Tipalti Accounts Payable

Get Hours Back Every Week with Complete

AP Automation Software

Powered by AI, Tipalti Accounts Payable automates the manual, time-consuming AP tasks, freeing your team to focus on higher-value initiatives.

Rated 4.5/5

based on 350+ Reviews

Leader in the IDC 2024 Marketscape

Worldwide Accounts Payable Automation Software for Midmarket

Trusted by Mid-Market Leaders

End-to-End AP Automation Platform

From supplier onboarding, invoice management to reconciliation,

all in one system

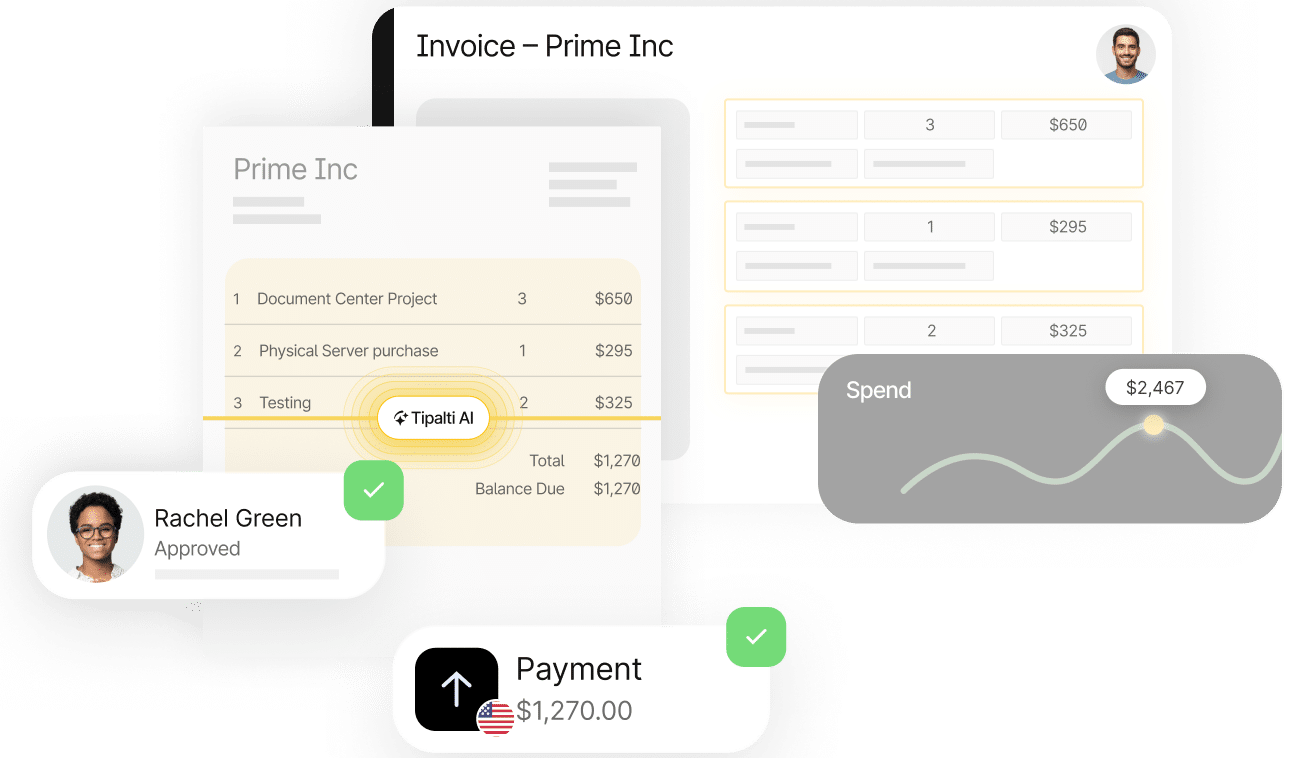

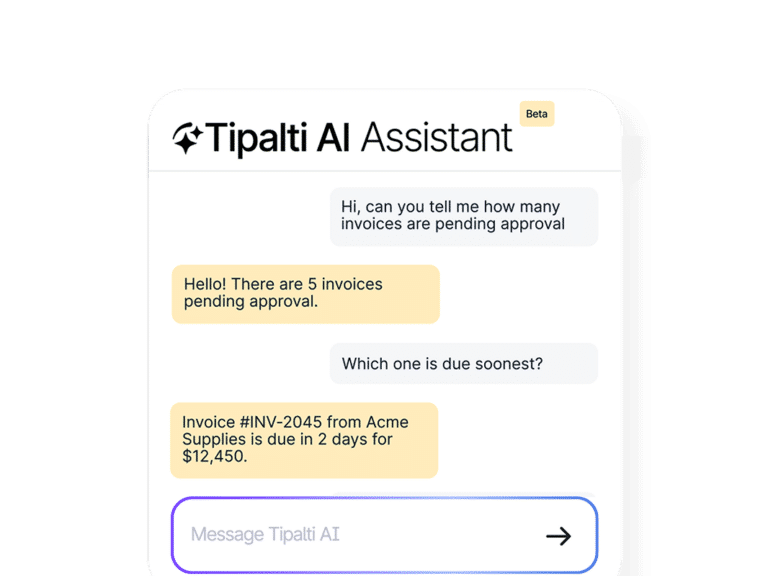

AI-Powered AP

Tipalti AI Assistant and Agents drive efficiency at scale by automating the AP process from capture and coding to approval and payment, while giving you visibility and insights to make better decisions.

Proven Impact Delivered to Our Customers

Up to

80%

Reduction in time spent

managing AP workflows

Over

25%

Faster book close

Data derived from Tipalti research and case studies. Results reflect companies upgrading from manual processes.

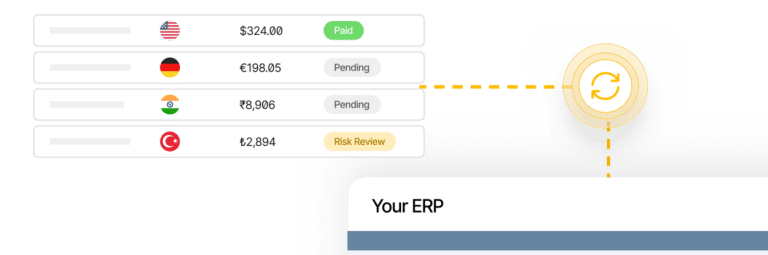

Pre-built ERP Integrations to Extend Automated Workflows

Integrate with leading ERP and accounting systems, such as NetSuite, Sage Intacct, QuickBooks, Microsoft Dynamics, and SAP.

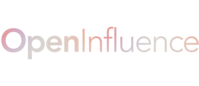

Real-Time Spend Visibility

See every payment, entity, and exception clearly and in real time, with the data you need to take action.

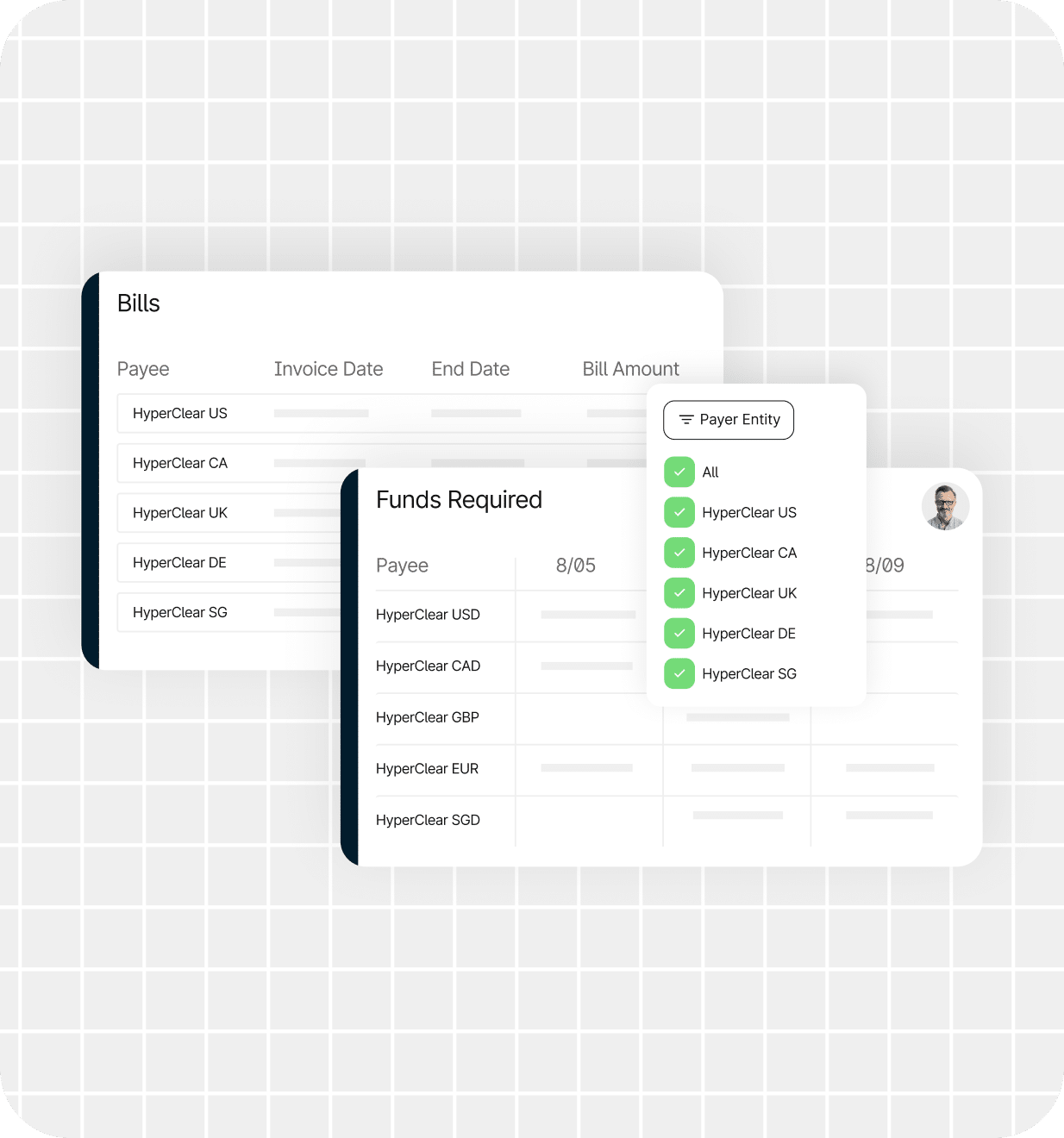

Multi-Entity Management

Roll up of spend data across entities into a consolidated headquarters view for easy monitoring and analysis.

Real-Time Reconciliation

Close your books 25% faster by integrating real-time, accurate spend data with your ERP.

AI-Driven Insights and Reporting

Tipalti AI Assistant is your 24/7 expert that connects data points to uncover opportunities and deliver actionable insights at your fingertips.

Transacting $75B+ in Annual Global Payments

Tipalti’s global infrastructure makes it easy to scale, stay compliant, and pay suppliers anywhere with confidence and control.

Built-In Financial and Regulatory Controls

From PO-matching to tax compliance and data security, Tipalti helps you stay ahead of risk while keeping operations running smoothly.

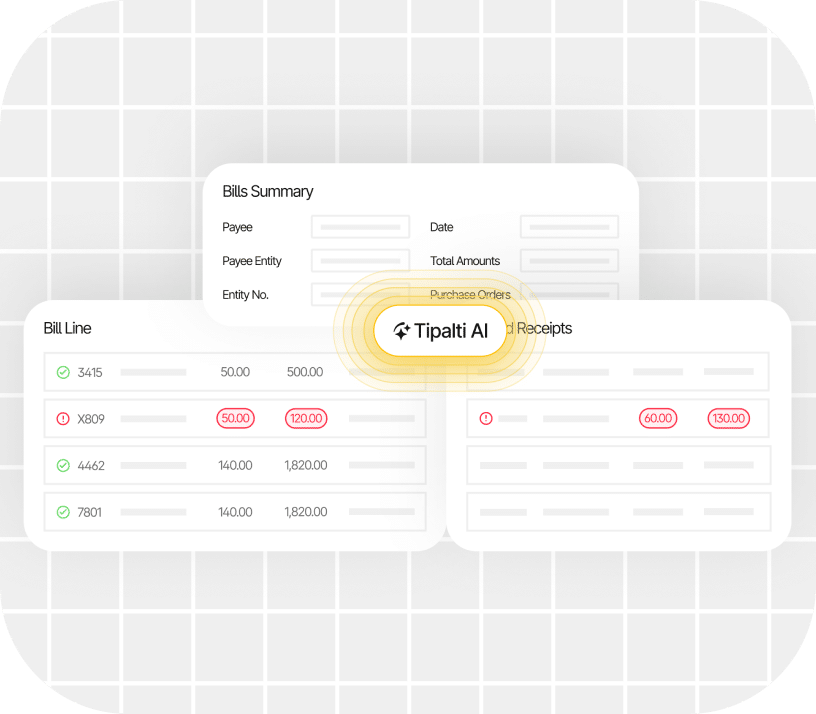

Automated PO-Matching

Prevent overspending with approval workflows, audit trails, automated two- and three-way PO matching, and centralized entity management.

Built-In Tax Compliance

Stay compliant with our KPMG-approved supplier tax automation, global tax ID validation, and streamlined year-end reporting.

Financial Compliance

Built-in safeguards to protect customer data and help you stay compliant with regulations, including industry certifications, encryption, access controls, and SSO integration.

Don’t Just Take Our Word for It, See What Our Global Customers Are Saying

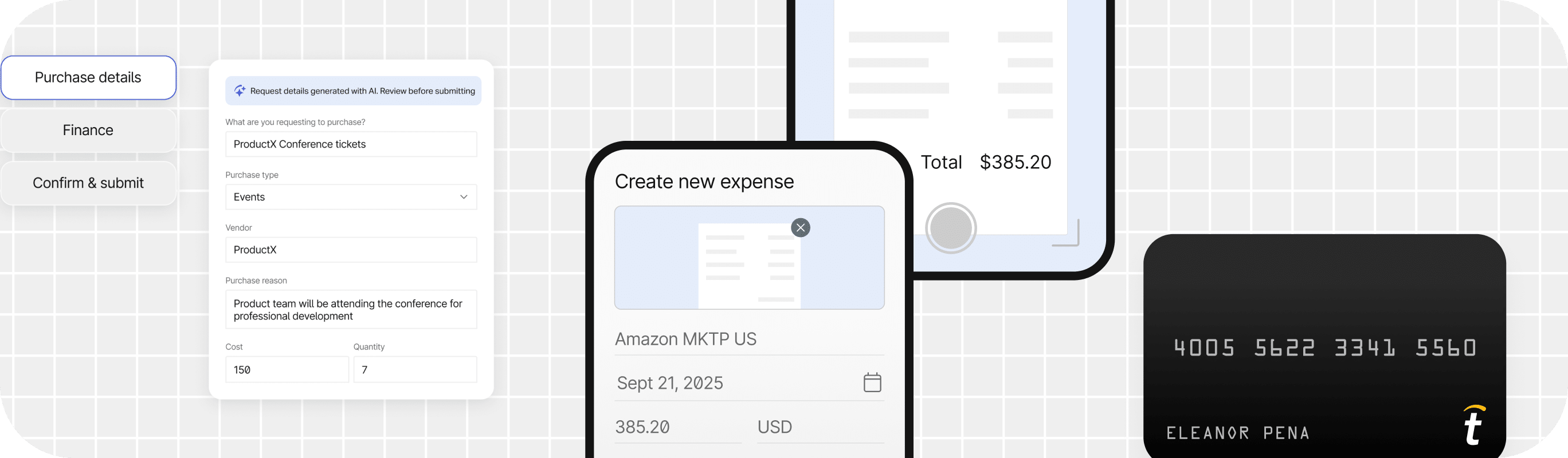

Extend to Procurement, Expenses and Card

Streamline your financial workflow by integrating Tipalti Procurement, Tipalti Expenses, and Tipalti Card in one platform.

Tipalti Procurement

Automate your entire procure-to-pay process. Unify purchasing and payments within a single platform to unlock end-to-end spend visibility and stronger controls.

Tipalti Expenses

Review, approve, reconcile, and reimburse employee expenses from one platform, so every step of the workflow happens in one place.

Tipalti Card

Use Tipalti Card to pay T&E expenses, pay invoices, and handle online or recurring virtual transactions—all from the same unified platform.

Customer Stories

See How the Top Teams

Automate AP

Ready to Get Your Time Back?

Book a demo to get started today and take control of your finance operations with Tipalti.

Resources

The AP Automation Playbook:

What every Modern Finance Leader Needs to Know

Recommendations

Access All Insights on AP Automation

FAQs

Still Have Questions?

What is AP automation?

AP automation is the process of digitizing and streamlining how companies manage invoices and payments. It replaces manual tasks—like data entry, paper handling, and chasing approvals—with automated workflows for invoice capture, PO matching, approvals, payments, and reconciliation.

Traditional AP teams struggle with manual, fragmented processes, forcing AP managers to spend more time on exceptions, while increasing risk, costs, and delayed cash flow visibility for Controllers, CFOs, and other finance leaders.

An AP automation software solution helps teams scale payments without added headcount, while delivering real-time visibility, stronger controls, and a more cost-effective alternative to outsourcing.

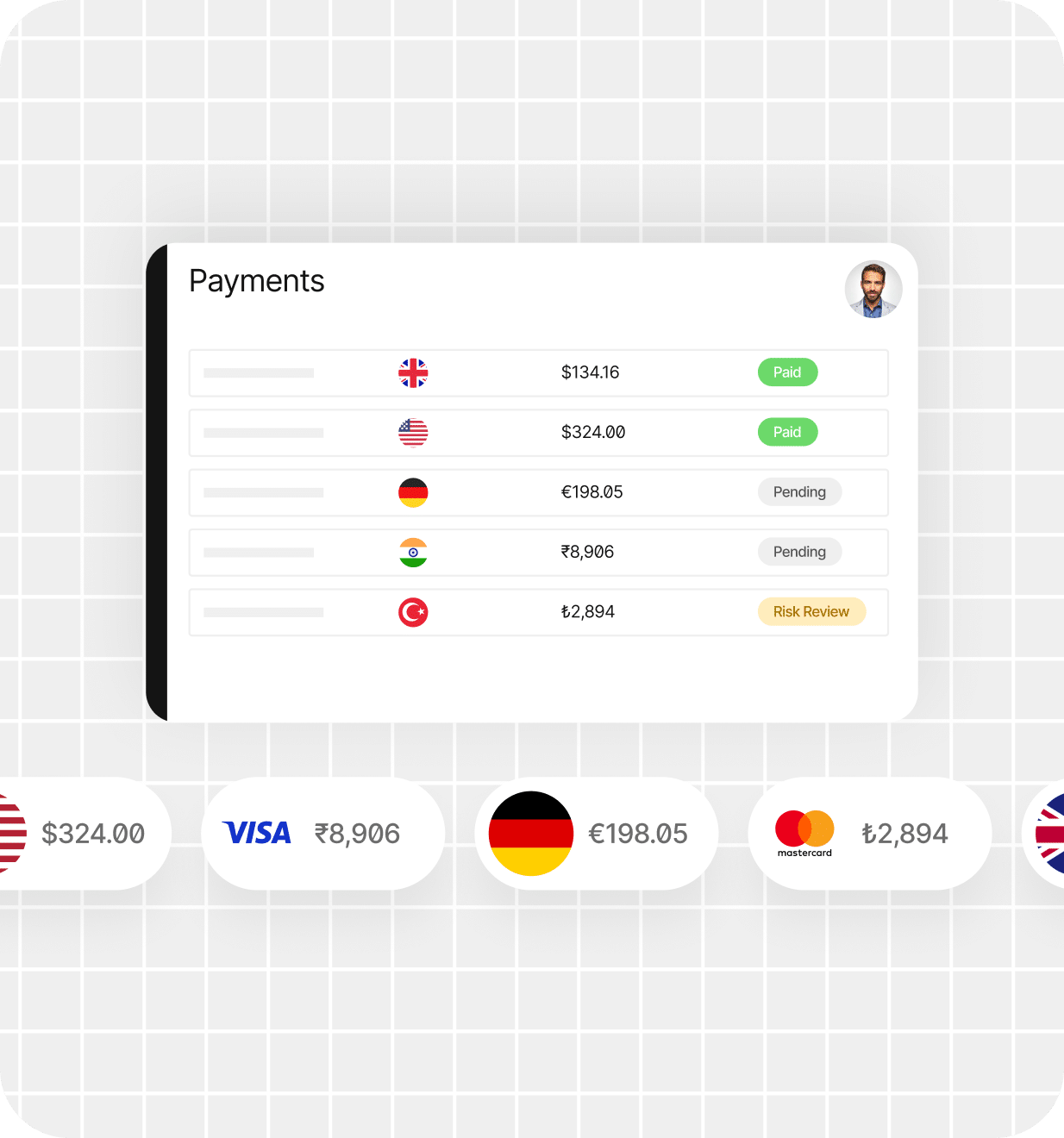

How does AP software work?

Accounts payable automation software optimizes the accounts payable process in key areas where manual labor is causing inefficiencies, such as invoice processing, mass payments, data entry, price matching, and more.

AP software starts by automatically capturing data from invoices, whether they come in by email, PDF, or paper. It then matches each invoice to purchase orders and other documents—like shipping receipts or inspection reports—to ensure accuracy. This step is called PO matching.

Next, the invoice is routed to the correct approvers based on your company’s workflow, helping standardize and accelerate pay processes. After approval, the system syncs the invoice data with your ERP and stores a complete audit trail of the transaction.

AP automation software helps reduce manual, error-prone work, cut processing costs, and improve visibility into cash flow. It also makes it easier to capture early payment discounts and close the books faster.

What are the key benefits of AP automation software?

Automation helps to reduce the AP portion of the procure-to-pay cycle time. It’s a best practice for improving the AP workflow. It skips the endless approver follow-up that happens with manual invoice processing and eases the labor workload.

A fully automated AP invoice approval process delivers the following benefits:

- Verifies vendors and validates supplier invoices to reduce discrepancies

- Forwards the approval request to the right person in the organization, improving processing time and decision-making for finance teams

- Enhances the structure of an AP department by separating duties both within and outside the finance team

- Prevents fraud, matches responsibilities, and redefines roles to strengthen controls across financial operations

- Matches invoices to electronic purchase orders in two-way and three-way match controls

- Enhances global supplier management by promptly alerting merchants when invoices have been paid

- Forges stronger supplier relationships through reliable vendor payments

- Reduces late payments, improves payment status visibility, and delivers measurable cost savings with user-friendly payable automation solutions

How can a business minimize manual invoice data entry?

A business can minimize manual invoice data entry by adopting automated invoicing tools that extract data using OCR and AI, integrating accounts payable systems directly with ERPs, and enabling electronic invoice submission from vendors.

Standardizing vendor formats and utilizing workflow automation further reduces the number of human touchpoints. Together, these steps improve accuracy, speed, and scalability while freeing finance teams from repetitive manual tasks.

How does AI improve invoice processing and automation?

AI improves invoice processing and automation by using intelligent data extraction (OCR and machine learning) to read invoices accurately, even when formats vary.

It can auto-validate data against purchase orders, flag exceptions, and route approvals without human intervention.

AI also learns from past corrections to improve accuracy over time, helping businesses speed up processing, reduce errors, cut costs, and eliminate repititive manual work.

How does Tipalti use AI to streamline AP workflows?

Tipalti uses AI to automate invoice capture, coding, and PO matching, eliminating most manual data entry and approvals. Its AI engine also detects duplicates or suspicious activity and routes invoices intelligently to the right approvers. Overall, it streamlines AP by speeding processing, reducing errors, and improving control.

You can streamline vendor invoice approval workflows by automating invoice intake, data capture, and routing so invoices move to the right approver without manual intervention. Standardizing approval rules, using notifications and reminders, and integrating your AP system with your ERP also speed up review and reduce bottlenecks. This results in faster cycle times, fewer errors, and clearer accountability.

Is AI-powered invoice capture better than OCR?

Yes, AI-powered invoice capture is generally better than traditional Optical Character Recognition (OCR) alone for processing invoices.

While OCR is a fundamental technology for digitizing text, AI leverages smarter context recognition and machine learning to understand the meaning and relationships between data fields, not just the characters.

This allows the AI system to continuously improve and adapt to various invoice formats without the need for fixed templates, offering greater accuracy and scalability.

How much does AP software typically cost?

The cost of AP automation software varies based on company size, invoice volume, and the level of automation required.

- Small businesses typically pay lower costs, often using lightweight AP tools priced per invoice or per user. These solutions focus on basic invoice capture and approvals but may lack scalability, global payments, and advanced controls.

- Mid-market companies generally invest more as invoice volumes grow and financial complexity increases. Pricing often reflects the need for automated invoice processing, ERP integrations, approval workflows, and payments—all designed to reduce manual effort without adding headcount.

- Larger or global organizations require enterprise-grade automation. Costs scale based on transaction volume, entities, and functionality such as multi-currency payments, tax compliance, audit controls, and real-time reporting.

Most AP automation software follows one of two pricing models:

- License-based pricing, with an annual fee tied to users or features.

- Transactional pricing, common in cloud platforms, where costs scale with invoices or payments processed.

Tipalti is built for mid-market and scaling organizations that need more than basic AP tools. As an end-to-end finance automation solution, Tipalti combines invoice automation, approval workflows, global payments, tax compliance, and ERP integrations in a single platform—allowing businesses to scale efficiently while maintaining financial control and visibility.

How do you calculate the ROI of automating accounts payable (AP)?

The ROI of Accounts Payable (AP) automation is calculated by dividing the total annual savings (from reduced labor, fewer errors, and early payment discounts) by the annual cost of the automation system, and then expressing the result as a percentage.

Example: If AP automation generates $120,000 in annual savings and costs $40,000 per year, the ROI would be 200% (($120,000 − $40,000) ÷ $40,000).

This calculation essentially compares the financial benefits gained from increased efficiency and cost avoidance against the software, implementation, and maintenance expenses. The core goal is to determine if the cost per invoice is significantly lower after automation.

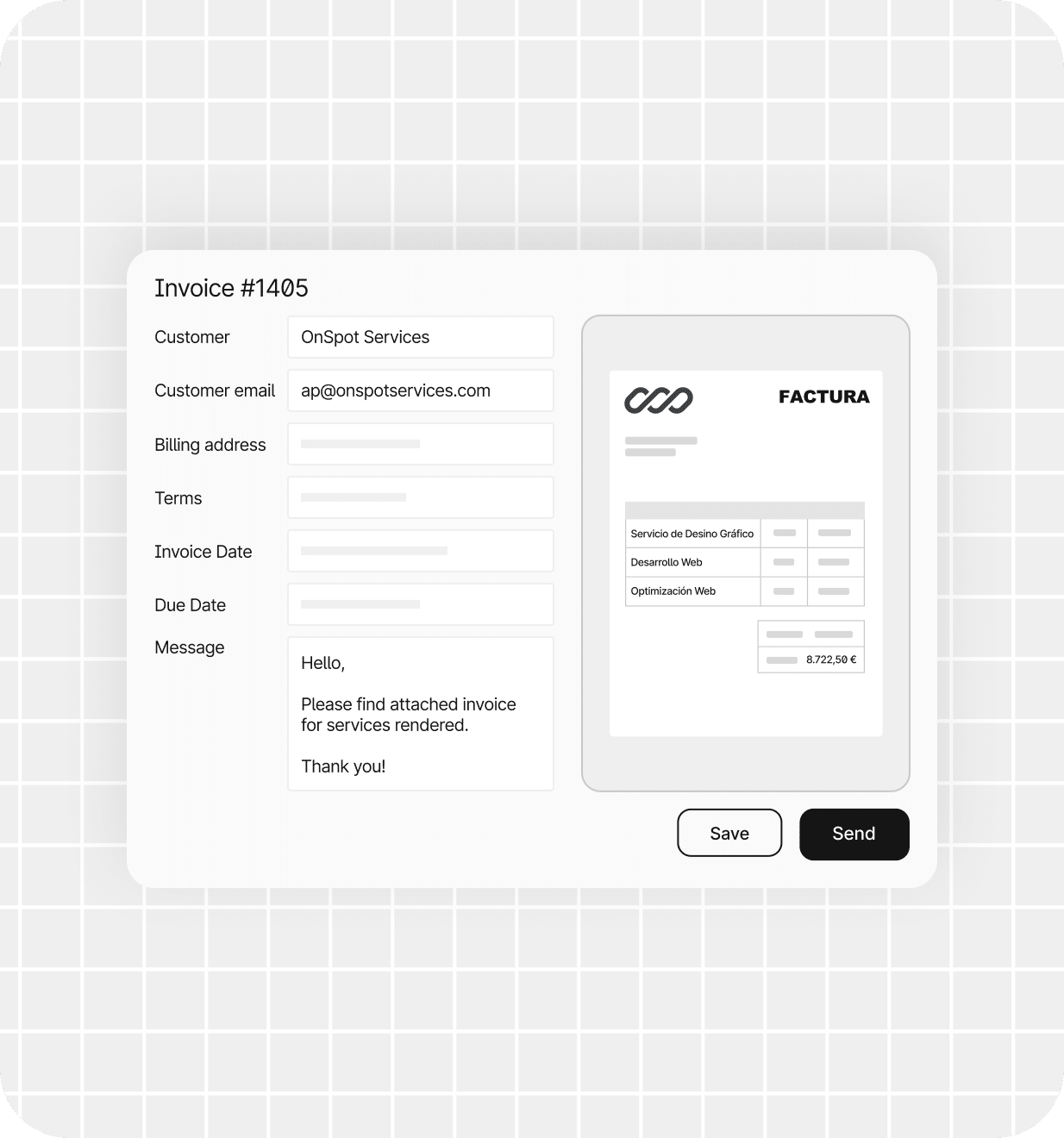

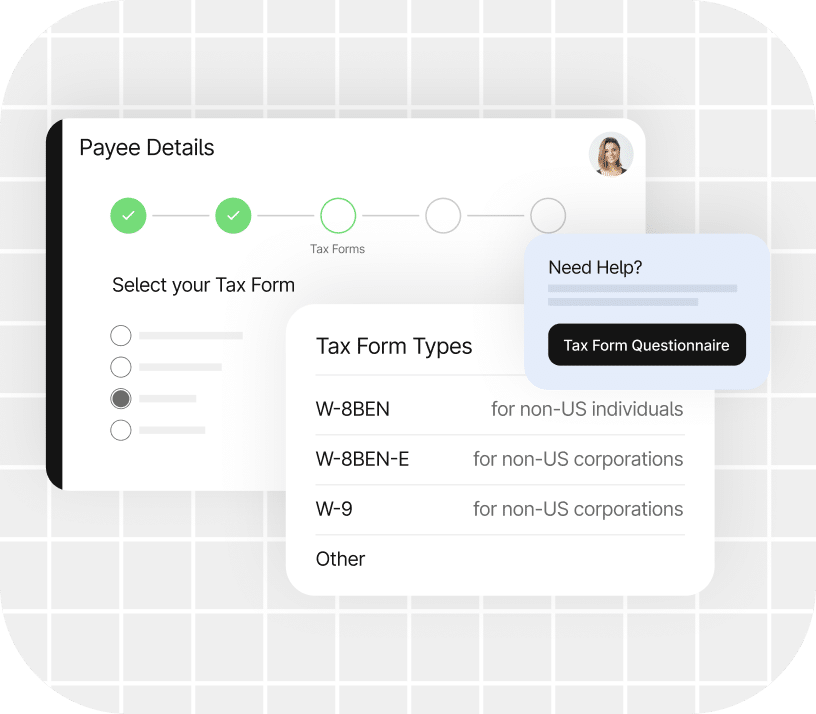

How does AP software handle tax compliance?

Accounts Payable (AP) software helps companies manage their bills and payments efficiently, especially when it comes to tax compliance. AP software includes features and functionalities that address tax-related requirements in an accurate and timely manner.

Automating the collection and validation of W-9 forms is a key feature, ensuring vendor tax information is accurate and ready for year-end reporting, such as 1099 forms.

Tipalti’s tax compliance solution helps your company comply with IRS tax provisions and simplifies the AP process. Our guided tax form wizard assists suppliers in choosing the correct form based on the country and business structure.

For non-US payers, local and VAT tax ID collection is available. If the foreign entity comes from a country with a US tax treaty, they can fill out and submit a W-8BEN-E form.

Tipalti facilitates IRS AP tax compliance with KPMG-approved tax form data validation and withholding calculations.

How does B2B payment processing work with AP automation software?

AP software improves oversight with a full view of B2B payment cycles and the analysis of accounts payable metrics. This is what makes AP software especially critical for operations for a small business.

When it comes to B2B payments, ACH transfers are the leading form of payment. Every year, check remittances steadily decrease while wire transfers are on the rise.

How does AP automation software integrate with ERP systems?

AP automation software integrates with ERP systems by syncing invoice, vendor, and payment data to streamline approvals, payments, and reconciliation.

Tipalti offers pre-built integrations with leading ERPs like NetSuite, Sage Intacct, QuickBooks Online, Microsoft Dynamics 365, Xero, and Acumatica, with real-time data sync to support faster reconciliation based on your workflows.

How do you choose the right accounts payable automation platform for your business?

To choose the right platform, start by identifying your invoice volume, complexity, and growth plans, then compare AP automation software solutions across each provider based on how well they support automation, controls, and scalability.

Platforms like Tipalti are designed to support these needs across invoice processing, approvals, payments, and reporting. Key factors to evaluate include:

- Invoice capture accuracy

- Approval workflows

- ERP integrations

- Payment capabilities

- Reporting

- Total cost of ownership

Smaller businesses may prioritize ease of use and faster setup, while growing and mid-market organizations should focus on platforms that can scale, support advanced workflows, and reduce manual effort as volumes increase.

| Features | Tipalti | BILL | Concur | Stampli |

|---|---|---|---|---|

|

Tax and Regulatory Compliance

|

|

Limited |

|

|

|

Supplier Management

|

|

Limited |

|

Limited |

|

Invoice Management

|

|

Limited | Limited |

|

|

Payments Network

|

|

Limited | Limited | Limited |

|

Corporate Cards

|

|

|

Limited |

|

Want a personalized live demo?

We are standing by to answer any questions you may have.

Request a demo

Complete the form below, and we’ll contact you to schedule your personalized demo.

Thank you for your interest

Thank you for watching our demo videos on AP automation and for your request to schedule a live personalized demo. We are excited to show how Tipalti can streamline your account payable process and enhance your financial operations. An AP automation specialist from Tipalti will reach out to you as soon as possible.