Business is evolving and global commerce is getting easier by the minute. People have a deep desire to collaborate, and we have the financial technology to make it happen.

The SWIFT service creates an international level of connectivity that speeds up global commerce and brings the world a little closer together. It provides a safe and secure means to facilitate cross-border payments and helps banks build an intermediary network.

In 2021, more than 11,000 global SWIFT member institutions sent an average of 42 million messages per day, marking an increase of 11.4% over 2020. Business is booming!

If you’re looking to streamline international transactions, elevate overseas commerce, and ensure security, the SWIFT network is a prime option.

What are SWIFT Codes?

A SWIFT code is a standard format used when making international transfers between banks and financial institutions. It identifies the branch, bank, and country an account is registered in and communicates the who, what, and where, through BIC (Bank Identifier Codes).

SWIFT stands for the Society for Worldwide Interbank Financial Telecommunication. SWIFT owns and administers the BIC system. It can identify a bank in seconds and send payment quickly. It was also the SWIFT network that standardized the formats for IBAN (international bank account numbers).

The SWIFT network utilizes BIC codes to make secure payments like international bank wires, international money transfers, and SEPA payments. It’s also used solely as a messaging system.

When a business uses the SWIFT network, they are not actually sending money. Instead, it is referred to as a “payment order” between two banks.

Other names for a SWIFT code include:

- SWIFT ID

- BIC code

- ISO9362

Format of a SWIFT Code

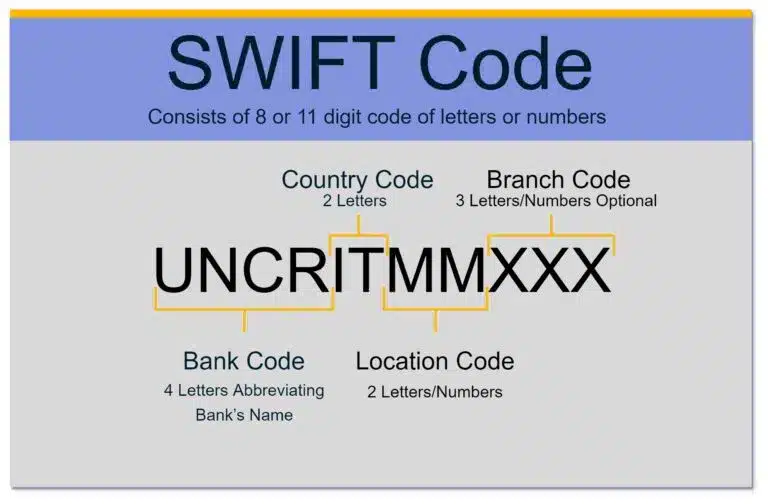

The SWIFT code is an 8-11 alphanumeric character code structured in a standard format from left to right as:

- Bank code (four letters abbreviating bank’s name)

- Country code (two letters representing the country)

- Location code (two letters or numbers for bank’s head office)

- Branch code (3 letters or numbers for the bank branch)

The branch code is much like a routing number used in the US. Some SWIFT codes simply use XXX in place of the branch code. In this case, the transfer will go to the bank’s main office.

The International Standard for SWIFT/BIC codes is ISO 9362 which is why you sometimes see this term used in place of SWIFT. The ISO is responsible for how a SWIFT code is structured, including the use of letters, numbers, and the length of codes.

Example of a SWIFT Code

One example of a SWIFT code is the Italian bank UniCredit Banca. It’s located in the city of Milan and has the code:

UNCRITMM (XXX)

- UNCR is the bank code for UniCredit

- IT is the country code for Italy

- MM stands for the location code, which is Milan

As you will see, there is no specific branch code for this bank. Therefore, the transfer will be sent to the primary office in Milan.

When is a SWIFT Code Needed?

A SWIFT code is generally needed when you are sending or receiving money internationally between banks, particularly if you are sending wire transfers or SEPA payments.

Originally, SWIFT was created to only facilitate communication about treasury and correspondent transactions. However, the functionality of the messaging format allowed for large scalability.

SWIFT now provides services for:

- Banks

- Corporates

- Foreign exchange

- Clearing systems

- Asset management companies

- Money brokers

- Non-bank financial institutions

- Treasury market participants

- Depositories

- And more…

How Does a SWIFT Code Work for International Payments?

The original design for SWIFT was to create a way for banks to communicate more efficiently and securely among themselves. Particularly in relation to processing international payments.

The word “communicate” is always used because SWIFT is only a messenger between banks. The code basically breaks down payment instructions from the issuing bank (the payor) to the remitting bank (the beneficiary/receiver).

A SWIFT code works when financial institutions like banks and clearing systems, use it to identify where to send money internationally. This includes the recipient’s bank, the sender’s bank, and the location the funds end up.

In addition to the sending and receiving bank, a SWIFT payment may also require an intermediary bank. Different countries have different banking rules and sometimes a third party needs to step in to see the transaction through.

In order for the SWIFT system to fully function, banks open accounts with each other called Nostro and Vostro accounts.

Nostro and Vostro Accounts

Since both banks need to keep a record of withdrawals and deposits, this leads to two mirroring ledgers known as Nostro and Vostro accounts.

Nostro

Nostro is Latin for “ours” and refers to an account a bank holds in a foreign location with another bank.

Vostro

Vostro means “yours” and it’s how a bank refers to accounts other banks have with them.

When both banks have a relationship through Nostro and Vostro accounts, SWIFT transfers are immediate and direct. When banks do not have this relationship, the SWIFT network must seek the help of a third party known as an intermediary bank.

Once a correspondent bank is located (meaning they have a relationship with the other two banks involved) the SWIFT transaction can proceed. The more banks involved in these international transactions, the more fees will be incurred. It may also take longer, and there may be more risk involved.

How to Find a SWIFT Code

A SWIFT code can be easily located in a variety of places, here are a few:

- Bank account statements

- Online banking customer portal

- Bank’s website

- Call the bank

You can also find it online with a quick SWIFT code search tool.

How to Check a SWIFT Code

There are resources online to check and validate a SWIFT code once you have it. Just copy and paste the code into a SWIFT code checker and the search engine will tell you whether it’s valid or not. Since international banks list these codes online, it doesn’t take long to make sure the one you have is accurate.

SWIFT Code FAQs

When it comes to the topic of SWIFT codes, some common questions that pop up include:

Is a SWIFT Code the Same as a BIC?

BIC stands for Bank Identifier Code and it’s the umbrella term for a SWIFT code. International bank statements may list them either way. So, keep an eye out for either term if you’re trying to find one.

Does it Cost Money to Use a SWIFT Code?

Typically, it cost money to send money internationally, no matter what. Your rates just depend on where it’s going, how it gets there, and who’s involved. Some banks charge fees they are willing to wave if you have an account.

If you’re sending funds to a bank that requires an intermediary, then there will be additional charges involved there; that your bank may not be able to avoid. There are also exchange rates to consider.

Additionally, SWIFT offers extra services like business intelligence, professional apps, global payments innovations, and compliance.

What Happens if You Give the Wrong SWIFT Code (BIC)?

In the best case, it’s rejected by the SWIFT network and the funds are returned in one to three weeks. This is still quite a pain, especially for small businesses.

A minor issue, like the wrong branch code, may be repaired quickly. However, don’t rely on the banks to fix your mistake.

To avoid any delivery problems, you should use a SWIFT checker online to ensure that the SWIFT number of the receiving bank is correct. It never hurts to double-check.

Is a SWIFT Code or BIC Like a Routing Number?

A SWIFT code is similar to a U.S. routing number used for domestic transactions. However, they are totally different in structure, subcodes, and function. SWIFT will get you overseas. A routing number will not.

Is a SWIFT Code the Same as an IBAN?

The main difference between SWIFT and IBAN lies in what the codes convey. A SWIFT code is used to identify a specific bank, whereas an IBAN number is used to identify an individual account.

To date, the SWIFT network is the most popular international payment system, surpassing the IBAN (international bank account number) system. The comparison of IBAN vs SWIFT is measured by the number of transactions.

The Future of SWIFT

SWIFT continues to retain a dominant position in capital markets despite competition from other real-time message services. There’s a method to that madness.

The network is continuously updating its database with new message codes that accommodate all kinds of financial transactions. SWIFT is constantly adapting to fintech processes and changing financial needs.

This makes it one of the most useful and adaptive systems for international transfers worldwide.