Financial Fraud Report

Which US states have the highest rates of financial fraud?

In recent years, there has been a significant increase in fraud. This comes as a result of today’s cyber landscape providing a vast online platform for criminals and fraudsters to attack various networks in the US.

According to the FBI’s Internet Crime Report, the potential total loss from cyberattacks and incidents has grown from $6.9 billion in 2021 to more than $10.2 billion in 2022.1

As online scams become more sophisticated, it provides ample opportunities for threats to increase. That’s why, to understand cyberattacks better, we decided to reveal the US states with the highest and lowest rates of financial fraud.

To protect yourself from cyberattacks, you can streamline your day-to-day operations with game-changing AP automation that enables you to rapidly scale and adapt to changing business needs, accelerate business visibility, and strengthen fraud, financial, cost, and cash controls.

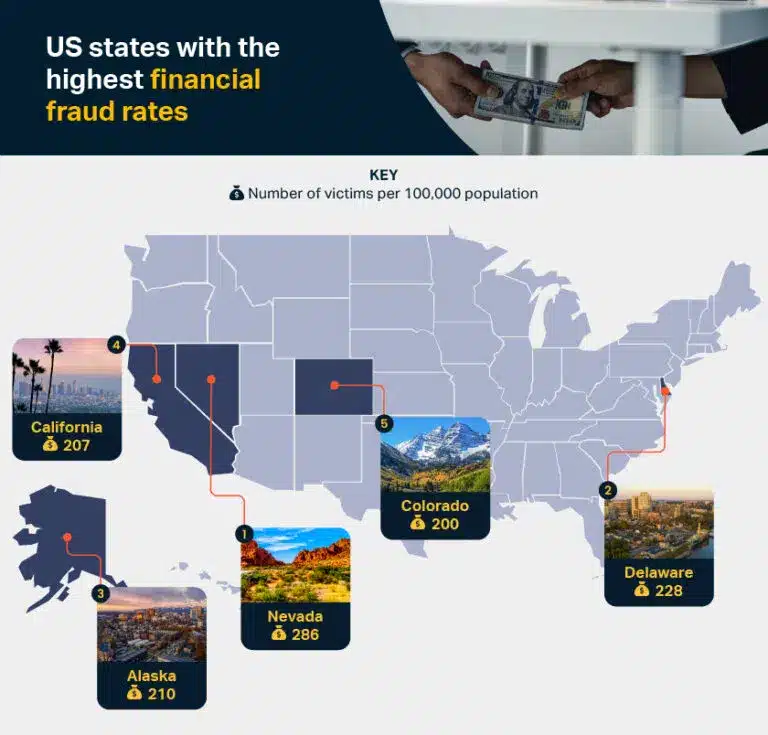

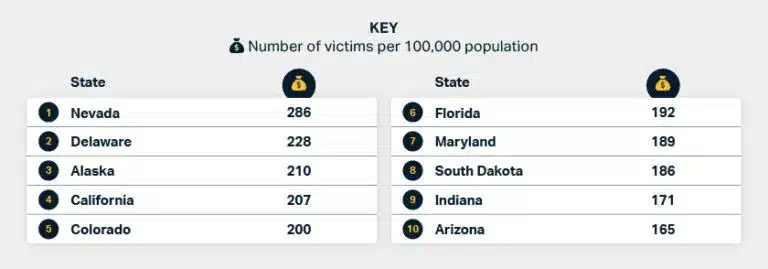

US states with the highest financial fraud rates

1. Nevada

Number of victims per 100,000 population: 286

Nevada has the highest financial fraud rate of 286 per 100,000 population. Despite having the highest financial fraud rates across all 50 states, Nevada’s law makes fraud a criminal offence with penalties of up to one to four years in prison and up to $5,000 in fines, depending on the severity.

According to the state’s law, fraud is when individuals deliberately misinterpret themselves to receive benefits they are not entitled to legally, including housing, insurance proceeds, and money.

2. Delaware

Number of victims per 100,000 population: 228

Delaware also has one of the highest rates of financial fraud, averaging 228 per 100,000 population. Although the small Mid-Atlantic state has a relatively high financial fraud rate, it has measures to minimize fraudulent activity.

The state’s Fraud and Consumer Protection Division was set up as part of the Attorney General’s Office to protect the public from fraud, including misleading or deceptive business practices and issues involving manufactured homes.

3. Alaska

Number of victims per 100,000 population: 210

Situated in the northwest of the United States, Alaska has the third-highest rate of financial fraud, with around 210 victims per 100,000 population. Some of the most common types of financial fraud in the state include advance fee fraud, phishing, and investment scams.

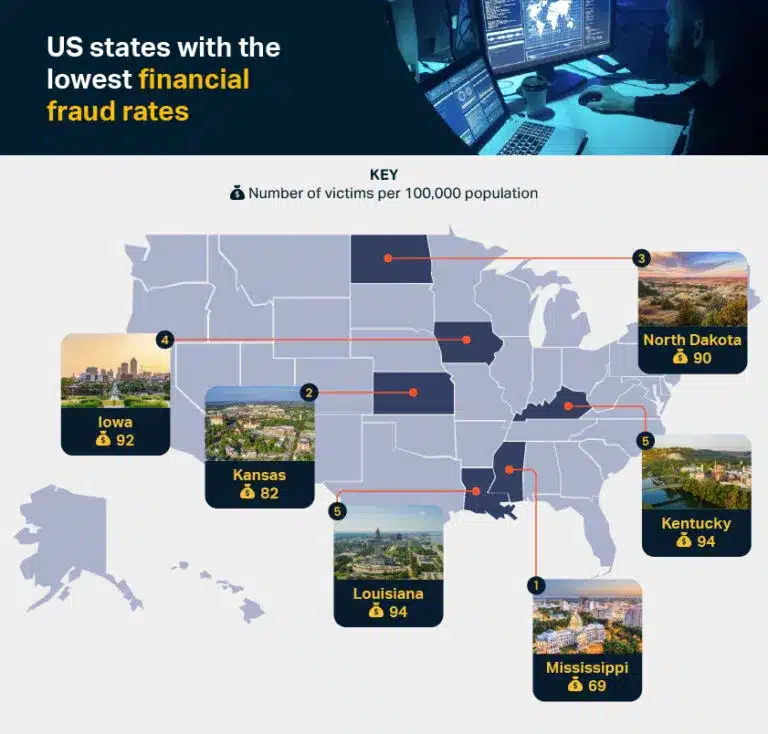

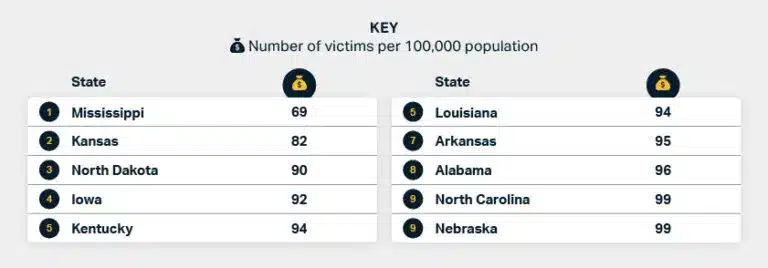

US states with the lowest financial fraud rates

1. Mississippi

Number of victims per 100,000 population: 69

Mississippi tops the list with the lowest financial fraud rate of 69 victims per 100,000 population. To protect Mississippians from the financial harm fraud can cause, both the federal and state courts have harsh penalties for criminals.

There are different penalties for different types of fraud. For example, the sentence for credit card fraud in Mississippi can be up to three years in jail and a fine of $1,000, depending on the amount fraudulently obtained.

2. Kansas

Number of victims per 100,000 population: 82

Kansas has the second lowest rate of financial fraud, with an average of 82 victims per 100,000 population. This is unsurprising as the Sunflower State classifies financial fraud, such as credit and card fraud, as a punishable offence by up to 9 months in prison and up to $100,000 in fines for the theft of values between $1,000-$25,000. Financial fraud above $25,000 is deemed a felony punishable with up to 17 months in prison.

3. North Dakota

Number of victims per 100,000 population: 90

North Dakota had less than 1,000 victims of financial fraud in 2022, with a rate of 90 victims per 100,000 population. Under North Dakota law, fraud is charged under the umbrella of theft, though it is taken more seriously than other physical acts of theft.

The state’s charges and penalties for fraud crimes are based on the value of the money or property, ranging from $3,000 to $20,000 in fines and up to 20 years in prison for the most complex schemes.

The most common types of financial fraud in the US

1. Phishing

Number of victims: 300,498

Phishing is the most common type of financial fraud, with the number of cases five times higher than data breaches – which take the second spot. It occurs when attackers trick users into revealing sensitive information or installing malware. Over a whopping 300,000 people fell victim to phishing in 2022.

Business email compromise, which involves scammers posing as high-level individuals within an organization, was one of the most popular types of phishing. These attacks cost US victims more than $2.7 billion in the same year, while the country saw a total loss of over $52 million.2

2. Personal data breach

Number of victims: 58,860

Personal data breach is the second most common type of financial fraud, with over 58,000 victims. A personal data breach refers to a breach of security in which unauthorized parties gain access to sensitive or confidential information, including personal data.

Data breaches have had one of the most significant impacts in the cyber world, with 1,802 security incidents discovered in 2022, accounting for a whopping 422 million breached records in the US.3

3. Non-payment/non-delivery

Number of victims: 51,679

The rise in online shopping over the last few years has resulted in a significant increase in non-payment and non-delivery fraud. A non-payment scam occurs when a seller provides goods or services but is never paid, while a non-delivery scam is when a buyer pays for goods or services online but never receives the items purchased. In 2022 alone, nearly 52,000 people fell victim to non-payment and non-delivery scams.

How do financial fraud rates in the US compare to the rest of the world?

We compared the top 20 countries with the highest number of victims, and the United States tops the list by a landslide, with almost half a million victims in total. The next country most affected by financial fraud is the United Kingdom, where 284,291 people fell victim to the crime. The victim count in the UK makes up nearly 60% of the total number of US victims.

Precautionary measures introduced to tackle fraud in the US

Automated payments have undoubtedly revolutionized how we conduct financial transactions, offering quick and convenient payments like never before. However, the convenience of automated payments also comes with increased risks of fraudulent activities.

To address this, precautionary measures such as biometrics, authentication, and AI-driven algorithms play pivotal roles in tackling fraud and enhancing online safety as they offer reliable, real-time fraud detection and prevention methods, making transactions more secure.

According to IC3’s Recovery Asset Team (RAT), introducing and implementing preventive measures have proven instrumental, with a 73% success rate. In 2022, the RAT froze $433.30 million out of $590.62 million in funds, based on reports.

Established in 2018, the RAT helps streamline communication with financial institutions. It also helps assist FBI field offices in freezing the funds of victims who made transfers to domestic accounts under fraudulent pretences.

Much like in the US, on a global scale, fraud prevention measures such as biometrics, authentication, and AI-driven algorithms are working. PWC’s Global Economic Crime and Fraud Survey suggests that in 2022, just less than half of organizations (46%) reported experiencing some form of fraud. This is the lowest fraud rate since 2018 (49%).

Certain platforms have limited controls regarding the right audit, fraud, tax, and regulatory compliance checks. As staying ahead of evolving cyber threats is an ongoing challenge that demands continuous innovation and adaptation, a trustworthy payable solution is crucial to safeguard against fraud loss and strengthen internal processes.

Methodology

To reveal the US states with the highest and lowest rates of financial fraud, we used IC3’s 2022 Internet Crime Report (p.25). This highlighted the overall statistics of the number of victims in each US state.

Using 2022’s population estimates from the United States Census, we calculated the total number of fraud victims from each state per 100,000 population. This was then ranked from the highest to lowest rates by state. Data collection for this section was completed on 15/09/2023.

To find out the most common types of financial fraud in the US, we used figures from IC3’s Internet Crime Report (p.21), which shows the different crime types by victim count. Figures were collected on 15/09/2023.

We compared the US fraud rates to the rest of the world using figures from IC3’s Internet Crime Report (p.19) and ranked them in order of the total number of victims in the top 20 countries. This data was completed on 18/09/2023.

IC3’s Internet Crime Report (p.10) and PwC’s Global Economic Crime and Fraud Survey 2022 (p.3) were used to gather information on the fraud prevention measures introduced to tackle fraud. Data collection for this section was completed on 18/09/2023.

1https://www.ic3.gov/Media/PDF/AnnualReport/2022_IC3Report.pdf

2 https://www.forbes.com/advisor/business/phishing-statistics/