Best way to pay invoices?

Tipalti provides a complete end-to-end workflow that ensures efficient, accurate processes and finance-protecting controls.

Tipalti’s accounts payable automation process for invoice-based workflows is a comprehensive solution that minimizes manual effort, maximizes self-service, and dramatically increases scalability and auditability. Here’s how it works to elevate your finance team.

The most critical step comes first: ensuring your vendors are payable.

You invite them to register on your Supplier Hub to provide their contact, billing details, and tax identification.

- The responsibility is on the vendor to provide information, incentivizing them to do it right in order to be paid.

- This step is vital to ensuring that no one is paid that your business hasn’t authorized.

- Reduce data entry

- Ensure supplier identity

- Collect and verify tax IDs

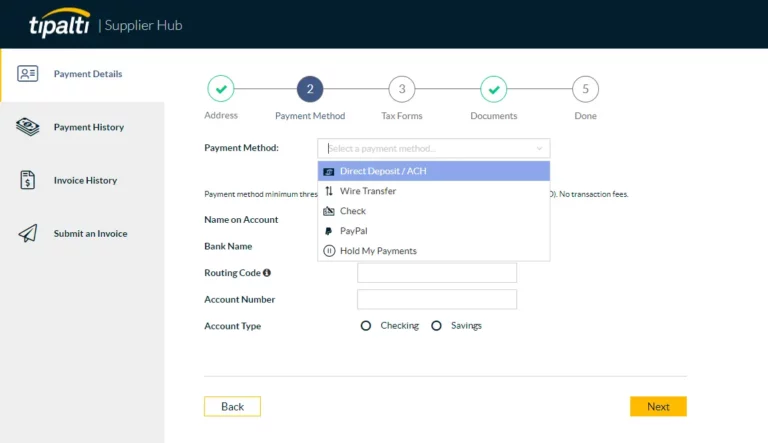

The vendor can upload their invoice from the Supplier Hub or email it to your payables alias.

The invoice is processed seamlessly using OCR (optical character recognition), machine learning, and managed services and automatically populated into Tipalti.

- Any missed characters by the cloud-AI are human-validated by Tipalti.

- If it is a PO-based invoice, Tipalti performs a 2-way and 3-way PO-match.

- Machine learning prefills much of the accounting and approval routing data based on past invoices.

- Maintain invoice records

- Set up straight-through processing and approvals

- Frees up manual effort

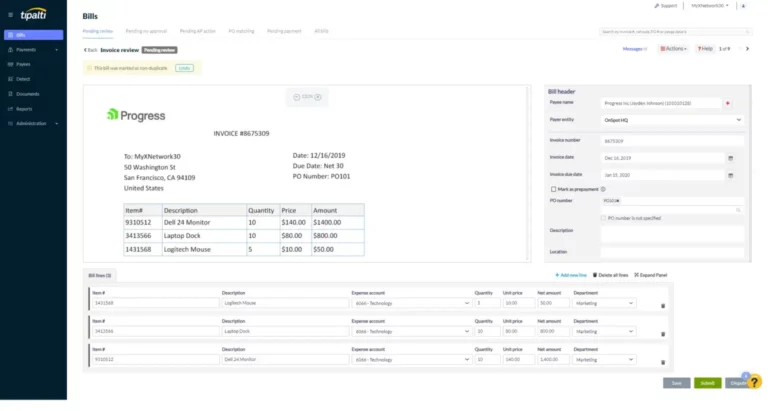

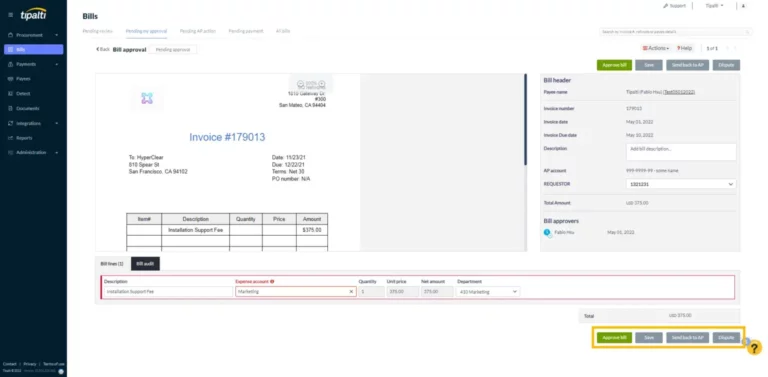

As the payer, review the invoice that has been automatically keyed in.

Until now, other than inviting the vendor to the portal, your finance team hasn’t had to do any data entry – including keying in bill data.

- Review the invoice to start the approval process.

- Approvers will get an email for approval.

- Approval audit trail

- Minimizes manual effort

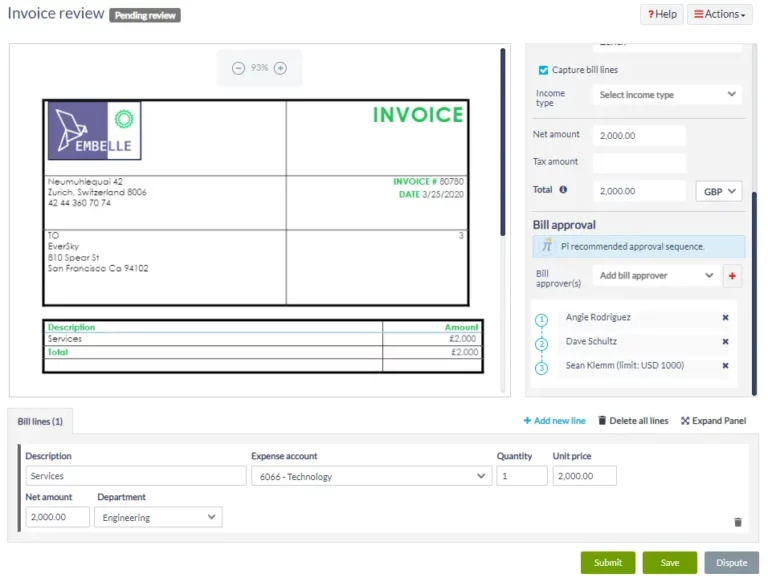

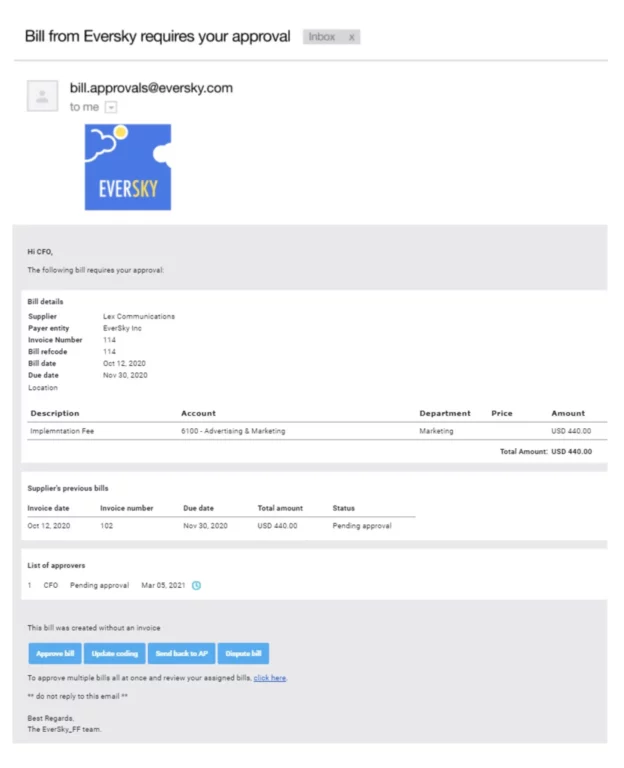

Approvers in the workflow receive a request to approve the invoice.

Approvers receive a branded email, including a copy of the invoice to be approved and which ledger account it will be filed under.

- The approver can:

- Approve the bill

- Update the account (GL) on the bill

- Send the invoice back to AP for a different routing process

- Dispute the bill

- Authorized approvers do not need to log into a separate portal and can perform these actions from any email client, including mobile.

- Potential duplicate bills are detected and flagged on top of the email, ensuring approvers are fully aware of the duplicate bills.

- Hassle-free approvals for stakeholders

- Clear audit trail for bill workflow

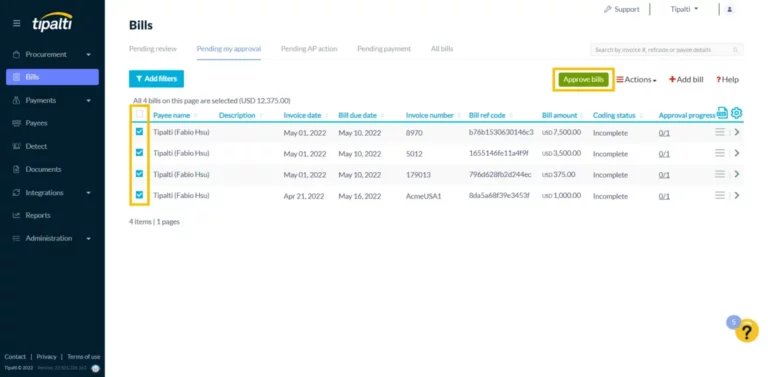

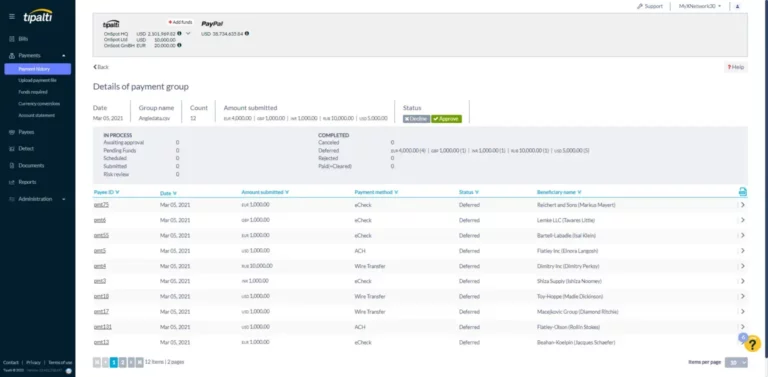

Schedule the invoice for payment.

Once all approvers have signed off on the invoice, your finance team can schedule the invoice for payment, along with any other bills in the system.

- Bills can be grouped for bulk scheduling

- Bills can be grouped regardless of payment method (wire, ACH, eCheck, etc.)

- Questionable bills can be flagged and send back to AP or disputed

- Easily manage payment runs

- Preschedule payments

- Easier global payments across varied methods

Add approval requirement for payments.

Payments can also be set up to require executive approval as an added financial control. Tipalti handles all the payment account execution.

- All payments are performed according to their scheduled due date once your executive approves

- Executives quickly log in to execute final approval

- Flexibility to put on-hold specific invoices from payment batches for paying them later

- No more logging into individual bank portals

- All payment execution is logged and auditable

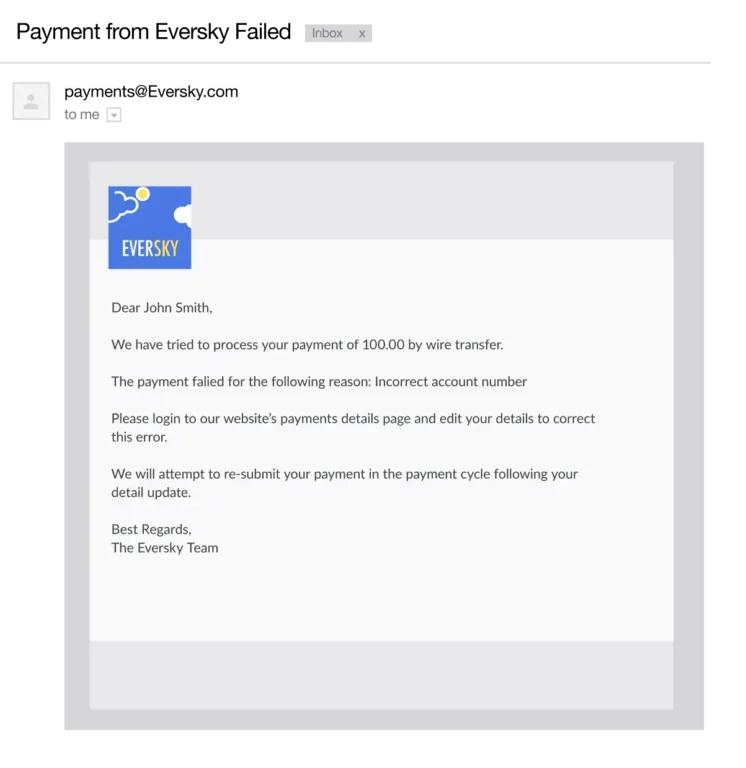

Vendor communications are automated.

Vendors will be notified immediately when a payment is made or if there’s a problem.

- Emails come from your business and have your branding to ensure trust

- If there’s a problem, the email prescribes a solution, often asking the vendor to update or provide additional information through the Supplier Hub

- Reduced payment inquiries

- Proactive communication

Reconciliation happens in real time.

Once the payment lands and clears, Tipalti is automatically updated with the successful result. No manual bank reconciliation is required.

- Payment data is sent to any connected ERPs or accounting platforms (e.g. NetSuite, QuickBooks Online, etc.)

- Complete details of transfer or conversion fees are included

- Faster reconciliation to accelerate the financial close

- Accurate, updated payment data

REQUEST A DEMO

Contact us today to see how Tipalti can automate your payables processes.