Accountants use trial balance reports and worksheets for a reporting period to determine whether the general ledger account debits and credits are in balance. Although using a trial balance can help detect accounting errors, some financial statement errors or omissions may not be prevented simply by using a trial balance.

Learn more about what a trial balance is, which error types a trial balance may not help you find, and the types of trial balance reports to use before closing the books each month to prepare financial statements.

What is a Trial Balance?

A trial balance is an accounting report used by business accountants during the accounting close process to ensure that all general ledger accounts have equal debit and credit totals, meaning the GL accounts are in balance, as required in double-entry bookkeeping.

Example of a Trial Balance Document

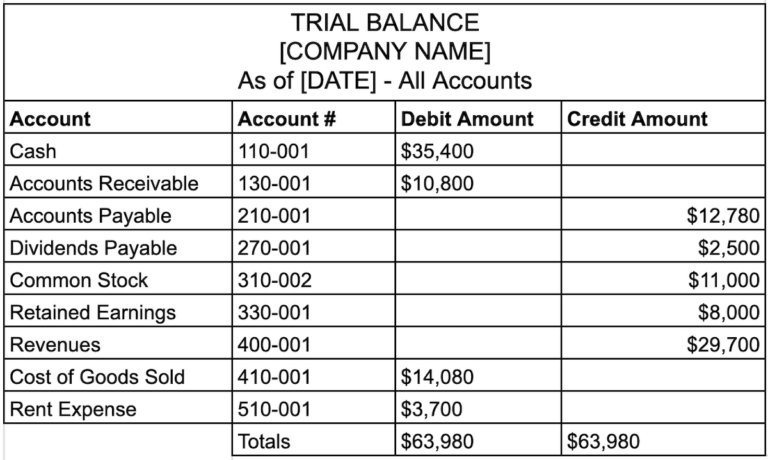

A trial balance document is often referred to as a trial balance report. This trial balance example includes an image and a description of a trial balance.

In a trial balance, each general ledger account is listed with the account number, account name description, debit amount in the Debit column, and credit amount in the Credit column. At the bottom of the trial balance report document, the Debit and Credit column totals are presented. According to the rules of double-entry accounting, total debits should equal total credits.

The trial balance may contain columns for Unadjusted Balance, Adjusting Entries, and Adjusted Balance, with debit and credits indicated.

Balance sheet accounts include Cash accounts, Marketable Securities, Accounts Receivable, Inventory, Fixed Assets, Prepaid Expenses, and Intangible Assets. Liabilities include Accounts Payable, Accrued Liabilities, Short-term Portion of Notes Payable, Notes Payable-Long Term, and Deferred Revenues. Shareholders’ Equity Accounts in the balance sheet include Retained Earnings, Paid-In Capital, Treasury Stock, and Accumulated Other Comprehensive Income (Loss).

The typical type of balance for an asset on the balance sheet is a debit balance, whereas the typical balance for a liability account is a credit balance. For example, Cash and Accounts Receivable, Net of the Allowance for Doubtful Accounts, typically have a debit balance, and the Accounts Payable account typically has a credit balance.

Although Accounts Receivable, Net of the Allowance for Doubtful Accounts has a debit balance, the Accounts Receivable balance sheet account typically has a debit balance, and the balance sheet account, Allowance for Doubtful Accounts, that offsets it as a contra-account has a credit balance.

Income statement accounts include Revenues, Cost of Goods Sold and Cost of Services, Expenses, gains, and losses.

Common types of account totals for income statement accounts are credits for sales and other types of revenue and debits for cost of sales and expenses. Gain accounts typically have credit balances, whereas loss accounts typically have debit balances.

If the trial balance doesn’t balance, your accounting team should investigate and correct errors. Scan and review the trial balance for reasonableness to detect errors. During the accounting close process, check that the trial balance line items are included in the general ledger.

Does a Business Have to Use a Trial Balance?

No, a business doesn’t need to use a trial balance, but it should. A trial balance can help a company detect some types of errors and make adjustments to the trial balance and accounting ledgers before the books are closed for the accounting period and financial statements are prepared. Rerun the trial balance after making adjusting entries and again after making closing entries.

It’s important to run a trial balance report and check it during the testing process of migrating from an existing accounting system to a new system that will replace it or add new functionality. The business needs to ensure that all accounts are mapped and included and will be posted to the general ledger. Otherwise, the general ledger and financial statements will be inaccurate.

Ready to improve payables and business spend?

Software for automating accounting for payables and supplier invoice processing and making efficient and cost-efficient global mass payments helps your company achieve competitive advantages.

What’s the Role of a Trial Balance in Accounting?

The role of a trial balance in accounting is to help accountants detect some errors when total debits don’t equal total credits for all balance sheet accounts and income statement accounts (including revenues, costs, expenses, gains, and losses).

Although companies also prepare a cash flow statement for cash flow management purposes and financial reporting, line items in the cash flow statement aren’t included in the trial balance.

During the accounting cycle, accountants use the trial balance report to ensure the books balance for debits and credits, in accordance with double-entry bookkeeping, and document adjusting and closing entries made to the general ledger accounts before actually closing the books and preparing financial statements.

What are the Different Types of Trial Balance?

Bookkeepers and accountants or small business owners use different types of trial balance, depending on the stage of the accounting cycle close. Accounting software and ERP systems often generate trial balance reports. Some small businesses less efficiently use Google Sheets or Excel worksheets or templates for preparing their trial balance documents.

Three different types of trial balance are:

- Unadjusted trial balance

- Adjusted trial balance

- Post-closing trial balance

Unadjusted Trial Balance

The unadjusted trial balance is the preliminary trial balance report or document that lists all ending balances or totals of accounts to determine if total debits and credit balances for account totals in the general ledger are equal. The trial balance includes balance sheet and income statement accounts. The trial balance is prepared after the subsidiary journals and journal entries have been posted to the general ledger.

After the preliminary Unadjusted Trial Balance, also known as the Trial Balance, is prepared, accountants review it and determine if corrections are required for determining adjusted balances.

Adjusted Trial Balance

The Adjusted Trial Balance is a second type of trial balance, set up like a worksheet, that includes debit and credit columns for each category: Unadjusted Trial Balance, Adjusting Entries, and Adjusted Trial Balance. Adjusting entries will include debit entries and credit entries. The total of the debits and credits should be equal if the books are in balance.

Post-closing Trial Balance

After making any required adjustments and closing entries in the accounting records, the trial balance is run again as the Post-closing Trial Balance to ensure that debits and credits are in balance and the financial statement reports can be prepared.

Is a Trial Balance the Same as a Balance Sheet?

No. A trial balance is not the same as a balance sheet. The trial balance report lists all balance sheet and income statement summary accounts with account numbers and descriptions. The trial balance also shows related debit or credit balance amounts for the balance sheet accounts or income statement account totals by debit or credit.

What are the Benefits of Using a Trial Balance?

The benefits of using a trial balance are:

- Ensuring total debit account balances equal total credit account balance amounts as a mathematical proof test

- Reviewing account balances as a list with account numbers/descriptions and debit and credit column totals that should be equal, as grand totals

- Having the ability to investigate and correct errors before closing the books if debits don’t initially equal credits or for other reasons

- Increasing financial statement accuracy

What are the Limitations of a Trial Balance?

The limitations of using a trial balance are:

- Not having all trial balance accounts included in the general ledger (in error)

- Not recording all necessary entries to include in the trial balance will result in the wrong amount on the financial statements

- Needing to spend time investigating differences when the trial balance total debits and credits totals don’t balance

- Not detecting that transactions were miscoded to the wrong account or that debits and credits were to the wrong accounts if total debits and credits still balance

- Delaying the financial close when errors occur

Know which account should be coded as a debit and which account is a credit when recording transactions. Get enough training to handle relevant GAAP accounting principles correctly.

As part of your review process, ensure that all trial balance accounts are posted to the general ledger. When you migrate to new accounting software systems, errors can occur without proper field mapping during the software conversion process.

Summing It Up

Businesses use trial balance accounting procedures to check that all of their general ledger accounts, including balance sheet and income statement accounts, are in balance for debits and credits after recording transactions and for closing the books. Double-entry bookkeeping requires that all accounting transactions have equal debits and credits. Accountants may use different types of trial balances for specific accounting tasks at different times.

Accelerate your company’s accounting close by using automated batch payment reconciliation in Tipalti AP automation software. Read the white paper to learn more about holistic AP automation in accounting.