Standardizing the process of ordering within an organization requires documentation. Putting a procurement system in place controls costs and creates a paper trail for easier auditing. Obtaining a purchase order vs purchase requisition are both key processes in acquiring items a business needs to survive. Every buying policy and procedure is different, so it’s important to first understand these two systems and how they can streamline your operations.

Purchase Requisition vs. Purchase Order: What’s the Difference?

The main difference between a purchase requisition and a purchase order is that a purchase requisition is for getting internal permission to buy goods or services, whereas a purchase order is for actually purchasing the goods or services. These documents are created and approved internally within a company.

Purchase Requisition vs. Purchase Order: What’s the Difference?

The main difference between a purchase requisition and a purchase order is that a purchase requisition is for getting internal permission to buy goods or services, whereas a purchase order is for actually purchasing the goods or services. These documents are created and approved internally within a company.

Purchase requisitions are more interdepartmental forms that allow larger organizations to handle their accounting and finances better. The bigger the business, the more the need for a procurement process. You simply cannot track the flow without putting it on paper.

What is a Purchase Requisition?

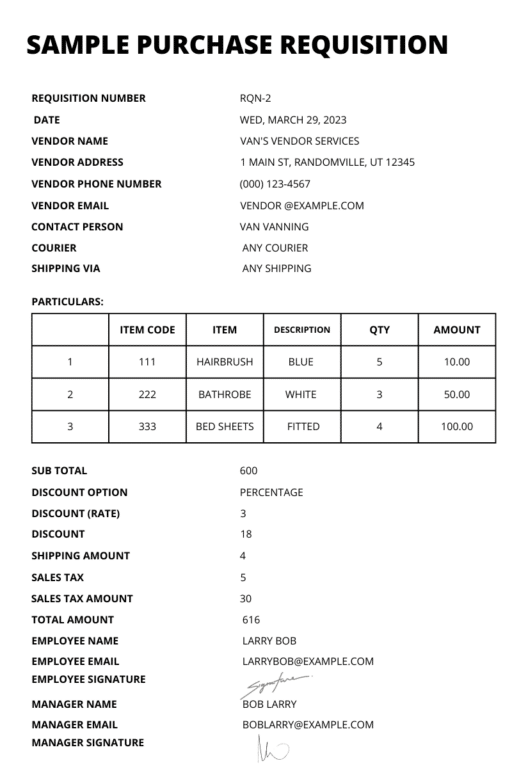

A purchase requisition is an internal document created by your employee to request the purchasing of goods or services from an outside vendor. Once the document is approved by the department manager, finance department, and is three-way matched, the actual purchasing of goods or services can now happen with the use of a purchase order.

Purchase Requisition Workflow

The purchasing request forms are documents developed by the purchaser and submitted to the finance department. It’s a means of getting permission to start the procurement process with an outside vendor. You’re waiting for the “thumbs up” to buy goods or services needed to complete a job.

You can’t go crazy with company cash. You need an approval process for validation purposes. This serves as the first step in creating an efficient audit trail with transparent records. It shows the IRS you care about keeping track of business finances.

The purchasing department will only look at a purchase requisition form over a certain dollar amount. Every company differs, but the average cost is anything $5000 and over. Each requisition order requires certain information.

Information on a Purchase Requisition Form

- Name of the department requesting

- Purchaser’s location and mailing address

- Exact amount of items

- Description of items

- Legal name of the outside supplier

- Expected price of purchase

- Requested delivery date

The more information the accounting department has, the more it facilitates the purchasing process. A good purchase requisition example would be when an employee needs equipment or ongoing services for their job.

Less is more! Especially when it comes to paperwork.

In the age of digitization, don’t get left behind with ancient audit trails. Automate the entire procurement and payables process now.

Why Do You Need a Purchase Requisition?

When a proposed purchase exceeds a certain amount, you want to document that for tax purposes. Every organization needs to buy things, but without a paper trail, the likelihood of fraud vastly increases. A business must maintain some form of control over their pocketbook. To prevent this, a procurement department serves an important role in the supply chain. They are a second set of eyes on the money going out. This is an essential strategy for small businesses where every penny counts.

Sample Purchase Requisition Form

What is a Purchase Order?

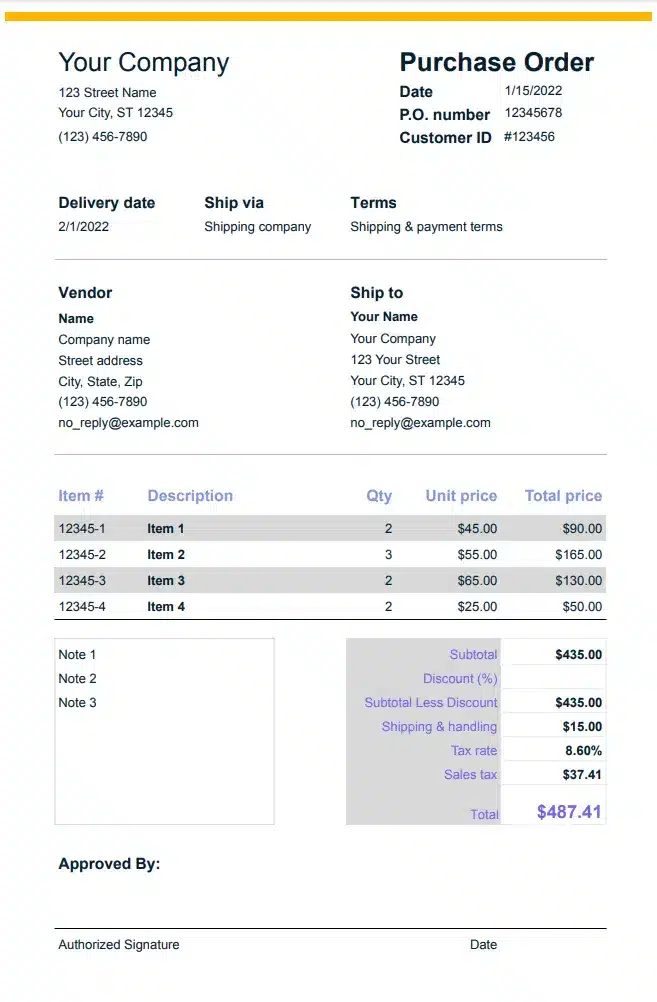

This is the next step in a purchasing system. Once a requisition is approved, it is assigned a purchase order number and sent to the vendor. This external document initiates the sales transaction and is a binding contract for all parties involved. The purchase order system is designed for organized recordkeeping. The PO number that is assigned generally matches the requisition number, and they are filed together. Just like a purchase requisition, a PO requires certain information, like:

• Name of the purchasing office

• Items to be purchased

• Payment terms

• Invoicing instructions

• Ship to address

• Purchase order number

Purchase orders serve as key documents in the entire accounting system and expedite recordkeeping. They help companies properly prepare for audits. You don’t want to be scrambling last-minute for a receipt from 10-months ago. Efficient processes save a business money.

Purchase orders can also be requested for internal transactions. This happens when one department in a business wishes to purchase goods or services from another. In this case, an interdepartmental purchase order is required to track the exchange of goods and services. This can be particularly helpful for larger businesses that have departments with separate operating budgets.

Why Do You Need a Purchase Order?

A business should never be satisfied with a verbal commitment. There is a great amount of legal risk involved. Purchase orders put things on paper. When new posts are made, they help to avoid duplicate orders. This is particularly important as your business scales up. It will be harder to track purchases without an assigned number like a PO.

Certain financial audits also require you turn in purchase orders. This serves as evidence a manager has approved a purchasing decision. It’s quicker and more efficient than digging through a drawer of receipts. It also keeps you from losing track of funds or complicating accounting practices.

Purchase orders can help a company avoid surprise price increases. If a supplier changes its cost between the date of order and the date of delivery or invoice, a PO will clarify the original price. The vendor must hold to the contract since a PO is a legal document. This clears up any potential for miscommunication or misappropriated funds.

The PO process will also keep your orders and invoices in check. It makes it easy to identify which products are coming in at any time and aids inventory management. If you have repeat orders, it helps to sort invoicing down the road.

Sample Purchase Order Form

The Future of Purchasing

All of these exchanges and documents are mostly busywork. Especially when you consider the capabilities of modern e-procurement technology. Purchase order software can quickly automate and oversee the entire process.

This means no more waiting for a signature on someone’s desk or a missing shipping receipt. When the purchasing process is digitized, no balls are dropped. Permissions can become instant and resources expedited. People focus more on driving business and less on menial tasks.

An electronic procurement system also integrates easily with other financial platforms. Utilize sophisticated digital processes (rather than relying on excel or email) to enjoy a significant reduction in cost, greater control over spend, and a streamlined purchasing system.

Automation is the future of purchasing and you can read more about it in our eBook: Reduce Your AP Workload with a Smarter Purchasing Process.