited functionality |

|

|

|

Ready to Get Your Time Back?

Book a demo to get started today and take control of your finance operations with Tipalti.

Resources

The AP Automation Playbook:

What every Modern Finance Leader Needs to Know

Recommendations

Access All Insights on AP Automation

FAQs

Still Have Questions?

What is AP automation?

Accounts payable automation (AP automation) involves using software to automate common vendor invoice tasks. It facilitates manual tasks for the payable department and allows for paperless document management, invoice processing, PO matching, and payment reconciliation.

Traditional accounts payable teams are burdened by overhead, manual data entry, and inefficiencies. An AP system allows teams to scale without adding more staff, gain better visibility into financial data, and achieve financial close-up to 25% faster.

Accounts payable software is a more affordable, flexible, and easier solution than accounts payable outsourcing.

How does AP software work?

AP software optimizes the accounts payable process in key areas where manual labor is causing inefficiencies, such as invoice processing, mass payments, data entry, price matching, and more.

The first step in invoice automation is data capture. An AP automation solution extracts all invoice data and automatically compares the line items with the purchase order information that is synced in your system, which is called PO matching. This can also be done with other documents like inspection reports and shipping receipts.

It then routes the invoice to the correct approvers. Once approved, the software sends invoice data to an integrated ERP system while archiving data from digital documents, paper invoices, and audit trails.

AP automation has many benefits. When automation software is used, accounts payable teams can reduce costs, eliminate routine tasks, and provide better visibility and control over financial data. It also facilitates cash flow and leads to early payment discounts.

What are the key benefits of AP automation software?

Automation helps to reduce the AP portion of procure-to-pay cycle time. It’s a best practice for improving the AP workflow. It skips the endless approver follow-up that happens with manual invoice processing and eases the labor workload.

The system automatically verifies vendors and validates invoices. It then forwards the approval request to the right person in the organization, completely automating the AP invoice approval process.

Accounts payable automation improves the structure of an AP department by separating duties both inside and outside of the team.

Proper segregation of AP duties is a requirement for solid internal controls. Other objectives include preventing fraud, matching responsibilities, and redefining roles to accommodate automation.

The invoice is automatically matched to the electronic purchase order in a two-way approval. Three-way approval requires those documents, plus a receiving report as the third item.

Plus, AP automation improves global supplier management by immediately alerting merchants when invoices have been paid. AP automation software forges stronger supplier relationships, and when a situation demands increased support or supply, vendors will be willing to go above and beyond to meet your needs.

How can a business minimize manual invoice data entry?

A business can minimize manual invoice data entry by adopting automated invoicing tools that extract data using OCR and AI, integrating accounts payable systems directly with ERPs, and enabling electronic invoice submission from vendors. Standardizing vendor formats and using workflow automation further reduces human touchpoints. Together, these steps improve accuracy, speed, and scalability while freeing teams from repetitive manual tasks.

How does AI improve invoice processing and automation?

AI improves invoice processing and automation by using intelligent data extraction (OCR and machine learning) to read invoices accurately, even when formats vary. It can auto-validate data against purchase orders, flag exceptions, and route approvals without human intervention. AI also learns from past corrections to improve accuracy over time, helping businesses speed up processing, reduce errors, cut costs, and eliminate repititive manual work.

How does Tipalti use AI to streamline AP workflows?

Tipalti uses AI to automate invoice capture, coding, and PO matching, eliminating most manual data entry and approvals. Its AI engine also detects duplicates or suspicious activity and routes invoices intelligently to the right approvers. Overall, it streamlines AP by speeding processing, reducing errors, and improving control.

You can streamline vendor invoice approval workflows by automating invoice intake, data capture, and routing so invoices move to the right approver without manual intervention. Standardizing approval rules, using notifications and reminders, and integrating your AP system with your ERP also speed up review and reduce bottlenecks. This results in faster cycle times, fewer errors, and clearer accountability.

How much does AP software typically cost?

The cost of AP automation software depends on the tasks your business needs to perform and how you plan to automate accounts. The best AP automation software offers the following modules:

- Scan and Archive: A document management system with invoice capture.

- Archival and Auto-Matching: This includes internal controls for AP, such as front-end processing and approval workflows. For this type of system, associated spend will include the annual license fee and related support costs, which include:

- Bi-directional integration

- Optical Character Recognition (OCR)

- Business intelligence

- Robotic Process Automation (RPA)

- Cloud-based Automation: In cloud-based AP automation, all infrastructure investments are made in the cloud, and the cost is shared. Usually, providers of this approach charge on a transactional basis instead of the license model.

Is AI-powered invoice capture better than OCR?

Yes, AI-powered invoice capture is generally better than traditional Optical Character Recognition (OCR) alone for processing invoices. While OCR is a fundamental technology for digitizing text, AI leverages smarter context recognition and machine learning to understand the meaning and relationships between data fields, not just the characters. This allows the AI system to continuously improve and adapt to various invoice formats without the need for fixed templates, offering greater accuracy and scalability.

How do you calculate the ROI of automating accounts payable (AP)?

The ROI of Accounts Payable (AP) automation is calculated by dividing the total annual savings (from reduced labor, fewer errors, and early payment discounts) by the annual cost of the automation system, and then expressing the result as a percentage.

This calculation essentially compares the financial benefits gained from increased efficiency and cost avoidance against the software, implementation, and maintenance expenses. The core goal is to determine if the cost per invoice is significantly lower after automation.

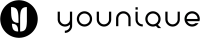

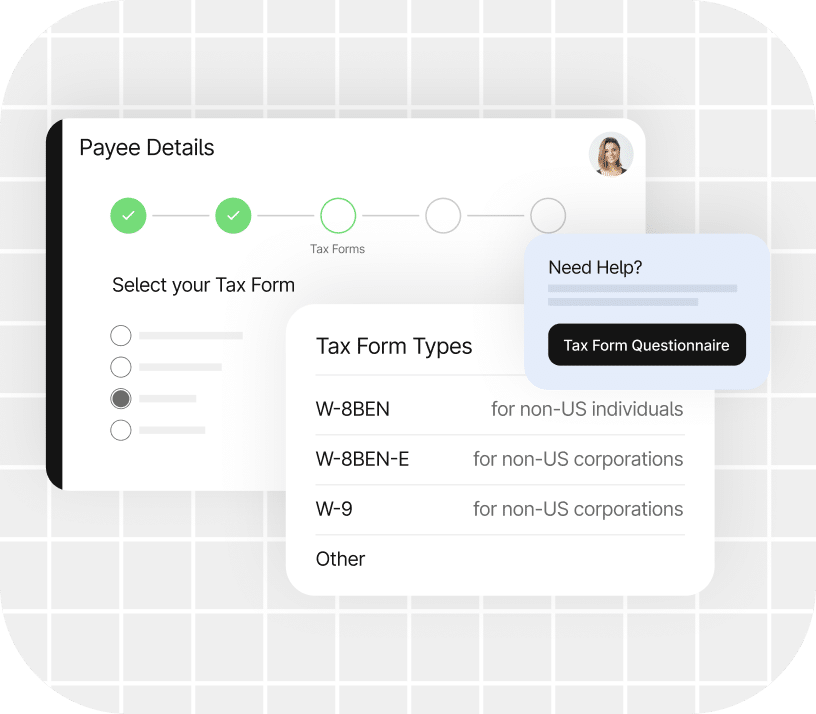

How does AP software handle tax compliance?

Accounts Payable (AP) software help companies manage their bills and payments efficiently, especially when it comes to tax compliance. AP software includes features and functionalities that address tax-related requirements in an accurate and timely manner.

Tipalti’s tax solution helps your company comply with IRS tax provisions and simplifies the AP process. Our guided tax form wizard assists suppliers in choosing the correct form based on the country and business structure.

For non-US payers, local and VAT tax ID collection is available. If the foreign entity comes from a country with a U.S. tax treaty, they can fill out and submit a W-8BEN-E form.

Tipalti facilitates IRS AP tax compliance with KPMG-approved tax form data validation and withholding calculations.

How does AP automation software integrate with ERP systems?

ERP system integrations are largely built around identifying back-end processes that can be streamlined with AP automation. Tipalti has pre-built integrations to connect to popular systems like Sage Intacct, NetSuite, QuickBooks Online, Microsoft Dynamics 365, Xero and Acumatica.

The Tipalti platform syncs bill and payment data in real-time, accelerating the reconciliation process. The level of integration is always dependent on your needs and workflow.

How does B2B payment processing work with AP automation software?

AP software improves oversight with a full view of B2B payment cycles and the analysis of accounts payable metrics. This is what makes AP software especially critical for operations for a small business.

When it comes to B2B payments, ACH transfers are the leading form of payment. Every year, check remittances steadily decrease while wire transfers are on the rise.

How do you choose the right accounts payable automation platform for your business?

Choosing the right Accounts Payable (AP) automation platform involves first defining your specific business needs for invoice volume, approval complexity, and budget. Next, you should prioritize platforms that offer seamless integration with your existing ERP or accounting software, strong security features, and essential capabilities like automated data capture, customizable workflows, and compliance tools.

Finally, assess its scalability, ease of use, and the quality of vendor support to ensure it can grow with your business and is easily adopted by your team.

Want a personalized live demo?

We are standing by to answer any questions you may have.

Request a demo

Complete the form below, and we’ll contact you to schedule your personalized demo.

Thank you for your interest

Thank you for watching our demo videos on AP automation and for your request to schedule a live personalized demo. We are excited to show how Tipalti can streamline your account payable process and enhance your financial operations. An AP automation specialist from Tipalti will reach out to you as soon as possible.