Scalable Expense and Reimbursement Management

Review, approve, reconcile, and reimburse in one comprehensive platform that simplifies all your workflows.

Expense Automation Features

Spend Smarter, Work Faster

Comprehensive, mobile-ready features for automating and managing employee spend and reimbursements.

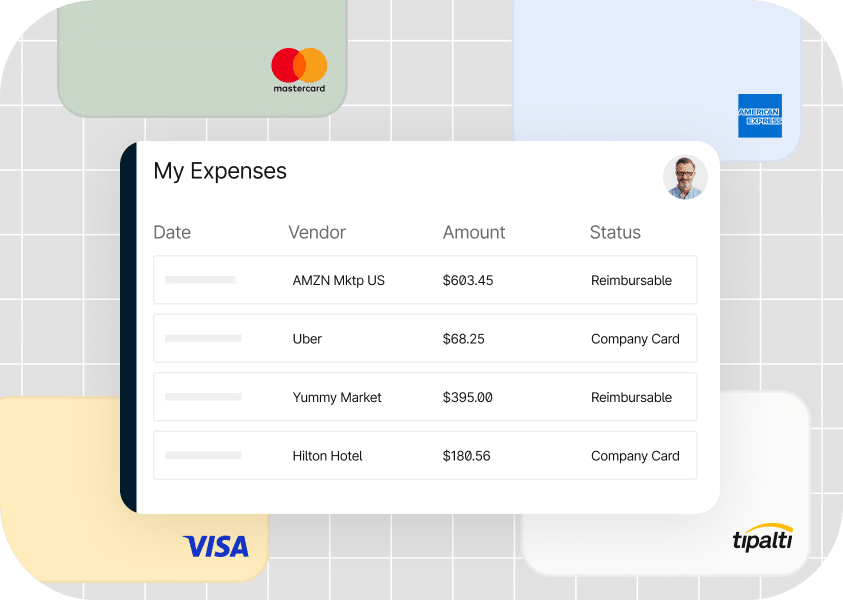

Painless Corporate Card Integration

Support employee card spend and card transaction reconciliation across Mastercard, Visa, AmEx and Tipalti Card. Manage out-of-pocket expenses and card transactions in one place.

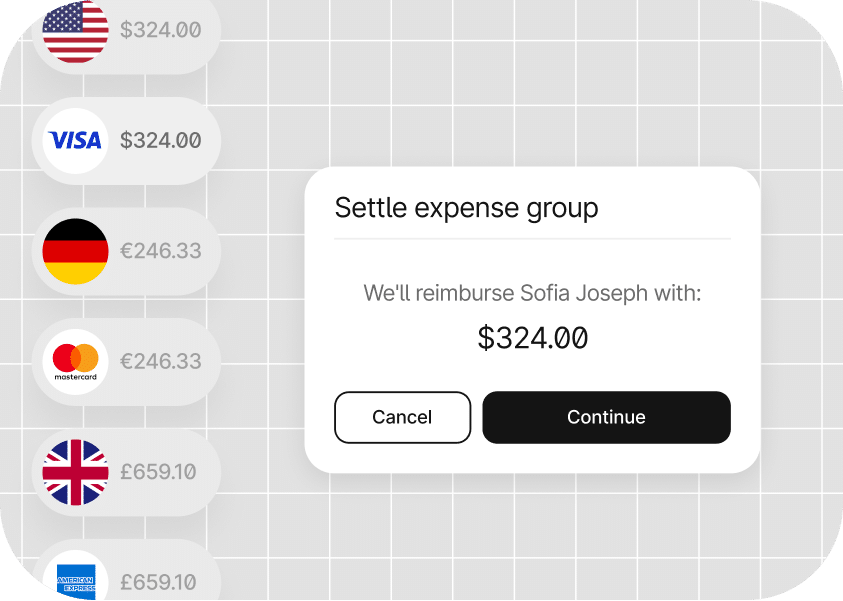

Global Reimbursements Everywhere

Secure reimbursements to 196 countries in more than 120 currencies, using 50+ global payment methods.

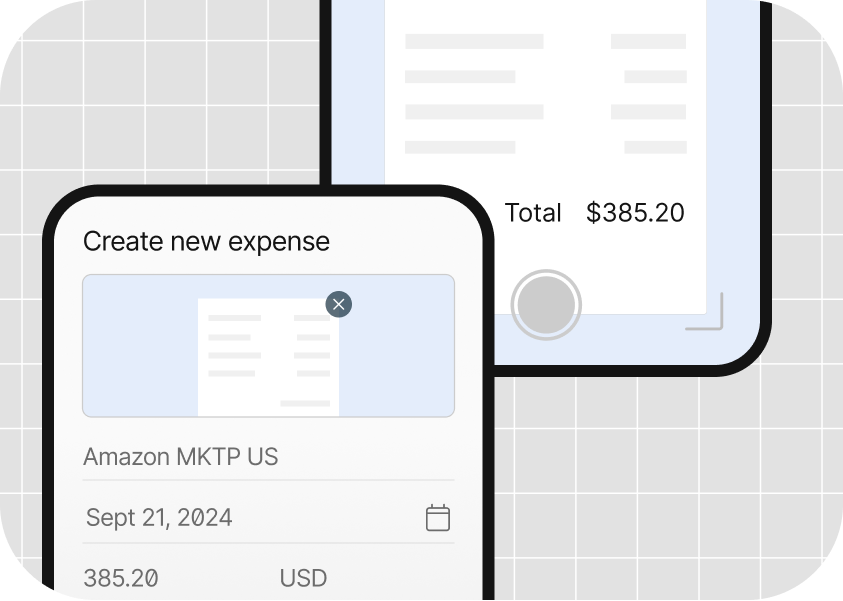

Expense Management That Employees Love

Employees can manage receipts with just a photo and a quick upload. Push notifications and emails keep everyone updated on approval status.

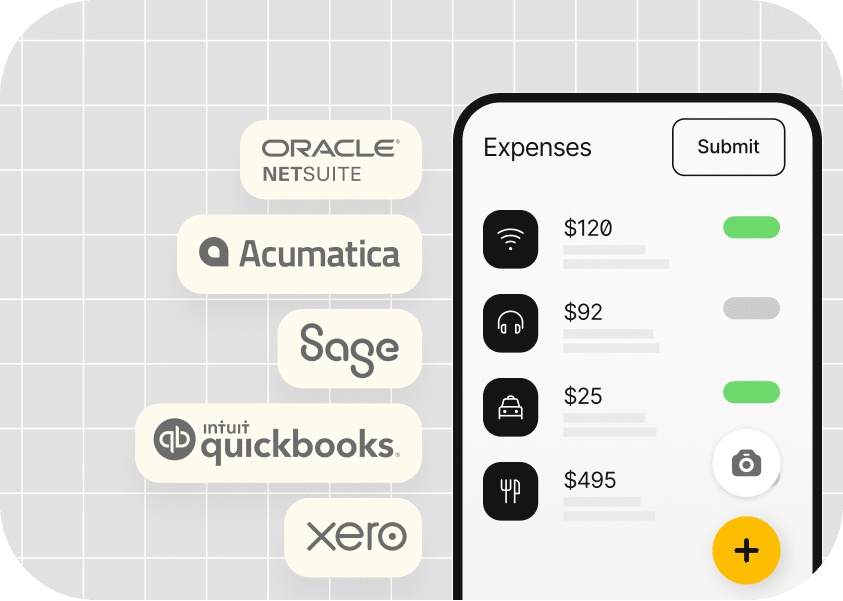

Instant Reconciliation

Accelerate your monthly close by 25% by integrating with ERP or account systems, such as NetSuite, Sage Intacct, and QuickBooks.

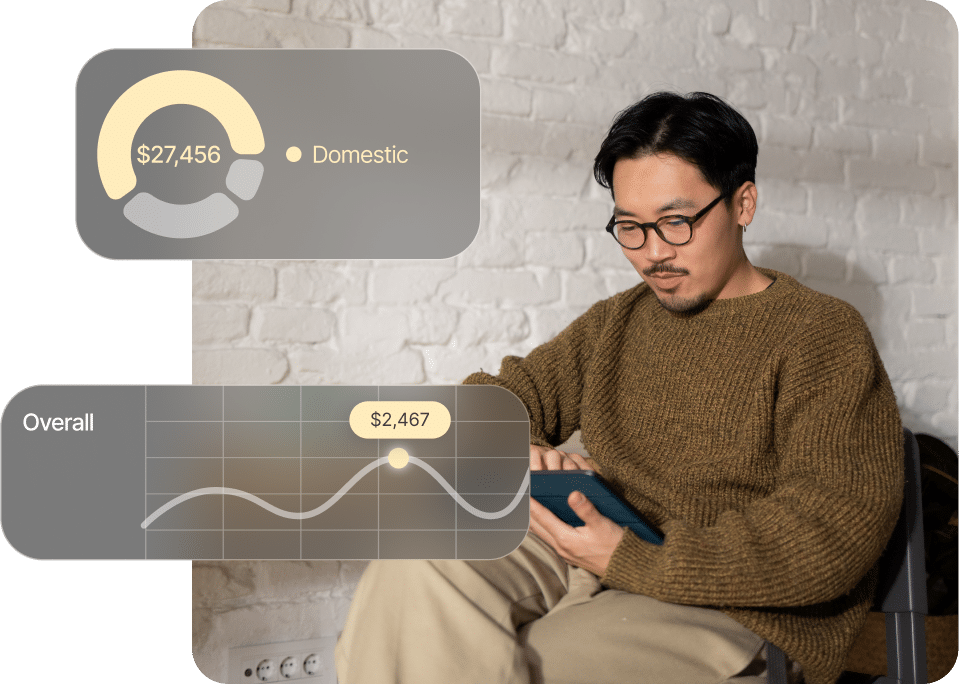

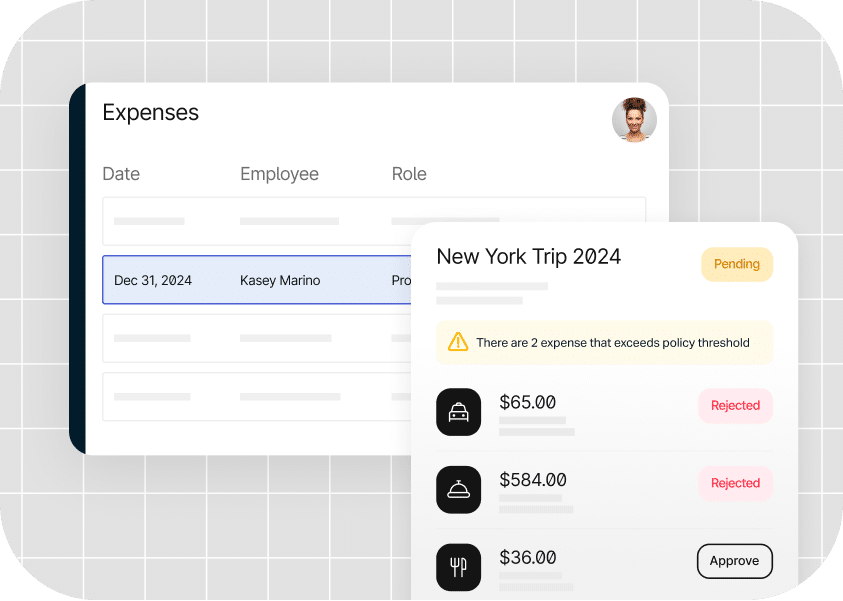

Spend Control and Visibility

Stress-free expense tracking for stronger budget control and better insights.

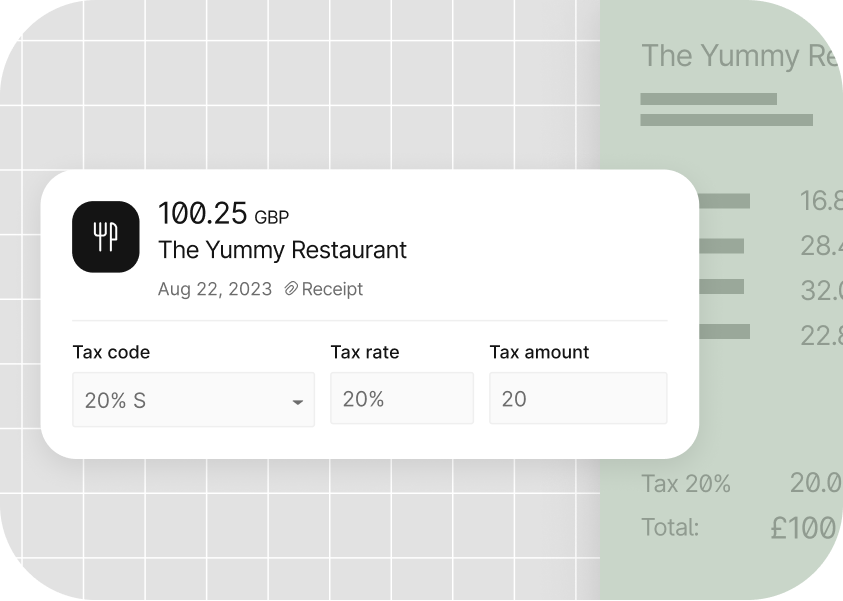

Automated Tax Support

Make tax time easier and more efficient by automatically capturing tax details for every expense.

Platform Features

Work smarter, not harder

With AI and machine learning capabilities, an intuitive UX, and quick and easy global payments, you can drive unprecedented efficiency.

Integrations

Pre-Built ERP Connections to Extend Automated Workflows

Compare

See how we stack up

| Features | Tipalti | Concur | Expensify |

|---|---|---|---|

|

Spend Controls

|

|

|

|

|

Cards

|

|

Limited functionality |

|

|

ERP Integrations

|

|

Limited functionality | Limited functionality |

|

Global Reimbursements

|

|

Limited functionality | Limited functionality |

|

User Experience

|

|

Limited functionality | Limited functionality |

|

All Spend in One Platform

|

|

Limited Functionality | Limited Functionality |

|

Customer Support

|

|

Limited functionality | Limited functionality |

Ready to save time and money?

Request a demo today and take control of your finance operations.

Expense Management FAQs

What is expense management software?

Expense management software is a digital solution that automates the tracking, submission, approval, and reimbursement of expenses for businesses of all sizes. It helps a business ensure compliance, oversee expenses, and provide insight into spending patterns.

A business expense can be anything an employee pays for related to their job. Expense management pertains to every task involved in ensuring these expenses are properly handled and paid back. The right expense management solution saves a company money, reduces mistakes, and improves efficiency.

How does expense management automation work?

Expense management automation streamlines the tasks associated with tracking, submitting, approving, and reimbursing expenses within the expense management process.

Here are a few quick steps for how it works:

- Employees submit expenses via an expense management system

- The system captures invoice data via optical character recognition (OCR)

- The system checks expenses against company policies

- Expenses are automatically routed to approvers

- Automated notifications and alerts are sent

- Real-time tracking of expense reports

- The system calculates the amounts owed

- Multi-currency payment processing for reimbursement

- An audit trail is created, documenting every step

- The system generates reports and analytics.

Tipalti is an end-to-end provider of advanced expense management. It can assist you with tasks like receipt scanning (to capture expense data), spend tracking, approval workflows, corporate cards, policy enforcement, and multi-currency support.

What are the benefits of automating employee expenses and reimbursements?

Automating expense reimbursement offers some key advantages for small businesses and large enterprises alike, including:

- Time efficiency

- Accuracy and compliance

- Improved visibility and control

- Enhanced experience

- Mobile accessibility

- Ease of use for business travel

Through expense reimbursement software, companies can streamline expense management, reduce costs, eliminate data entry, simplify travel booking, and enhance accuracy, contributing to greater efficiency and employee satisfaction

What is the best way to reconcile expenses?

The best way to facilitate expense reconciliation is to keep detailed records, implement internal spend controls, and take advantage of intelligent expense management tools. The right software offers advanced functionality like in-depth analytics and payment reconciliation reporting.

Tipalti is accounting software that helps businesses cut through manual expense filing and reconciliation challenges, accelerating monthly close by up to 25%. Tipalti’s expense management platform helps streamline employee expense reports and strengthens financial controls.

Tipalti’s user-friendly system reduces your team’s workload by automating payment reconciliation, enforcing policies, consolidating business spend, and seamlessly integrating with your ERP.

How does Tipalti automate expense reporting?

Traditionally, creating an expense report and reviewing it for compliance, accuracy, and relevance was a manual process. Today, the best expense management software, like Tipalti, takes care of the grunt work.

Expense report automation simplifies receipt management. Systems like Tipalti help a business manage spend in a single, all-in-one platform. This helps businesses scale rapidly, facilitates expense management, eliminates policy violations, and reduces risk.

A mobile expense management app allows employees to automatically create and submit reports, which managers can then quickly review and approve.

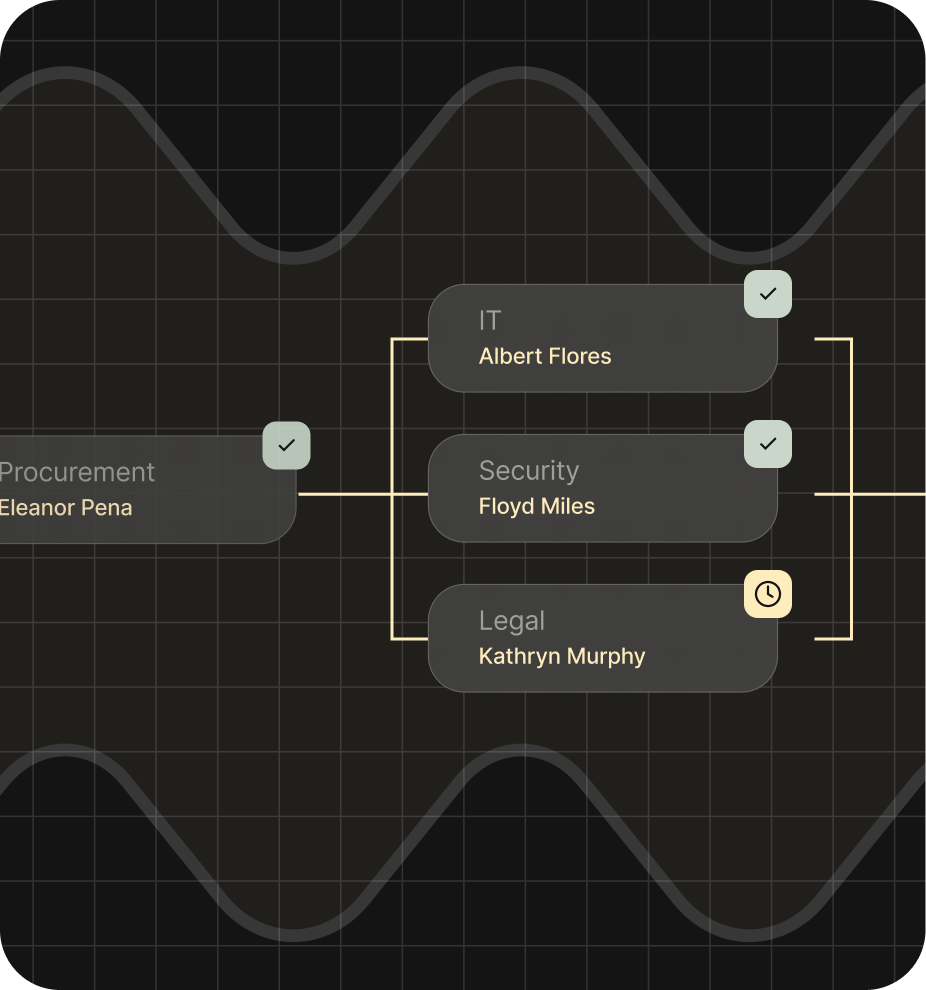

What steps in the expense approval process can be automated?

Automating the various steps in the expense approval process includes:

- Receipt capture (remote and mobile features)

- Submitting expenses and filing an expense report

- Checking policies and flagging discrepancies

- Routing for approval based on specific criteria

- Parallel approval paths for multiple approvers

- Approval notifications

- Integration with other accounting systems

- Real-time tracking of the expense approval status

- Generating an audit trail

- Reporting and analytics tools

By leveraging expense approval software to automate these steps, businesses can reduce manual efforts, improve compliance, and expedite the overall process.

How do I reimburse expenses with Tipalti?

Tipalti’s robust global payment infrastructure enables finance teams to efficiently reimburse employees, no matter where they are in the world.

It facilitates expense reimbursement and enables managers to review and approve employee expenses easily via the mobile app. As a result, finance can quickly reimburse employees internationally.

The Tipalti solution enables expense payments to 196 countries in over 120 currencies using 50+ payment methods. It streamlines travel and expense management for companies of all sizes, from startups to enterprise corporations.

Can you automate spend control?

Spend control can be automated via expense management software, custom approval workflows, corporate cards, policy enforcement, integrations, analytics, and more.

Tipalti Expenses enables customers to set spending limits within specific categories over defined time periods, ensuring meticulous budget control.

Create multi-level expense policies per subsidiary. Promptly notify employees and approvers in case of expense policy breaches, providing clear details on the rule violated.

How does integration with the Tipalti Card work?

Tipalti Card includes physical and virtual cards that streamline the issuance, control, visibility, reporting, and reconciliation of all card expenditures. Integrating Tipalti Card into a unified finance automation dashboard centralizes spend, expenses, procurement, and more.

The corporate card integration feature consolidates Tipalti Card and reimbursable expenses in our expense management software. Employees connect expenses with their cards, managing all business needs in a single spot.

An organization can effortlessly set spend controls, issue new cards, and benefit from automated transaction coding. Sync all card tasks to your ERP to ensure accuracy and save valuable time.

Can you integrate the Amex corporate card with Tipalti Expenses?

Tipalti currently integrates Visa, Mastercard, and American Express. Tipalti Expenses easily connects with Visa and Mastercard networks and integrates with external corporate cards, allowing businesses to integrate banking with employee transactions and gain full control over corporate card management.

Companies can upload receipts, provide coding, and reconcile to an ERP. They can also manage the card and reimbursable spend through the mobile app and Tipalti Hub.

Recommendations