Save time and empower your finance team with Tipalti. The most complete AP solution loved by 5,000+ businesses.

AP automation software provides businesses with significant cost savings through efficiency, timely early payment discounts, and better analysis for decision-making. It provides single and multi-entity corporations with real-time spend visibility and enhances internal controls.

This guide compares native Sage Intacct AP automation with Tipalti’s more comprehensive, third-party Sage Intacct AP automation add-on that integrates with Sage Intacct accounting software.

AP Automation for Sage Intacct

With an integrated AP automation app, Sage Intacct ERP accounting software users:

- Eliminate manual processes

- Reduce supplier onboarding and accounts payable invoice processing to payment time

- Streamline AP workflows, including electronic purchase order and receiving report matching

- Gain efficiency with RPA (robotic process automation)

- Cut business costs with the best spend management software features

Automating accounts payable with AP automation for Intacct improves internal controls and reduces fraud risk and payment errors. It accelerates invoice processing time, including for the approval process, and should automate regulatory compliance for global payments. With the best AP automation software, your business can reduce hiring needs.

YouTube video for integrating Tipalti with Sage Intacct

What is the Sage Intacct ERP Accounting System?

Sage Intacct is a multi-currency and multi-entity, cloud-based accounting system designed for fast-growing companies that need to scale up their accounting software as their revenue grows. The product is designed for small businesses (with up to 500 employees) and medium-sized business users. Some Sage Intacct users are single-entity businesses. Other Sage Intacct users are multi-entity businesses requiring consolidations of financial statements. Sage Intacct competitors include QuickBooks Online and NetSuite.

The AICPA, which is the professional trade organization for licensed CPAs, recommends using Sage Intacct as your accounting system. Sage Intacct is the AICPA’s only preferred financial management solution. Going beyond Sage Intacct, the AICPA believes that CPAs and business financial executives should use AI (artificial intelligence) with human-in-the-loop exceptions handling (that automation software provides) to improve their accounting efficiency, according to its CPA.com 2025 AI in Accounting Report.

Does Sage Intacct have AP Automation?

Sage Intacct offers a native AP automation product that digitally captures invoices, matches invoices, enables paperless approvals, uses a non-MSB payment partner, reconciles accounts payable, and provides payment status.

Why Should Financial Management Choose an AP Automation Solution?

The best AP automation software digitizes invoices, adding streamlined and automated invoice processing workflows, tax and global regulatory compliance, and AI-generated custom reporting for business intelligence. It improves global payments and financial controls.

With any standard manual accounts payable in an accounting or ERP system software module, your finance team may experience:

• Many frustrations

• Longer accounts payable process cycles

• Manual payment processes that aren’t personalized to customer needs

• Paper invoices, purchase orders, and receiving reports

• Manual data entry inaccuracies

• Inadequate real-time vendor and invoicing verification, leading to potential fraud

• Missing supplier W-9 and W-8 series tax forms

• Approver delays

Fraud Risks and Detection

“Fraud costs public companies an estimated 2.5% of revenue,” according to a CFO Magazine article, a joint ACFE and AFC survey (from the Association of Certified Fraud Examiners and Anti-Fraud Collaboration). This overall fraud rate includes vendor fraud. Furthermore, fraud may be undetected and not even measured by the statistics.

More than half (56%) [of ACFE survey respondents] simply recommended more or improved proactive and continuous monitoring for fraud. Fifteen percent advocated for new or improved use of technology or AI, and 13% suggested enhanced efforts related to fraud awareness training and an anti-fraud culture.

Cost Savings from Automation

How does a reduction in accounts payable workload translate to cost savings in processing an accounts payable invoice?

AP Process Costs Reduction

The “total cost to perform the AP function per $1,000 revenue” metric is $0.92 for bottom performers in the 75th percentile, $0.57 for a median performer, compared to $0.38 for a top performer in the 25th percentile. These metrics are provided in an August 2025 CFO Magazine article written by Perry Wiggins, the APQC CFO, Secretary, and Treasurer, titled “3 ways to reduce AP process costs: Metric of the month.”

The CFO article suggests 3 ways to improve AP process costs:

- Policies and procedures for capturing vendor payment terms

- In supplier agreements

- During initial supplier onboarding

- Improve invoice accuracy and controls

- Duplicate invoice detection

- Reducing risk of errors and rework

- Using electronic payments

- Improve vendor communication

- Standard invoice submission process

- Other vendor communications, including automated payment status

From the CFO article on AP process costs:

Organizations can assess the efficiency of accounts payable by benchmarking the metric ‘total cost to perform the AP function per $1,000 revenue.’ At the American Productivity & Quality Center, we define this as including all AP-related labor, technology, overhead and outsourced services, divided by total revenue, then multiplied by $1,000.

When comparing top to bottom performers:

For a billion-dollar company, that’s a difference of more than $500,000 annually.

Consider the difference for your own company as it transitions to becoming a top performer with AP automation.

AP Invoice Processing Cost

In February 2018, the top-ranked 25% of organizations surveyed by APQC (American Productivity & Quality Center) had an AP invoice processing cost of $2.07 or less. This benchmark metric was $5.83 for median performers and $10.00 or more for the bottom performers.

Top AP Automation Solution for Sage Intacct: Tipalti

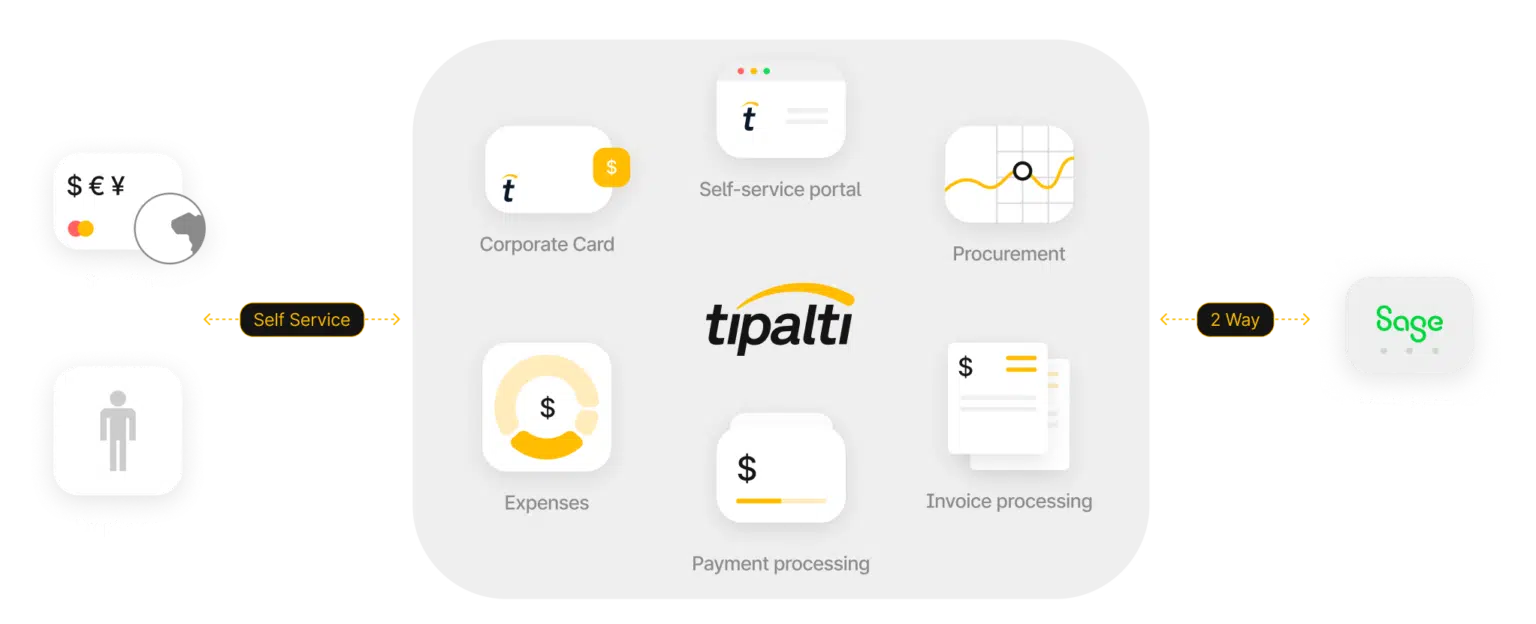

Tipalti is a top AP end-to-end automation solution for Sage Intacct. Instead of using native Sage Intacct automation software for accounts payable automation, Tipalti AP automation integrates with Sage Intacct accounting software via a pre-built API and bi-directionally syncs. Tipalti also integrates with other ERPs, including Sage 100.

We provide a Tipalti overview, describe its features, and cover Tipalti pricing.

Overview

Tipalti provides AP automation software, targeting mid-market companies, smaller companies with exceptional growth potential, and enterprise companies. Tipalti is scalable for business growth.

Other Tipalti finance automation products include its advanced FX solutions for currency management (Tipalti Multi-FX and Tipalti FX Hedging), mass payments automation, employee Expense Management automation, and PO management as Procurement automation software.

Tipalti offers approved users the Tipalti Card, a cashback rewards corporate card to control employee spending that integrates with Tipalti Expense Management software.

In June 2025, Tipalti acquired Statement, a treasurer automation software provider. As of August 2025, Statement Treasury is a standalone solution that can be used with Tipalti finance automation. Statement will be fully integrated into Tipalti’s platform in the second half of 2025.

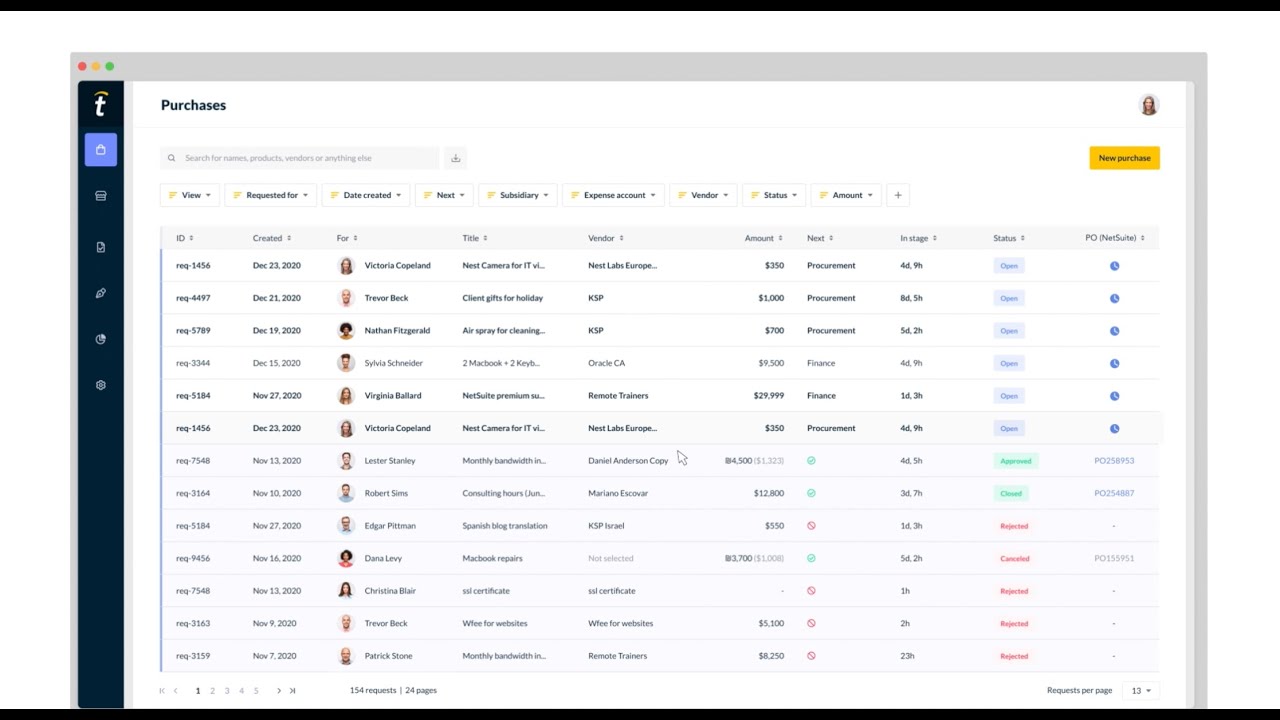

Features

• Self-service supplier onboarding

• Supplier and bank account validation

• Supplier invoice receipt and payment status communication

• Invoice data capture

• Automated invoice processing

- 2 or 3-way matching

- Error detection using 26,000+ rules, with exceptions flagging

- Guided approvals with automatic routing

- Global payments

• Automated global regulatory compliance

• Cash flow requirements

• Global payments by licensed money transmitter

• Choice of 50+ available payment methods in 200 countries and 120+ currencies

• Automatic real-time payment reconciliation

• AI Report Builder

Self-Service Supplier Onboarding with Payment Method Choices

Tipalti starts the purchase-to-pay cycle with self-service supplier onboarding through a portal called Supplier Hub. Tipalti self-service supplier onboarding includes collecting supplier contact information, W-9 or W-8 tax forms, and payment method selection and payment information. Tipalti offers real-time supplier tax verification using a KPMG-approved tax engine that verifies the taxpayer identification number (TIN).

Vendors choose how they want you to pay them through Tipalti AP automation for Sage Intacct. Their payment automation choices include US ACH (a type of EFT), PayPal, paper checks, global ACH, wire transfers, or prepaid debit cards in the preferred currency with cross-border remittance.

This supplier onboarding process shifts some of your organization’s accounts payable process time to vendors and increases information accuracy.

Invoice Processing Automation

Tipalti automates the entire AP process, including invoice data capture, PO matching, routing for approval workflows, and global payments. The Tipalti Expense Management product integrates with Tipalti AP Automation to enable simple employee expense claim submission, including using mobile app receipt photos for creation, approvals, and management.

The Tipalti automation platform provides automatic real-time payment reconciliation and AP reporting that:

- Gives more visibility for cash management sooner

- Improves financial statement accuracy

- Helps you close the books earlier every month and at year-end

- Gives the finance and accounting team more time for financial planning & analysis (FP&A), strategy, and decision support

Tipalti AI Smart Scan for digitized invoice capture uses OCR (optical character recognition) and artificial intelligence with machine learning. For invoice automation, suppliers submit invoices via email or Supplier Hub upload.

The 2-way or 3-way matching with purchase orders (POs) and receiving records provides an exception tolerance that’s acceptable for your business.

Automated global regulatory compliance includes OFAC blacklists screening, AML (anti-money laundering), and KYC (know your customer).

Real-time visibility of accounts payable and batch payments cash requirements improves cash management, including cash flow forecasting.

Tipalti real-time batch payment reconciliation handles multiple payment methods and currencies for large invoice payment batches.

Supplier Management, including Automatic Payment Status

Tipalti excels at supplier management, which is important to your supply chain. In the Supplier Hub, vendors have complete visibility of invoices, payment statuses, and any problems that could delay payment. Suppliers also receive emailed payment status.

AI Report Builder

AI Report Builder for real-time custom reporting is one of the features in Tipalti AI-driven AP and finance automation. Tipalti’s AI Report Builder uses your natural language prompt in Tipalti to create a report that you can analyze and download for business intelligence in decision-making.

Financial Controls

Tipalti for Sage Intacct automation offers an audit trail and segregation of duties with role-based access. Automatic processes improve internal controls, help you avoid fraud, and save your company time and money.

Pricing

Tipalti uses a SaaS subscription-based pricing model that grows with your business needs. To upgrade from the basic platform, a business can add advanced functionality and users when needed. Tipalti provides custom pricing quotes.

Tables Comparing Native Sage Intacct and Tipalti for AP Automation

Table 1

| Supplier Onboarding/ Invoice Processing through Invoice Approval | Sage Intacct Native Integration Capabilities | Tipalti Add-On Capabilities |

|---|---|---|

| Multi-entity, real-time visibility by entity and combined | Yes | Yes |

| Digital invoice capture – headings and line items | Yes, with AI/machine learning | Yes, with Tipalti AI Smart Scan |

| Self-service supplier onboarding portal | Yes | Yes |

| Auto-coding with AI | Yes | Yes |

| Automated 2-way or 3-way matching | Yes | Yes |

| Duplicate invoice and error detection | Yes | Yes |

| Automated global regulatory compliance | No | Yes |

| Supplier fraud behavior monitoring | Yes – through payment partner | Yes – with Tipalti Detect® |

| Human-in-the-loop exceptions handling | Yes | Yes |

| Paperless approval routing and communications | Yes | Yes |

Table 2

| Payments, Taxes, Analysis, and Optional Functionality | Sage Intacct Native Integration Capabilities | Tipalti Add-On Capabilities |

|---|---|---|

| Payments transmitted by registered Money Services Business | No | Yes |

| Global payments in local currencies/currency conversion | Yes | Yes |

| Real-time payment reconciliation | Yes | Yes |

| Secure payments and audit trail | Yes | Yes |

| KMPG-approved tax engine | No | Yes |

| Native supplier TIN matching | No – third-party tax software integration required | Yes |

| Optional 1099 e-filing through tax software partner | Yes | Yes |

| AI-powered queries to create real-time custom reports | No | Yes – AI Report Builder |

| Extend with FX, treasury, expenses, and procurement | No | Yes |

Table Comparison Highlights: Tipalti vs. Native Sage Intacct AP Automation

This tabular comparison of native Intacct AP automation with Tipalti AP automation indicates that Tipalti provides more extensive functionality than native Sage Intacct AP automation in certain areas of accounts payable automation. Tipalti offers a unified platform of finance automation products to extend its functionality further.

Tipalti is a money transmitter registered and regulated as a money services business (MSB), whereas Sage Intacct’s partnered payment provider isn’t a registered MSB.

The optional Tipalti Multi-FX product (supporting 30 currencies) works with Tipalti AP automation as an advanced currency management solution. Multi-FX enables your business to pay supplier invoices for all subsidiaries using a virtual payment account, eliminating the need to establish an international regional banking network. Corporate headquarters can fund your virtual account in your preferred currency.

Tipalti also offers its Tipalti Hedging product to hedge currency fluctuations in payables between the invoice date and payment.

66% fewer payment errors. 25% faster close. 80% less AP workload.

Case Study: ImaginAb

ImaginAb, a biotech company, uses AP automation for Intacct by integrating Tipalti AP automation with its Sage Intacct accounting software. According to the results in its Tipalti customer story, Imagin Ab eliminated 1,750 hours of annual accounts payable workload, shifted staff time to value-added projects, accelerated its financial close, and reduced its hiring needs by using Tipalti AP automation to replace manual accounts payable processes. As a further benefit, “ImaginAb eliminated the likelihood of having an audit deficiency in accounts payable, processing, and payments.”

When we automated, we had an accounts payable person who was spending 40 hours a week doing accounts payable. Now that the system is automated, the accounts payable time is probably in the five to 10 hours per week arena.

David Fractor, Chief Financial Officer, ImaginAb

Maximize Sage Intacct Investment with Tipalti’s AP Automation

Sage AP automation, as Intacct accounting software with seamless integration to add-on AP automation software, addresses the frustrations of AP teams, accounting, and financial management. With a third-party Sage Intacct-integrated AP automation solution, your business can maximize investment in Sage Intacct accounting software.

When selecting AP automation for Sage Intacct, choose award-winning Tipalti AP automation integrated with Sage Intacct accounting software to:

- Meet your current and future business needs

- Leverage employees’ time for participation in higher-value projects

- Reduce invoice processing time

- Reduce costs, fraud, and errors

- Elevate supplier relationships and payment satisfaction

Tipalti provides digital transformation, scales for supplier invoice volume growth, and handles the AP automation needs of complex organizations. Besides Sage Intacct, Tipalti also works with other ERP systems and retains your Tipalti automation data if your business chooses migration to a different system.

Automate payables in Sage Intacct for faster, smarter global payments

Cut 80% of manual AP work, sync seamlessly with Sage Intacct, and pay vendors in over 200 countries on time.